Paying a monthly bill, such as a telephone bill of $168, affects a business’s financial condition because it now has less cash on hand. Such an economic event or condition that directly changes an entity’s financial condition or its results of operations is a business transaction. For example, purchasing land for $50,000 is a business transaction. In contrast, a change in a business’s credit rating does not directly affect cash or any other asset, liability, or stockholders’ equity amount.

All business transactions can be stated in terms of changes in the elements of the accounting equation. How business transactions affect the accounting equation can be illustrated by using some typical transactions. As a basis for illustration, a business organized by Chris Clark is used.

Assume that on November 1, 2013, Chris Clark organizes a corporation that will be known as NetSolutions. The first phase of Chris’s business plan is to operate Net-Solutions as a service business assisting individuals and small businesses in developing Web pages and installing computer software. Chris expects this initial phase of the business to last one to two years. During this period, Chris plans on gathering information on the software and hardware needs of customers. During the second phase of the business plan, Chris plans to expand NetSolutions into a personalized retailer of software and hardware for individuals and small businesses.

Each transaction during NetSolutions’ first month of operations is described in the following paragraphs. The effect of each transaction on the accounting equation is then shown.

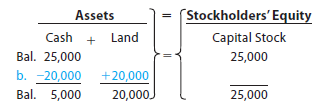

Transaction A – Nov. 1, 2013 Chris Clark deposited $25,000 in a bank account in the name of NetSolutions in exchange for shares of stock in the corporation.

Stock issued to stockholders’ (owners), such as Chris Clark, is referred to as capital stock. This transaction increases assets by increasing Cash (on the left side of the equation) by $25,000. To balance the equation, Capital Stock under stockholders’ equity (on the right side of the equation) increases by the same amount.

The effect of this transaction on NetSolutions’ accounting equation is shown below.

The accounting equation shown above is only for the corporation, NetSolutions. Under the business entity concept, Chris Clark’s personal assets, such as a home or personal bank account, and personal liabilities are excluded from the equation.

Transaction B – Nov. 5, 2013 NetSolutions paid $20,000 for the purchase of land as a future building site.

The land is located in a business park with access to transportation facilities. Chris Clark plans to rent office space and equipment during the first phase of the business plan. During the second phase, Chris plans to build an office and a warehouse for NetSolutions on the land.

The purchase of the land changes the makeup of the assets, but it does not change the total assets. The items in the equation prior to this transaction and the effect of the transaction are shown below. The new amounts are called balances.

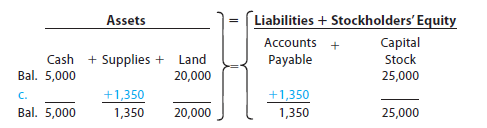

Transaction C – Nov. 10, 2013 NetSolutions purchased supplies for $1,350 and agreed to pay the supplier in the near future.

You have probably used a credit card to buy clothing or other merchandise. In this type of transaction, you received clothing for a promise to pay your credit card bill in the future.

That is, you received an asset and incurred a liability to pay a future bill. NetSolutions entered into a similar transaction by purchasing supplies for $1,350 and agreeing to pay the supplier in the near future. This type of transaction is called a purchase on account and is often described as follows: Purchased supplies on account, $1,350.

The liability created by a purchase on account is called an account payable. Items such as supplies that will be used in the business in the future are called prepaid expenses, which are assets. Thus, the effect of this transaction is to increase assets (Supplies) and liabilities (Accounts Payable) by $1,350, as follows:

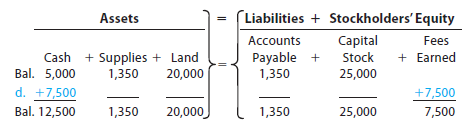

Transaction D – Nov. 18, 2013 NetSolutions received cash of$7,500for providing services to customers.

You may have earned money by painting houses or mowing lawns. If so, you received money for rendering services to a customer. Likewise, a business earns money by selling goods or services to its customers. This amount is called revenue.

During its first month of operations, NetSolutions received cash of $7,500 for providing services to customers. The receipt of cash increases NetSolutions’ assets and also increases stockholders’ equity in the business. The revenues of $7,500 are recorded in a Fees Earned column to the right of Capital Stock. The effect of this transaction is to increase Cash and Fees Earned by $7,500, as follows.

Different terms are used for the various types of revenues. As illustrated above, revenue from providing services is recorded as fees earned. Revenue from the sale of merchandise is recorded as sales. Other examples of revenue include rent, which is recorded as rent revenue, and interest, which is recorded as interest revenue.

Instead of receiving cash at the time services are provided or goods are sold, a business may accept payment at a later date. Such revenues are described as fees earned on account or sales on account. For example, if NetSolutions had provided services on account instead of for cash, transaction (d) would have been described as follows: Fees earned on account, $7,500.

In such cases, the firm has an account receivable, which is a claim against the customer. An account receivable is an asset, and the revenue is earned and recorded as if cash had been received. When customers pay their accounts, Cash increases and Accounts Receivable decreases.

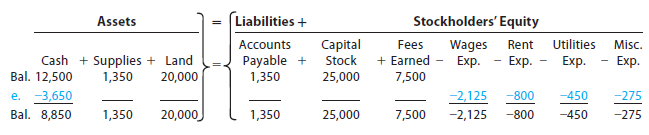

Transaction E – Nov. 30, 2013 NetSolutions paid the following expenses during the month: wages, $2,125; rent, $800; utilities, $450; and miscellaneous, $275.

During the month, NetSolutions spent cash or used up other assets in earning revenue. Assets used in this process of earning revenue are called expenses. Expenses include supplies used and payments for employee wages, utilities, and other services.

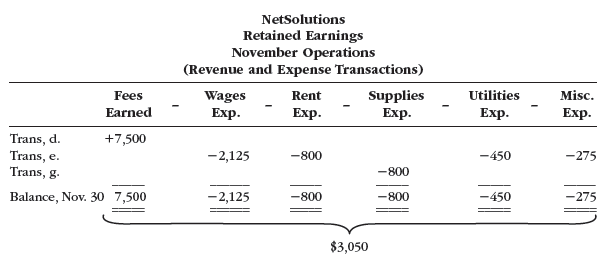

NetSolutions paid the following expenses during the month: wages, $2,125; rent, $800; utilities, $450; and miscellaneous, $275. Miscellaneous expenses include small amounts paid for such items as postage, coffee, and newspapers. The effect of expenses is the opposite of revenues in that expenses reduce assets and stockholders’ equity. Like fees earned, the expenses are recorded in columns to the right of Capital Stock. However, since expenses reduce stockholders’ equity, the expenses are entered as negative amounts. The effect of this transaction is shown below.

Businesses usually record each revenue and expense transaction as it occurs. However, to simplify, NetSolutions’ revenues and expenses are summarized for the month in transactions (d) and (e).

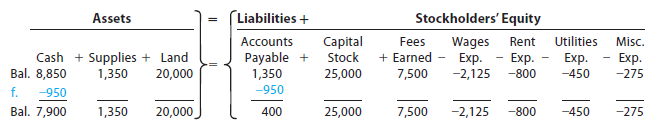

Transaction F – Nov. 30, 2013 NetSolutions paid creditors on account, $950.

When you pay your monthly credit card bill, you decrease the cash and decrease the amount you owe to the credit card company. Likewise, when NetSolutions pays $950 to creditors during the month, it reduces assets and liabilities, as shown below.

Paying an amount on account is different from paying an expense. The paying of an expense reduces stockholders’ equity, as illustrated in transaction (e). Paying an amount on account reduces the amount owed on a liability.

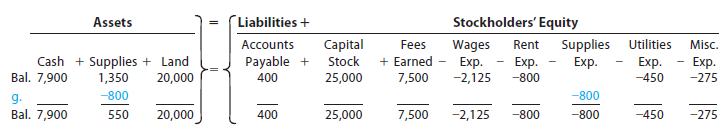

Transaction G – Nov. 30, 2013 Chris Clark determined that the cost of supplies on hand at the end of the month was $550.

The cost of the supplies on hand (not yet used) at the end of the month is $550. Thus, $800 ($1,350 – $550) of supplies must have been used during the month. This decrease in supplies is recorded as an expense, as shown below.

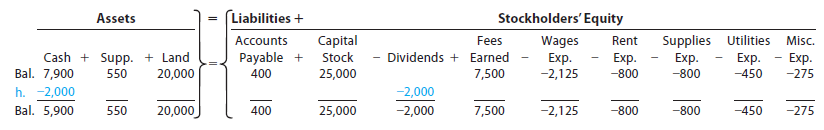

Transaction H – Nov. 30, 2013 NetSolutions paid $2,000 to stockholders (Chris Clark) as dividends.

Dividends are distributions of earnings to stockholders. The payment of dividends decreases cash and stockholders’ equity. Like expenses, dividends are recorded in a separate column to the right of Capital Stock as a negative amount. The effect of the payment of dividends of $2,000 is shown below.

Dividends should not be confused with expenses. Dividends do not represent assets or services used in the process of earning revenues. Instead, dividends are considered a distribution of earnings to stockholders.

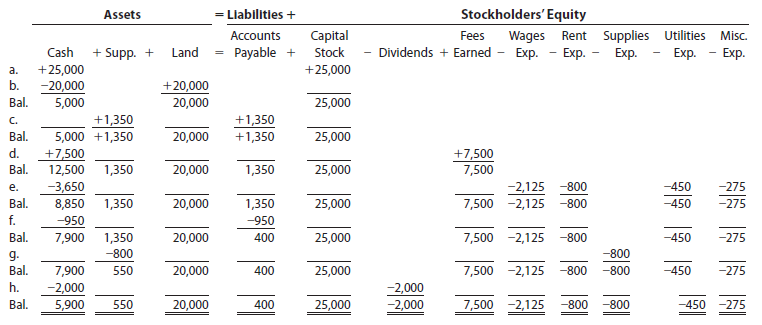

Summary The transactions of NetSolutions are summarized below. Each transaction is identi- Summary fied by letter, and the balance of each accounting equation element is shown after every transaction.

You should note the following:

- The effect of every transaction is an increase or a decrease in one or more of the accounting equation elements.

- The two sides of the accounting equation are always equal.

- The stockholders’ equity (owner’s equity) is increased by amounts invested by stockholders (capital stock).

- The stockholders’ equity (owner’s equity) is increased by revenues and decreased by expenses.

- The stockholders’ equity (owner’s equity) is decreased by dividends paid to stockholders.

Stockholders’ equity is classified as:

-

- Capital Stock

- Retained Earnings.

Capital stock is shares of ownership distributed to investors of a corporation. It represents the portion of stockholders’ equity contributed by investors. For NetSolutions, shares of capital stock of $25,000 were distributed to Chris Clark in exchange for investing in the business.

Retained earnings is the stockholders’ equity created from business operations through revenue and expense transactions. For NetSolutions, retained earnings of $3,050 were created by its November operations (revenue and expense transactions), as shown below.

Stockholders’ equity created by investments by stockholders (capital stock) and by business operations (retained earnings) is reported separately. Since dividends are distributions of earnings to stockholders, dividends reduce retained earnings. NetSolutions paid $2,000 in dividends during November, thus reducing retained earnings to $1,050 ($3,050 — $2,000).

The effects of investments by stockholders, dividends, revenues, and expenses on stockholders’ equity are illustrated in Exhibit 5.

Example Exercise 1-3 Transactions

Salvo Delivery Service is owned and operated by Joel Salvo. The following selected transactions were completed by Salvo Delivery Service during February:

- Received cash from owner as additional investment in exchange for capital stock, $35,000.

- Paid creditors on account, $1,800.

- Billed customers for delivery services on account, $ 11,250.

- Received cash from customers on account, $6,740.

- Paid dividends, $1,000.

Indicate the effect of each transaction on the accounting equation elements (Assets, Liabilities, Stockholders’ Equity Capital Stock, Dividends, Revenue, and Expense). Also indicate the specific item within the accounting equation element that is affected. To illustrate, the answer to (1) is shown below.

- Asset (Cash) increases by $35,000; Stockholders’ Equity (Capital Stock) increases by $35,000.

Follow My Example 1-3

- Asset (Cash) decreases by $1,800; Liability (Accounts Payable) decreases by $1,800.

- Asset (Accounts Receivable) increases by $11,250; Revenue (Delivery Service Fees) increases by $11,250.

- Asset (Cash) increases by $6,740; Asset (Accounts Receivable) decreases by $6,740.

- Asset (Cash) decreases by $1,000; Dividends increases by $1,000.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I’m very pleased to find this site. I wanted to thank you

for your time for this particularly fantastic read!!

I definitely really liked every little bit of it and I have you bookmarked

to look at new things on your website.

I seriously love your blog.. Pleasant colors & theme. Did you make this website

yourself? Please reply back as I’m trying to create my

own personal website and would love to know where you got this from or just what the theme is named.

Many thanks!

Very nice article, exactly what I needed.

Hi there, I found your blog via Google while looking for a related topic, your site came up, it looks good. I have bookmarked it in my google bookmarks.

Great line up. We will be linking to this great article on our site. Keep up the good writing.