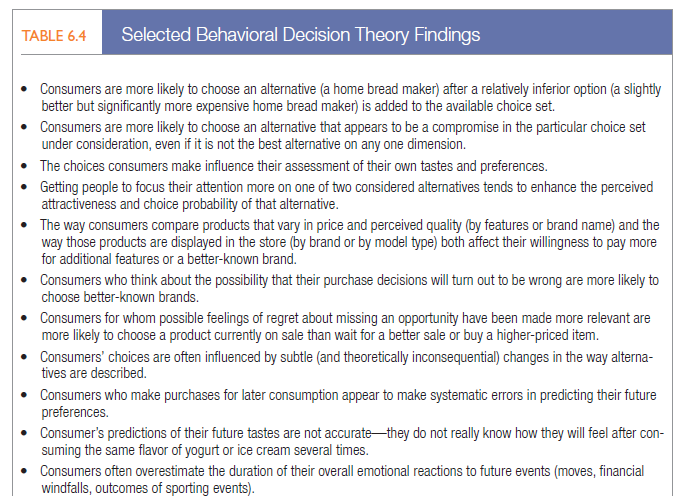

As you might guess from low-involvement decision making and variety seeking, consumers don’t always process information or make decisions in a deliberate, rational manner. One of the most active academic research areas in marketing over the past three decades has been behavioral decision theory (BDT). Behavioral decision theorists have identified many situations in which consumers make seemingly irrational choices. Table 6.4 summarizes some provocative findings from this research.74

What all these and other studies reinforce is that consumer behavior is very constructive and the context of decisions really matters. Understanding how these effects show up in the marketplace can be crucial for marketers.

The work of these and other academics has also challenged predictions from economic theory and assumptions about rationality, leading to the emergence of the field of behavioral economics.75 Here we review some of the issues in three broad areas: decision heuristics, framing, and other contextual effects.

1. DECISION HEURISTICS

Above we reviewed some common heuristics that occur with non-compensatory decision making. Other heuristics similarly come into play in everyday decision making when consumers forecast the likelihood of future outcomes or events.76

- The availability heuristic—Consumers base their predictions on the quickness and ease with which a particular example of an outcome comes to mind. If an example comes to mind too easily, consumers might overestimate the likelihood of its happening. For example, a recent product failure may lead consumers to inflate the likelihood of a future product failure and make them more inclined to purchase a product warranty.

- The representativeness heuristic—Consumers base their predictions on how representative or similar the outcome is to other examples. One reason package appearances may be so similar for different brands in the same product category is that marketers want their products to be seen as representative of the category as a whole.

- The anchoring and adjustment heuristic—Consumers arrive at an initial judgment and then adjust it— sometimes only reluctantly—based on additional information. For services marketers, a strong first impression is critical to establishing a favorable anchor so subsequent experiences will be interpreted in a more favorable light.

Note that marketing managers also may use heuristics and be subject to biases in their own decision making.

2. FRAMING

Decision framing is the manner in which choices are presented to and seen by a decision maker. A $200 cell phone may not seem that expensive in the context of a set of $400 phones but may seem very expensive if other phones cost $50. Framing effects are pervasive and can be powerful.77

We find framing effects in comparative advertising, where a brand can put its best foot forward by comparing itself to another with inferior features; in pricing where unit prices can make the product seem less expensive (“only pennies a day”); in product information where larger units can seem more desirable (a 24-month warranty versus a two-year warranty); and with new products, where consumers can better understand a new product’s functions and features by seeing how it compares with existing products.78

Marketers can be very clever in framing decisions. To help promote its environmentally friendly cars, Volkswagen Sweden incorporated a giant working piano keyboard into the steps next to the exit escalator of a Stockholm subway station. Stair traffic rose 66 percent as a result, a fact VW cleverly captured in a YouTube video seen more than 20 million times.79

MENTAL ACCOUNTING Researchers have found that consumers use a form of framing called “mental accounting” when they handle their money.80 Mental accounting describes the way consumers code, categorize, and evaluate financial outcomes of choices. Formally, it is “the tendency to categorize funds or items of value even though there is no logical basis for the categorization, e.g., individuals often segregate their savings into separate accounts to meet different goals even though funds from any of the accounts can be applied to any of the goals.”81 Consider the following two scenarios:

- You spend $50 to buy a ticket for a concert.82 As you arrive at the show, you realize you’ve lost your ticket. You decide to buy a replacement.

- You decide to buy a ticket to a concert at the door. As you arrive at the show, you realize somehow you lost $50 along the way. You decide to buy the ticket anyway.

Which one are you more likely to do? Most people choose scenario 2. Although you lost the same amount in each case—$50—in the first case you may have mentally allocated $50 for going to a concert. Buying another ticket would exceed your mental concert budget. In the second case, the money you lost did not belong to any account, so you had not yet exceeded your mental concert budget.

Mental accounting has many applications to marketing.83 According to the University of Chicago’s Richard Thaler, it is based on a set of core principles:

- Consumers tend to segregate gains. When a seller has a product with more than one positive dimension, it’s desirable to have the consumer evaluate each dimension separately. Listing multiple benefits of a large industrial product, for example, can make the sum of the parts seem greater than the whole.

- Consumers tend to integrate losses. Marketers have a distinct advantage in selling something if its cost can be added to another large purchase. House buyers are more inclined to view additional expenditures favorably given the already high price of buying a house.

- Consumers tend to integrate smaller losses with larger gains. The “cancellation” principle might explain why withholding taxes from monthly paychecks is less painful than making large, lump-sum tax payments—the smaller withholdings are more likely to be overshadowed by the larger pay amount.

- Consumers tend to segregate small gains from large losses. The “silver lining” principle might explain the popularity of rebates on big-ticket purchases such as cars.

The principles of mental accounting are derived in part from prospect theory. Prospect theory maintains that consumers frame their decision alternatives in terms of gains and losses according to a value function. Consumers are generally loss-averse. They tend to overweight very low probabilities and underweight very high probabilities.

Source: Kotler Philip T., Keller Kevin Lane (2015), Marketing Management, Pearson; 15th Edition.

I think other website proprietors should take this web site as an model, very clean and fantastic user genial style and design.