After a firm has gained an understanding of the industry and the target mar- ket in which it plans to compete, the next step is to complete a competitor analysis. A competitor analysis is a detailed analysis of a firm’s competition. It helps a firm understand the positions of its major competitors and the op- portunities that are available to obtain a competitive advantage in one or more areas. These are important issues, particularly for new ventures.18 In the words of Sun Tzu, quoted earlier in this chapter, “Time spent in reconnais- sance is seldom wasted.”

First we’ll discuss how a firm identifies its major competitors. We’ll then look at the process of completing a competitive analysis grid, which is a tool for organizing the information a firm collects about its primary competitors.

1. Identifying competitors

The first step in a competitive analysis is to determine who the competition is. This is more difficult than one might think. For example, take a company such as 1-800-FLOWERS. Primarily, the company sells flowers. But 1-800-FLOWERS is not only in the flower business; in fact, because flowers are often given for gifts, the company is also in the gift business. If the company sees itself in the gift business rather than just the flower business, it has a broader set of com- petitors and opportunities to consider. In addition, some firms sell products or services that straddle more than one industry. For example, a company that makes computer software for dentists’ offices operates in both the computer software industry and the health care industry. Again, this type of company has more potential competitors but also more opportunities to consider.

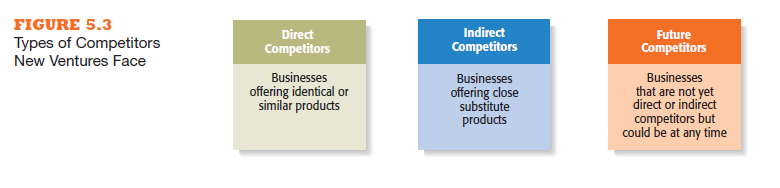

The different types of competitors a business will face are shown in Figure 5.3. The challenges associated with each of these groups of competitors are described here:

■ Direct competitors: These are businesses that offer products or services that are identical or highly similar to those of the firm completing the analysis. These competitors are the most important because they are going after the same customers as the new firm. A new firm faces winning over the loyal followers of its major competitors, which is difficult to do, even when the new firm has a better product.

■ Indirect competitors: These competitors offer close substitutes to the product the firm completing the analysis sells. These firms’ products are also important in that they target the same basic need that is being met by the new firm’s product. For example, when people told Roberto

Goizueta, the late CEO of Coca-Cola, that Coke’s market share was at a maximum, he countered by saying that Coke accounted for less than 2 percent of the 64 ounces of fluid that the average person drinks each day. “The enemy is coffee, milk, tea [and] water,” he once said.19

■ Future competitors: These are companies that are not yet direct or indi- rect competitors but could move into one of these roles at any time. Firms are always concerned about strong competitors moving into their mar- kets. For example, think of how the world has changed substantially for Barnes & Noble and other brick-and-mortar bookstores since Amazon.com was founded. These changes are perhaps especially dramatic for Borders, which filed for bankruptcy in 2011. Former competitor Barnes & Noble bought Borders’s remaining assets (primarily its brand name) later in that year. But this story has yet to reach a conclusion, in that in February of 2014, investment firm G Asset Management offered “to acquire a major- ity interest in Barnes & Noble Inc.” If this transaction takes place, G Asset intends to split Barnes & Noble’s retail and e-reader businesses into sepa- rate operations.20 And, think of how smartphone technology continues to change the nature of competition for a variety of firms, including those selling entertainment services, telephone services, and the like.

It is impossible for a firm to identify all its direct and indirect competitors, let alone its future competitors. However, identifying its top 5 to 10 direct com- petitors and its top 5 to 10 indirect and future competitors makes it easier for the firm to complete its competitive analysis grid.

If a firm does not have a direct competitor, it shouldn’t forget that the sta- tus quo can be the toughest competitor of all. In general, people are resistant to change and can always keep their money rather than spend it.21 A product or service’s utility must rise above its cost, not only in monetary terms but also in terms of the hassles associated with switching or learning something new, to motivate someone to buy a new product or service.22

Creating meaningful value and sharp differentiation from competitors are actions small firms in crowded industries can take to remain competitive and gain market share. Three firms that have successfully accomplished this are profiled in the “Savvy Entrepreneurial Firm” feature.

2. Sources of competitive intelligence

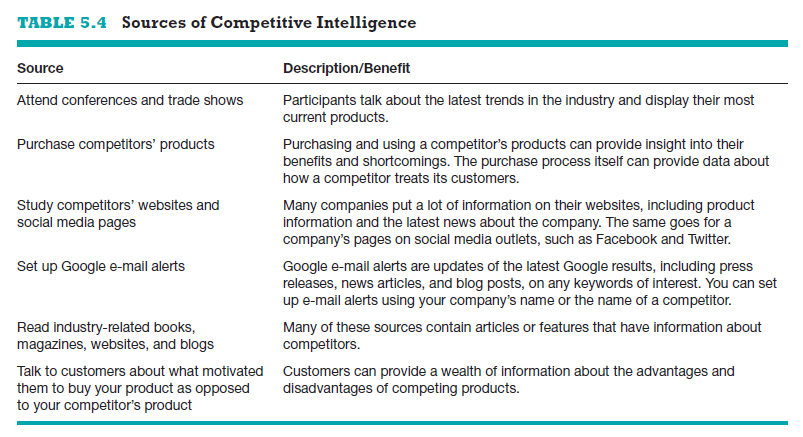

To complete a meaningful competitive analysis grid, a firm must first under- stand the strategies and behaviors of its competitors. The information that is gathered by a firm to learn about its competitors is called competitive intel- ligence. Obtaining sound competitive intelligence is not always a simple task.

If a competitor is a publicly traded firm, a description of the firm’s business and its financial information is available through annual reports filed with the Securities and Exchange Commission (SEC). These reports are public records and are available at the SEC’s website (www.sec.gov). If one or more of the competitors is a private company, the task is more difficult, given that private companies are not required to divulge information to the public. There are a number of ways that a firm can ethically obtain information about its competi- tors. A sample of the most common techniques is shown in Table 5.4.

3. Completing a competitive analysis grid

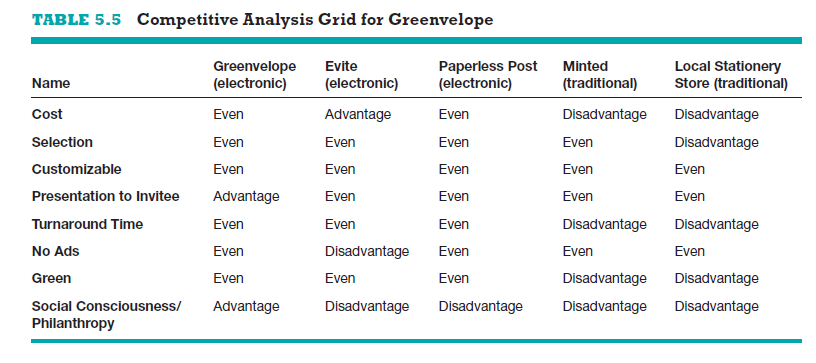

As we mentioned previously, a competitive analysis grid is a tool for or- ganizing the information a firm collects about its competitors. It can help a firm see how it stacks up against its competitors, provide ideas for markets to pursue, and, perhaps most importantly, identify its primary sources of com- petitive advantage. To be a viable company, a new venture must have at least one clear competitive advantage over its major competitors.

An example of a competitive analysis grid is provided in Table 5.5. This grid is for Greenvelope, the online wedding invitation start-up featured at the begin- ning of the chapter. The main competitive factors in the industry, which include online and traditional wedding invitation services, are cost, selection, customiz- able, presentation to invitee, turnaround time, no ads, green, and social con- sciousness/philanthropy. Some industry participants, such as Greenvelope, also engage in philanthropy. (As highlighted previously, Greenvelope gives 1 percent of its revene each quarter to Moutains to Sound, a nonprofit or- ganization that supports the greenway along the I-90 corridor of Northwest Washington State.) These factors are placed on the vertical axis of Greenvelope’s competitive analysis grid. The horizontal axis contains Greenvelope and its four main competitors. In each box, Greenvelope rates itself against its main com- petitors. The purpose of this exercise is for a company to see how it stacks up against its competitors and to illustrate the areas in which it has an advantage (and has a disadvantage). For example, Greenvelope rates itself as superior to its competitors in terms of presentation to invitee and social consciousness/ philanthropy. It will likely use this information in its advertising and promo- tions. An additional benefit of completing a competitive analysis grid is that it helps a company fine-tune its offering. For example, Greenvelope rates itself as “even” with its competitors on several criteria. It might use that knowledge to look for ways to up its game on one or more of these criteria to increase its over- all competitiveness in relation to its competitors.

As this discussion shows, analyzing competitors is a complex and chal- lenging process. But, the link between understanding competitors and how an entrepreneurial venture stacks up against them and the new firm’s suc- cess in both the short and long term is clear and strong. In the “What Went Wrong?” feature, we describe the experiences of Digg. Once one of the hottest Internet sites, this firm competed in a rapidly emerging industry. While read- ing about Digg, keep in mind the actions firms should take to understand their competitors and to form a competitive analysis grid. In an overall sense, might more effective work in terms of understanding its competitors and their actions increase the likelihood of Digg’s competitive success?

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

I am continually invstigating online for tips that can assist me. Thx!

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.