1. The Issue of Transaction Costs

The internalization theory of Buckley and Casson (1998) is based on the transaction cost approach of Coase published in The Nature of the Firm (1937) and the market-hierarchy paradigm of Williamson (1975). Firms have two fundamental possibilities when dealing with transactions: externally in the market (e.g., contracts) or in-house through hierarchy (e.g., production). The transaction costs in the market need to be compared with the internal coordination costs that arise when operations are carried out in-house. Contractual transactions do not perform as expected by the contracting parties or even fail because of the actors’ bounded rationality phenomena (e.g., individual preferences) and the issue of market imperfections (Zhao, Luo, & Suh 2004). Market imperfections are described as follows.

Market imperfections

- First, market transactions are not free of costs for the firm because of limited information and a lack of reliable future market forecasts and because of time lags between initiation and completion of the international business activity.

- Second, there is a monopoly (or monopsony) incentive in terms of ‘internalization of the market’ (forward or backward integration) in order to implement the desired price.

- Third, the bilateral concentration of market power (bilateral monopoly) leads to an indeterminate or unstable bargaining situation.

- Fourth, there are market imperfections caused by an inequality between buyer and seller (e.g., because of its size and bargaining power) with respect to knowledge of the nature or value of the product.

- Finally, market imperfections arise from government interventions in international markets through tariffs or restrictions on capital movements, protectionism, and from discrepancies among countries in rates of income and profit taxation (Buckley & Casson 1976).

The extent and degree of being confronted by market imperfections mainly depends on three transaction dimensions as described in transaction cost theory, such as asset specificity, uncertainty, and frequency. These dimensions are introduced as follows (compare: Williamson 1975, 1985).

1.1. Asset Specificity

Asset specificity refers to the degree to which an asset can be redeployed to alternative uses and by alternative users (Williamson 1991).

There are six types of asset specificity:

- site specificity (causing an influence of operational efficiency of the business actor),

- physical asset specificity (e.g., specialized equipment, tools, and technologies),

- learning and experience curve assets of human resources,

- brand name,

- dedicated assets (investments caused by a particular customer), and

- temporal specificity (non-separability of applied technologies).

Bilateral dependence between market actors (e.g., supplier and customer) rises with increasing asset specificity (as a result of explicit investments causing ‘actor-specific sunk costs’) and, therefore, increases the financial risk. The probability of internalization of value-added activities (e.g., vertical forward integration by the supplier or vertical backward integration by the client firm) increases with an enhanced investment specificity (Williamson 1991).

1.2. Uncertainty

Actors’ uncertainty related to market transactions is the result of imperfect information (e.g., understanding of performance and quality of the product or service) combined with the actor’s bounded rationality dilemma (human decisions usually are not completely rational, but are influenced by emotions, experience, preferences, likes and dislikes).

Uncertainty as a result of market imperfections necessarily requires market research activities and the initiation, negotiation, and conclusion of contracts (which cause ex-ante costs). Contract supervision and putting through agreed conditions after the contract is signed cause ex-post costs. Because market actors can never rely on perfect and complete information, contracts naturally are imperfect as well because it is impossible to consider all potential eventualities in the course of the market transaction process in concrete contractual terms. The higher the uncertainty, the more difficult it is to include the entire complexity of possible future developments in contracts and, as a consequence, the higher the risk that the market transaction will fail (Williamson 1975; Zajac & Olsen 1993).

The danger of opportunistic behavior from the transaction partner rises in accordance with the perceived degree of uncertainty. Opportunism refers to the incomplete or distorted disclosure of information, especially calculated efforts to mislead, distort, disguise, obfuscate, or otherwise confuse (Williamson 1985). The costs of negotiating, monitoring, and enforcing contract conditions in order to ban opportunistic behavior have a tremendous impact on the amount of transaction costs (Hill 1990:501). Because contracts can help to mitigate the risk of opportunism in a relationship, they are frequently classified as contractual governance mechanisms (Hoetker & Mellewigt 2009).

In addition to (formal visible) contracts, which help to clarify the relationship expectations between the actors, invisible influencing factors such as trust and commitment also have a significant impact on the development of mutually shared expectations related to contractual relationships. The development of trust and commitment can be supported by the contracting actors’ efforts, such as timely communication, smooth exchange of correct information, and coordination of activities (Walter, Muller, Helfert, & Ritter 2003). However, all these efforts aiming to develop and maintain a trusting contractual relationship cause administrative costs.

1.3. Frequency

The more frequently equal transactions are carried out in the market, the lower the average costs of a transaction due to the actors’ learning and experience curve effects. In addition, mutual trust between the transaction partners may rise, which minimizes the contractual negotiation costs of the transaction partners. With an increasing frequency of transactions and mutual trust, the desire to internalize market transactions (hierarchy) decreases (Williamson 1999).

Therefore, market transactions are recommended as an efficient business form

- the more standardized the product and service that is the subject of the transaction;

- the higher the actors’ degree of information, which results in transactional transparency;

- when product offer and demand are sufficient, such as in polypol market forms; and

- the more frequently transactions are carried out by the actors.

Backward integration out of manufacturing into the supplier’s value-added activities would be implied by hierarchy.

The hybrid mode of business is located between market and hierarchy with respect to control mechanisms, legal responsibility, and costs and corresponding financial risks. An international joint venture serves as an examples of hybrid business entry strategy (Williamson 1991). Hybrid business models are chosen by actors attempting to balance their market uncertainty risk with the financial risk of internalizing market transactions.

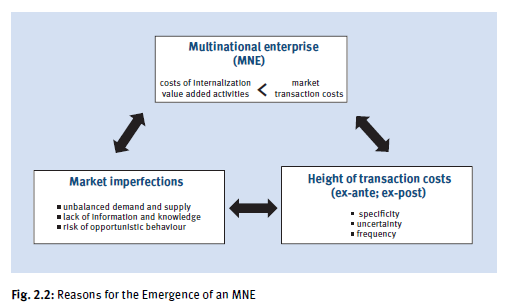

2. Emergence of Multinational Enterprises

Buckley and Casson (1976) transferred the contents of the transaction cost concept to the idea of the multinational enterprise (MNE). Market imperfections (as previously defined in the transaction costs theory) for intermediate products require coordination efforts for global business activities. The desire to increase coordination efficiency has led to the phenomena of emerging MNEs. MNEs internalize the markets across national boundaries whenever the costs of internal organization of market activities are lower than market transactions. Decision determinants for favoring or disfavoring internalization depend on (Buckley & Casson 1976) the following:

- industry-specific factors, such as the nature of the product and the structure of the market (compare location theory/market based-view);

- region-specific factors, which relate to the geographical and societal characteristics of the markets (compare location theory/market based-view);

- nation-specific factors, such as political and fiscal relations between the nations concerned (compare location theory/market based-view); and

- firm-specific factors, which reflect the ability of the management to ‘internalize the market’ (compare resource-based view).

As illustrated in Figure 2.2, MNEs appear whenever it is cheaper to allocate international resources and value- added activities internally than by making transactions in the markets (Brown 1976; Buckley & Casson 1976). Because MNEs own and control resources and activities in different countries, they become able to maximize their profits in a world of imperfect markets. The higher the internal efficiency of in-house procurement and operations, the more desirable is the internalization of international market transactions (Caves 1982).

Buckley and Casson emphasize the role of an MNE as a cross-boundary developer and transferor of various kinds of knowledge and skills. In an imperfect market system, foreign investment has allowed MNEs to bypass imperfect external conditions through internalization (Buckley & Casson 1976).

In recent years, the classic internalization theory by Buckley and Casson (1976) has been further developed towards the new internalization theory which relies on two main behavioral assumptions. The first assumption is called bounded rationality, meaning that individuals’ behavior is intended to be rational, but is limited in always being so (Simon 1961). The second assumption, named bounded reliability, claims that individuals intend to be reliable but may fail to fulfill open-ended commitments for various reasons which may be out of the control of the individual. In the context of international expansion, internalization or de-internalization becomes a governance mechanism for managing the bounded rationality and bounded reliability of actors involved in international transactions (Cano-Kollmann et al. 2016; Kano & Verbeke 2015). In simple terms, the firm integrates (internalizes) market transactions into the organization because the management is better able to monitor, guide and control its (in-house) employees. This helps in overcoming the bounded rationality and bounded reliability dilemma more than in the case of external market actors (e.g., contracted but independent suppliers).

3. Review of Internalization Theory

Internalization theory extends the market imperfections approach as claimed in transaction cost theory by focusing on failings in intermediate-product markets rather than on final products. The internalization model identifies transaction costs as a main impulse for internationalization (Buckley & Casson 1976; Robock & Simmonds 1989). Buckley and Casson (1976) identified different factors determining the internationalization decision, which does not depend only on market imperfections but also on organizational capabilities, particularly in terms of internal market organization and coordination. As a result of their study, they were the first to describe and explain the emerging MNE phenomena, which has been increasingly seen since the 1970s. They also considered the role of knowledge (disparities) in driving foreign investment decisions as opposed to market transactions (Zuchella & Scabini 2007). MNEs appear when it is cheaper to allocate international knowledge resources internally than via the market mechanism (Brown 1976). However, the internalization theory is complex and, therefore, cause-and-effect variables are difficult to quantify in the course of empirical analysis.

Buckley and Casson (1976) focus on industry-specific factors related to internalizing markets for intermediate products in multistage production processes, for example through vertical integration. A vertically integrated firm is determined mainly by the interplay of comparative advantage, tariff and non-tariff trade barriers, and regional incentives to internalize. The firm will become an MNE whenever the combination of these factors makes it optimal to locate different operational stages of value-added activities in different countries (Buckley & Casson 1976).

However, there are other motives for enterprises to internationalize, such as for example the necessity of a supplier ‘to follow its customer’ to foreign markets. Moreover, the actual amount of transaction costs can hardly be quantified. Uncertainty is perceived differently by the operating management, and costs usually change over time. Due to the influence of transaction cost theory (Williamson 1975, 1985) the internalization model is based on ‘rationality’ but pays very limited attention to behavioral-sociological aspects, such as ethics, culture and norms, or personal preferences of the management (McIvor et al. 2006). Buckley and Casson (2009) moderate the critics by claiming that rationality does not imply the necessity of complete information. Instead, a rational decision maker collects only enough information to reduce uncertainty.

The latest research considers the behavioral aspects of trust-building and learning as drivers for the success of MNEs in international markets (Vahlne & Ivarsson 2014). Internalization may be rather disadvantageous in countries where the protection of invested private capital is not secure (consider, for example, the proceeding cases of expropriation of MNEs that originated in the oil industry in Venezuela).

The internalization concept of Buckley and Casson (1976) explains the growth of MNEs domestically and internationally. The approach focuses on a firm’s motives to internationalize but does not consider appropriately the potential of national governments and their political/legal influence on MNE investment decisions. For example, in countries such as China or India, it is often necessary or at least advisable to establish a joint venture with local firms in order to enter the foreign market successfully. The need to found a joint venture with a local partner influences the firm’s decision alternatives and may hinder realizing the concept of a complete internalization (e.g., through foreign direct investment) of foreign country activities into the firm’s hierarchy (Robock & Simmonds 1989).

Source: Glowik Mario (2020), Market entry strategies: Internationalization theories, concepts and cases, De Gruyter Oldenbourg; 3rd edition.

Thank you for some other excellent article. The place else may anybody get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I am at the look for such information.

I’m still learning from you, but I’m trying to achieve my goals. I certainly liked reading everything that is posted on your website.Keep the tips coming. I enjoyed it!