We define company sales potential as the most probable sales of a company’s product in a designated country over a strategic planning period, given assumptions with respect to entry mode and marketing effort.8 Company sales potential may also be viewed as a company’s most probable share of a country’s industry market potential. CSP depends not only on external market factors but also on a company’s international market entry strategy. Different strategies will generate different CSPs. Specifically, CSP depends on the entry mode (export, investment, licensing and other contractual arrangements) and on the level of marketing effort in the marketing plan (resources committed to product, pricing, distribution, and promotion policies).

To estimate company sales potential, therefore, managers need to make assumptions about their company’s entry mode and international marketing plan. As we shall stress in later chapters, managers should make systematic comparisons of alternative entry modes in searching for the right mode. An input in those comparisons is the CSP of each entry mode, that is to say, the cash inflow (revenues) projected over the strategic planning period. It follows that decisions on the target country, the entry mode, and the marketing plan are joint decisions.

In this discussion of company sales potential, we assume that the company is entering foreign inarkets for the first time. A derivative assumption is that company managers prefer export entry. However, we must stress that the target selection model offered in Figure 7 is not linked to a given entry mode. Rather, its purpose is to identify the country with the highest CSP. Once the identification is made, it is up to company managers to decide on the entry mode that can best exploit that potential. For that reason the managers of our representative company should not immediately reject a high-IMP country because it cannot be entered via exports. Instead, they should go on to complete the CSP profile of that country by estimating sales potential based on local production of the company’s product. In short, it is important for managers to identify countries with high CSP, regardless of the feasibility of export entry or any other single entry mode. The starting point is market opportunity for the company’s candidate product; how that opportunity is best exploited comes later. Although company resources and other factors may constrain a company to some form of export extry now, international managers should consider the entry mode, as well as the marketing plan, as decision variables over the longer run.

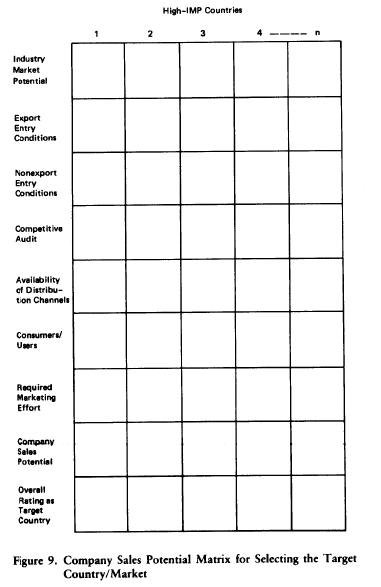

Figure 9 is presented as an aid in making CSP estimates for high-IMP countries and in comparing them across countries.

For our representative company, the first area of investigation is an appraisal of export entry conditions: (1) import regulations and (2) transportation and other logistical costs to move the product from the home country to the foreign country in question. Import regulations, which are mainly restrictive, include import duties and nontariff trade barriers, such as border taxes, health regulations, quotas, industrial standards, and antidumping laws. In most instances, import regulations add to the cost of export entry; at the extreme, they render export entry unprofitable or impossible. Managers need to ascertain export entry conditions and the attendant costs for their candidate product for each high-IMP country.

For the reason mentioned earlier, managers should also review nonexport entry conditions, but at this stage only to a degree sufficient to establish the feasibility (as contrasted to the desirability) of nonexport entry.

The significance of export entry costs for CSP depends mainly on the capacity of the candidate product to absorb those costs and still remain competitive in the foreign market. This brings us to a second area of investigation: a competitive audit of each high-IMP country audit. The following questions need to be answered in such an audit:

Basic Information

- Which competitive products are sold in country X?

- What are the market shares of competitive products?

- How do competitive products compare with our own in reputation, features, and other attributes?

- Which support facilities (production, warehousing, sales branches, and so on) do competitors have in country X?

- Which problems do competitors face?

- Which relationships do competitors have with the local government? Do they enjoy special preferences?

Marketing Information

- Which distribution channels are used by competitors?

- How do competitors’ prices compare with our own?

- What credit terms, commissions, and other compensation are extended by competitors to their channel members?

- What promotion programs are used by competitors?

How successful are they?.

- How good are competitors’ post-sales services?

Market Supply Information

- How do competitive products get into the market?

If they are imported:

- Who are the importers?

- How do importers operate?

- What credit, pricing, and other terms are extended to importers by foreign suppliers?

- How long has each importer worked with his foreign supplier? Is he satisfied with his supplier?

If they are produced locally:

- Who are the producers?

- Are the producers entirely locally owned, or is there foreign participation?

- What advantages do local manufacturers have over importing competitors?

Comparisons between the company’s product and those of competitors should go beyond price to encompass quality, design, and other features of product differentiation. Nor should comparisons be confined to the physical product; they should also be made for package and service dimensions. Again, comparisons should be made among all products that satisfy the same function or need. In the final analysis, the company is competing not against other products but for the favor of potential customers.

Managers should also assess other aspects of the marketing effort of potential competitors, namely, their pricing, channel, and promotion policies. It is wise to focus on the market leaders, who can be expected to offer the stiffest competition. What are the sources of each leader’s strength? Low prices? Product quality? Distribution? Service? Something else?

Another element of the competitive audit is an appraisal of market structure. What is the degree of monopoly in the market? Is competition rigorous or loose? Market structure bears directly on ease of entry for a newcomer. Some country markets have strong associations of local producers who bend their collective efforts to keep out foreign intruders. Other country markets are dominated by a few big firms with a host of small followers. Still other country markets may have no dominant firms and a loose competitive structure that facilitates entry.

A third area of investigation is the availability of distribution channels for the company’s product. CSP analysis of channel structure is limited to questions of channel availability: Can we obtain adequate distribution of our product in this country? Can we match the distribution of the market leaders? Are there any distribution bottlenecks that would require extraordinary marketing effort (and time) to overcome? As we shall observe in discussing export entry, good distribution is vital to an effective marketing plan.

A fourth area of investigation is the ultimate consumerluser of the company’s product in high-IMP countries. Evidently, the more managers know about the final consumers or users of their product in these countries, the better they can estimate company sales potentials. Answers to the questions under “The Target Market” on page 29 indicate the key attributes of potential customers. Although a thorough assessment of consumers or users may not be cost-effective when management is undertaking comparative CSP evaluation, managers should try to get enough information to make confident judgments on the probable responses of consumers or users in each country to the company’s product and other elements of its marketing plan. As observed earlier, it may be possible to improve consumer/user responses through product adaptations of one sort or another. Once a target country is chosen, the design of the marketing plan will call for a fuller investigation of final consumers or users. Hence we shall return to this subject in Chapter 7.

The end result of these investigations is a sales potential profile for each high-IMP country. Managers now know whether or not their company can compete in each country and what marketing effort will be needed to do so. They are also able to project the sales of the company’s product over the strategic planning period. In most instances, they should select the country with the highest sales potential as the target country. But managers committed to export entry will reject the country with the highest sales potential if it has negative entry conditions. More generally, sales potential estimates may not fully capture all the factors of interest to managers, such as risk. Hence the overall rating of a country is not necessarily identical with its CSP. Sales potential profiles are informed judgments by managers rather than the outcome of routine calculations. It is seldom possible to quantify all the many market factors, and it is even more difficult to relate them to sales potential. In this respect, we should also recall that the highest sales potential in a given country is conditional on the choice of an optimum entry mode, which is the subject of the next four chapters.

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

I got this web page from my friend who told me

concerning this web site and at the moment this time I am visiting this website and reading very informative posts at this place.