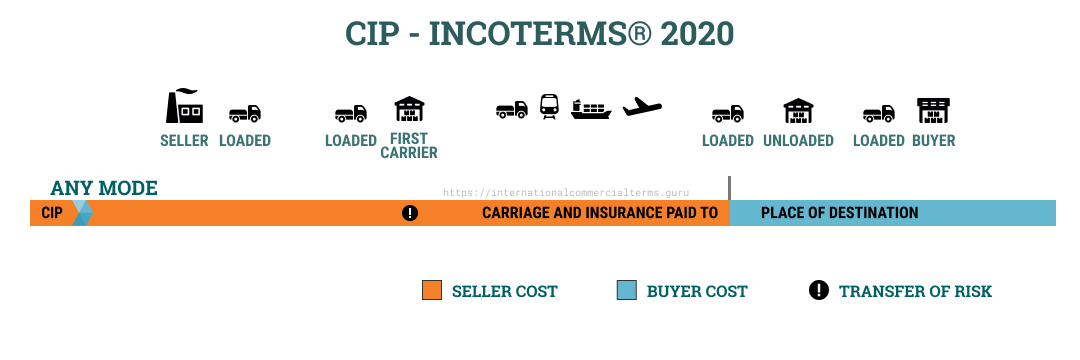

CIP (or Carriage and Insurance Paid To) – Incoterms 2020 is an Incoterm where the seller is responsible for the delivery of goods to an agreed destination in the buyers country, and must pay for the cost of this carriage. The sellers risk however, ends once they have placed the goods on the ship, at the origin destination. The buyer can pay for additional insurance during carriage of the goods. The risk is passed when the goods are received by the first carrier.

Carriage and Insurance Paid to is eligible for any form of transportion.

CIP | Carriage and Insurance Paid To

CIP (insert named place of destination) Incoterms® 2020

EXPLANATORY NOTES FOR USERS

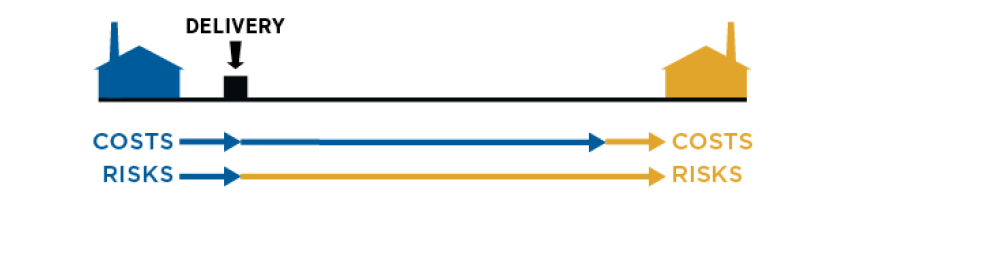

1. Delivery and risk – “Carriage and Insurance Paid To” means that the seller delivers the goods – and transfers the risk – to the buyer

- by handing them over to the carrier

- contracted by the seller

- or by procuring the goods so delivered.

- The seller may do so by giving the carrier physical possession of the goods in the manner and at the place appropriate to the means of transport used.

Once the goods have been delivered to the buyer in this way, the seller does not guarantee that the goods will reach the place of destination in sound condition, in the stated quantity or indeed at all.

This is because risk transfers from seller to buyer when the goods are delivered to the buyer by handing them over to the carrier; the seller must nonetheless contract for the carriage of the goods from delivery to the agreed destination. Thus, for example, goods are handed over to a carrier in Las Vegas (which is not a port) for carriage to Southampton (a port) or to Winchester (which is not a port). In either case, delivery transferring risk to the buyer happens in Las Vegas, and the seller must make a contract of carriage to either Southampton or Winchester.

2. Mode of transport – This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

3. Places (or points) of delivery and destination – In CIP two locations are important: the place or point at which the goods are delivered (for the transfer of risk) and the place or point agreed as the destination of the goods (as the point to which the seller promises to contract for carriage).

4. Insurance – The seller must also contract for insurance cover against the buyer’s risk of loss of or damage to the goods from the point of delivery to at least the point of destination. This may cause difficulty where the destination country requires insurance cover to be purchased locally: in this case the parties should consider selling and buying under CPT. The buyer should also note that under the CIP Incoterms® 2020 rule the seller is required to obtain extensive insurance cover complying with Institute Cargo Clauses (A) or similar clause, rather than with the more limited cover under Institute Cargo Clauses (C). It is, however, still open to the parties to agree on a lower level of cover.

5. Identifying the place or point of delivery with precision – The parties are well advised to identify both places, or indeed points within those places, as precisely as possible in the contract of sale. Identifying the place or point (if any) of delivery as precisely as possible is important to cater for the common situation where several carriers are engaged, each for different legs of the transit from delivery to destination. Where this happens and the parties do not agree on a specific place or point of delivery, the default position is that risk transfers when the goods have been delivered to the first carrier at a point entirely of the seller’s choosing and over which the buyer has no control. Should the parties wish the risk to transfer at a later stage (e.g. at a sea or river port or at an airport), or indeed an earlier one (e.g. an inland point some way away from a sea or river port), they need to specify this in their contract of sale and to carefully think through the consequences of so doing in case the goods are lost or damaged.

6. Identifying the destination as precisely as possible – The parties are also well advised to identify as precisely as possible in the contract of sale the point within the agreed place of destination, as this is the point to which the seller must contract for carriage and insurance and this is the point to which the costs of carriage and insurance fall on the seller.

7. ‘or procuring the goods so delivered’ – The reference to “procure” here caters for multiple sales down a chain (string sales), particularly common in the commodity trades.

8. Costs of unloading at destination – If the seller incurs costs under its contract of carriage related to unloading at the named place of destination, the seller is not entitled to recover such costs separately from the buyer unless otherwise agreed between the parties.

9. Export/import clearance – CIP requires the seller to clear the goods for export, where applicable. However, the seller has no obligation to clear the goods for import or for transit through third countries, or to pay any import duty or to carry out any import customs formalities.

Carriage and Insurance Paid To Seller and Buyer Obligations

CIP A1 / B1 General Obligations

A1 (General Obligations)

In each of the eleven rules the seller must provide the goods and their commercial invoice as required by the contract of sale and any other evidence of conformity such as an analysis certificate or weighbridge document etc that might be relevant and specified in the contract.

Each of the rules also provides that any document can be in paper or electronic form as agreed to in the contract, or if the contract makes no mention of this then as is customary. The rules do not define what “electronic form” is, it can be anything from a pdf file to blockchain or some format yet to be developed in the future.

B1 (General obligations)

In each of the rules the buyer must pay the price for the goods as stated in the contract of sale.

The rules do not refer to when the payment is to be made (before shipment, immediately after shipment, thirty days after shipment, half now half later, or whatever) or how it is to be paid (prepayment, against an email of copy documents, on presentation of documents to a bank under a letter of credit, or other arrangement). These matters should be specified in the contract.

CIP A2 / B2: Delivery

A2 (Delivery)

The seller delivers the goods by handing them over to its contracted carrier, on the agreed date or within the agreed period.

There has in the past been some confusion because Incoterms® 2000 referred to “the first carrier” if there were subsequent carriers. In practice there may well be several carriers contracted in turn by the seller’s contracted carrier, such as the truck collecting the goods and taking them to the airport terminal, the cargo handler contracted by the airline to move the goods to the aircraft and load them onto it, the airline itself, and the repeat of these at the other end. But the only carrier of concern is that carrier contracted to move the goods from the point of delivery to the destination.

Most importantly, delivery occurs when the seller passes the goods to their carrier to transport them, not when the goods reach the destination

B2 (Delivery)

The buyer not only must take delivery when they have been handed to the seller’s carrier, but also physically receive them at the named place, or point within that place, of destination.

CIP A3 / B3: Transfer of risk

A3 (Transfer of risk)

In all the rules the seller bears all risks of loss or damage to the goods until they have been delivered in accordance with A2 described above. The exception is loss or damage in circumstances described in B3 below, which varies dependent on the buyer’s role in B2.

B3 (Transfer of risk)

The buyer bears all risks of loss or damage to the goods once the seller has delivered them as described in A2.

If the contract provides for the buyer to inform the seller the time for dispatching the goods or the point of receiving the goods within the destination place and the buyer fails to do so, then the buyer bears the risk of loss or damage to the goods from the agreed date or the end of the agreed period.

For example, if the buyer does not inform the buyer where he is to send the goods, how can the seller dispatch them? If the seller has clearly identified the goods then the risk transfers to the buyer either on the agreed date or the end of the agreed period.

CIP A4 / B4: Carriage

A4 (Carriage)

The seller must contract for the carriage of the goods, or procure such contract if this is one leg of a “string” sale. The contract must be from the place of delivery and maybe an agreed point within that place. It must be made on “usual terms” and for the “usual route in a customary manner of the type used by the carriage of the type of goods sold.” If the seller and buyer agree on specific matters regarding the contract of carriage that is well and good, but if they don’t then the seller must arrange it in the usual manner for those goods.

As the seller has to arrange the carriage it needs to know from the buyer if there is a specific point in the place of destination to which the goods must be transported. For example, if the destination is shown as simply “New Delhi, India” where in that large metropolis is the seller’s carrier to leave the goods? It could be that it is to be the buyer’s premises, or a particular location say in a green-fields building site, or the carrier’s premises, or the airport, or the container yard… the exact point should be agreed upon. If it is not then it is the seller’s choice to select the point that best suits its purpose, usually being the cheapest option such as a cargo terminal.

If the delivery at the destination is to occur after the buyer completes any necessary import formalities then the cost of storage due to delays in those formalities being completed is for the buyer, always assuming the seller has provided the buyer with necessary documents in time.

The seller must comply with any transport-related security requirements for the whole of the transport to the destination.

B4 (Carriage)

The buyer has no obligation to the seller to arrange a contract of carriage.

CIP A5 / B5: Insurance

A5 (Insurance)

The seller must arrange a contract of insurance at its own cost to cover the buyer’s risks. This cover must be of the level provided by LMA/IUA Institute Cargo Clauses (A) or similar dependent on the mode of transport used, often referred to generally as “all risks” as it covers all manner of risks with specific exclusions.

If the buyer requests, the seller must also arrange, at the buyer’s cost, additional cover under the LMA/IUA Institute War Clauses (Cargo) and Institute Strikes Clauses (Cargo) or similar dependent on the mode of transport unless such cover is already included, as it usually is, with the “all risks” insurance.

The amount of the insurance must be at least 110 percent of the invoice value and in the currency of that invoice and contract. It must cover the goods for at least the duration from the point of delivery described in A2 above to the named place of destination. Often in contracts of sale and letters of credit the stipulation is the unnecessary wording “warehouse to warehouse.”

The seller must provide the buyer a separate contract or a certificate under an existing policy giving the details of the shipment to enable the buyer, or anyone else having an insurable interest in the goods, to claim from the insurer. This document usually shows the seller as the insured and is then endorsed by the seller on the back of the original/s in blank or with a specific endorsement

The seller must also provide the buyer, at the buyer’s request, risk and expense, with information that the buyer needs to arrange any additional insurance.

B5 (Insurance)

Despite the buyer having the risk of loss or damage to the goods from the delivery point, the buyer does not have an obligation to the seller to insure the goods. However, the buyer must provide the seller, if it requests, with any information it needs to arrange any additional insurance requested by the buyer under A5. For example, the seller might need to know the location of the destination warehouse so its insurer can assess the risk and levy an appropriate premium.

CIP A6 / B6: Delivery / Transport / Document

A6 (Delivery / Transport document)

The seller must provide the buyer with the usual transport documents for the transport contracted in A4, if it is customary or the buyer requested it, and at the seller’s cost.

As CPT and CIP cover any mode or modes of transport, what form that document of transport takes will be dependent on the mode/s used. If the modes include carriage by sea such as in FCL or LCL transactions then it is usual for the seller to obtain a sea waybill or bill of lading. If the latter is issued in a negotiable form and in several originals then a full set of those originals must be presented to the buyer, sometimes through the seller’s bank to the buyer’s bank under a letter of credit. If the mode includes the goods going by air then typically an air waybill will be issued and if requested the seller will be given one “original for shipper” but this is not a negotiable transport document. Shipment by truck might involve issue of a CMR in Europe or simply some form of consignment note or truck waybill and these too are not negotiable. Shipment by rail similarly will usually be covered by some form of rail consignment note that is not negotiable.

The transport document must cover movement of the contracted goods within the agreed period for shipment. If it is agreed then this document must enable the buyer to claim the goods from the carrier at the named place of destination, and in a string sale enable the buyer to sell the goods in transit to a subsequent buyer by transferring that document. This would usually be in the form of a negotiable bill of lading.

B6 (Delivery / Transport document)

The buyer must accept the transport document provided by the seller so long as it is in conformity with the contract.

CIP A7 / B7: Export / Import clearance

A7 (Export / Import clearance)

This rule, like all the multimodal rules, is suitable for both domestic and international transactions.

Where applicable, the seller must at its own risk and expense carry out all export clearance formalities required by the country of export, such as licences or permits; security clearance for export; pre-shipment inspection; and any other authorisations or approvals.

The seller has no obligation to arrange any transit/import clearances. However if the buyer requests, at its own risk and cost, the seller must assist in obtaining any documents and/or information which relate to formalities required by the country of transit or import such as permits or licences; security clearance for transit/import; pre-shipment inspection required by the transit/import authorities; and any other official authorisations or approvals.

B7 (Export / Import clearance)

Where applicable, the buyer must assist the seller at the seller’s request, risk and cost, in obtaining any documents and/or information needed for all export-related formalities required by the country of export.

Where applicable, the buyer must carry out and pay for all formalities required by any country of transit and the country of import. These include licences and permits required for transit; import licences and permits required for import; import clearance; security clearance for transit and import; pre-shipment inspection; and any other official authorisations and approvals. They are the buyer’s responsibility because they occur after delivery by the seller.

At first glance it might seem strange that both seller and buyer have responsibility for pre-shipment inspections. To clarify, the seller is responsible if it is a requirement of the country of export, and the buyer is responsible if it is a requirement of the country of transit/import.

CIP A8 / B8: Checking / Packaging / Marking

A8 (Checking / Packaging / Marking)

In all rules the seller must pay the costs of any checking operations which are necessary for delivering the goods, such as checking quality, measuring the goods and/or packaging, weighing, counting the goods and/or packaging.

The seller must also package the goods, at its own cost, unless it is usual for the trade of the goods that they are sold unpackaged, such as in the case of bulk goods. The seller must also take into account the transport of the goods and package them appropriately, unless the parties have agreed in their contract that the goods be packaged and/or marked in a specific manner.

B8 (Checking / Packaging / Marking)

In all rules there is no obligation from the buyer to the seller as regards packaging and marking. There can in practice however be agreed exceptions, such as when the buyer provides the seller with labels, logos, or similar.

CIP A9 / B9: Allocation of Costs

A9 (Allocation of costs)

The seller must pay all costs until the goods have been delivered under A2, other than any costs the buyer must pay as stated in B9.

Transport costs resulting from the contract of carriage, including costs of loading the goods and any transport-related security, must be paid by the seller. The cost of providing to the buyer proof of the goods being delivered are also for the seller.

If the contract of carriage includes unloading at the agreed destination, the seller must pay these. Additionally, any costs of transit included in the contract of carriage must also be paid by the seller.

The seller must pay any costs involved in providing the usual proof that the goods have been delivered, so if the contract between the parties states that proof as being a transport document then the carrier’s document fee is for the seller.

The seller must pay any costs, export duties and taxes, where applicable, related to export clearance.

The seller must pay the costs of insurance.

If the buyer is requested by the seller to provide information or documents in relation to export clearance or insurance, then the seller must pay the buyer for these costs.

B9 (Allocation of costs)

The buyer must pay the seller all costs relating to the goods from when they have been delivered, other than those payable by the seller.

If the seller has been requested by the buyer to provide assistance in obtaining information or documents needed for the buyer to effect import formalities, then the buyer must reimburse the seller’s costs.

Where applicable, the buyer must pay any duties, taxes and other costs for import clearance.

The buyer must pay for unloading costs unless they were paid by the seller under the contract of carriage.

The buyer pays for any costs of the country of transit unless they have been paid by the seller under the contract of carriage.

CIP A10 / B10: Notices

A10 (Notices)

The C rules as we have seen before involve two distinct points. This is reflected by the requirement that the seller must give the buyer notice that the goods have been delivered as required in A2, and any notice the buyer will need enabling the buyer to receive the goods. The manner in which this will be done is usually detailed in the contract, such as by a simple email and/or copies of shipping documents being emailed.

B10 (Notices)

If the parties agree in the contract that the buyer is entitled to determine the time for the seller to deliver the goods, and possibly more importantly, the point within the named place of destination where it will receive the goods, the buyer must give the seller sufficient notice. The contract will usually detail how much notice is to be given, and this might vary with the mode/s of transport.

Carriage and Insurance Paid To: Advantages and Disadvantages

CIP first appeared in Incoterms® 1980 as standing for Freight Carriage and Insurance Paid To, but was shortened in the 1990 rules.

The only difference between CPT and CIP is that the CIP seller must contract for insurance against the buyer’s risk. The level of cover has been changed in Incoterms® 2020 to be the maximum of Institute Cargo Clauses (A), (Air) or similar, for 110% of the CIP value, or similar — what is sometimes referred to as an “all risks” cover.

15 Jul 2021

15 Jul 2021

15 Jul 2021

15 Jul 2021

15 Jul 2021

15 Jul 2021