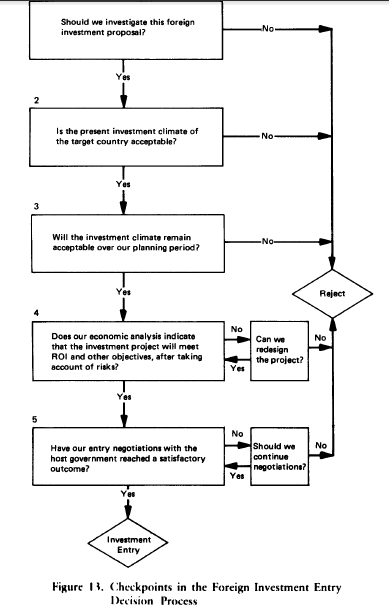

The investment entry decision process involves several subdecisions taken over a lengthy period of time, with multiple feedbacks that stimulate the reconsideration of earlier decisions. Figure 13 seeks to structure this complex decision process by means of a sequence of checkpoints that must be passed if an investment proposal is to gain acceptance.

The decision to investigate a foreign investment proposal is the first, and most important, checkpoint. Not only will a decision to investigate require substantial management time and money, it will also tend to generate a commitment to invest in those managers carrying on the investigation. The decision to investigate, therefore, should be taken only after an appraisal of alternative entry modes and alternative forms of investment entry. If managers agree that the most appropriate way to enter the target country/market is through investment, they should then go on to appraise alternative forms of investment entry: acquisition versus greenfield, and sole venture versus joint venture. This entry strategy review ensures against too early a commitment to investment entry or to a particular form of investment entry. Too commonly, companies respond to an outside investment proposal by setting up an investigation team that thinks only in terms of the proposal and is open to the danger of tunnel vision.

Once the decision to investigate an investment proposal is taken, the next steps are a thorough assessment of both the present and expected investment climates of the target country. Investment climate embraces all the environmental factors and forces—political, economic, and sociocultural—that can have a significant influence on the profitability and safety of the proposed investment project. Although the present investment climate of a target country is fully knowable to managers because it already exists, the future investment climate can be assessed only in probability terms. Since the most critical features of the future investment climate are political in nature, the dominant concern of managers is the question of political risk.

When investment-climate checkpoints are passed, managers turn to a full-scale economic analysis of the proposed project. If the project fails to meet profitability or other objectives, it may be possible to redesign the project to make it acceptable. Redesign may be intended to raise profitability (say, by reducing plant scale or adapting technology to local labor and other factor costs), to lower risk (for example, by switching from a sole venture to a joint venture), or both. The political analysis of step 3 should be integrated with the economic analysis of step 4 to ascertain the risk- adjusted profitability of the project.

If the project passes the profitability/risk checkpoint, the next step is entry negotiations with the host government.’ In negotiations, the host government may press for certain changes in the project that managers may need to evaluate with a new economic/risk analysis. II negotiations reach a satisfactory outcome, the company proceeds to make the investment entry.

Figure 13 is intended to identify the key steps in the investment decision process, but we do not want to suggest that the actual process is a unidirectional sequence of checkpoints. In practice, the decision process is likely to take many twists and turns. In the early phases of the decision process, managers are inclined to make crude judgments of the investment climate and the economic viability of the project in order to decide if any further investigation is desirable. More refined analyses of the investment climate and the project in later phases may confirm or deny these earlier judgments. Thus managers may run through steps 2, 3, and 4 several times before deciding to proceed to negotiations with the host government. These negotiations, in turn, may cause managers to reassess the investment climate and/or the project.6

We now turn to a closer look at the several aspects of investment entry: analyzing the investment climate, analyzing the investment project, entry through acquisition, entry through joint venture, and entry negotiations with the host government.

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

Hi everybody, here every one is sharing such knowledge, so it’s fastidious to read this

web site, and I used to pay a visit this blog everyday.