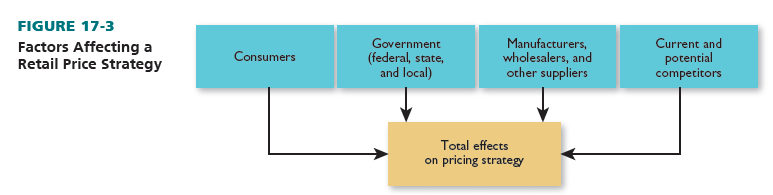

Several factors have an impact on a retail pricing strategy, as shown in Figure 17-3. Sometimes, the factors have a minor effect. In other cases, they severely restrict a firm’s pricing options.

1. The Consumer and Retail Pricing

Retailers should understand the price elasticity of demand—the sensitivity of customers to price changes in terms of the quantities they will buy—because there is often a relationship between price and consumer purchases and perceptions. If small percentage changes in price lead to substantial percentage changes in the number of units bought, demand is price elastic. This occurs when the urgency to purchase is low or there are acceptable substitutes. If large percentage changes in price lead to small percentage changes in the number of units bought, demand is price inelastic. Then purchase urgency is high or there are no acceptable substitutes (as takes place with brand or retailer loyalty). Unitary elasticity occurs when percentage changes in price are directly offset by percentage changes in quantity.

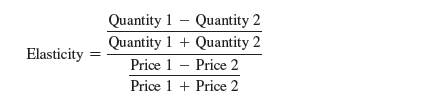

Price elasticity is computed by dividing the percentage change in the quantity demanded by the percentage change in the price charged. Because purchases generally decline as prices go up, elasticity tends to be a negative number:

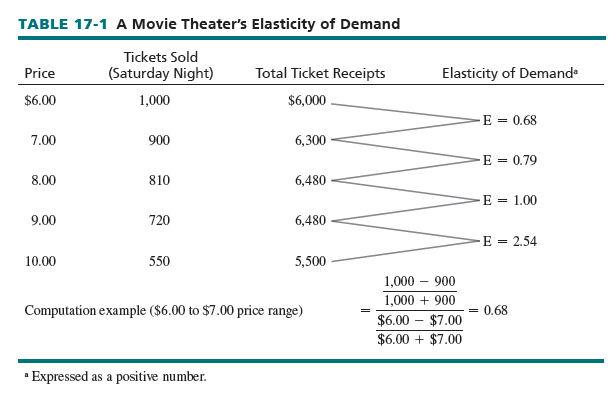

Table 17-1 shows price elasticity for a 1,000-seat movie theater (with elasticities converted to positive numbers) that offers second-run films. Quantity demanded (tickets sold) declines at each price from $6.00 to $10.00. Demand is inelastic from $6.00 to $7.00 and $7.00 to $8.00; ticket receipts rise since the percentage price change exceeds the percentage change in tickets sold. At $8.00 to $9.00, demand is unitary; ticket receipts are constant since the percentage change in tickets sold exactly offsets the percentage price change. Demand is elastic from $9.00 to $10.00; ticket receipts fall since the percentage change in tickets sold is more than the percentage change in price.

For our movie theater example, total ticket receipts are highest at $8.00 or at $9.00. But what about total revenues? If patrons spend an average of $4.00 each at the concession stand, the best price is $6.00 (total overall revenues of $10,000). This theater is most interested in total revenues because its operating costs are the same whether there are 1,000 or 550 patrons. But typically, retailers should evaluate the costs, as well as the revenues, from serving additional customers.

In retailing, computing price elasticity is difficult. First, as with the movie theater, demand for individual events or items may be hard to predict. One week, the theater may attract 1,000 patrons to a movie, and the next week it may attract 400 patrons to a different movie. Second, many retailers carry thousands of items and cannot possibly compute elasticities for every one. As a result, they usually rely on average markup pricing, competition, tradition, and industrywide data to indicate price elasticity.

Price sensitivity varies by market segment, based on shopping orientation. After identifying potential segments, retailers determine which of them form their target market:

- Economic consumers: They perceive competing retailers as similar and shop around for the lowest possible prices. This segment has grown dramatically in recent years.

- Status-oriented consumers: They perceive competing retailers as quite different. They are more interested in upscale retailers with prestige brands and strong customer service than in price.

- Assortment-oriented consumers:They seek retailers with a strong selection in the product categories being considered. They want fair prices.

- Personalizing consumers:They shop where they are known and feel a bond with employees and the firm itself. These shoppers will pay slightly above-average prices.

- Convenience-oriented consumers:They shop because they must, want nearby stores with long hours, and may use TV shopping or the Web. These people will pay more for convenience.

2. The Government and Retail Pricing

Three levels of government may affect domestic retail pricing decisions: federal, state, and local. When laws are federal, they apply to interstate commerce. A retailer operating only within the boundaries of one state may not be restricted by some federal legislation. Major government rules relate to horizontal price fixing, vertical price fixing, price discrimination, minimum price levels, unit pricing, item price removal, and price advertising. For retailers operating outside their home countries, a fourth level of government comes into play: international jurisdictions.

HORIZONTAL PRICE FIXING An agreement among manufacturers, among wholesalers, or among retailers to set prices is known as horizontal price fixing. Such agreements are illegal under the Sherman Antitrust Act and the Federal Trade Commission Act, regardless of how “reasonable” prices may be. It is also illegal for retailers to get together regarding the use of coupons, rebates, or other price-oriented tactics.

Although few large-scale legal actions have been taken in recent years, the penalties for horizontal price fixing can be severe. A recent horizontal price-fixing case involved Apple and five book publishing companies and alleged that together the companies conspired to raise the price of E-books to consumers. The judge ruled that the price-fixing conspiracy was a per se violation of Section 1 of the Sherman Act. The publishers promptly settled the case but Apple decided to appeal the decision to the Supreme Court. In March 2016, the Supreme Court held that it would not consider Apple’s appeal. The $450 million case action settlement against Apple is in effect.4

VERTICAL PRICE FIXING When manufacturers or wholesalers seek to control the retail prices of their goods and services, vertical price fixing occurs. Until 2007, retailers in the United States could not be forced to adhere to minimum retail prices set by manufacturers and wholesalers. Federal laws banning this practice were intended to encourage price competition among retailers and lower prices for consumers. However, as a result of a 2007 Supreme Court ruling, the situation changed significantly. The Supreme Court decision stated that minimum resale price restrictions should be judged on a case-by-case basis. Among the factors to be considered are the effect on competition, consumer benefits, and other issues.

Minimum resale price agreements are most likely to be found to be anticompetitive if these agreements facilitate price fixing at one level of the channel such as at the retailer level. Proof of a retail-level agreement often includes evidence that two or more retailers have communicated among themselves, and then asked a common supplier to set minimum resale prices or to punish competing retailers that cut prices. In addition, minimum resale price maintenance is not permitted when a dominant retailer uses it to hurt competitors.

Today, even though manufacturers and wholesalers may be able to enforce minimum prices at the retail level if they choose, most suppliers opt not to do so since they do not want to eliminate business with discounters such as Walmart, Target, and Costco.

Manufacturers and wholesalers can also legally control retail prices by one of these methods: (1) They can screen retailers. (2) They can set realistic list prices. (3) They can pre-print prices on products (which retailers do not have to use). (4) They can set regular prices that are accepted by consumers (such as 75 cents for a newspaper). (5) They can use consignment selling, whereby the supplier owns items until they are sold and assumes costs normally associated with the retailer. (6) They can own retail facilities. (7) They can refuse to sell to retailers that advertise discount prices in violation of written policies. (8) A supplier has a right to announce a policy for dealer pricing and can refuse to sell to those that do not comply. (9) It cannot use coercion to prohibit a retailer from advertising low prices.

PRICE DISCRIMINATION The Robinson-Patman Act bars manufacturers and wholesalers from discriminating in price or purchase terms (such as advertising allowances) in selling to individual retailers if these retailers are purchasing products of “like quality” and the effect of such discrimination is to injure competition. The intent of this act is to stop large retailers from using their power to gain discounts not justified by the cost savings achieved by suppliers due to big orders. There are exceptions that allow justifiable price discrimination when:

- Products are physically different.

- The retailers paying different prices are not competitors.

- Competition is not injured.

- Price differences are due to differences in supplier costs.

- Market conditions change—costs rise or fall or competing suppliers shift their prices.

Discounts are not illegal, so long as suppliers follow the preceding rules, make discounts available to competing retailers on an equitable basis, and offer discounts sufficiently graduated so small retailers can also qualify. Discounts for cumulative purchases (total yearly orders) and for multistore purchases by chains may be hard to justify.

Although the Robinson-Patman Act restricts sellers more than buyers, retailers are covered under Section 2(F): “It shall be unlawful for any person engaged in commerce, in the course of such commerce, knowingly to induce or receive a discrimination in price which is prohibited in this section.” Thus, a retail buyer must try to get the lowest prices charged to any competitor, yet not bargain so hard that discounts cannot be justified by acceptable exceptions. The act applies to purchases but not to services or leases.5

MINIMUM-PRICE LAWS Nearly one-half of the states have minimum-price laws that prevent retailers from selling certain items for less than their cost plus a fixed percentage to cover overhead. Besides general laws, some state rules set minimum prices for specific products. For instance, in New Jersey and Connecticut, the retail price of liquor cannot be less than the wholesale cost (including taxes and delivery charges).

Minimum-price laws protect small retailers from predatory pricing, in which large retailers seek to reduce competition by selling goods and services at very low prices, thus causing small retailers to go out of business. In one case, three Arkansas pharmacies filed a suit claiming Walmart had sold selected items below cost in order to reduce competition. Walmart agreed it had priced some items below cost to meet or beat rivals’ prices but not to harm competitors. The Arkansas Supreme Court ruled Walmart did not use predatory pricing since the three pharmacies were still profitable.

With loss leaders, retailers price selected items below cost to lure more customer traffic to their stores. Supermarkets and other retailers advertise loss leaders to induce customers to visit a store or Web site. When the customers are at the store, they will also buy additional items that have higher margins, thus increasing overall sales and profits. The loss leader products may result in no profit being made but will be made up through the sale of other goods/services that may or may not be related to the product. Implementing the loss leader strategy can be risky. Price-sensitive customers may not make additional purchases, hence some loss leaders may be conditional bargains requiring customers to meet a minimum purchase limit. Pervasive use of loss leaders by retailers can lead to downward pressure on prices, so using it to penetrate the market needs to be carefully considered.6

UNIT PRICING In some states, the proliferation of package sizes has led to unit-pricing laws, whereby some retailers must express both the total price of an item and its price per unit of measure. Food stores are most affected by unit-price rules because grocery items are more regulated than nongrocery items.7 There are exemptions for firms with low sales. The aim of unit pricing is to enable consumers to compare prices of products available in many sizes. Thus, a 5-ounce can of tuna fish priced at $1.35 would also have a shelf label showing this as 27 cents per ounce. And a person learns that a 20-ounce bottle of soda selling for $1.00 (5 cents per ounce) costs more than a 67.6-ounce (2-liter) bottle for $1.49 (2.2 cents per ounce).

Retailer costs include computing per-unit prices, printing product and shelf labels, and keeping computer records. These costs are influenced by the way prices are attached to goods (by the supplier or the retailer), the number of items subject to unit pricing, the frequency of price changes, sales volume, and the number of stores in a chain.

Unit pricing can be a good strategy for retailers to follow, even when not required. At many supermarkets, the unit-pricing system more than pays for itself because of decreased price-marking errors, better inventory control, and improved space management.

ITEM PRICE REMOVAL The boom in computerized checkout systems has led many firms, especially supermarkets, to push for item price removal—whereby prices are marked only on shelves or signs and not on individual items. Instead of the costly price marking of individual items, retailers want to rely on scanning equipment that reads pre-marked product codes and enters price data at the checkout counter. Their efforts have been successful; in 2011, Michigan removed its law—leaving Massachusetts as the only place in the United States with a statewide ban on some forms of item price removal. Shelf pricing is now more widely accepted.

Why have retailers opposed item pricing laws? They insist that electronic or manual shelf labeling and checkout scanners make prices on individual items redundant. Instead of serving customers, salesperson hours are wasted ticketing items with a sticker gun and increased employee expenses. Consumerists support them because price tags help customers shop and help them verify the prices they are charged at checkout. They also help cashiers reduce checkout errors.8

PRICE ADVERTISING The Federal Trade Commission (FTC) has guidelines pertaining to advertising price reductions, advertising prices in relation to competitors’ prices, and bait-and-switch advertising.

A retailer cannot claim or imply that a price has been reduced from some former level (a suggested list price) unless the former price was one that the retailer had actually offered for a good or service on a regular basis during a reasonably substantial, recent period of time.

When a retailer says its prices are lower than its competitors’ prices, it must make certain that its comparisons pertain to firms selling large quantities in the same trading area. A somewhat controversial, but legal, practice is price matching. For the most part, a retailer makes three assumptions when it “guarantees to match the lowest price” of any competing retailer: (1) This guarantee gives shoppers the impression that a firm always offers low prices or else it would not make such a commitment. (2) Most shoppers will not return to a store after a purchase even if they see a lower price advertised elsewhere. (3) The guarantee may exclude most deep discounters and online firms by stating that they are not really competitors.

Bait-and-switch advertising is an illegal practice in which a retailer lures a customer by advertising goods and services at exceptionally low prices. When the customer contacts the retailer (by entering a store, calling a toll-free number, or going to a Web site), he or she is told the good/ service of interest is out of stock or of inferior quality. A salesperson (or Web script) tries to convince the person to buy a more costly substitute. The retailer does not intend to sell the advertised item. In deciding if a promotion uses bait-and-switch advertising, the FTC considers how many transactions are made at the advertised price, whether sales commissions are excluded on sale items, and total sales relative to advertising costs.

3. Manufacturers, Wholesalers, and Other Suppliers—and Retail Pricing

There may be conflicts between manufacturers (and other suppliers) and retailers in setting final prices; each would like some control. Manufacturers usually want a certain image and to enable all retailers, even inefficient ones, to earn profits. Most retailers want to set prices based on their image, goals, and so forth. A supplier can best control prices through exclusive distribution, not selling to price-cutting retailers, or being its own retailer. A retailer can best gain control by being a vital customer, threatening to stop carrying items, stocking private brands, or selling gray-market goods (defined soon).

Many manufacturers set prices to retailers by estimating final retail prices and then subtracting required retailer and wholesaler profit margins. In men’s apparel, the common retail markup is 50 percent of the final price. Thus, a man’s shirt retailing at $50 can be sold to a retailer for no more than $25. If a wholesaler is involved, the manufacturer’s wholesale price must be far less than $25.

Retailers sometimes carry manufacturers’ brands and place high prices on them so rival brands (such as private labels) can be sold more easily. This is called “selling against the brand” and is disliked by manufacturers because sales of their brands are apt to decline. Some retailers also sell gray-market goods, brand-name products bought in foreign markets or goods transshipped from other retailers. Manufacturers dislike gray-market goods because they are often sold at low prices by unauthorized dealers. They may sue gray-market goods resellers on the basis of copyright and trademark infringement.

When suppliers are unknown or products are new, retailers may seek price guarantees. For example, to get its radios stocked, a new supplier might have to guarantee the $30 suggested retail price. If the retailers cannot sell the radios for $30, the manufacturer pays a refund. Should the retailers have to sell the radios at $25, the manufacturer gives back $5. Another guarantee is one in which a supplier tells the retailer that no competitor can buy an item for a lower price. If anyone does, the retailer gets a rebate. The relative power of the retailer and its suppliers determines whether such guarantees are provided.

A retailer also has other suppliers: employees, fixtures manufacturers, landlords, and outside parties (such as ad agencies). Each has an effect on price because of its costs to the retailer.

4. Competition and Retail Pricing

Market pricing occurs when shoppers have a large choice of retailers. In this instance, retailers often price similarly to each other and have less control over price because consumers can easily shop around. Supermarkets, fast-food restaurants, and gas stations may use market pricing due to their competitive industries. Demand for specific retailers may be weak enough so that some customers would switch to a competitor if prices are raised much.

With administered pricing, firms seek to attract consumers on the basis of distinctive retailing mixes. This occurs when people consider image, assortment, service, and so forth to be important and they are willing to pay above-average prices to unique retailers. Upscale department stores, fashion apparel stores, and expensive restaurants are among those with unique offerings and solid control over their prices.

Most price-oriented strategies can be quickly imitated. Thus, the reaction of competitors is predictable if the leading firm is successful. This means a price strategy should be viewed from both short-run and long-run perspectives. If competition becomes too intense, a price war may erupt—whereby various firms continually lower prices below regular amounts and sometimes below their cost to lure consumers from competitors. Price wars are sometimes difficult to end and can lead to low profits, losses, or even bankruptcy for some competitors. This is especially so for Web retailers.

Source: Barry Berman, Joel R Evans, Patrali Chatterjee (2017), Retail Management: A Strategic Approach, Pearson; 13th edition.

Very interesting topic, thank you for putting up.