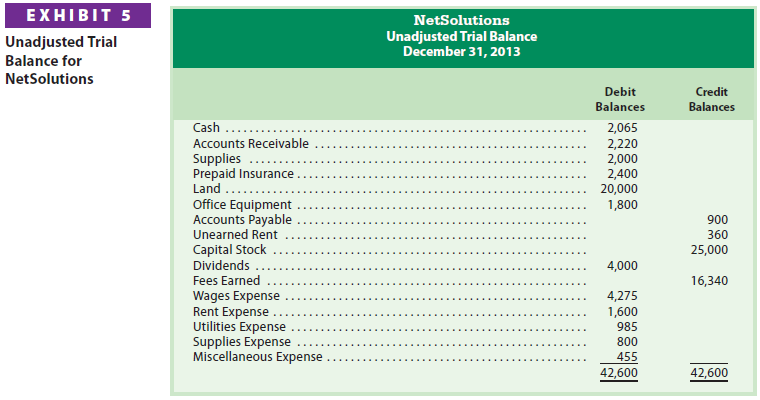

To illustrate adjusting entries, the December 31, 2013, the unadjusted trial balance of NetSolutions, shown in Exhibit 5 is used. An expanded chart of accounts for NetSolutions is shown in Exhibit 6. The additional accounts used in this chapter are shown in color. The rules of debit and credit shown in Exhibit 3 of Chapter 2 are used to record the adjusting entries.

1. Prepaid Expenses

Supplies The December 31, 2013, unadjusted trial balance of NetSolutions indicates a balance in the supplies account of $2,000. In addition, the prepaid insurance account has a balance of $2,400. Each of these accounts requires an adjusting entry.

The balance in NetSolutions’ supplies account on December 31 is $2,000. Some of these supplies (CDs, paper, envelopes, etc.) were used during December, and some are still on hand (not used). If either amount is known, the other can be determined. It is normally easier to determine the cost of the supplies on hand at the end of the month than to record daily supplies used.

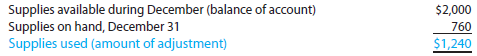

Assuming that on December 31 the amount of supplies on hand is $760, the amount to be transferred from the asset account to the expense account is $1,240, computed as follows:

At the end of December, the supplies expense account is increased (debited) for $1,240, and the supplies account is decreased (credited) for $1,240 to record the supplies used during December. The adjusting journal entry and T accounts for Supplies and Supplies Expense are as follows:

The adjusting entry is shown in color in the T accounts to separate it from other transactions. After the adjusting entry is recorded and posted, the supplies account has a debit balance of $760. This balance is an asset that will become an expense in a future period.

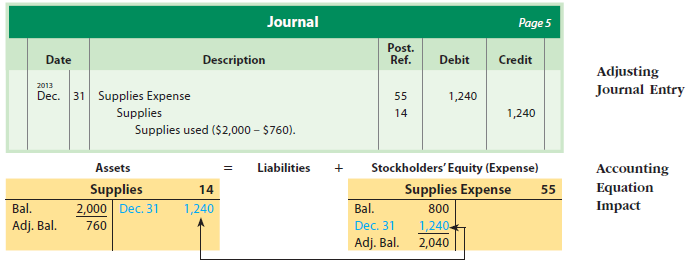

Prepaid Insurance The debit balance of $2,400 in NetSolutions’ prepaid insurance account represents a December 1 prepayment of insurance for 12 months. At the end of December, the insurance expense account is increased (debited), and the prepaid insurance account is decreased (credited) by $200, the insurance for one month. The adjusting journal entry and T accounts for Prepaid Insurance and Insurance Expense are as follows:

After the adjusting entry is recorded and posted, the prepaid insurance account has a debit balance of $2,200. This balance is an asset that will become an expense in future periods. The insurance expense account has a debit balance of $200, which is an expense of the current period.

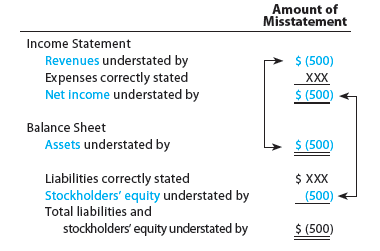

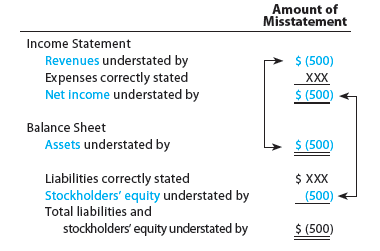

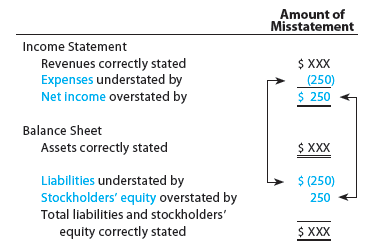

If the preceding adjustments for supplies ($1,240) and insurance ($200) are not recorded, the financial statements prepared as of December 31 will be misstated. On the income statement, Supplies Expense and Insurance Expense will be understated by a total of $1,440 ($1,240 1 $200), and net income will be overstated by $1,440. On the balance sheet, Supplies and Prepaid Insurance will be overstated by a total of $1,440. Since net income increases retained earnings, stockholders’ equity also will be overstated by $1,440 on the balance sheet. The effects of omitting these adjusting entries on the income statement and balance sheet are as follows:

Arrow (1) indicates the effect of the understated expenses on assets. Arrow (2) indicates the effect of the overstated net income on stockholders’ equity.

Payments for prepaid expenses are sometimes made at the beginning of the period in which they will be entirely used or consumed. To illustrate, the following December 1 transaction of NetSolutions is used.

Dec. 1 NetSolutions paid rent of $800 for the month.

On December 1, the rent payment of $800 represents Prepaid Rent. However, the Prepaid Rent expires daily, and at the end of December there will be no asset left. In such cases, the payment of $800 is recorded as Rent Expense rather than as Prepaid Rent. In this way, no adjusting entry is needed at the end of the period.

2. Unearned Revenues

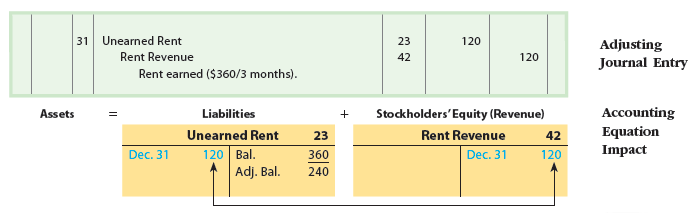

The December 31 unadjusted trial balance of NetSolutions indicates a balance in the unearned rent account of $360. This balance represents the receipt of three months’ rent on December 1 for December, January, and February. At the end of December, one month’s rent has been earned. Thus, the unearned rent account is decreased (debited) by $120, and the rent revenue account is increased (credited) by $120. The $120 represents the rental revenue for one month ($360/3). The adjusting journal entry and T accounts are shown below.

After the adjusting entry is recorded and posted, the unearned rent account has a credit balance of $240. This balance is a liability that will become revenue in a future period. Rent Revenue has a balance of $120, which is revenue of the current period.3

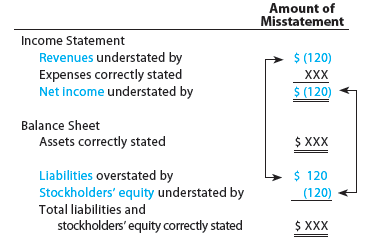

If the preceding adjustment of unearned rent and rent revenue is not recorded, the financial statements prepared on December 31 will be misstated. On the income statement, Rent Revenue and the net income will be understated by $120. On the balance sheet, liabilities (Unearned Rent) will be overstated by $120, and stockholders’ equity (Retained Earnings) will be understated by $120. The effects of omitting this adjusting entry are shown below.

3. Accrued Revenues

During an accounting period, some revenues are recorded only when cash is received. Thus, at the end of an accounting period, there may be revenue that has been earned but has not been recorded. In such cases, the revenue is recorded by increasing (debiting) an asset account and increasing (crediting) a revenue account.

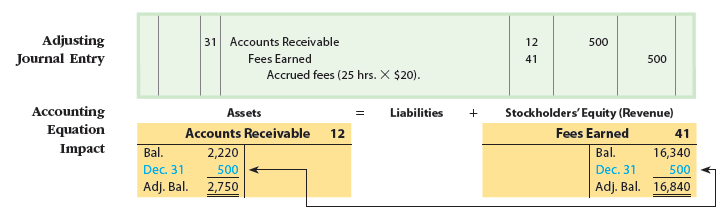

To illustrate, assume that NetSolutions signed an agreement with Dankner Co. on December 15. The agreement provides that NetSolutions will answer computer questions and render assistance to Dankner Co.’s employees. The services will be billed to Dankner Co. on the fifteenth of each month at a rate of $20 per hour. As of December 31, NetSolutions had provided 25 hours of assistance to Dankner Co. The revenue of $500 (25 hours X $20) will be billed on January 15. However, NetSolutions earned the revenue in December.

The claim against the customer for payment of the $500 is an account receivable (an asset). Thus, the accounts receivable account is increased (debited) by $500, and the fees earned account is increased (credited) by $500. The adjusting journal entry and T accounts are shown below.

If the adjustment for the accrued revenue ($500) is not recorded, Fees Earned and the net income will be understated by $500 on the income statement. On the balance sheet, assets (Accounts Receivable) and stockholders’ equity (Retained Earnings) will be understated by $500. The effects of omitting this adjusting entry are shown below.

4. Accrued Expenses

Some types of services used in earning revenues are paid for after the service has been performed. For example, wages expense is used hour by hour, but is paid only daily, weekly, biweekly, or monthly. At the end of the accounting period, the amount of such accrued but unpaid items is an expense and a liability.

For example, if the last day of the employees’ pay period is not the last day of the accounting period, an accrued expense (wages expense) and the related liability (wages payable) must be recorded by an adjusting entry. This adjusting entry is necessary so that expenses are properly matched to the period in which they were incurred in earning revenue.

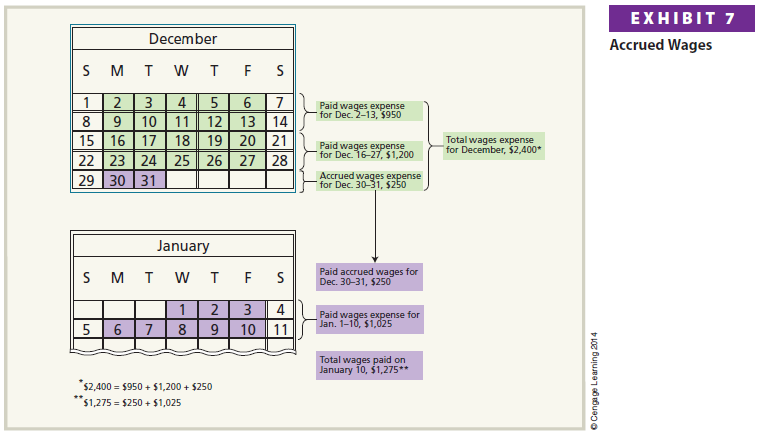

To illustrate, NetSolutions pays its employees biweekly. During December, NetSolutions paid wages of $950 on December 13 and $1,200 on December 27. These payments covered pay periods ending on those days as shown in Exhibit 7.

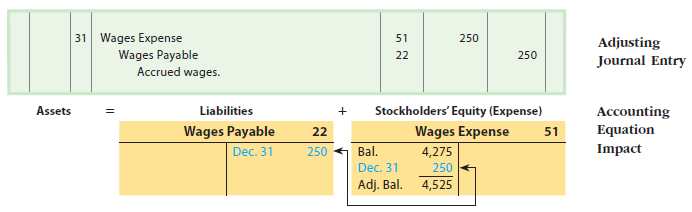

As of December 31, NetSolutions owes $250 of wages to employees for Monday and Tuesday, December 30 and 31. Thus, the wages expense account is increased (debited) by $250 and the wages payable account is increased (credited) by $250. The adjusting journal entry and T accounts are shown below.

After the adjusting entry is recorded and posted, the debit balance of the wages expense account is $4,525. This balance of $4,525 is the wages expense for two months, November and December. The credit balance of $250 in Wages Payable is the liability for wages owed on December 31.

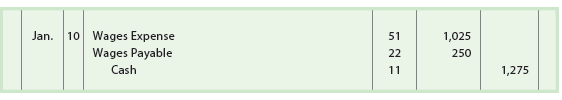

As shown in Exhibit 7, NetSolutions paid wages of $1,275 on January 10. This payment includes the $250 of accrued wages recorded on December 31. Thus, on January 10, the wages payable account is decreased (debited) by $250. Also, the wages expense account is increased (debited) by $1,025 ($1,275 – $250), which is the wages expense for January 1-10. Finally, the cash account is decreased (credited) by $1,275. The journal entry for the payment of wages on January 10 is shown below.4

If the adjustment for wages ($250) is not recorded, Wages Expense will be understated by $250, and the net income will be overstated by $250 on the income statement. On the balance sheet, liaiblities (Wages Payable) will be understated by $250, and stockholders’ equity (Retained Earnings) will be overstated by $250. The effects of omitting this adjusting entry are shown as follows:

5. Depreciation Expense

Fixed assets, or plant assets, are physical resources that are owned and used by a business and are permanent or have a long life. Examples of fixed assets include land, buildings, and equipment. In a sense, fixed assets are a type of long-term prepaid expense. However, because of their unique nature and long life, they are discussed separately from other prepaid expenses.

Fixed assets, such as office equipment, are used to generate revenue much like supplies are used to generate revenue. Unlike supplies, however, there is no visible reduction in the quantity of the equipment. Instead, as time passes, the equipment loses its ability to provide useful services. This decrease in usefulness is called depreciation.

All fixed assets, except land, lose their usefulness and, thus, are said to depreciate. As a fixed asset depreciates, a portion of its cost should be recorded as an expense. This periodic expense is called depreciation expense.

The adjusting entry to record depreciation expense is similar to the adjusting entry for supplies used. The depreciation expense account is increased (debited) for the amount of depreciation. However, the fixed asset account is not decreased (credited). This is because both the original cost of a fixed asset and the depreciation recorded since its purchase are reported on the balance sheet. Instead, an account entitled Accumulated Depreciation is increased (credited).

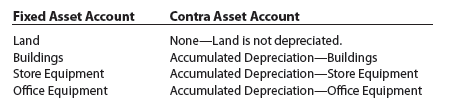

Accumulated depreciation accounts are called contra accounts, or contra asset accounts. This is because accumulated depreciation accounts are deducted from their related fixed asset accounts on the balance sheet. The normal balance of a contra account is opposite to the account from which it is deducted. Since the normal balance of a fixed asset account is a debit, the normal balance of an accumulated depreciation account is a credit.

The normal titles for fixed asset accounts and their related contra asset accounts are as follows:

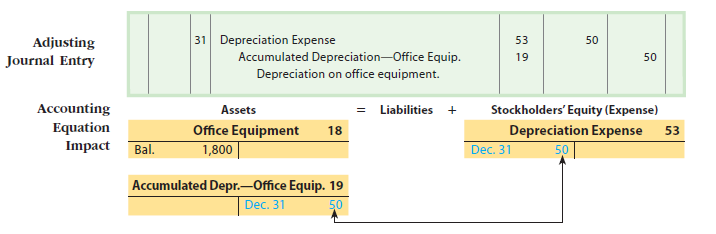

The December 31, 2013, unadjusted trial balance of NetSolutions (Exhibit 5) indicates that NetSolutions owns two fixed assets: land and office equipment. Land does not depreciate; however, an adjusting entry is recorded for the depreciation of the office equipment for December. Assume that the office equipment depreciates $50 during December. The depreciation expense account is increased (debited) by $50, and the accumulated depreciation—office equipment account is increased (credited) by $50.[2] The adjusting journal entry and T accounts are shown below.

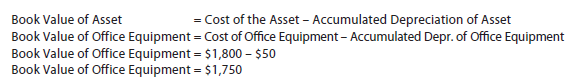

After the adjusting journal entry is recorded and posted, the office equipment account still has a debit balance of $1,800. This is the original cost of the office equipment that was purchased on December 4. The accumulated depreciation— office equipment account has a credit balance of $50. The difference between these two balances is the cost of the office equipment that has not yet been depreciated. This amount, called the book value of the asset (or net book value), is computed as shown below.

The office equipment and its related accumulated depreciation are reported on the December 31, 2013, balance sheet as follows:

The market value of a fixed asset usually differs from its book value. This is because depreciation is an allocation method, not a valuation method. That is, depreciation allocates the cost of a fixed asset to expense over its estimated life. Depreciation does not measure changes in market values, which vary from year to year. Thus, on December 31, 2013, the market value of NetSolutions’ office equipment could be more or less than $1,750.

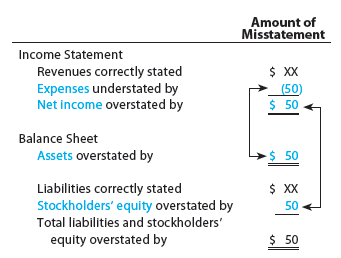

If the adjustment for depreciation ($50) is not recorded, Depreciation Expense on the income statement will be understated by $50, and the net income will be overstated by $50. On the balance sheet, assets (the book value of Office Equipment) and stockholders’ equity (Retained Earnings) will be overstated by $50. The effects of omitting the adjustment for depreciation are shown on the next page.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Pretty part of content. I just stumbled upon your web site and in accession capital to say that I get actually enjoyed account your blog posts. Anyway I’ll be subscribing for your feeds or even I achievement you get entry to persistently fast.