A business firm has systems to support different groups or levels of management. These systems include transaction processing systems and systems for business intelligence.

1. Transaction Processing Systems

Operational managers need systems that keep track of the elementary activities and transactions of the organization, such as sales, receipts, cash deposits, payroll, credit decisions, and the flow of materials in a factory. Transaction processing systems (TPS) provide this kind of information. A transaction processing system is a computerized system that performs and records the daily routine transactions necessary to conduct business, such as sales order entry, hotel reservations, payroll, employee record keeping, and shipping.

The principal purpose of systems at this level is to answer routine questions and to track the flow of transactions through the organization. How many parts are in inventory? What happened to Mr. Smith’s payment? To answer these kinds of questions, information generally must be easily available, current, and accurate.

At the operational level, tasks, resources, and goals are predefined and highly structured. The decision to grant credit to a customer, for instance, is made by a lower-level supervisor according to predefined criteria. All that must be determined is whether the customer meets the criteria.

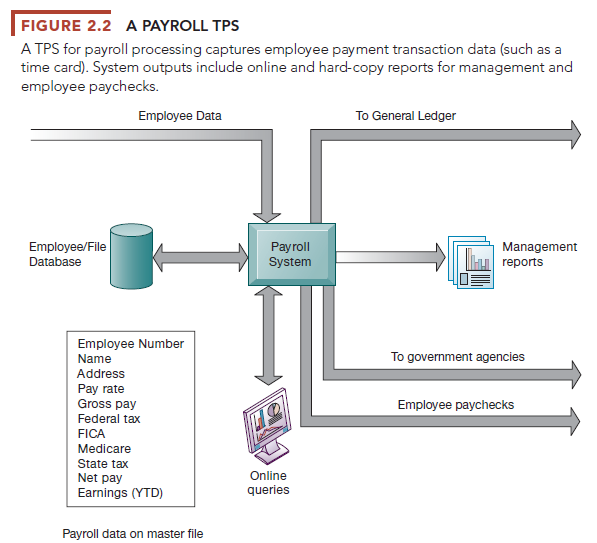

Figure 2.2 illustrates a TPS for payroll processing. A payroll system keeps track of money paid to employees. An employee time sheet with the employee’s name, social security number, and number of hours worked per week represents a single transaction for this system. Once this transaction is input into the system, it updates the system’s master file (or database) that permanently maintains employee information for the organization. The data in the system are combined in different ways to create reports of interest to management and government agencies and to send paychecks to employees.

Managers need TPS to monitor the status of internal operations and the firm’s relations with the external environment. TPS are also major producers of information for the other systems and business functions. For example, the payroll system illustrated in Figure 2.2, along with other accounting TPS, supplies data to the company’s general ledger system, which is responsible for maintaining records of the firm’s income and expenses and for producing reports such as income statements and balance sheets. It also supplies employee payment history data for insurance, pension, and other benefits calculations to the firm’s human resources function and employee payment data to government agencies such as the U.S. Internal Revenue Service and Social Security Administration.

Transaction processing systems are often so central to a business that TPS failure for a few hours can lead to a firm’s demise and perhaps that of other firms linked to it. Imagine what would happen to UPS if its package tracking system was not working! What would the airlines do without their computerized reservation systems?

2. Systems for Business Intelligence

Firms also have business intelligence systems that focus on delivering information to support management decision making. Business intelligence is a contemporary term for data and software tools for organizing, analyzing, and providing access to data to help managers and other enterprise users make more informed decisions. Business intelligence addresses the decision-making needs of all levels of management. This section provides a brief introduction to business intelligence.

Business intelligence systems for middle management help with monitoring, controlling, decision-making, and administrative activities. The term management information systems (MIS) also designates a specific category of information systems serving middle management. MIS provide middle managers with reports on the organization’s current performance. This information is used to monitor and control the business and predict future performance.

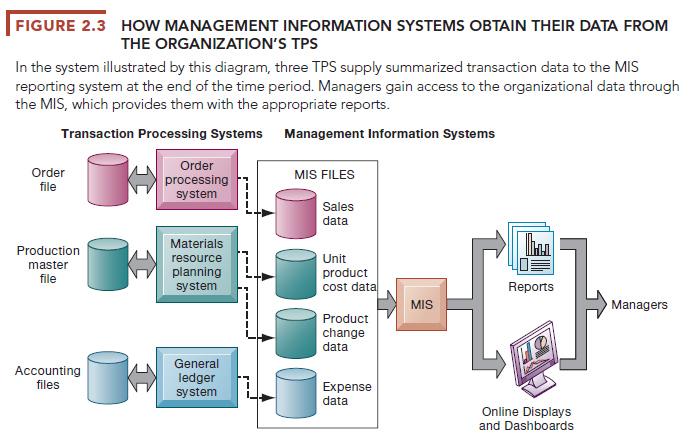

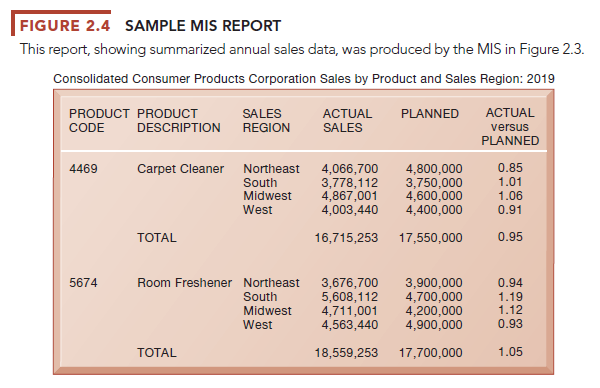

MIS summarize and report on the company’s basic operations using data supplied by transaction processing systems. The basic transaction data from TPS are compressed and usually presented in reports that are produced on a regular schedule. Today, many of these reports are delivered online. Figure 2.3 shows how a typical MIS transforms transaction-level data from inventory, production, and accounting into MIS files that are used to provide managers with reports. Figure 2.4 shows a sample report from this system.

| FIGURE 2.4 SAMPLE MIS REPORT

This report, showing summarized annual sales data, was produced by the MIS in Figure 2.3.

MIS typically provide answers to routine questions that have been specified in advance and have a predefined procedure for answering them. For instance, MIS reports might list the total pounds of lettuce used this quarter by a fast- food chain or, as illustrated in Figure 2.4, compare total annual sales figures for specific products to planned targets. These systems generally are not flexible and have little analytical capability. Most MIS use simple routines, such as summaries and comparisons, as opposed to sophisticated mathematical models or statistical techniques.

Other types of business intelligence systems support more non-routine decision making. Decision-support systems (DSS) focus on problems that are unique and rapidly changing, for which the procedure for arriving at a solution may not be fully predefined in advance. They try to answer questions such as these: What would be the impact on production schedules if we were to double sales in the month of December? What would happen to our return on investment if a factory schedule were delayed for six months?

Although DSS use internal information from TPS and MIS, they often bring in information from external sources, such as current stock prices or product prices of competitors. These systems are employed by “super-user” managers and business analysts who want to use sophisticated analytics and models to analyze data.

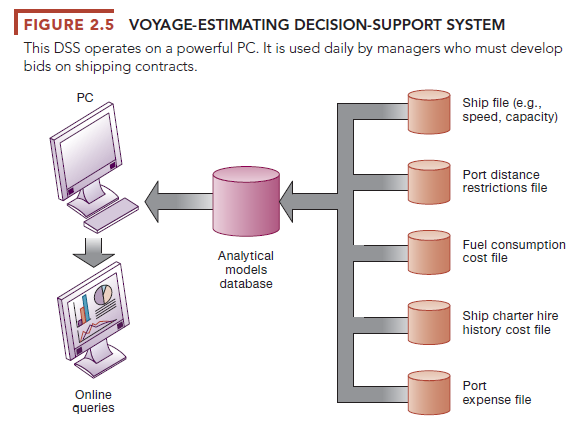

An interesting, small, but powerful DSS is the voyage-estimating system of a large global shipping company that transports bulk cargoes of coal, oil, ores, and finished products. The firm owns some vessels, charters others, and bids for shipping contracts in the open market to carry general cargo. A voyage-estimating system calculates financial and technical voyage details. Financial calculations include ship/time costs (fuel, labor, capital), freight rates for various types of cargo, and port expenses. Technical details include myriad factors, such as ship cargo capacity, speed, port distances, fuel and water consumption, and loading patterns (location of cargo for different ports).

The system can answer questions such as the following: Given a customer delivery schedule and an offered freight rate, which vessel should be assigned at what rate to maximize profits? What is the optimal speed at which a particular vessel can optimize its profit and still meet its delivery schedule? What is the optimal loading pattern for a ship bound for the U.S. West Coast from Malaysia? Figure 2.5 illustrates the DSS built for this company. The system operates on a powerful desktop personal computer, providing a system of menus that makes it easy for users to enter data or obtain information.

The voyage-estimating DSS we have just described draws heavily on models. Other business intelligence systems are more data-driven, focusing instead on extracting useful information from very large quantities of data. For example, large ski resort companies such as Intrawest and Vail Resorts collect and store large amounts of customer data from call centers, lodging and dining reservations, ski schools, and ski equipment rental stores. They use special software to analyze these data to determine the value, revenue potential, and loyalty of each customer to help managers make better decisions about how to target their marketing programs.

Business intelligence systems also address the decision-making needs of senior management. Senior managers need systems that focus on strategic issues and long-term trends, both in the firm and in the external environment. They are concerned with questions such as: What will employment levels be in five years? What are the long-term industry cost trends? What products should we be making in five years?

Executive support systems (ESS) help senior management make these decisions. They address nonroutine decisions requiring judgment, evaluation, and insight because there is no agreed-on procedure for arriving at a solution. ESS present graphs and data from many sources through an interface that is easy for senior managers to use. Often the information is delivered to senior executives through a portal, which uses a web interface to present integrated personalized business content.

ESS are designed to incorporate data about external events, such as new tax laws or competitors, but they also draw summarized information from internal MIS and DSS. They filter, compress, and track critical data, displaying the data of greatest importance to senior managers. Increasingly, such systems include business intelligence analytics for analyzing trends, forecasting, and “drilling down” to data at greater levels of detail.

For example, the chief operating officer (COO) and plant managers at Valero, the world’s largest independent petroleum refiner, use a Refining Dashboard to display real-time data related to plant and equipment reliability, inventory management, safety, and energy consumption. With the displayed information, the COO and his team can review the performance of each Valero refinery in the United States and Canada in terms of how each plant is performing compared to the production plan of the firm. The headquarters group can drill down from executive level to refinery level and individual system-operator level displays of performance. Valero’s Refining Dashboard is an example of a digital dashboard, which displays on a single screen graphs and charts of key performance indicators for managing a company. Digital dashboards are becoming an increasingly popular tool for management decision makers.

The Interactive Session on Organizations describes examples of several of these types of systems that the NFL (National Football League) and its teams use. Note the types of systems illustrated by this case and the role they play in improving both operations and decision making.

Source: Laudon Kenneth C., Laudon Jane Price (2020), Management Information Systems: Managing the Digital Firm, Pearson; 16th edition.

18 Jun 2021

21 Jun 2021

21 Jun 2021

18 Jun 2021

18 Jun 2021

18 Jun 2021