Snack food market in India is growing at 25-30 per cent per year. This is what the organized sector believes. The unorganized sector dominates nearly 50 per cent of the market. The local players sell both branded and unbranded products that are 20-25 per cent cheaper than the national brands. The unbranded products are supplied to small- and medium-sized restaurants, bars, clubs and pubs in bulk quantity. However, the branded products are popular among the educated elite and the young generation in urban areas. Due to the changing trends in lifestyle and adoption of western culture, food habits among Indian youths are showing a change. As a result, there is more inclination towards fun and enjoyment in life, which is reflected in food habits and living style of the younger Indian population, both in urban and semi-urban areas.

1. Company Background

Based on the market survey conducted in 1987 by Jolly Snack Food Products Co. (JSFPC), a subsidiary of the multinational company set up a snack food plant at Patiala and Delhi to manufacture potato chips, baked cheese, fried pallets, and so on. Their mission is “to be people’s favourite snacks and be always available when required.” In the demanding market scenario, where staying ahead of the competition is a key challenge, the pace with which one responds is of strategic importance. With volatile demand, today the emphasis is on “make to sell rather than make to stock.” With high consumer expectations and the need for rapid response in marketing, distribution assumes more significance and provides the required competitive edge. Availability of material and products at the right time and place has become a prerequisite for creating long-term loyalty.

The market survey conducted by JSFPC, through country’s leading market research agency, on consumer perception indicates over 95 per cent customer satisfaction. The three product varieties introduced so far hit the markets and increased the bottom line of the company. But due to competition from the unorganized sector on the price front, Randeep Singh, GM (marketing) is worried about the distribution cost as a percentage of the product cost, which has been growing over the years and reducing the profit margin. On the other hand, due to cut-throat competition JSFPC is under tremendous pressure to keep prices at a level acceptable to the customers.

2. Problem Analysis

To analyze the distribution cost problem, Randeep Singh assigned the job to Lobo, an engineer MBA with four years of experience in the distribution of FMCG products, who joined JSFPC as logistics manager. He is with the company for the last one month. Lobo took it as challenge to show his worth to the company. He studied the current JSFPC distribution system that is reflected in the distribution chain shown in Figure 24.4.1.

JSFPC’s first phase of distribution from the factories to the C&F agents is more critical as it involves the long-distance freight-paid dispatches, with primary freight charges included in the maximum retail price (MRP). The distribution of the product from the C&F agent down to the retailer is taken care of by the channel members. The freight charges for secondary transportation from C&F agents down the line are taken care of by the channel members, who are compensated through commissions and quantity discounts. As the products are sent through open trucks, JSFPC encounters the following problems:

3. Transhipments

Due to the minimal weight requirements, the transporter sometimes clubs some other heavy goods with JSFPC products, resulting in transit damages. The trucks are sometimes not loaded to volume capacity because of varying product mix requirements.

4. Freight

JSFPC products occupy more space and hence the 9-tonne truck is underutilized in terms of the weight factor, resulting in higher freight charges per unit weight.

5. Damages

Transit damages in the open trucks is to the extent of 8-10 per cent due to improper handling, transhipments, protrusions, mixing with other cargo (no control over the transporter once a vehicle leaves the factory).

6. Pilferage

JSFPC have sometimes received complaints from C&F agents about short supplies, which usually occur due to pilferage of this tempting food product. The percentage is not so alarming but JSFPC wants to eliminate this.

JSFPC is packing the products in transparent plastic bags of 200 grams each. These bags are packed in cartons of average size 2 ft X 1 ft X 1 ft. The average dispatches of three stock keeping units (SKUs) during the last twelve months were:

SKU “A”—68 per cent

SKU “B”—25 per cent

SKU “C”—7 per cent

7. Proposed Solution

To get over the present problem, Lobo considered using closed containers for dispatch of the material from the factory to the C&F agents. He thought the closed box container would be the safer, faster and cheaper method of dispatching the material. JSFPC could enter into a contract with the transporter for container shipment on a long-term basis at the lowest cost. Logo first decided to compare the freight of open truck (9 tonnes) with the various sizes of the containers on the following basis:

- Rs per km

- Rs per cu ft

- Rs per kg

- Rs per case

The comparison of cases fitting into the open truck and the various sizes of containers is presented in Table 24.4.1:

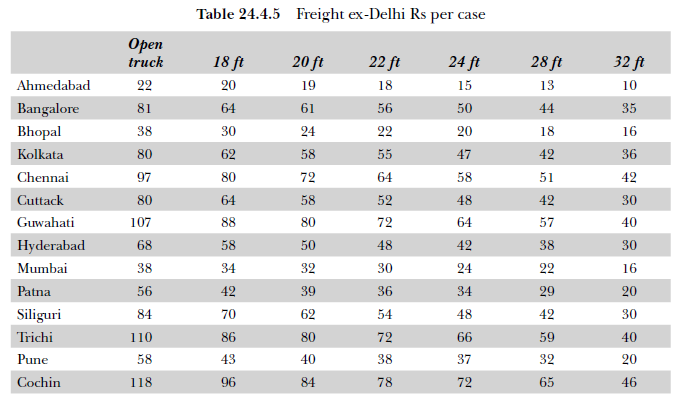

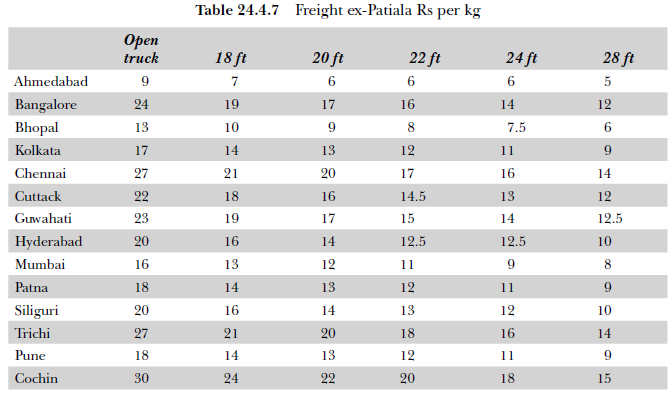

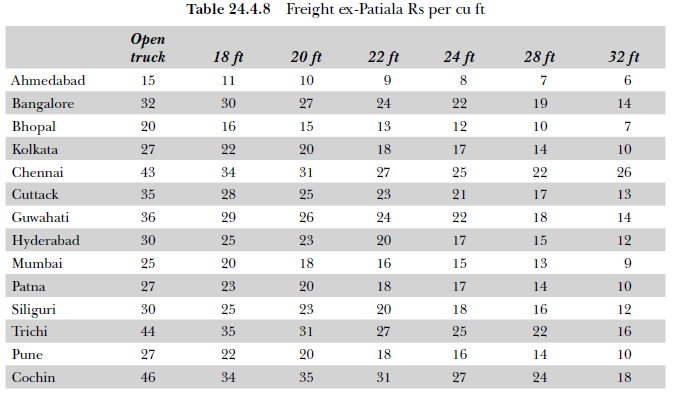

The major task before Lobo was to find out the optimum size of the container in place of the open truck. Once this exercise was over, the C&F agent’s base could be further enlarged. The freight economy with the reduction in transit damages and pilferages would ensure a lot of savings that will enhance the margins and may help in reviewing the MRP to face competition. Lobo worked out the freight for each of the above container sizes on per km, per kg, per cu ft and per case basis, the results are presented in Tables 24.4.2-24.4.9.

Source: Sople V.V (2013), Logistics Management, Pearson Education India; Third edition.

Some times its a pain in the ass to read what website owners wrote but this web site is very user pleasant! .