A classic example of a market with multiple customer segments is the airline industry, in which business travelers are willing to pay a higher fare to travel on a specific schedule, whereas leisure travelers are willing to shift their schedules to take advantage of lower fares. Many similar instances arise in a supply chain. Consider ToFrom, a trucking firm that has purchased six trucks, with a total capacity of 6,000 cubic feet, to use for transport between Chicago and St. Louis. The monthly lease charge, driver, and maintenance expense is $1,500 per truck, resulting in a total monthly cost of $9,000. Market research has indicated that the demand curve for trucking capacity is

d = 10,000 – 2,000p

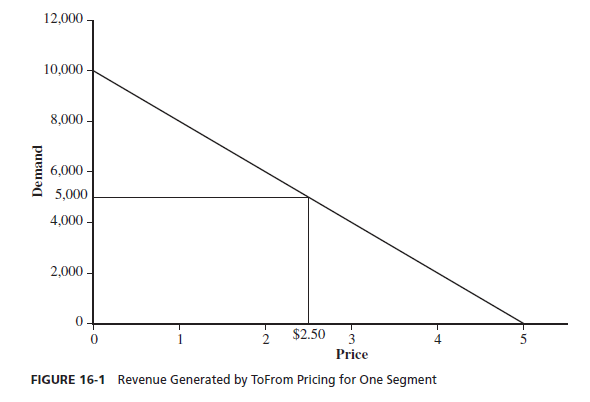

where d is the demand across all segments and p is the transport cost per cubic foot. A price of $2 per cubic foot results in a demand of 6,000 cubic feet (all customers willing to pay $2 or more), revenue of $12,000, and a profit of $3,000, whereas a price of $3.50 per cubic foot results in a demand of 3,000 (only customers willing to pay $3.50 or more), revenue of $10,500, and a profit of $1,500. The real question is whether the 3,000 cubic feet of demand at a price of $3.50 can be separated from the 3,000 additional cubic feet of demand generated at a price of $2 per cubic foot. If ToFrom assumes that all demand comes from a single segment and cannot be separated, the optimal price is $2.50 per cubic foot, resulting in a demand of 5,000 cubic feet and revenue of $12,500, as shown in Figure 16-1.

However, if ToFrom can differentiate the segment that buys 3,000 cubic feet at $3.50 from the segment that buys 3,000 cubic feet only at $2.00, the firm can use revenue management to improve revenues and profits. ToFrom should charge $3.50 for the segment willing to pay that price and $2.00 for the 3,000 cubic feet that sells only at the lower price. The firm thus extracts revenue of $10,500 from the segment willing to pay $3.50 and revenue of $6,000 from the segment willing to pay only $2.00 per cubic foot, for total revenue of $16,500, as shown in Figure 16-2. In the presence of different segments that have different values for trucking capacity, revenue management increases the revenue from $12,500 to $16,500 and results in a significant improvement in profits.

In theory, the concept of differential pricing increases total profits for a firm. Two fundamental issues, however, must be handled in practice. First, how can the firm differentiate between the two segments and structure its pricing to make one segment pay more than the other? Second, how can the firm control demand so the lower-paying segment does not use the entire availability of the asset?

To differentiate between the various segments, the firm must create barriers by identifying product or service attributes that the segments value differently. For example, business travelers on an airline want to book at the last minute and change their schedules if necessary. Leisure travelers, on the other hand, are willing to book far in advance and adjust the duration of their stays. Plans for business travelers are also subject to change. Thus, advance booking and a penalty for changes on the lower fare separate the leisure traveler from the business traveler. For a transportation provider such as ToFrom, the segments can be differentiated based on how far in advance a customer is willing to commit and pay for the transportation capacity. Similar separation can also occur for production- and storage-related assets in a supply chain.

In the presence of multiple segments that can be separated, the firm must solve the following two problems:

- What price should it charge for each segment?

- How should it allocate limited capacity among the segments?

1. Pricing to Multiple Segments

Let us start by considering the simple scenario in which the firm has identified criteria on which it can separate the various customer segments. One such criterion may be an airline requiring a Saturday night stayover. Another might be a trucking company separating customers based on the advance notice with which they are willing to commit to a shipment. The firm now wishes to identify the appropriate price for each segment. Consider a supplier (of product or some other supply chain function) that has identified k distinct customer segments that can be separated. Assume that the demand curve for segment i is given by (we assume linear demand curves to simplify the analysis)

![]()

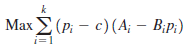

The supplier has a cost c of production per unit and must decide on the price pi to charge each segment; di is the resulting demand from segment i. The goal of the supplier is to price so as to maximize its profits. The pricing problem can be formulated as follows:

Without a capacity constraint, the problem separates by segment, and for segment i, the supplier attempts to maximize

![]()

The optimal price for each segment i is given by

If the available capacity is constrained by Q, the optimal prices are obtained by solving

Both formulations are simple enough to be solved in Excel. Example 16-1 illustrates the benefit of differential prices to multiple segments (see worksheet Example16-1 in workbook Chapter 16- examples).

EXAMPLE 16-1 Pricing to Multiple Segments

A contract manufacturer has identified two customer segments for its production capacity—one willing to place an order more than one week in advance and the other willing to pay a higher price as long as it can provide less than one week’s notice for production. The customers that are unwilling to commit in advance are less price sensitive and have a demand curve d1 = 5,000 – 20p1. Customers willing to commit in advance are more price sensitive and have a demand curve of d2 = 5,000 – 40p2. Production cost is c = $10 per unit. What price should the contract manufacturer charge each segment if its goal is to maximize profits? If the contract manufacturer were to charge a single price over both segments, what should it be? How much increase in profits does differential pricing provide? If total production capacity is limited to 4,000 units, what should the contract manufacturer charge each segment?

Analysis:

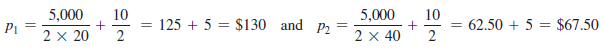

Without capacity constraints, the differential prices to be charged each segment are given by Equation 16.1. We thus obtain

The demand from the two segments is given by

di = 5,000 – (20 X 130) = 2,400 and d2 = 5,000 – (40 X 67.5) = 2,300

The total profit is

Total profit = (130 X 2,400) + (67.5 X 2,300) – (10 X 4,700) = $420,250

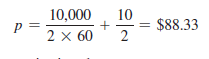

If the contract manufacturer charges the same price p to both segments, it is attempting to maximize

(p – 10) (5,000 – 20p) + (p -10)(5,000 – 40p)= (p – 10) (10,000 – 60p)

The optimal price in this case is given by

The demand from the two segments is given by

d1 = 5,000 – 20 X 88.33 = 3,233.40 and d2 = 5,000 – 40 X 88.33 = 1,466.80

The total profit is

Total profit = (88.33 – 10) X (3,233.40 + 1,466.80) = $368,166.67

Differential pricing thus raises the profits by more than $50,000 relative to offering a fixed price.

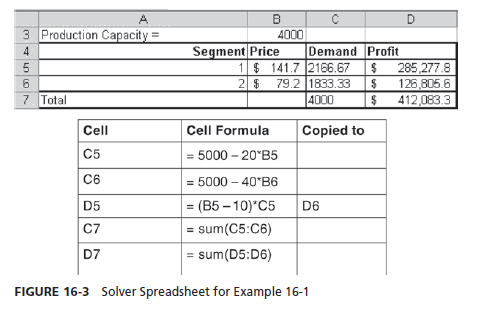

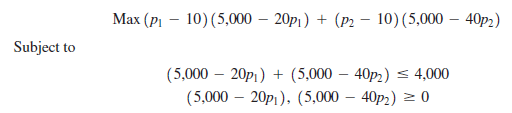

Now, let us consider the case in which total production capacity is limited to 4,000 units. The optimal differential price results in demand that exceeds total production capacity. Thus, we resort to the formulation in Equation 16.2 and solve

The results of the constrained optimization (using Solver in worksheet Example16-1) are shown in Figure 16-3. Observe that the limited capacity leads the contract manufacturer to charge a higher price to each of the two segments relative to when there was no capacity limit.

The methodology we have described has two important assumptions that are unlikely to hold in practice. The first assumption is that no one from the higher-price segment decides to shift to the lower-price segment after prices are announced. In other words, we have assumed that the attribute such as lead time used to separate the segments works perfectly. In practice, this is unlikely to be the case. Our second assumption is that once prices are decided, customer demand is predictable. In practice, uncertainty will always be associated with demand. Talluri and Van Ryzin (2004) and Phillips (2005) have an excellent discussion of several models for revenue management that account for uncertainty and a few models that account for customers being strategic and deciding on their actions after prices are announced.

2. Allocating Capacity to a Segment Under Uncertainty

In most instances of differential pricing, demand from the segment paying the lower price arises earlier in time than demand from the segment paying the higher price. It is also often the case that the lower-price segment can use up the entire available capacity. For example, leisure travelers tend to book their tickets earlier than business travelers and most airlines could fill a plane at discount prices targeting leisure travelers. It is thus important that suppliers limit the amount of capacity committed to lower-price buyers even if sufficient demand exists from the lower-price segment to use the entire available capacity. This raises the question of how much capacity to save for the higher-price segment, which typically arrives later. The answer would be simple if demand were predictable. In practice, demand is uncertain and firms must make this decision taking uncertainty into account.

The basic trade-off to be considered by the supplier with production capacity is between committing to an order from a lower-price buyer or waiting for a higher-price buyer to arrive later on. The two risks in such a situation are spoilage and spill. Spoilage occurs when the capacity reserved for higher-price buyers is wasted because demand from the higher-price segment does not materialize. Spill occurs if higher-price buyers must be turned away because the capacity has already been committed to lower-price buyers. The supplier should decide on the capacity to commit for the higher-price buyers to minimize the expected cost of spoilage and spill. A current order from a lower-price buyer should be compared with the expected revenue from waiting for a higher-price buyer. The order from the lower-price buyer should be accepted if the expected revenue from the higher-price buyer is lower than the current revenue from the lower-price buyer.

We now develop this trade-off in terms of a formula that can be used when the supplier is working with two customer segments. Let pL be the price charged to the lower-price segment and pH be the price charged to the higher-price segment with uncertain demand. Assume that the anticipated demand for the higher-price segment is normally distributed, with a mean of DH and a standard deviation of sH. If we reserve a capacity CH for the higher-price segment, the expected marginal revenue RH (CH) from reserving more capacity is given by

RH(CH) = Prob(demand from higher-price segment > CH) X pH

The reserved quantity for the higher-price segment should be chosen so the expected marginal revenue from the higher-price segment equals the current marginal revenue from the lower-price segment; that is, RH (CH) = pL. In other words, the quantity CH reserved for the higher-price segment should be such that

Prob( demand from higher-price segment > CH) = pL/pH (16.3)

If demand for the higher-price segment is normally distributed, with a mean of DH and a standard deviation of sH, we can obtain the quantity reserved for the higher-price segment as

![]()

If there are more than two customer segments, the same philosophy can be used to obtain a set of nested reservations. The quantity C1 reserved for the highest-price segment should be such that the expected marginal revenue from the highest-priced segment equals the price of the next-highest-priced segment. The quantity C2 reserved for the two highest-priced segments should be such that the expected marginal revenue from the two highest-priced segments equals the price of the third-highest-priced segment. This sequential approach can be used to obtain a set of nested reservations of capacity for all but the lowest-priced segment.

An important point to observe is that the use of differential pricing increases the level of asset availability for the high-priced segment. Capacity is being saved for these customers because of their willingness to pay more for the asset. Thus, effective use of revenue management both increases firm profits and improves service for the more valuable customer segment. Example 16-2 illustrates how profits can be increased by reserving capacity for the higher paying segment when demand is uncertain (see worksheet Example16-2).

EXAMPLE 16-2 Allocating Capacity to Multiple Segments

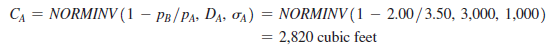

ToFrom Trucking serves two segments of customers. One segment (A) is willing to pay $3.50 per cubic foot but wants to commit to a shipment with only 24 hours’ notice. The other segment (B) is willing to pay only $2.00 per cubic foot and is willing to commit to a shipment with up to one week’s notice. With two weeks to go, demand for segment A is forecast to be normally distributed, with a mean of 3,000 cubic feet and a standard deviation of 1,000. How much of the available capacity should be reserved for segment A? How should ToFrom change its decision if segment A is willing to pay $5 per cubic foot?

Analysis:

In this case we have

Revenue from segment A, pA = $3.50 per cubic foot

Revenue from segment B, pB = $2.00 per cubic foot

Mean demand for segment A, DA = 3,000 cubic feet

Standard deviation of demand for segment A, sA = 1,000 cubic feet

Using Equation 16.4, the capacity to be reserved for segment A is given by

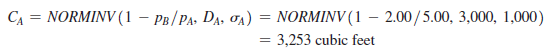

Thus, ToFrom should reserve 2,820 cubic feet of truck capacity for segment A when customers from this segment are willing to pay $3.50 per cubic foot. If the amount customers are willing to pay increases from $3.50 to $5.00, the reserved capacity should be increased to

Ideally, the demand forecast for all customer segments should be revised and a new reservation quantity calculated each time a customer order is processed. In practice, such a procedure is difficult to implement. It is more practical to revise the forecast and the reservation quantity after a period of time over which either the forecast demand or the forecast accuracy has changed by a significant amount.

Another approach to differential pricing is to create different versions of a product targeted at different segments. Publishers introduce new books from best-selling authors as hardcover editions and charge a higher price. The same books are introduced later as paperback editions at a lower price. The two versions are used to charge a higher price to the segment that wants to read the book as soon as it is introduced. Different versions can also be created by bundling different options and services with the same basic product. Automobile manufacturers create high- end, mid-level, and low-end versions of the most popular models based on the options provided. This policy allows them to charge differential prices to different segments for the same core product. Many contact lens manufacturers sell the same lens with a one-week, one-month, and six-month warranty. In this instance, the same product with different services in the form of warranty is used to charge differential prices.

To use revenue management successfully when serving multiple customer segments, a firm must use the following tactics effectively:

- Price based on the value assigned by each segment

- Different prices for each segment

- Forecast at the segment level

Freight railroads and trucking firms have not used revenue management with multiple segments effectively. Airlines, in contrast, have been much more effective in using this approach. A major hindrance for railroads is the lack of scheduled freight trains. Without scheduled trains, it is hard to separate the higher-price and lower-price segments. To take advantage of revenue management opportunities, owners of transportation assets in the supply chain must offer some scheduled services as a mechanism for separating the higher-price and lower-price segments. Without scheduled services, it is difficult to separate customers that are willing to commit early from those that want to use the service at the last minute.

Source: Chopra Sunil, Meindl Peter (2014), Supply Chain Management: Strategy, Planning, and Operation, Pearson; 6th edition.

Spot on with this write-up, I truly think this amazing site needs much more

attention. I’ll probably be returning to read through more, thanks for the information!

What’s Taking place i am new to this, I stumbled upon this I’ve found It positively helpful and it has aided

me out loads. I’m hoping to contribute & aid other users like its helped

me. Great job.

Really nice style and superb subject matter, absolutely nothing else we need : D.