A large corporation is typically a collection of businesses. Often, the firm is organized financially as a collection of strategic business units and the returns to the firm are directly tied to the performance of all the strategic business units. Information systems can improve the overall performance of these business units by promoting synergies and core competencies.

1. Synergies

The idea of synergies is that when the output of some units can be used as inputs to other units or two organizations pool markets and expertise, these relationships lower costs and generate profits. Bank and financial firm mergers such as the merger of JPMorgan Chase and Bank of New York as well as Bank of America and Countrywide Financial Corporation occurred precisely for this purpose.

One use of information technology in these synergy situations is to tie together the operations of disparate business units so that they can act as a whole. For example, acquiring Countrywide Financial enabled Bank of America to extend its mortgage lending business and to tap into a large pool of new customers who might be interested in its credit card, consumer banking, and other financial products. Information systems would help the merged companies consolidate operations, lower retailing costs, and increase cross-marketing of financial products.

2. Enhancing Core Competencies

Yet another way to use information systems for competitive advantage is to think about ways that systems can enhance core competencies. The argument is that the performance of all business units will increase insofar as these business units develop, or create, a central core of competencies. A core competency is an activity for which a firm is a world-class leader. Core competencies may involve being the world’s best miniature parts designer, the best package delivery service, or the best thin-film manufacturer. In general, a core competency relies on knowledge that is gained over many years of practical field experience with a technology. This practical knowledge is typically supplemented with a long-term research effort and committed employees.

Any information system that encourages the sharing of knowledge across business units enhances competency. Such systems might encourage or enhance existing competencies and help employees become aware of new external knowledge; such systems might also help a business leverage existing competencies to related markets. For example, Procter & Gamble, a world leader in brand management and consumer product innovation, uses a series of systems to enhance its core competencies by helping people working on similar problems share ideas and expertise. Employees working in research and development (R&D), engineering, purchasing, marketing, legal affairs, and business information systems around the world can share documents, reports, charts, videos, and other data from various sources online and locate employees with special expertise. P&G systems also can link to research scientists and entrepreneurs outside the company who are searching for new, innovative products worldwide.

3. Network-Based Strategies

Internet and networking technology have inspired strategies that take advantage of firms’ abilities to create networks or network with each other. Network- based strategies include the use of network economics, a virtual company model, and business ecosystems.

Network Economics Network economics refers to market situations where the economic value being produced depends on the number of people using a product. For certain products and markets, the real economic value comes from the fact that other people use the product. In these situations, “network effects” are at work. For instance, what’s the value of a telephone if it is not connected to millions of others? Email has value because it allows us to communicate with millions of others. Business models that are based on network effects have been highly successful on the Internet, including social networks, software, messaging apps, and on-demand companies like Uber and Airbnb.

In traditional economics—the economics of factories and agriculture- production experiences diminishing returns. The more any given resource is applied to production, the lower the marginal gain in output, until a point is reached where the additional inputs produce no additional outputs. This is the law of diminishing returns, and it is the foundation for most of modern economics.

In some situations, the law of diminishing returns does not work. For instance, in a network, the marginal costs of adding another participant are about zero, whereas the marginal gain is much larger. The larger the number of subscribers in a telephone system or the Internet, the greater the value to all participants because each user can interact with more people. It is not much more expensive to operate a television station with 1,000 subscribers than with 10 million subscribers. The value of a community of people grows with size, whereas the cost of adding new members is inconsequential. The value of Facebook to users increases greatly as more people use the social network.

From this network economics perspective, information technology can be strategically useful. Internet sites can be used by firms to build communities of users-like-minded customers who want to share their experiences. This builds customer loyalty and enjoyment and builds unique ties to customers. eBay, the giant online auction site, is an example. This business is based on a network of millions of users, and has built an online community by using the Internet. The more people offering products on eBay, the more valuable the eBay site is to everyone because more products are listed, and more competition among suppliers lowers prices. Network economics also provides strategic benefits to commercial software vendors. The value of their software and complementary software products increases as more people use them, and there is a larger installed base to justify continued use of the product and vendor support.

Virtual Company Model Another network-based strategy uses the model of a virtual company to create a competitive business. A virtual company, also known as a virtual organization, uses networks to link people, assets, and ideas, enabling it to ally with other companies to create and distribute products and services without being limited by traditional organizational boundaries or physical locations. One company can use the capabilities of another company without being

organizationally tied to that company. The virtual company model is useful when a company finds it cheaper to acquire products, services, or capabilities from an external vendor or when it needs to move quickly to exploit new market opportunities and lacks the time and resources to respond on its own.

Fashion companies, such as GUESS, Ann Taylor, Levi Strauss, and Reebok, enlist Hong Kong-based Li & Fung to manage production and shipment of their garments. Li & Fung handles product development, raw material sourcing, production planning, quality assurance, and shipping. Li & Fung does not own any fabric, factories, or machines, outsourcing all of its work to a network of more than 15,000 suppliers in 40 countries all over the world. Customers place orders with Li & Fung over its private extranet. Li & Fung then sends instructions to appropriate raw material suppliers and factories where the clothing is produced. The Li & Fung extranet tracks the entire production process for each order. Working as a virtual company keeps Li & Fung flexible and adaptable so that it can design and produce the products ordered by its clients in short order to keep pace with rapidly changing fashion trends.

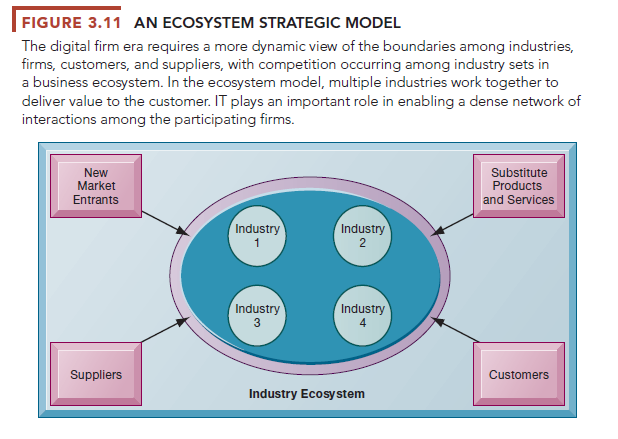

Business Ecosystems and Platforms The Internet and the emergence of digital firms call for some modification of the industry competitive forces model. The traditional Porter model assumes a relatively static industry environment; relatively clear-cut industry boundaries; and a relatively stable set of suppliers, substitutes, and customers. Instead of participating in a single industry, some of today’s firms participate in industry sets—collections of industries that provide related services and products that deliver value to the customer (see Figure 3.11). Business ecosystem is another term for these loosely coupled but interdependent networks of suppliers, distributors, outsourcing firms, transportation service firms, and technology manufacturers (Iansiti and Levien, 2004).

An example of a business ecosystem is the mobile Internet platform. In this ecosystem there are four industries: device makers (Apple iPhone, Samsung, LG, and others), wireless telecommunication firms (AT&T, Verizon, T-Mobile, Sprint, and others), independent software applications providers (generally small firms selling games, applications, and ring tones), and Internet service providers (who participate as providers of Internet service to the mobile platform). Each of these industries has its own history, interests, and driving forces. But these elements come together in a sometimes cooperative and sometimes competitive new mobile digital platform ecosystem, creating value for consumers that none of them could achieve acting alone.

Business ecosystems typically have one or only a few keystone firms that dominate the ecosystem and create the platforms used by other niche firms. For instance, both Microsoft and Facebook provide platforms composed of information systems, technologies, and services that thousands of other firms in different industries use to enhance their own capabilities (Van Alstyne et. al, 2016). Facebook is a platform used by billions of people and millions of businesses to interact and share information as well as to buy, market, and sell numerous products and services. More firms are trying to use information systems to develop into keystone firms by building IT-based platforms that other firms can use. Alternatively, firms should consider how their information systems will enable them to become profitable niche players in the larger ecosystems created by keystone firms.

Source: Laudon Kenneth C., Laudon Jane Price (2020), Management Information Systems: Managing the Digital Firm, Pearson; 16th edition.

Hiya, I’m really glad I’ve found this info. Today bloggers publish only about gossips and web and this is really annoying. A good blog with exciting content, this is what I need. Thank you for keeping this web site, I will be visiting it. Do you do newsletters? Can’t find it.

Good write-up, I’m regular visitor of one’s blog, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.