From the 1870s until 1971, U.S. exports typically exceeded U.S. imports, except during World War II. Even during this period, U.S. exports fell below imports because a substantial percentage of the exports was not sold but provided to allies under the Marshall Plan. All this began to change in the 1970s. The United States registered a trade deficit in 1971, when the merchandise trade balance showed a $2.27 billion deficit, in contrast to the previous decades, when exports exceeded imports. Some of the contributing factors to this state of affairs included the overvalued dollar and increased government expenditures at home and abroad that often resulted in purchases of foreign products and services. This situation was further exacerbated in 1973, when oil prices sharply increased and worsened the U.S. trade deficit due to large increases in expenditures for imports for petroleum products (Stein and Foss, 1992) (see International Perspective 15.10).

1. Domestic International Sales Corporations and the General Agreement on Tariffs and Trades

In an effort to remedy the worsening trade imbalance, the government enacted the Revenue Act of 1972. The act created the Domestic International Sales Corporation (DISC) to promote U.S. exports by providing tax incentives that would lower the cost of exporting goods in foreign markets. The legislation was also intended to remove the disadvantage faced by U.S. companies engaged in export activities through domestic corporations (Chou, 2005).

The DISC statute was also intended to offset the competitive disadvantage faced by U.S. firms because of the various incentives provided by major trading nations to their export firms. Under the DISC scheme, a U.S. corporation could export its products through a subsidiary (DISC) organized in the United States (a shell corporation) with minimum capital of $2,500. The DISC was required to engage almost exclusively in export sales. The tax implications for a corporation that elected to be treated as a DISC were as follows:

- Approximately half of the DISC’s earnings were taxed at the shareholder level regardless of whether they were distributed to shareholders (constructive dividends).

- The remainder of the DISC’s earnings was not taxable to the shareholder until actually distributed. This allowed for an indefinite deferral of tax. In effect, this amounted to a de facto tax exemption on about half of the DISC’s earnings because deferred taxes may never become due.

- Deferred taxes became due when distributed to shareholders, when a shareholder disposed of its DISC stock, or the corporation ceased to qualify as a DISC.

The DISC came under increasing attack by U.S. trading partners as an unfair and illegal subsidy to U.S. exporters. In a complaint by the European Economic Community and Canada against the United States, the GATT panel issued a report stating that the DISC scheme conferred a tax benefit to exports and resulted in the price of exports being lower than the price of similar goods for domestic consumption. The panel concluded that the scheme was in violation of the General Agreement on Tariffs and Trades (GATT) treaty (GATT, 1977). Even though the United States never conceded the inconsistency of the DISC with the GATT agreement, it nevertheless proceeded to replace the DISC with an alternative scheme that was acceptable to the GATT. (A vestige of the old DISC, the Interest-Charge-DISC, remains in place.)

The Tax Reform Act of 1984 created the Foreign Sales Corporation (FSC) to promote U.S. exports. Once the FSC was incorporated outside the United States and satisfied other requirements in the statute, its earnings were exempt from U.S. taxation. Although the FSC provided a benefit to U.S. exporters comparable to those of the DISC, it was permitted under the GATT because the GATT treaty does not require member countries to tax “economic processes” that take place outside their territory (Levin, 2004).

The European Union filed a complaint with the WTO asserting that the FSC regime was an illegal subsidy inconsistent with the GATT treaty (1998). In 1999, the WTO ruled in favor of the EU and called for the elimination of the FSC regime by 2000. In response to the WTO ruling, the United States repealed the FSC and enacted the Extraterritorial Income Exclusion Act (ETI) (2000), which provides U.S. exporters with the same tax benefit as the FSC. ETI allows U.S. exporters to exclude from federal income tax 15 percent of their net income from the export sale of qualified U.S. origin goods. Alternatively, exporters of low-profit items could exclude 1.2 percent of their gross receipts (not to exceed 30 percent of the net) from the export sale of qualified U.S. origin goods (not more than 50 percent of whose value is attributable to foreign content). The EU again challenged the ETI as an unfair subsidy to U.S. corporations, and the WTO dispute settlement body found that it violated the treaty (2001).

The ETI was phased out in 2004. The IC-DISC appears to be one of the few remaining tax incentives for U.S. exporters (Clausing, 2005; Gravelle, 2005).

2. Interest-Charge Domestic International Sales Corporations (IC-DISCs)

The IC-DISC is a tax deferral vehicle (on the first $10 million of U.S. export sales) that can be used by small and medium-size exporting companies. It provides a 20 percent tax savings for qualifying U.S. exporters in view of the favorable dividend tax rules under the Jobs and Growth Tax Relief Reconciliation Act of 2003 (Loizeau, 2004).

To be eligible for IC-DISC status, a corporation must satisfy certain requirements:

- It must be a U.S. corporation.

- At least 95 percent of its foreign trading gross receipts for the tax year must be “qualified exports receipts” Qualified export receipts include receipts from sales, leases, or rental of export property (Section 993 [a]). It also includes gross receipts for services related to warranty, repair, or transportation of export property; engineering or architectural services from overseas projects; and interest on qualified export assets.

- The adjusted basis of its qualified export assets must be at least 95 percent of its total assets at the end of the tax year. Qualified export assets include accounts receivable, temporary investments, export property, assets used primarily in connection with the production of qualified export receipts, and loans to producers.

- It must have one class of stock with a minimum value (capital) of $2,500.

- It must elect in a timely manner to be treated as an IC-DISC for the current tax year.

- Certain personal holding companies and financial and insurance institutions as well as companies that are members of any controlled group of which an FSC is a member are ineligible to be treated as IC-DISCs.

2.1. How Does an IC-DISC Work?

Step 1: A U.S. exporter (or shareholder) forms a tax-exempt IC-DISC corporation.

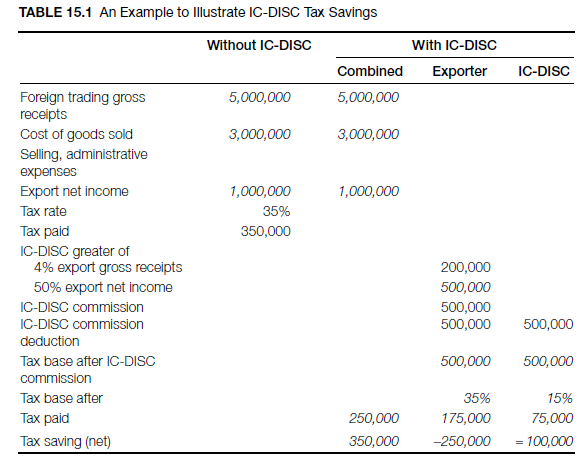

Step 2: The U.S. exporter pays the IC-DISC commission. The allowable commission rate is the greater of either 50 percent of export net income or 4 percent of gross export income.

Step 3: The U.S. exporter deducts the commission paid to the IC-DISC from its income taxed at 35 percent (the IC-DISC pays no U.S. income tax on the commission income).

Step 4: When the IC-DISC pays dividend to its shareholders, the shareholders pay dividend income tax of 15 percent. (On income at IC-DISC, which is accumulated and untaxed, shareholders are required to pay interest.)

2.2. Tax Benefits of IC-DISC

- Reduced taxable income: The U.S. exporter pays an annual tax-deductible commission on its export sales to the IC-DISC. This reduces its taxable base at the corporate level by the commission paid to the IC-DISC.

- Increased dividend income to shareholders: The entire commission paid to the IC-DISC can then be distributed as a dividend at the end of taxable year. This payment could be subject to only a 15 percent individual dividend tax rate rather than the corporate tax rate of 35 percent.

- Deferral of IC-DISC incomefrom taxation: The IC-DISC is not subject to tax. However, its U.S. shareholders are subject to tax on deemed dividend distributions from the IC-DISC, which does not include income derived from the first $10 million of the IC-DISC’s qualified export receipts each year. Thus, the IC-DISC allows a U.S. shareholder to defer paying tax on income attributable to $10 million of export sales. The U.S. shareholder must, however, pay an interest charge on its IC-DISC earnings (deferred tax liability) until it is distributed (see Table 15.1).

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

I love it when people come together and share opinions, great blog, keep it up.