The export price decision is distinct from the price decision in the home market. The export decision has to consider variations in market conditions and the existence of cartels or trade associations, as well as the existence of different channels of distribution. The presence of different environmental variables in export markets militates against the adoption of a single export-pricing policy (ethnocentric pricing) around the world. Another factor against uniform pricing is that different markets may be at different stages in the life cycle of a product at any given time.

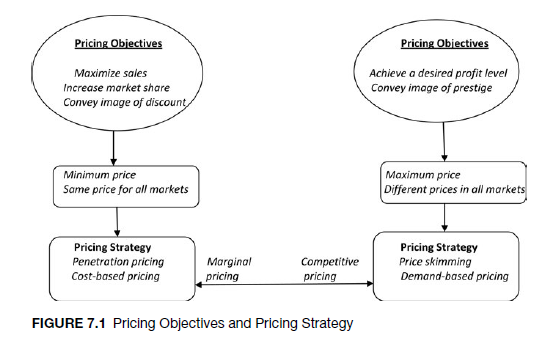

It is customary to charge a high price during the introduction and growth stages of a product and to progressively reduce the price as the product matures. Other pricing alternatives include (1) polycentric pricing, which is pricing sensitive to local conditions, and (2) geocentric pricing, whereby a firm strikes an intermediate position. There are five approaches to export pricing: cost-based pricing, marginal pricing, skimming and penetration pricing, and demand-based pricing.

1. Cost-Based Pricing

The most common pricing approach used by exporters is one that is based on full- cost-oriented pricing. Under this procedure, a markup rate on full cost is determined and then added to the product’s cost to establish the price. The markup rate could be based on the desired target rate of return on investment.

2. Marginal Pricing

Marginal pricing is more common in exporting than in domestic markets. It is often employed by businesses that have unused capacity or to gain market share. In this case, the price does not cover the product’s total cost but instead includes only the marginal (variable) cost of producing the product to be sold in the export market. This results in the sale of a product at a lower price in the export market than at home and often leads to charges of dumping by competitors.

3. Skimming versus Penetration Pricing

Skimming, or charging a premium price for a product, is common in industries that have few competitors or in which the companies produce differentiated products. Such products are directed to the high-income, price-inelastic segment of the market.

Penetration-pricing policy is based on charging lower prices for exports to stimulate market growth. Increasing market share and maximizing revenues could generate high profits.

4. Demand-Based Pricing

Under this method, export prices are based on what consumers or industrial buyers are willing to pay for the product or service. When prices are set by demand, market surveys will help supply the data to identify the level of demand. The level of demand generally establishes the range of prices that will be acceptable to customers. Companies often test-market a product at various prices and settle on a price that results in the greatest sales.

A firm does not have to sell a product at or below market price to be competitive in export markets. A superior or unique product can command a higher price. Cartier watches and Levi’s jeans are examples of products that, despite their high prices, generate enormous sales worldwide due to their reputation. These are products for which consumers feel a strong desire and for which there are few or no substitutes (products with inelastic demand). In cases in which demand for the product is elastic, consumers are sensitive to changes in price. For example, rebates and other discount schemes often revive lagging export sales in the auto industry (which is characterized by elastic demand). A few years ago, Toyota launched a special sales campaign in Tokyo to give away money (about one million yen to 100 customers) to some of the customers of the competitor car it sells in Japan on behalf of General Motors.

5. Competitive Pricing

Competitive pressures are important in setting prices in export markets. In this case, export prices are established by maintaining the same price level as the competition, reducing prices or increasing the price with some level of product improvement. However, price-cutting is generally a more effective strategy for small competitors than for dominant firms. An important factor in establishing a pricing strategy is also a projection of likely responses of existing and potential competitors (Oster, 1990).

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

Good info. Lucky me I reach on your website by accident, I bookmarked it.