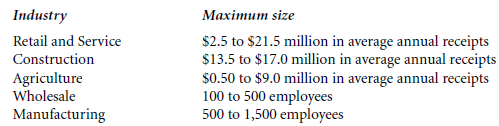

The Small Business Administration (SBA) also provides a few programs for U.S. exporters. The SBA Act defines an eligible small business as one that is independently owned and operated and not dominant in its field of operation. To qualify for the programs, applicants must meet the definition of a small business under SBA’s size standards and other eligibility requirements. The following represent general guidelines to determine a small business (Eximbank, 2012b):

Some of the SBA programs that are intended to promote exports are described in the following sections.

1. Export Working Capital Program Loans (EWCP)

The EWCP is a combined effort of the SBA and Eximbank to provide short-term working capital to U.S. exporters. To be processed by the SBA, loan guarantee requests must be equal to or less than $5.00 million. Loan requests greater than $5 million are processed by the Eximbank. The applicant must be in business for one year (not necessarily exporting) at the time of application. The agency can guarantee up to 90 percent of loans and accrued interest up to 120 days.

2. International Trade Loan Program

This program assists small businesses that are already engaged or preparing to engage in international trade and those that are adversely affected by import competition. The SBA can guarantee up to 90 percent of the loan to a maximum of $4.5 million (the maximum guarantee for the working capital component is $4 million). Maturity on the working capital loan is ten years. Collateral is required and must be located in the United States.

3. SBA Export Express Loan

SBA Export Express is a flexible financing tool available to assist small businesses in developing and expanding export markets. SBA Export Express offers financing up to $500,000. Export Express can take the form of a term loan or a revolving line of credit. For example, you can use funds to participate in a foreign trade show, support standby letters of credit, or translate product literature for use in foreign markets. You may also use funds to finance specific export orders, expand production facilities, and purchase equipment inventory or real estate.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.