Export-import firms depend heavily upon the availability of insurance to cover against risks of transportation of goods. Risks in transportation are an integral part of foreign trade, partly due to our inability to adequately control the forces of nature or to prevent human failure as it affects the safe movement of goods. Insurance played an important part in stimulating early commerce. In Roman times, for example, money was borrowed to finance overseas commerce, and the lender would be paid substantial interest on the loan only if the voyage was successful. The loan was canceled if the ship or cargo was lost as a result of ocean perils. The interest charged in the event of a successful voyage was essentially an insurance premium (Greene and Trieschmann, 1984; Mehr, Cammack, and Rose, 1985).

The primary purpose of insurance in the context of foreign trade is to reduce the financial burden of losses arising from the movement of goods over long distances. In export trade, it is customary to arrange extended marine insurance to cover not only the ocean voyage but also other means of transport that are used to deliver the goods to the overseas buyer. There are five essential elements to an insurance contract:

- The insured must have an insurable interest, that is, a financial interest based on some legal right in the preservation of the property. The insured must prove the extent of the insurable interest to collect, and recovery is limited by the insured’s interest at the time of loss.

- The insured is subjected to risk of loss of that interest by the occurrence of certain specified perils.

- The insurer assumes the risk of loss.

- This assumption is part of a general scheme to distribute the actual loss among a large group of persons bearing similar risks.

- As a consideration, the insured pays a premium to a general insurance fund (Reuvid and Sherlock, 2011; Vance, 1951).

Since insurance is a contract of indemnity, a person may not collect more than the actual loss in the event of damage caused by an insured peril. An export firm, for example, is not permitted to receive payment from the carrier for damages for the loss of cargo and also recover for the same loss from the insurer. On paying the exporter’s claim, the insurer stands in the position of the exporter (insured party) to claim from the carrier or other parties who are responsible for occasioning the loss or damage. This means that the insurer is subrogated to all the rights of the insured after having indemnified the latter for its loss. This is generally described as the principle of subrogation. Another point to consider is whether an exporter, as an insured party, can assign the policy to the overseas customer. It appears that assignment is generally allowed insofar as there is an agreement to transfer the policy with the merchandise to the buyer and the seller has an insurable interest during the time when the assignment is made.

1. Marine Insurance

Marine policy is the most important type of insurance in the field of international trade. This is because (1) ocean shipping remains the predominant form of transport for large cargo, and (2) marine insurance is the most traditional and highly developed branch of insurance. All other policies, such as aviation and inland carriage, are largely based on principles of marine insurance. Practices and policies are also more standardized across countries in the area of marine insurance than in insurance of goods carried by land or air (Day and Griffin, 1993).

The different types of marine insurance include the following:

- Marine cargo insurance: Cargo insurance caters specifically to the cargo of the ship and also pertains to the belongings of a ship’s voyagers. This chapter focuses on cargo insurance.

- Hull insurance: Hull insurance mainly caters to the torso and hull of the vessel, along with all the articles and pieces of furniture in the ship. This type of marine insurance is mainly taken out by the owner of the ship in order to avoid any loss to the ship in case of any mishaps.

- Liability insurance: Liability insurance provides compensation for any liability occurring on account of a ship’s crashing or colliding or because of any other induced attacks.

- Freight insurance: Freight insurance offers and provides protection to merchant vessels’ corporations that stand a chance of losing money in the form of freight in case the cargo is lost due to an accident involving the ship. This type of marine insurance solves the problem of companies losing money because of a few unprecedented events and accidents.

1.1. Developments in the Marine Insurance Market

- Overcapacity in the shipping industry and consequences: Ship owners ordered too many big ships to meet demand for container and bulk space over the past few years. This was accompanied by increasing outside investment in cargo and hull insurance that contributed to lower premiums for shippers. The insurance market has low entry barriers, and investors have entered the market hoping to get higher returns than the equity or bond markets could offer. The recent cargo and liability loss claims from tornadoes, storms, and other natural disasters are, however, likely to slow the decline in premiums. Cargo policies tend to show better results for insurance companies than hull coverage because claim subrogation, or the settlements of claims against other underwriters, tends to bring money back to the underwriters in years after they have paid out the initial claims.

- Decline in the cost of piracy insurance: A dramatic fall in pirate attacks off the Somali coast is forcing down the cost of piracy insurance for commercial ships. The use of international navies to crack down on pirates, as well as armed guards and defensive measures taken on vessels, including barbed wire, as well as strikes on the pirates’ coastal bases has dramatically reduced pirate attacks on ships. According to data from the International Maritime Bureau, there were only 63 pirate attacks during the first half of 2012 compared to 163 during the same period in 2011. In 2011, the ransom paid to pirates was estimated at $160 million (U.S.), costing the world economy some $7 billion. The decline in such attacks is likely to attract new entrants into the kidnap and ransom insurance market, which has grown from scratch to be worth about $250 million in little more than five years. In April 2010, President Barack Obama issued an executive order prohibiting the payment of any ransom to certain persons listed in an Annex to the Executive Order. It prevents ransom payments only if (a) it is made or facilitated by a person subject to U.S. jurisdiction, and (b) if it is paid to one of the persons listed on the Annex to the Executive Order, either directly or indirectly.

- Popularity of trade disruption insurance (TDI): There are two sides to the supply chain from the perspective of insurance cover. One deals with the protection of physical assets (goods) in transit, while the other protects revenue from supply-chain disruption. TDI covers, inter alia, losses from political, credit, and other supply-chain risks. A fuel supply company, for example, purchases TDI to cover alternative delivery costs if weather interrupts shipments to remote Alaskan facilities. Multinational food companies that sell fresh produce often purchase TDI to cover losses for spoilage because of supply- chain delays or disruption. In the event of a natural disaster—even if there is no physical damage—TDI covers losses incurred from plant downtime, storage costs, contractual penalties, or lost revenue. Companies can be protected from lost market share or new facility construction costs (Biederman, 2006). TDI is growing at about 14 percent a year.

1.2. Types of Marine Insurance Policies

Cargo policies may be written for a single trip or shipment (voyage policy), for a specified period (time policy), usually one year, or for an indefinite period (open policy), in which case the policy remains in effect until canceled by the insured or the insurer. The majority of cargo policies are written on open contracts. Under the latter policy, shipments are reported to the underwriter as they are made, and a premium is paid monthly based on the shipment actually made. The time policy differs from the open contract not just in the term of the policy but also with respect to the premium payment method. Under the time policy, the shipper pays a premium deposit on an estimated future shipment, and adjustments are later made by comparing the estimates with the actual shipment. Another version of open policy is one that is generally available to exporters/importers with larger shipments. It covers most of the shipper’s needs and has certain deductibles (blanket policy). Under a blanket policy, the insured is not required to advise the insurer of the individual shipments, and one premium covers all shipments.

1.3. Coverage Under Marine Cargo Insurance Policy

There are two general types of marine cargo insurance policies: perils-only policy and all-risks policy.

The perils-only policy generally covers extraordinary and unusual perils that are not expected during a voyage. The standard perils-only policy covers loss or damage to cargo attributable to fire or explosion, stranding, sinking, collision of the vessel, general average sacrifice, and so on. Such policies do not generally cover damage due to unseaworthiness of the vessel or pilferage. An essential feature of such a policy is that underwriters indemnify for losses that are attributable to expressly enumerated perils. The burden is on the cargo owner to show that the loss was due to one of the listed perils.

Export-import companies have the option of purchasing additional coverage (e.g., to include risk of water damage, rust, or contamination of cargo from oil) or taking all-risks policy that provides broader coverage.

Marine insurance policies generally specify the extent of coverage provided under the policy. Levels of cargo coverage fall into two broad categories: with average (WA) and free of particular average (FPA). This indicates whether the policy covers less than total losses (WA) or only total losses (FPA).

With average policy cover (WA): With average policy covers total as well as partial losses. Most with average policies limit coverage to those losses that exceed 3 percent of the value of the goods. A standard WA coverage may read:

Subject to particular average if amounting to 3%, unless general or the vessel and/or craft is stranded, sunk, burnt, on fire and/or in collision, each package separately insured or on the whole.

This policy provides protection against partial losses by sea perils if the damage amounts to 3 percent or more of the value of the shipment. If the vessel is stranded or sunk or is damaged by other covered conditions, the percentage requirement is waived and the losses are recovered in full.

Free of particular average (FPA): Free of particular average (FPA) provides limited coverage. This clause provides that, in addition to total losses, partial losses from certain specified risks such as stranding or fire are recoverable. A standard FPA clause reads:

Free of particular average (unless general) or unless the vessel or craft be stranded, sunk, burnt, on fire or in collision with another vessel.

The all-risks policy provides the broadest level of coverage except for those expressly excluded in the policy. A typical clause reads:

To cover against all risks of physical loss or damage from any external cause irrespective of percentage, but excluding, nevertheless, the risk of war, strikes, riots, seizure, detention, and other risks excluded by the F.C & S (free of capture and seizure) (losses due to war, civil strife, or revolution) warranty and the S.R & C.C (strikes, riots, and civil commotion) warranty, excepting to the extent that such risks are specifically covered by endorsement.

In the case of an all-risks policy, the burden to prove that the loss was due to an excluded clause rests with the underwriter. Additional coverage can be provided through an endorsement on the existing all-risks policy or through a separate war-risks policy. The following types of loss are not usually covered by the all risks and other policies: (1) loss of market as well as loss, damage, or deterioration arising from delay; (2) loss arising from inherent vice of the goods (e.g., steel showing rust from exposure to air and moisture) as well as ordinary leakage (ordinary loss of weight or volume and wear and tear; (3) loss or damage arising from strikes, riots, civil commotions, or acts of war; (4) insufficient packing; (5) unseaworthy vessel (this exclusion applies if at the start of the voyage the vessel was unseaworthy or unfit to go to sea and the insured or its employees were aware of this situation) (Malbon and Bishop, 2006).

Exporters that sell on credit and use terms of sale where the buyer is responsible for insurance (FAS, FOB, and so on) should consider taking out contingency insurance for the benefits of the overseas buyer in case the latter’s insurance becomes inadequate to cover the loss. By paying a small premium for such insurance, the exporter creates a favorable condition for the buyer to pay for the shipment. Contingency insurance is supplementary to the policy taken out by the overseas buyer, and recovery is not made under the policy unless the buyer’s policy is inadequate to cover the loss.

Marine cargo insurance covers only the period when the goods are on the ship. The marine extension (warehouse-to-warehouse clause) extends the standard marine coverage to the period before the loading of the goods and the period between offloading and delivery to the consignee.

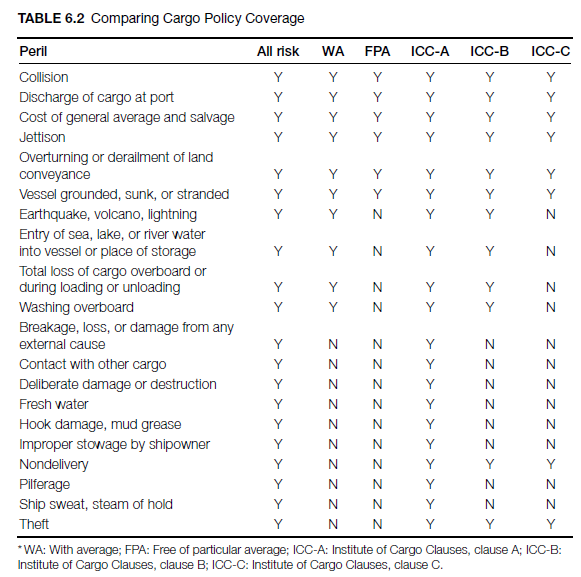

The policies described (all-risks, with average, free of particular average) are mostly written by U.S.-based insurance companies. A similar set of standard terms (Institute of Cargo Clauses or ICC Clauses) are used by Lloyd’s insurers and insurers that are members of the Institute of London underwriters (most of the U.K. insurance market). The A clauses in the ICC are equivalent to all-risks clauses, while the B and C clauses are equivalent to with average and free of particular average clauses, respectively (Table 6.2).

1.4. Insurance Policy versus Certificates

An insurance company may issue an insurance policy (policy) or a certificate. If the insurer issues only policies, an application must be completed by the insured for each shipment and delivered to the insurer or agent before a policy is prepared and sent to the former. This can be time consuming. However, in the case of certificates, the insurer provides a pad of insurance certificates to the exporter or importer, and a copy of the completed certificate (with details of goods, destination, type and amount of insurance required, and so on) is mailed to the insurance company whenever a shipment is made. Certificates save time and facilitate a more efficient operation of international business transactions.

Open policies for import/export shipments are often reported by using declaration forms that require the completion of certain particulars such as points of shipment and destination, description of units, amount of insurance, and so on. When full information is not available at the time a declaration is made, a provisional report may be submitted to the insurance agent (this is closed when the value is finally known). They are prepared by the assured and forwarded daily or weekly or as shipments are made. The premium is billed monthly based on the schedule of rates provided in the policy.

Insurance policies or certificates are often used in the case of exports, since the exporter must provide evidence of insurance to banks, customers, or other parties in order to permit the collection of claims abroad. Besides what is often included in declarations, policies/ certificates include additional information such as names of beneficiary (usually assured or “order”), thus making the instrument negotiable upon endorsement by the assured. Whether the policy/certificate is prepared by the assured, freight forwarder or agent, it is important to describe the shipment in sufficient detail (see International Perspective 6.3).

2. General Average: Illustration

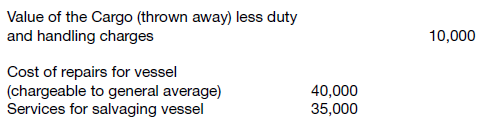

A vessel carrying a cargo of copper was stranded, and part of the cargo had to be sacrificial (thrown away) to lighten the vessel. The vessel had sustained certain damage, and a salvage vessel was employed to refloat it. Adjustment of the general average will be as follows:

Example 6.1

Cargo owner’s liability = Assigned contribution – value of cargo sacrificed

Thus, 25,000 – 10,000 = 15,000 (to be paid)

Vessel’s liability = Assigned contribution – vessel’s sacrifice

Thus, 75,000 – 90,000 = 15,000 (to receive)

Air Cargo Insurance: A modified form of marine insurance coverage is issued for air cargo insurance. Some airlines sell their own coverage.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

You really make it seem so easy along with your presentation but I find this topic to be actually something which I think I’d by no means understand. It sort of feels too complicated and very wide for me. I am taking a look ahead to your subsequent publish, I¦ll attempt to get the hang of it!

I am not sure the place you’re getting your info, however great topic. I must spend a while finding out more or figuring out more. Thanks for excellent info I used to be in search of this info for my mission.