This case summarizes the strategic approach used by eBay to take advantage of increased consumer adoption of the Internet. It summarizes its objectives, strategy and proposition and some of the risks that need management.

1. Context

It’s hard to believe that one of the most celebrated dotcoms has now celebrated its tenth birthday. Pierre Omidyar, a 28-year-old French-born software engineer living in California coded the site while working for another company, eventually launching the site for business on Monday, 4 September 1995 with the more direct name ‘Auction Web’. Legend reports that the site attracted no visitors in its first 24 hours. The site became eBay in 1997.

2. Mission

eBay describes its purpose as to ‘pioneer new communities around the world built on commerce, sustained by trust, and inspired by opportunity’.

At the time of writing eBay comprises three major businesses:

- The eBay marketplaces (approximately 70% of net revenues in 2007). The mission for the core eBay business is to ‘create the world’s online market- place’.The marketplace platforms include an average of 100 million products for sale on each day! eBay’s SEC filing notes some of the success factors for this business for which eBay seeks to manage the functionality, safety, ease-of-use and reliability of the trading platform.

- PayPal (approximately 25% of net revenues in 2007). The mission is to ‘create the new global standard for online payments’. This company was acquired in 2003.

- Skype Internet telephony (5% of net revenues in 2007). This company was acquired in 2005. eBay has suffered an ‘impairment charge’ from valuing the company too highly, but more recently it has started to provide the service for MySpace users.

Advertising and other net revenues represented 4% of total net revenues during 2007. This case focuses on the best-known eBay business, the eBay marketplace.

3. Revenue model

The vast majority of eBay’s revenue is for the listing and commission on completed sales. For PayPal purchases an additional commission fee is charged. Margin on each transaction is phenomenal since once the infrastructure is built, incremental costs on each transaction are tiny – all eBay is doing is transmitting bits and bytes between buyers and sellers.

Advertising and other non-transaction net revenues represent a relatively small proportion of total net revenues and the strategy is that this should remain the case. Advertising and other net revenues totalled $94.3 million in 2004 (just 3% of net revenue).

4. Proposition

The eBay marketplace is well known for its core service which enables sellers to list items for sale on an auction or fixed-price basis giving buyers the opportunity to bid for and purchase items of interest. At the end of 2007, there were over 532,000 online storefronts established by users in locations around the world.

Software tools are provided, particularly for frequent traders including Turbo Lister, Seller’s Assistant, Selling Manager and Selling Manager Pro, which help automate the selling process; the Shipping Calculator, Reporting tools, etc. Today over sixty per cent of listings are facilitated by software, showing the value of automating posting for frequent trading.

Fraud is a significant risk factor for eBay. BBC (2005) reported that around 1 in 10,000 transactions within the UK were fraudulent. 0.0001 % is a small percentage, but scaling this up across the number of transactions, this is a significant volume.

eBay has developed ‘Trust and Safety Programs’ which are particularly important to reassure customers since online services are prone to fraud. For example, the eBay feedback forum can help establish credentials of sellers and buyers. Every registered user has a feedback profile that may contain compliments, criticisms and/or other comments by users who have conducted business with that user. The Feedback Forum requires feedback to be related to specific transactions There is also a Safe Harbor data protection method and a standard purchase protection system.

According to the SEC filing, eBay summarizes the core messages to define its proposition as follows:

For buyers:

- Selection

- Value

- Convenience

- Entertainment.

In 2007, as part of the social media revolution eBay introduced Neighbourhoods (http://neighborhoods.ebay.com) where groups can discuss brands and products they have a high involvement with.

For sellers:

- Access to broad markets

- Cost-effective marketing and distribution

- Access to large buyer base

- Good conversion rates.

In January 2008, eBay announced significant changes to its marketplaces business in three major areas: fee structure, seller incentives and standards, and feedback. These changes have been controversial with some sellers, but are aimed at improving the quality of experience. Detailed Seller Ratings (DSRs) enable sellers to be reviewed in four areas: (1) item as described, (2) communication, (3) delivery time and (4) postage and packaging charges. This is part of a move to help increase conversion rate by increasing positive shopping experiences, for example by including more accurate descriptions with better pictures and avoiding excessive shipping charges. Power sellers with positive DSRs will be featured more favourably in the search results pages and will gain additional discounts.

5. Competition

Although there are now few direct competitors of online auction services in many countries, there are many indirect competitors. SEC (2008) describes competing channels as including online and offline retailers, distributors, liquidators, import and export companies, auctioneers, catalogue and mail-order companies, classifieds, directories, search engines, products of search engines, virtually all online and offline commerce participants (consumer-to-consumer, business-to-consumer and business-to-business) and online and offline shopping channels and networks.

BBC (2005) reports that eBay is not complacent about competition. It has already pulled out of Japan due to competition from Yahoo! and within Asia and China is also facing tough competition by Yahoo! which has a portal with a broader range of services more likely to attract subscribers.

Before the advent of online auctions, competitors in the collectables space included antique shops, car boot sales and charity shops. Anecdotal evidence suggests that all of these are now suffering at the hands of eBay. Some have taken the attitude of ‘if you can’t beat ‘em, join ‘em’. Many smaller traders who have previously run antique or car boot sales are now eBayers. Even charities such as Oxfam now have an eBay service where they sell high-value items contributed by donors. Other retailers such as Vodafone have used eBay as a means to distribute certain products within their range.

6. Objectives and strategy

The overall eBay aims are to increase the gross merchandise volume and net revenues from the eBay Marketplace. More detailed objectives are defined to achieve these aims, with strategies focusing on:

- Acquisition – increasing the number of newly registered users on the eBay Marketplace.

- Activation – increasing the number of registered users that become active bidders, buyers or sellers on the eBay Marketplace.

- Activity – increasing the volume and value of transactions that are conducted by each active user on the eBay Marketplace. eBay had approximately 83 million active users at the end of 2007, compared to approximately 82 million at the end of 2006. An active user is defined as any user who bid on, bought, or listed an item during the most recent 12-month period.

The focus on each of these three areas will vary according to strategic priorities in particular local markets.

eBay Marketplace growth is also driven by defining approaches to improve performance in these areas. First, category growth is achieved by increasing the number and size of categories within the marketplace, for example: Antiques, Art, Books and Business & Industrial. Second, formats for interaction. The traditional format is auction listings, but it has been refined now to include the ‘Buy-It-Now’ fixed price format. Another format is the ‘Dutch Auction’ format, where a seller can sell multiple identical items to the highest bidders. eBay Stores was developed to enable sellers with a wider range of products to showcase their products in a more traditional retail format. eBay says it is constantly exploring new formats, often through acquisition of other comapnies, for example through the acquisition in 2004 of mobile.de in Germany and Marktplaats.nl in the Netherlands, as well as investment in craigslist, the US-based classified ad format. Another acquisition is Rent.com, which enables expansion into the online housing and apartment rental category. In 2007, eBay acquired StubHub an online ticket marketplace, and it also owns comparison marketplace Shopping.com. Finally, marketplace growth is achieved through delivering specific sites localised for different geographies as follows. You can see there is still potential for greater localisation, for example in parts of Scandinavia, Eastern Europe and Asia.

Localised eBay marketplaces:

- Singapore

- Sweden

- United Kingdom

- South Korea

- Switzerland

- United States

- Spain Taiwan

In its SEC filing, success factors eBay believes are important to enable it to compete in its market include:

- ability to attract buyers and sellers;

- volume of transactions and price and selection of goods;

- customer service; and

- brand recognition.

eBay stresses the importance of developing its ‘Value- Added Tools and Services’ which are ‘pre-trade’ and ‘post-trade’ tools and services to enhance the user experience and to make trading faster, easier and safer.

It also notes that in the context of its competitors, other factors it believes are important are:

- community cohesion, interaction and size;

- system reliability;

- reliability of delivery and payment;

- web site convenience and accessibility;

- level of service fees; and

- quality of search tools.

This implies that eBay believes it has optimized these factors, but its competitors still have opportunities for improving performance in these areas which will make the market more competitive.

7. Risk management

The SEC filing lists the risks and challenges of conducting business internationally as follows:

- regulatory requirements, including regulation of auctioneering, professional selling, distance selling, banking, and money transmitting;

- legal uncertainty regarding liability for the listings and other content provided by users, including uncertainty as a result of less Internet-friendly legal systems, unique local laws, and lack of clear precedent or applicable law;

- difficulties in integrating with local payment providers, including banks, credit and debit card associations, and electronic fund transfer systems;

- differing levels of retail distribution, shipping, and communications infrastructures;

- different employee-employer relationships and the existence of workers’ councils and labour unions;

- difficulties in staffing and managing foreign operations;

- longer payment cycles, different accounting practices, and greater problems in collecting accounts receivable;

- potentially adverse tax consequences, including local taxation of fees or of transactions on web sites;

- higher telecommunications and Internet service provider costs;

- strong local competitors;

- different and more stringent consumer protection, data protection and other laws;

- cultural ambivalence towards, or non-acceptance of, online trading;

- seasonal reductions in business activity;

- expenses associated with localising products, including offering customers the ability to transact business in the local currency;

- laws and business practices that favour local competitors or prohibit foreign ownership of certain businesses;

- profit repatriation restrictions, foreign currency exchange restrictions, and exchange rate fluctuations;

- volatility in a specific country’s or region’s political or economic conditions; and

- differing intellectual property laws and taxation laws.

8. Results

eBay’s community of confirmed registered users has grown from around 2 million at the end of 1998 to more than 94 million at the end of 2003 and to more than 135 million at 31 December 2004. It is also useful to identify active users who contribute revenue to the business as a buyer or seller. eBay had 56 million active users at the end of 2004 who are defined as any user who has bid, bought or listed an item during a prior 12-month period.

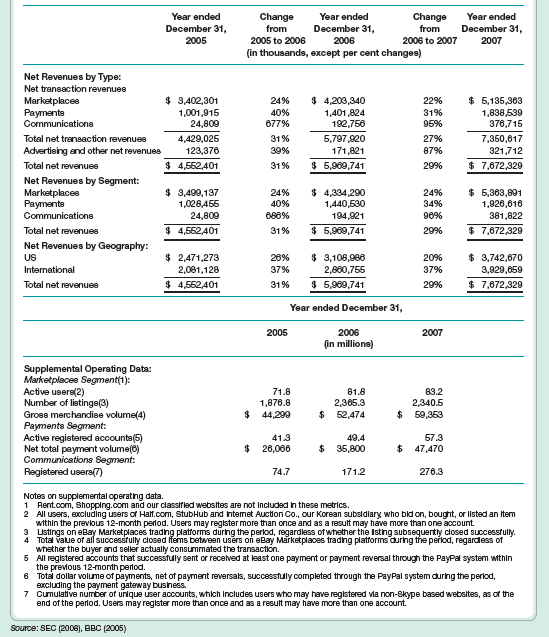

Financial results are presented in the above tables.

Source: Dave Chaffey (2010), E-Business and E-Commerce Management: Strategy, Implementation and Practice, Prentice Hall (4th Edition).

As a Newbie, I am continuously browsing online for articles that can aid me. Thank you

I like the helpful info you provide in your articles. I will bookmark your blog and check again here frequently. I’m quite sure I will learn plenty of new stuff right here! Good luck for the next!