In this section, the complete accounting cycle for one period is illustrated. Assume cycle for one period– that for several years Kelly Pitney has operated a part-time consulting business from her home. As of April 1, 2014, Kelly decided to move to rented quarters and to operate the business on a full-time basis as a professional corporation. The business will be known as Kelly Consulting, P.C. During April, Kelly Consulting entered into the following transactions:

Apr.

- The following assets were received from Kelly Pitney in exchange for capital stock: cash, $13,100; accounts receivable, $3,000; supplies, $1,400; and office equipment, $12,500. There were no liabilities received.

- Paid three months’ rent on a lease rental contract, $4,800.

- Paid the premiums on property and casualty insurance policies, $1,800.

- Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $5,000.

Apr.

- Purchased additional office equipment on account from Office Station Co., $2,000.

- Received cash from clients on account, $1,800.

- Paid cash for a newspaper advertisement, $120.

- Paid Office Station Co. for part of the debt incurred on April 5, $1,200.

- Recorded services provided on account for the period April 1-12, $4,200.

- Paid part-time receptionist for two weeks’ salary, $750.

- Recorded cash from cash clients for fees earned during the period April 1-16, $6,250.

- Paid cash for supplies, $800.

- Recorded services provided on account for the period April 13-20, $2,100.

- Recorded cash from cash clients for fees earned for the period April 17-24, $3,850.

- Received cash from clients on account, $5,600.

- Paid part-time receptionist for two weeks’ salary, $750.

- Paid telephone bill for April, $130.

- Paid electricity bill for April, $200.

- Recorded cash from cash clients for fees earned for the period April 25-30, $3,050. 30. Recorded services provided on account for the remainder of April, $1,500.

- Paid dividends of $6,000.

1. Step 1. Analyzing and Recording Transactions in the Journal

The first step in the accounting cycle is to analyze and record transactions in the journal using the double-entry accounting system. As illustrated in Chapter 2, transactions are analyzed and journalized using the following steps:

- Carefully read the description of the transaction to determine whether an asset, liability, capital stock, retained earnings, dividends, revenue, or expense account is affected.

- For each account affected by the transaction, determine whether the account increases or decreases.

- Determine whether each increase or decrease should be recorded as a debit or a credit, following the rules of debit and credit shown in Exhibit 3 of Chapter 2.

- Record the transaction using a journal entry.

The company’s chart of accounts is useful in determining which accounts are affected by the transaction. The chart of accounts for Kelly Consulting is as follows:

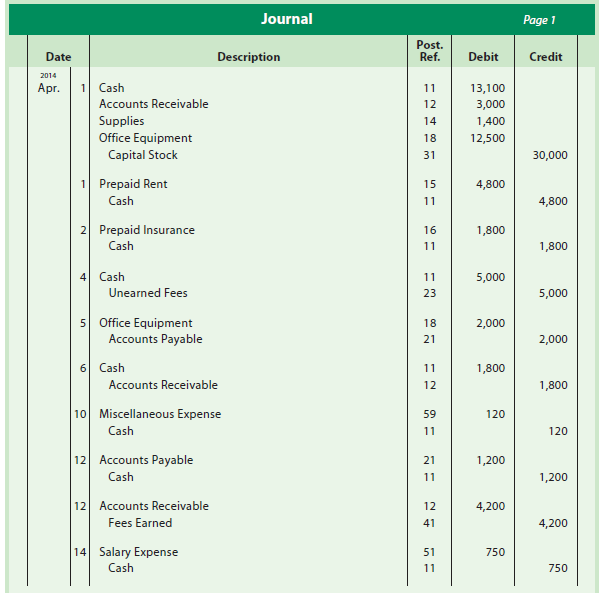

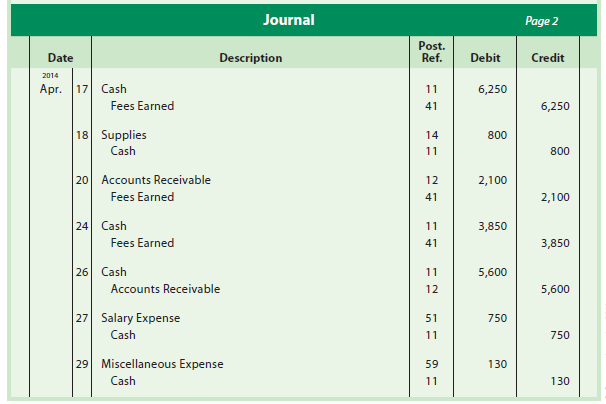

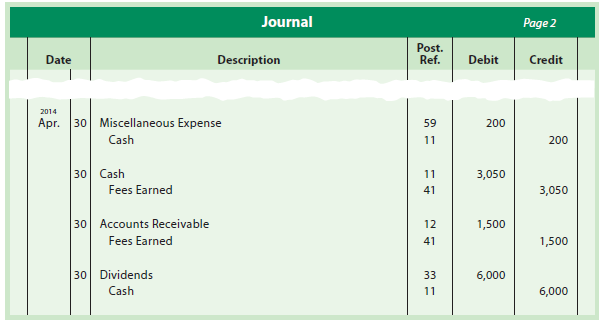

After analyzing each of Kelly Consulting’s transactions for April, the journal entries are recorded as shown in Exhibit 9.

2. Step 2. Posting Transactions to the Ledger

Periodically, the transactions recorded in the journal are posted to the accounts in the ledger. The debits and credits for each journal entry are posted to the accounts in the order in which they occur in the journal. As illustrated in Chapters 2 and 3, journal entries are posted to the accounts using the following four steps:

- The date is entered in the Date column of the account.

- The amount is entered into the Debit or Credit column of the account.

- The journal page number is entered in the Posting Reference column.

- The account number is entered in the Posting Reference (Post. Ref.) column in the journal.

Exhibit 9

Journal Entries

for April, Kelly

Consulting, P.C.

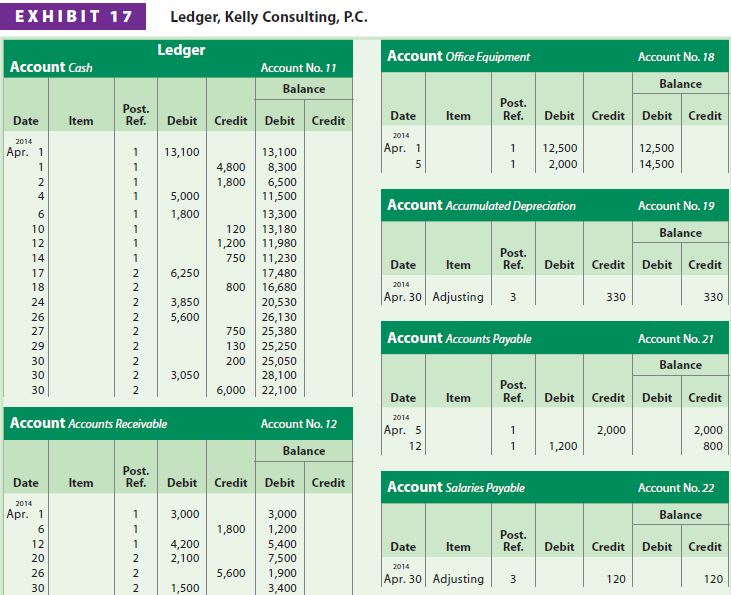

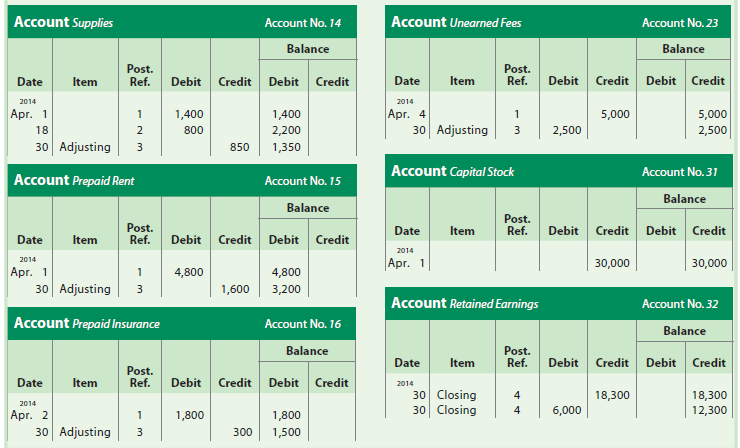

The journal entries for Kelly Consulting have been posted to the ledger shown in Exhibit 17 on pages 172-173.

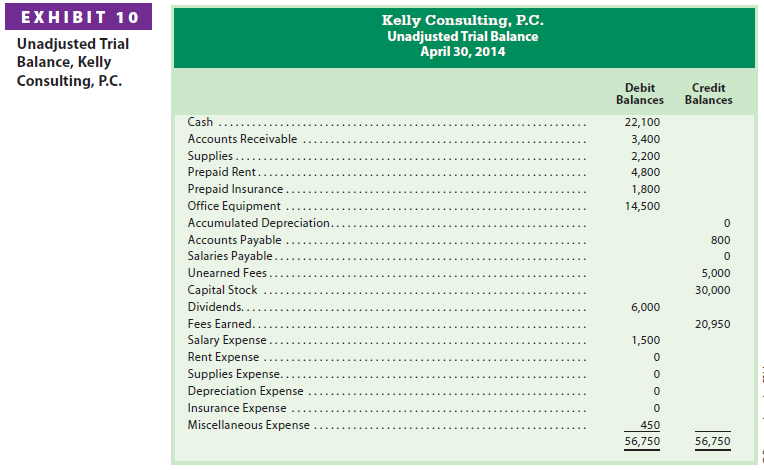

3. Step 3. Preparing an Unadjusted Trial Balance

An unadjusted trial balance is prepared to determine whether any errors have been made in posting the debits and credits to the ledger. The unadjusted trial balance shown in Exhibit 10 does not provide complete proof of the accuracy of the ledger. It indicates only that the debits and the credits are equal. This proof is of value, however, because errors often affect the equality of debits and credits. If the two totals of a trial balance are not equal, an error has occurred that must be discovered and corrected.

The unadjusted account balances shown in Exhibit 10 were taken from Kelly Consulting’s ledger shown in Exhibit 17, on pages 172-173, before any adjusting entries were recorded.

4. Step 4. Assembling and Analyzing Adjustment Data

Before the financial statements can be prepared, the accounts must be updated. The four types of accounts that normally require adjustment include prepaid expenses, unearned revenue, accrued revenue, and accrued expenses. In addition, depreciation expense must be recorded for fixed assets other than land. The following data have been assembled on April 30, 2014, for analysis of possible adjustments for Kelly Consulting:

- Insurance expired during April is $300.

- Supplies on hand on April 30 are $1,350.

- Depreciation of office equipment for April is $330.

- Accrued receptionist salary on April 30 is $120.

- Rent expired during April is $1,600.

- Unearned fees on April 30 are $2,500.

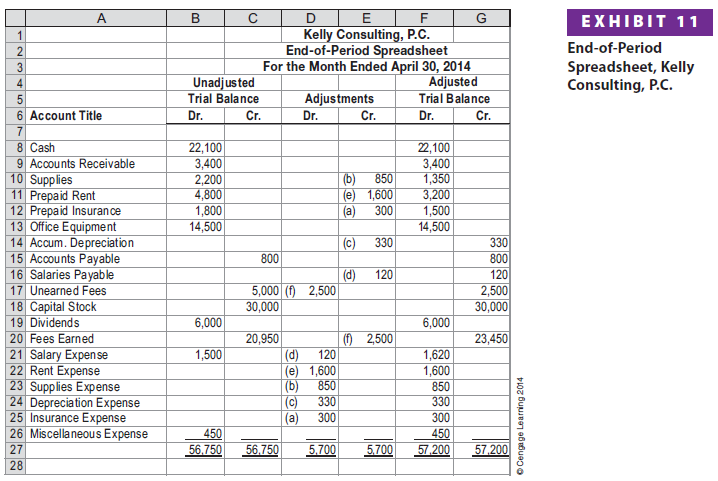

5. Step 5. Preparing an Optional End-of-Period Spreadsheet

Although an end-of-period spreadsheet is not required, it is useful in showing the flow of accounting information from the unadjusted trial balance to the adjusted trial balance. In addition, an end-of-period spreadsheet is useful in analyzing the impact of proposed adjustments on the financial statements. The end-of-period spreadsheet for Kelly Consulting is shown in Exhibit 11.

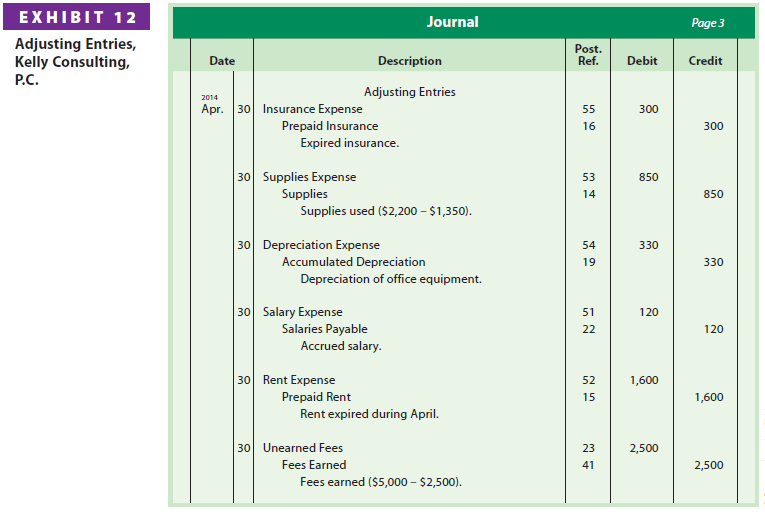

6. Step 6. Journalizing and Posting Adjusting Entries

Based on the adjustment data shown in Step 4, adjusting entries for Kelly Consulting are prepared as shown in Exhibit 12. Each adjusting entry affects at least one income statement account and one balance sheet account. Explanations for each adjustment including any computations are normally included with each adjusting entry.

Each of the adjusting entries shown in Exhibit 12 is posted to Kelly Consulting’s ledger shown in Exhibit 17 on pages 172-173. The adjusting entries are identified in the ledger as “Adjusting.”

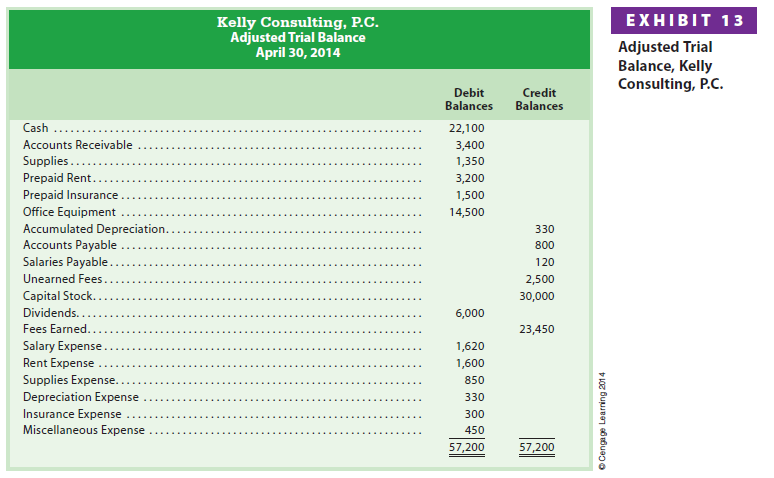

7. Step 7. Preparing an Adjusted Trial Balance

After the adjustments have been journalized and posted, an adjusted trial balance is prepared to verify the equality of the total of the debit and credit balances. This is the last step before preparing the financial statements. If the adjusted trial balance does not balance, an error has occurred and must be found and corrected. The adjusted trial balance for Kelly Consulting as of April 30, 2014, is shown in Exhibit 13.

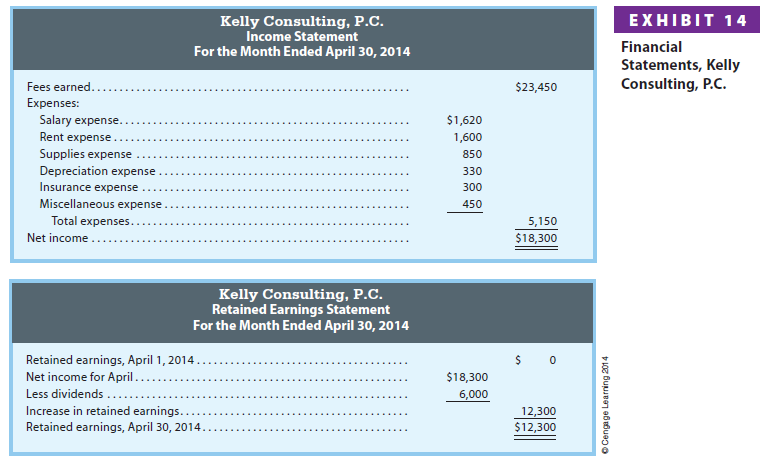

8. Step 8. Preparing the Financial Statements

The most important outcome of the accounting cycle is the financial statements. The income statement is prepared first, followed by the retained earnings statement and then the balance sheet. The statements can be prepared directly from the adjusted trial balance, the end-of-period spreadsheet, or the ledger. The net income or net loss shown on the income statement is reported on the retained earnings statement along with any dividends. The ending retained earnings is reported on the balance sheet and is added with total liabilities to equal total assets.

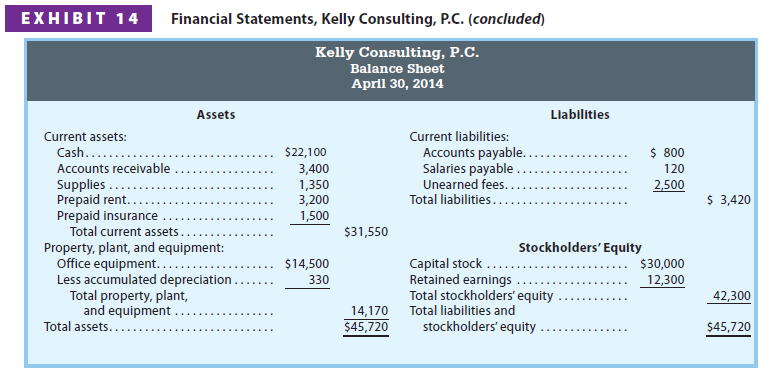

The financial statements for Kelly Consulting are shown in Exhibit 14. Kelly Consulting earned net income of $18,300 for April. As of April 30, 2014, Kelly Consulting has total assets of $45,720, total liabilities of $3,420, and total stockholders’ equity of $42,300.

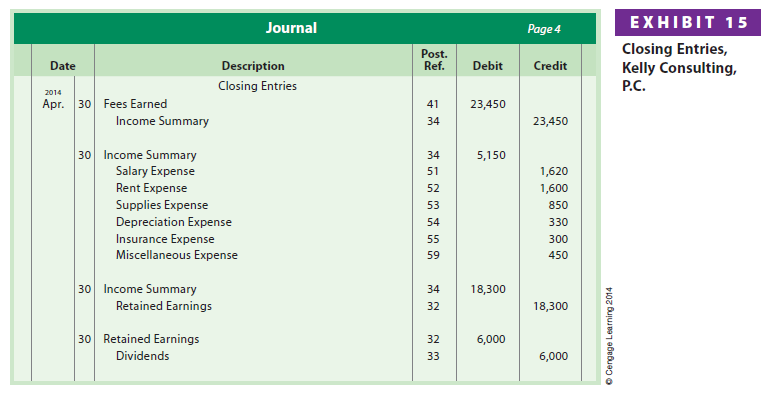

9. Step 9. Journalizing and Posting Closing Entries

As described earlier in this chapter, four closing entries are required at the end of an accounting period. These four closing entries are as follows:

- Debit each revenue account for its balance and credit Income Summary for the total revenue.

- Credit each expense account for its balance and debit Income Summary for the total expenses.

- Debit Income Summary for its balance and credit the retained earnings account.

- Debit the retained earnings account for the balance of the dividends account and credit the dividends account.

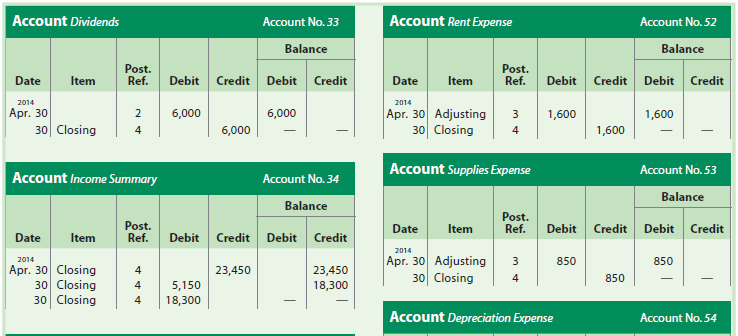

The four closing entries for Kelly Consulting are shown in Exhibit 15. The closing entries are posted to Kelly Consulting’s ledger as shown in Exhibit 17 (pages 172173). After the closing entries are posted, Kelly Consulting’s ledger has the following characteristics:

- The balance of Retained Earnings of $12,300 agrees with the amount reported on the retained earnings statement and the balance sheet.

- The revenue, expense, and dividends accounts will have zero balances.

The closing entries are normally identified in the ledger as “Closing.” In addition, a line is often inserted in both balance columns after a closing entry is posted. This separates next period’s revenue, expense, and dividend transactions from those of the current period.

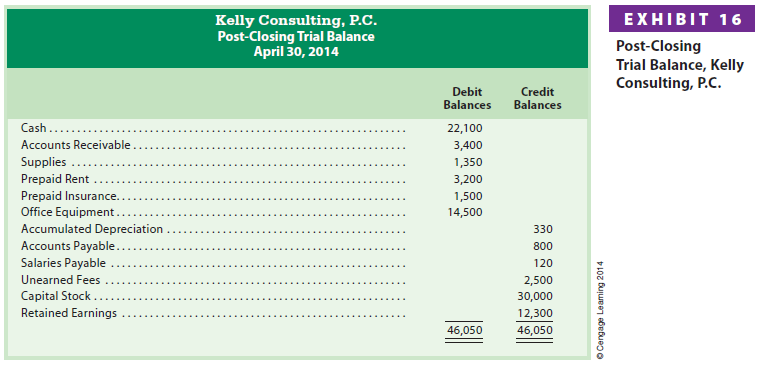

10. Step 10. Preparing a Post-Closing Trial Balance

A post-closing trial balance is prepared after the closing entries have been posted. The purpose of the post-closing trial balance is to verify that the ledger is in balance at the beginning of the next period. The accounts and amounts in the post-closing trial balance should agree exactly with the accounts and amounts listed on the balance sheet at the end of the period.

The post-closing trial balance for Kelly Consulting is shown in Exhibit 16. The balances shown in the post-closing trial balance are taken from the ending balances in the ledger shown in Exhibit 17. These balances agree with the amounts shown on Kelly Consulting’s balance sheet in Exhibit 14.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

best

i like it best one

Keep up the wonderful work, I read few content on this web site and I believe that your blog is very interesting and holds lots of good information.