Although merchandising transactions affect the balance sheet in reporting inventory, they primarily affect the income statement. An income statement for a merchandising business is normally prepared using either a multiple-step or single-step format.

1. Multiple-Step Income Statement

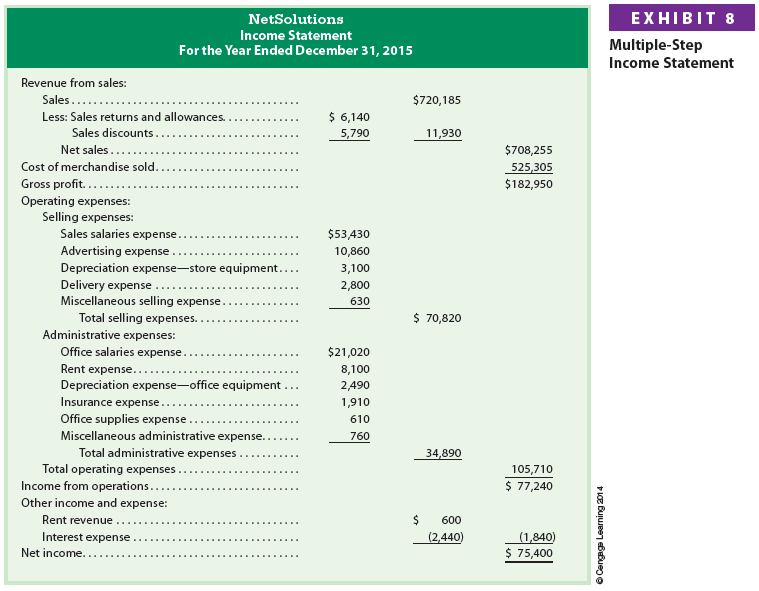

The 2015 income statement for NetSolutions is shown in Exhibit 8.6 This form of income statement, called a multiple-step income statement, contains several sections, subsections, and subtotals.

Revenue from Sales This section of the multiple-step income statement consists of sales, sales returns and allowances, sales discounts, and net sales. The total amount of sales to customers for cash and on account is reported in this section. From this total, sales returns and allowances and sales discounts are deducted to yield net sales. Some companies only report net sales in the income statement, and report sales, sales returns and allowances, and sales discounts in a note to the financial statements.

NetSolutions reported sales of $720,185, sales returns and allowances of $6,140, and sales discounts of $5,790 for the year ended December 31, 2015. As a result, net sales were $708,255.

Cost of Merchandise Sold As shown in Exhibit 8, NetSolutions reported cost of merchandise sold of $525,305 during 2015. This amount is the cost of merchandise sold to customers. Cost of merchandise sold may also be reported as cost of goods sold or cost of sales.

Gross Profit The excess of net sales over cost of merchandise sold is gross profit. As shown in Exhibit 8, NetSolutions reported gross profit of $182,950 in 2015.

Income from operations Income from operations, sometimes called operating income, is determined by subtracting operating expenses from gross profit. Operating expenses are normally classified as either selling expenses or administrative expenses.

Selling expenses are incurred directly in the selling of merchandise. Examples of selling expenses include sales salaries, store supplies used, depreciation of store equipment, delivery expense, and advertising.

Administrative expenses, sometimes called general expenses, are incurred in the administration or general operations of the business. Examples of administrative expenses include office salaries, depreciation of office equipment, and office supplies used.

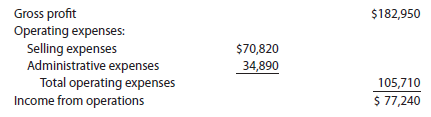

Each selling and administrative expense may be reported separately as shown in Exhibit 8. However, many companies report selling, administrative, and operating expenses as single line items as shown below for NetSolutions.

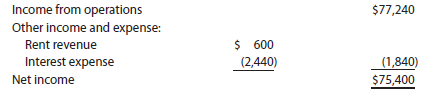

Other Income and Expense Other income and expense items are not related to the primary operations of the business. Other income is revenue from sources other than the primary operating activity of a business. Examples of other income include income from interest, rent, and gains resulting from the sale of fixed assets. Other expense is an expense that cannot be traced directly to the normal operations of the business. Examples of other expenses include interest expense and losses from disposing of fixed assets.

Other income and other expense are offset against each other on the income statement. If the total of other income exceeds the total of other expense, the difference is added to income from operations to determine net income. If the reverse is true, the difference is subtracted from income from operations. The other income and expense items of NetSolutions are reported as shown below and in Exhibit 8.

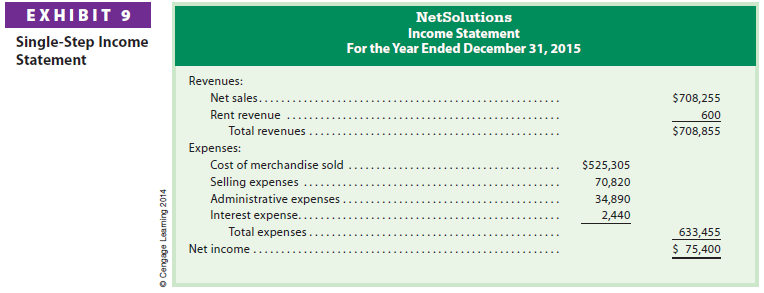

2. Single-Step Income Statement

An alternate form of income statement is the single-step income statement. As shown in Exhibit 9, the income statement for NetSolutions deducts the total of all expenses in one step from the total of all revenues.

The single-step form emphasizes total revenues and total expenses in determining net income. A criticism of the single-step form is that gross profit and income from operations are not reported.

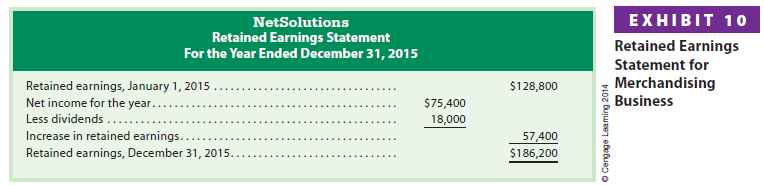

3. Retained Earnings Statement

The retained earnings statement for NetSolutions is shown in Exhibit 10. This statement is prepared in the same manner as for a service business.

4. Balance Sheet

The balance sheet may be presented with assets on the left-hand side and the liabilities and stockholders’ equity on the right-hand side. This form of the balance sheet is called the account form. The balance sheet may also be presented in a downward sequence in three sections. This form of balance sheet is called the report form. The report form of balance sheet for NetSolutions is shown in Exhibit 11.

In Exhibit 11, merchandise inventory is reported as a current asset and the current portion of the note payable of $5,000 is reported as a current liability.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I’ve read some excellent stuff here. Definitely price bookmarking for revisiting. I surprise how much attempt you put to create this sort of fantastic informative site.