How should managers price a candidate product for international market entry? Few questions in international marketing are more troublesome. Managers must decide on a pricing policy that will enable their company to attain its several goals in the target market (such as market share, sales volume, and growth) over the strategic planning period, and to do so at an acceptable level of profits or return on investment. Moreover, they must make pricing decisions with some uncertainty about their own costs and about demand and competition in the target market. Also, they need to consider antitrust, tariff, and other legal and policy constraints of both home and target country governments. Again, they need to reconcile the often divergent interests and perspectives on international pricing held by different functional groups in the company, notably marketing and finance. Finally, managers need to integrate pricing with the rest of the foreign marketing plan.

In view of this complexity, a systematic approach to entry pricing is hardly a waste of time. This section identifies the questions that should be raised in planning entry-pricing strategies, examines different basic approaches to pricing, describes several entry-pricing strategies, calls attention to some special factors in international pricing, and concludes with a multiple-stage entry-pricing model.

1. Entry-Pricing Strategy: Some Questions

In pricing for foreign market entry, international managers face several interdependent questions:.

- How sensitive will the sales volume of the candidate product be to its price in the target market? What other factors influence buying decisions and in what degree? What are the pricing policies of competitors? How much pricing discretion do we have in the target market?

- In light of our answers to these questions and other considerations, what should be the role of price in our foreign marketing plan? Aggressive? Passive? What pricing strategy best fits our strategies for product, promotion, channel, and logistics? What should be our pricing objectives?

- What is the probable life cycle of the candidate product type in the target market? How should we price over the entire strategic planning period?

- What should be our price to middlemen in the target market? Should we try to control or influence the final-buyer price? How?

- How should we allow for tactical pricing flexibility?

- Will our pricing policy be legal in the target country? Will it attract government investigation and possibly regulation?

2. Fundamental Approaches to Entry Pricing

Fundamentally, entry-pricing decisions involve costs, sales volume, and revenues. But decision makers may treat these variables in radically different ways depending on their approach to entry pricing.

Full-Cost Pricing. Full-cost pricing is the most common approach of U.S. companies in pricing products for foreign markets. A full-cost price is simply the sum of total unit costs attributed to a product and a profit margin: direct production costs plus direct marketing costs plus allocated production and other overheads plus a profit margin. The full-cost approach is attractive to companies because it is easy to understand and the availability of conventional accounting data makes it comparatively easy to calculate. Moreover, it seems to ensure that each sales transaction will be profitable. But full-cost pricing has serious weaknesses. As a purely cost- oriented approach, it ignores demand and competition in the foreign target market, assuming implicitly that price will have no effect on sales volume. It also requires an arbitrary allocation of indirect costs (overheads) to the candidate product, even though such costs will remain unaffected by sales of that product. Again, by failing to consider the influence of price on sales volume, it fails to consider the effect of price on production volume and therefore on total unit costs.

Because of these weaknesses, the full-cost approach cannot lead managers to the profit-maximizing price or, more generally, to the most appropriate price to attain strategic goals in a foreign target market. Full-cost_ pricing, moreover, does not provide assurance of profits, which depend not only on a profit margin but also on sales volume. Since a certain level of production is assumed in the allocation of overheads (so-called standard costs), failure to reach the corresponding sales volume can cause losses over an accounting period.

Quite frequently, U.S. companies set export prices by simply adding an “export margin” to a domestic full cost price. The result is not a true full- cost price, because direct costs incurred in domestic sales may not be incurred in export sales, and conversely. Full-cost pricing, especially the “domestic-plus” variant, is quite likely to overprice a product in export markets because of price escalation, namely, the addition to the F.O.B.

export price of several subsequent charges (such as shipping, insurance, forwarding fees, duties and border taxes, and channel markups). Escalation can make the final-buyer price in the international target market several times the F.O.B. price.

When full-cost pricing proves to be uncompetitive in a target market, profit margins may be cut, with a resulting less-than-full-cost price. Such ad hoc adjustments reflect a “back-door” consideration of market demand and competition that is forced on managers by poor market performance. In sum, the use of a full-cost approach to pricing for international market entry is particularly undesirable in view of escalation effects and the often slow feedback of information on market performance, which delay ad hoc price adjustments. Instead, what managers need is an approach that pays explicit attention to demand and competition in the foreign target market.

Incremental-Cost Pricing. The incremental-cost approach distinguishes between variable costs (such as labor, materials, and some marketing costs), which vary directly with production and sales, and fixed costs, which remain unaffected over a specified planning period. (In the very long run, of course, all costs are variable.) The incremental costs of foreign market entry, therefore, are the new costs of that entry which would not exist in its absence.3 An incremental-cost price, then, is the sum of variable production and marketing costs plus a profit contribution.

Incremental costs alone should not be used by managers to determine entry prices, because, like full costs, they do not take account of demand and competition in the target market. But incremental costs do indicate a floor price that a company could accept for its candidate product without incurring out-of-pocket cash losses. Indeed, any price above the incremental floor price generates a positive cash flow even if it is below the full-cost price. The difference between full costs and incremental costs, therefore, defines a range of prices over which a company would make some contribution to overhead costs although it would not make an accounting profit.

The principal use of costs should be to determine the profit consequences of alternative prices. For this use, incremental costs are superior to full costs. But to determine the moat profitable price, managers also need to know the demand facing the candidate product in the foreign target market.

Profit-Contribution Pricing. A product’s demand schedule shows the amounts that can be sold at different prices. Its two key features are (1) the amounts demanded at different prices and (2) the sensitivity of the amounts demanded to price changes. Sensitivity, known as demand elasticity, is defined as the ratio of the percentage change in amount demanded to the percentage change in price. If the absolute value (ignoring sign) of this fraction is greater than one, then demand is elastic: a decrease in price will increase total sales revenues, and conversely. On the other hand, if it is smaller than one, then demand is inelastic: a decrease in price will decrease total sales revenues, and conversely. Elasticity, then, is also a measure of the sensitivity of total sales revenues to price changes.

The demand schedule facing a candidate product in a foreign target market may be very unlike its demand schedule in the home market. This will be the case when the target market differs substantially from the home market in size, preferences, income, the differentiation of the candidate product as perceived by consumers/users, and competition. To estimate the demand schedule in a target market, managers can use three general methods: (1) buyer surveys, (2) market testing, and (3) statistical analysis of past relationships between sales and price in other markets similar to the target market. Clearly, demand estimation is most difficult when the product is generically new to the target market and that market does not resemble other markets in which the company has sales experience. Nonetheless, it is important that managers make explicit judgments about the shape and elasticity of a candidate product’s demand schedule in a target market rather than assume implicitly that demand is wholly price-insensitive, as is done with full-cost pricing.

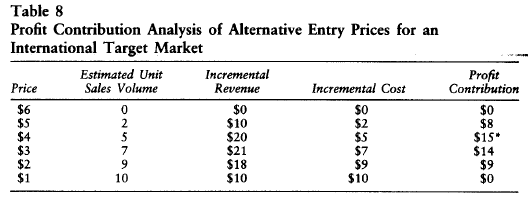

The profit contribution of a candidate product in a target market is its incremental revenues minus its incremental costs over the planning period. Incremental revenues are all the revenues created by product sales; they would not exist in the absence of those sales. Incremental costs were defined earlier. The most profitable price is the price that generates the highest profit contribution. Table 8 offers a hypothetical example of how managers can identify the most profitable price among alternative prices by using the profit-contribution approach.

Here the manager has established a range of alternative prices for the candidate product that extends downward from a $6 price, which he esti-mates the target market would fully reject, to a floor price, which equals unit incremental costs of $1. Among these alternative prices, which price would maximize profit (or minimize loss)? The answer is, the price that offers the highest profit contribution, namely, $4 with a profit contribution of $15 (indicated by an asterisk in the table).

Profit-contribution pricing is often confused with incremental cost pricing and therefore rejected on the ground that it fails to cover fixed costs, which must be covered if a company is to survive in the long run. Actually, the profit-contribution price may or may not cover full costs, depending on the market. The profit-contribution approach is based on the economic truth that fixed costs have nothing to do with the determination of the most profitable price. The price that maximizes profit contribution is the best a company can choose in the target market in the context of a given marketing plan.

If the highest profit contribution is positive but smaller than the overhead charges allocated to a product, then managers may respond to the prospective accounting loss in several ways: (1) abandon market entry, although by so doing the company will have lower cash flow unless it can obtain a higher profit contribution by selling the same product in another market; (2) go ahead with the entry strategy because it will provide a positive cash flow; (3) alter the entry strategy by changing other elements of the marketing plan (such as advertising effort) which, by raising revenues more than costs, create the opportunity for a price that will both maximize profit contribution and cover full costs; (4) reduce incremental production costs at home in one or more ways or reduce them by sourcing the product within the target country or from a third country, that is to say, by changing the entry mode; or (5) reduce the product’s overhead burden by changing the allocation rule. Courses of action (3), (4), and (5) may, of course, be taken together.

3. Entry-Pricing Strategies

Entry-pricing strategy is intended to obtain the maximum profit contribution for the entire marketing plan over the planning period, taking into account risks and other internal or external constraints. It follows that pricing strategy can be decided only along with distribution, promotion, and other marketing mix strategies. Managers may be seeking any one or more of several specific pricing objectives in the target market, including quick profits (payback), minimum risk, target sales growth, target market share, gaining support of middlemen, enhancing a high-quality image, meeting competitors, “buying” market entry, and avoiding government investigation. Whatever the objectives may be, they should be consistent with the objectives of the overall international marketing plan.

Pioneer Pricing Strategies. Pioneer pricing strategies are strategies for introducing a product that is generically new to the target market, that is to say, a product that is in the introductory phase of its life cycle. Two very different pioneer strategies can be distinguished: skimming and development.

A skimming-price strategy sets a high entry price for the new products, with the intent to earn quick profits before rivals respond with substitute products at a lower price. This strategy is especially attractive when a company is unwilling (or unable) to finance the cost of long-run market development and/or views market potential as highly uncertain. It is also appealing when a company has only a modest production capacity to serve the target market.

The profitability of a skimming strategy depends, of course, on the willingness of enough “early adopters” to pay a high price for the candidate product. But a high price also encourages competitors to enter the market with comparable products at lower prices. Skimming strategy, therefore, cannot build a long-run market position and may, for that reason, be less than optimum over the entire planning period. Anything that will slow down competitors’ responses (such as patent protection) is favorable to this strategy. In sum, a skimming-price strategy can be judged a low-risk strategy because it aims at a quick return with minimum marketing effort, but over the longer run it may turn out to be a high-risk strategy because it loses the market to competitors.

A development-price strategy deliberately uses a low entry price to build up a dominant market position which can be defended against competitors. With this strategy, a company is willing to accept losses in early years because it views them as an investment in market development. As a long-run strategy, development pricing is most attractive when market potential is large, development costs are reasonable, substantial economies of scale are experienced in production, and the company has the production and marketing capacity to support volume sales. This strategy discourages potential competitors because price is so low that profits can be made only, at high sales volumes.

A pricing strategy that tries to combine the advantages of both the skimming and development strategies is life-cycle pricing. Although a company introduces its pioneer product at a high skimming price, it plans to lower price in the successive stages of the product’s life cycle in order to maintain market dominance. The success of this strategy depends on the correct timing of successive price reductions. Failure to anticipate changing market and competitive conditions can transform this strategy into a sequence of reactions to competitive moves, reactions that come too late to avoid an erosion of market position.

Other Entry-Pricing Strategies. Companies with highly differentiated products are inclined toward a pricing strategy that enhances a high-quality- product image. However irrational, consumers/users tend to discredit high-quality claims for a product that is priced near (or especially below) the prices of average-quality competitive products. Hence the creation of a high-quality image ordinarily requires a comparatively high price, which may be suboptimum in profitability until that image is established in the market. Forgone short-run profits, therefore, are considered an investment in image development. For this strategy to work, a company must serve a market segment that is willing to pay for high quality, and it must be able to persuade consumers/users that its product has that quality. With respect to the latter, it is a mistake for a company to believe that its high-quality image in the home market can be easily transferred to a foreign target market. In general, a high-quality image in a market can be achieved only through marketing effort in that market.

An entry-pricing strategy to reach a target market share will not be successful if competitors in the target market quickly match that strategy. This is the common situation when a large company enters a market with a small number of major competitors, that is to say, an oligopolistic market. Instead, the company must try to get its target market share through nonprice marketing efforts, such as product improvements, promotion, and distribution. But this strategy may work for a smaller company that is not viewed by major competitors as a threat to their own market shares.

Pricing to achieve a target market share should not be confused with a strategy to undercut competitors with an entry price below a company’s costs. This is a high-risk strategy, because it invites price retaliation by competitors (with resulting losses for everyone) and/or antidumping and other forms of protection by the host government. This strategy, which may be labeled buying international market entry, is unlikely, therefore, to eliminate local competitors. In sum, buying international market entry not only is an unprofitable entry strategy in the short-run but will most likely remain unprofitable in the long run as well.

Pricing to achieve target sales may deliberately sacrifice short-run profits for sales growth. This strategy works best in a price-elastic, high- growth market, which allows a company to obtain volume sales without taking them away from competitors. Pricing for growth can be justified as a long-run strategy only if volume sales will lead to profits through economies of scale in production and/or marketing.

Competitive pricing strategy matches the prices of competitors in the foreign target market. It is the only possible strategy for commodity-like products that are mildly differentiated in the eyes of buyers. For then, price becomes the critical variable in purchase decisions, and a company has little pricing discretion, acting more as a price-taker than a price-maker. A competitive pricing strategy is also needed for sales to government agencies and industrial users under conditions of competitive bidding.

4. Planning the Discount Structure

Up to this point, we have been talking about the final-buyer price of the candidate product, for it is this price that influences the buying decisions of consumers/users in the target market. In many instances, however, companies will be using indirect channels with independent intermediaries (agents, distributors, wholesalers, or retailers) to reach final buyers. Hence managers need to determine the price discounts that they should offer these middlemen.

Channel discount policy derives from both pricing and channel strategies. Discounts must be sufficient to attract good middlemen and to stimulate their marketing efforts, but at the same time they should be compatible with the final-buyer price desired by the international company. Since few countries allow manufacturers to establish legal controls on resale prices, getting middlemen to resell at the proper price can be accomplished only by convincing them that they will gain more by following the manufacturer’s pricing strategy than by setting prices on their own.4 This is seldom an easy task, but if international managers cannot control resale prices, then they also cannot control final-buyer prices.

Functional discounts are the most important discounts in entry pricing. They have two purposes: (1) payment to middlemen for their ordinary marketing efforts (personal selling, stocking, delivery, and so on) and (2) payment to encourage middlemen to undertake extraordinary marketing efforts on behalf of the client company. In deciding on functional-discount policy, therefore, managers need to decide first on the channel performance they want in the target market (see Chapter 3).

Quantity discounts may also be offered to middlemen as well as others. They should be justified by savings in order-taking, transportation, hatu dling, and other costs. Cash discounts intended to accelerate payment are more useful as a tactical instrument than as a strategic one.

5. Some Special Factors in International Pricing

Throughout this text we have called attention to special factors in international business. Many of these factors influence entry-pricing strategies; here we merely identify the more prominent ones. Chapter 3 has already discussed export price quotations, foreign exchange risks, and terms of payment, which include credit arrangements. Other price-related factors are tariffs and nontariff trade barriers, antitrust laws, and price controls. These factors can add to costs, limit pricing discretion, restrain sales, or introduce risks. They should be considered along with ordinary costs and market factors in planning entry-pricing strategies.

6. The Need for Tactical Pricing Flexibility

An entry-pricing strategy is intended to give a company the most appropriate pricing system in the target foreign market, after full account is taken of market objectives, costs, demand, competition, and special factors over the planning period. When translated into policy, written manuals, and directives, entry-pricing strategy becomes a set of guidelines for operating managers. As strategic guidelines, they should allow those managers some tactical flexibility in negotiating with middlemen and final buyers, meeting short-run market developments, or countering sporadic competitive activity. At the same time, tactical flexibility should be consistent with pricing strategy; otherwise, flexibility may achieve a tactical victory at the cost of a strategic defeat.

To conclude this section on pricing, we offer in Figure 18 a multistage model that brings together in a systematic way the several factors that managers should consider in planning entry-pricing strategies.

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

I like what you guys are up too. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my site :).