A firm’s pro forma financial statements are similar to its historical financial statements except that they look forward rather than track the past. New ven- tures typically offer pro forma statements, but well-managed established firms also maintain these statements as part of their routine financial planning pro- cess and to help prepare budgets. The preparation of pro forma statements also helps firms rethink their strategies and make adjustments if necessary. For example, if the pro forma statements predict a downturn in profitability, a firm can make operational changes, such as increasing prices or decreasing ex- penses, to help prevent the decrease in profitability from actually happening.22

A firm’s pro forma financial statements should not be prepared in isola- tion. Instead, they should be created in conjunction with the firm’s overall planning activities. For example, it’s often critical to have a good sense of how quickly a firm can raise money. Sometimes a firm has a good product or service, good demand, and knows how much capital it needs to maintain a sufficient cash flow, but it can’t raise the money in time. This is what hap- pened to Wise Acre Frozen Treats, as illustrated in this chapter’s “What Went Wrong?” feature. The Wide Acre Frozen Treats case is a good example of how one aspect of financial management (i.e., raising money) can have a dramatic impact on another aspect of financial management (i.e., maintaining a suf- ficient cash flow).

The following sections explain the development of pro forma financial statements for New Venture Fitness Drinks.

1. Pro Forma income statement

Once a firm forecasts its future income and expenses, the creation of the pro forma income statement is merely a matter of plugging in the numbers. Table 8.6 shows the pro forma income statement for New Venture Fitness Drinks. Recall that net sales for New Venture Fitness Drinks are forecast to increase by 40 percent from 2014 to 2015 and by 25 percent from 2015 to 2016, and that its cost of sales has averaged 47.5 percent of net sales. In the pro forma income statement, the constant ratio method of forecasting is used to forecast the cost of sales and general and administrative expenses, meaning that these items are projected to remain at the same percentage of sales in the future as they were in the past (which is the mathematical equivalent of saying that they will increase at the same rate of sales). Depreciation, other income, and several other items that are not directly tied to sales are figured separately—using rea- sonable estimates. The most dramatic change is “other income,” which jumps significantly from 2014 to 2015. New Venture Fitness Drinks anticipates a sig- nificant increase in this category as the result of the renegotiation of a licens- ing agreement for one of its fitness drinks that is sold by another company.

2. Pro Forma Balance sheet

The pro forma balance sheet provides a firm a sense of how its activities will affect its ability to meet its short-term liabilities and how its finances will evolve over time. It can also quickly show how much of a firm’s money will be tied up in accounts receivable, inventory, and equipment. The pro forma balance sheet is also used to project the overall financial soundness of a com- pany. For example, a firm may have a very aggressive set of pro forma income statements that project rapidly increasing growth and profitability. However, if this rapid growth and profitability push the firm’s debt ratio to 75 percent (which is extremely high), investors may conclude that there is too much risk involved for the firm to be an attractive investment.

The pro forma balance sheet for New Venture Fitness Drinks is shown in Table 8.7. Note that the company’s projected change in retained earnings each year is consistent with its projected net income for the same period on its pro forma income statements. The same approach was used to construct the pro forma balance sheets as the pro forma income statements. For each item listed under current assets and current liabilities, the item’s historical percentage of sales was used to project its future percentage of sales. Several of the numbers were adjusted slightly upward, such as inventory levels and accounts payable, to reflect the potential impact of the opening of the second restaurant.

In regard to property, plant, and equipment, New Venture Fitness Drinks plans to invest $100,000 in 2015 and $275,000 in 2016. The pro forma bal- ance sheet shows a corresponding increase in valuation in this category for 2015 and 2016, respectively. The company’s projected long-term debt for 2015 and 2016 reflects changes resulting from principal reductions from cash flow and increased borrowing to fund the property, plant, and equipment pur- chases just mentioned. These transactions are reflected in the pro forma state- ment of cash flows for New Venture Fitness Drinks.

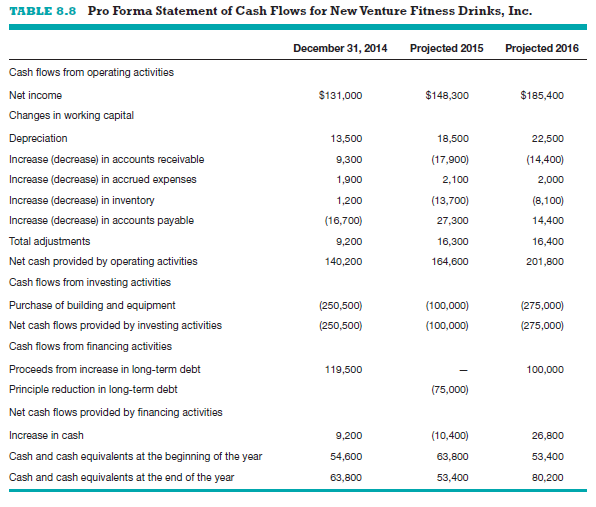

3. Pro Forma statement of cash Flows

The pro forma statement of cash flows shows the projected flow of cash into and out of the company during a specified period. The most important func- tion of the pro forma statement of cash flows is to project whether the firm will have sufficient cash to meet its needs. As with the historical statement of cash flows, the pro forma statement of cash flows is broken into three activities: op- erating activities, investing activities, and financing activities. Close attention is typically paid to the section on operating activities because it shows how changes in the company’s accounts receivable, accounts payable, and inven- tory levels affect the cash that it has available for investing and finance activi- ties. If any of these items increases at a rate that is faster than the company’s annual increase in sales, it typically raises a red flag. For example, an increase in accounts receivable, which is money that is owed to a company by its cus- tomers, decreases the amount of cash that it has available for investment or finance activities. If accounts receivable gets out of hand, it may jeopardize a company’s ability to fund its growth or service its debt.

The pro forma consolidated statement of cash flows for New Venture Fitness Drinks is shown in Table 8.8. The figures appearing on the statement come directly, or are calculated directly, from the pro forma income statement and the pro forma balance sheet. The one exception is that the last line of each statement of cash flows, which reflects the company’s cash balance at the end of the period, becomes the first line of the company’s balance sheet for the next period. The pro forma statement of cash flows for New Venture Fitness Drinks shows healthy cash balances at the end of each projected period and shows that investment activities are being funded more by earnings than by debt. This scenario reflects a company that is generating sufficient cash flow to fund the majority of its growth without overly relying on debt or investment capital.

In regard to dividends, the pro forma statement of cash flows shows that New Venture Fitness Drinks is not planning to pay a dividend to its stockhold- ers in 2015 and 2016. Recall that New Venture Fitness Drinks is incorporated and has stockholders even though it is not traded on an organized exchange. If New Venture Fitness Drinks were planning to pay a dividend, the projected dividend payments would show up under financing activities and would reduce the amount of cash available for investing and financing activities. It is common for a new firm to invest the majority of its cash in activities that fund its growth, such as property, plant, and equipment purchases, rather than pay dividends.

4. Ratio analysis

The same financial ratios used to evaluate a firm’s historical financial state- ments should be used to evaluate the pro forma financial statements. This work is completed so the firm can get a sense of how its projected financial performance compares to its past performance and how its projected activities will affect its cash position and its overall financial soundness.

The historical financial ratios and projected ratios for New Venture Fitness Drinks are shown in Table 8.9. The profitability ratios show a slight decline from the historical period to the projected. This indicates that the projected increase in assets and corresponding sales will not produce income quite as efficiently as has been the case historically. Still, the numbers are strong, and no dramatic changes are projected.

The liquidity ratios show a consistently healthy ratio of current assets to current liabilities, suggesting that the firm should be able to cover its short- term liabilities without difficulty. The overall financial stability ratios indicate promising trends. The debt ratio drops from an actual of 39.7 percent in 2014 to a projected 31.8 percent in 2016. The debt-to-equity ratio shows an even more dramatic drop, indicating that an increasing portion of the firm’s assets is being funded by equity rather than debt.

In summary, it is extremely important for a firm to understand its financial position at all times and for new ventures to base their financial projections on solid numbers. As mentioned earlier, regardless of how successful a firm is in other areas, it must succeed financially to remain strong and viable.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

8 May 2021

10 May 2021

7 May 2021

8 May 2021

7 May 2021

8 May 2021