How do we measure brand equity? An indirect approach assesses potential sources of brand equity by identifying and tracking consumer brand knowledge structures.59 A direct approach assesses the actual impact of brand knowledge on consumer response to different aspects of the marketing. “Marketing Insight: The Brand Value Chain” shows how to link the two approaches.

The two general approaches are complementary, and marketers can employ both. In other words, for brand equity to perform a useful strategic function and guide marketing decisions, marketers need to fully understand (1) the sources of brand equity and how they affect outcomes of interest and (2) how these sources and outcomes change, if at all, over time. Brand audits are important for the former; brand tracking for the latter.

- A brand audit is a focused series of procedures to assess the health of the brand, uncover its sources of brand equity, and suggest ways to improve and leverage its equity. Marketers should conduct a brand audit when setting up marketing plans and when considering shifts in strategic direction. Conducting brand audits on a regular basis, such as annually, allows marketers to keep their fingers on the pulse of their brands so they can manage them more proactively and responsively. A good brand audit provides keen insights into consumers, brands, and the relationship between the two.

- Brand-tracking studies use the brand audit as input to collect quantitative data from consumers over time, providing consistent, baseline information about how brands and marketing programs are performing. Tracking studies help us understand where, how much, and in what ways brand value is being created to facilitate day-to-day decision making.

One firm that recently conducted an influential major brand audit is Kellogg’s.60

KELLOGG’S The ready-to-eat cereal category has been under siege in recent years as busy consumers choose to eat on the run while nutrition-minded consumers worry about genetically modified ingredients. With a history spanning more than a century, Kellogg decided it needed to refresh the brand and address the issues head-on. An extensive brand audit, dubbed “Project Signature,” was launched to provide strategic direction and creative inspiration. After a year of work with brand consulting partner Interbrand, the result was a new tagline, “Let’s Make Today Great”; an updated, more contemporary logo and design look; clear identification of the brand’s core purpose as highlighting the “power of breakfast”; explicit incorporation of the Kellogg’s master brand into all its marketing campaigns; and consolidation of 42 company Web sites around the world into one. The brand audit influenced a number of Kellogg’s specific marketing programs and activities, from the cause-related “Share Your Breakfast” campaign (to help the one in five U.S. children who might not have access to breakfast) to the “Love Your Cereal” social media program debunking myths about cereal. An Olympic sponsor, Kellogg also devotes 20 percent of its communication budget to online engagement.

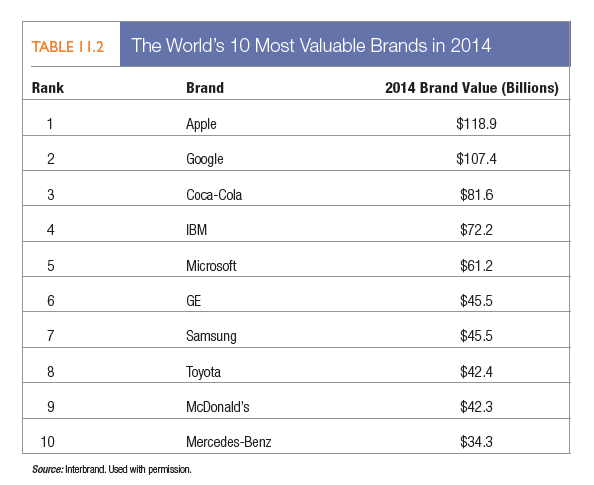

Marketers should distinguish brand equity from brand valuation, which is the job of estimating the total financial value of the brand. Table 11.2 displays the world’s most valuable brands in 2012 according to the Interbrand rankings, as described below in “Marketing Insight: What Is a Brand Worth?”61 In these well-known companies, brand value is typically more than half the total company market capitalization. John Stuart, cofounder of Quaker Oats, said: “If this business were split up, I would give you the land and bricks and mortar, and I would take the brands and trademarks, and I would fare better than you.” U.S. companies do not list brand equity on their balance sheets, in part because of differences in opinion about what constitutes a good estimate. However, companies do give it a value in countries such as the United Kingdom, Hong Kong, and Australia.

1. MARKETING INSIGHT The Brand Value Chain

The brand value chain is a structured approach to assessing the sources and outcomes of brand equity and the way marketing activities create brand value (Figure 11.6). It is based on several premises.

First, brand value creation begins when the firm targets actual or potential customers by investing in a marketing program to develop the brand, including marketing communications, trade or intermediary support, and product research, development, and design. This marketing activity will change customers’ mind-sets—what customers think and feel and everything that becomes linked to the brand. Next, these customers’ mind-sets will affect buying behavior and the way consumers respond to all subsequent marketing activity—pricing, channels, communications, and the product itself—and the resulting market share and profitability of the brand. Finally, the investment community will consider this market performance of the brand to assess shareholder value in general and the value of a brand in particular.

The model also assumes that three multipliers increase or decrease the value that can flow from one stage to another.

- The program multiplier determines the marketing program’s ability to affect the customer mind-set and is a function of the quality of the program investment.

- The customermultiplier determines the extent to which value created in the minds and hearts of customers affects market performance. This result depends on competitive superiority (how effective the quantity and quality of the marketing investment of other competing brands are), channel and other intermediary support (how much brand reinforcement and selling effort various marketing partners are putting forth), and customer size and profile (how many and what types of customers, profitable or not, are attracted to the brand).

- The marketmuitiplier determines the extent to which the value shown by the market performance of a brand is manifested in shareholder value. It depends, in part, on the actions of financial analysts and investors.

Researchers at Millward Brown adopt a very similar perspective. They maintain that a brand’s financial success depends on its ability to be meaningful, different, and salient. These three brand qualities (MD&S) predispose someone to positive purchase behavior (choose the brand over others, pay more for it, stick with or try it in the future), which in turn generates financial benefits to the company (increased volume share, higher price premium, increased likelihood to grow value share in the future).

Millward Brown asserts that this brand predisposition is measured by three brand equity metrics: power, premium and potential.

- People are predisposed to choose the brand over others. This will drive brand volume, so power predicts volume share based entirely on perceptions, absent of activation factors.

- People are predisposed to pay more for the brand. This will allow the brand to charge more, so premium predicts the price index your brand can command.

- Potential indicates the likelihood of value share growth for the brand in the next 12 months, based on people’s predisposition to stick to the brand or try it in the future.

2. MARKETING INSIGHT What Is a Brand Worth?

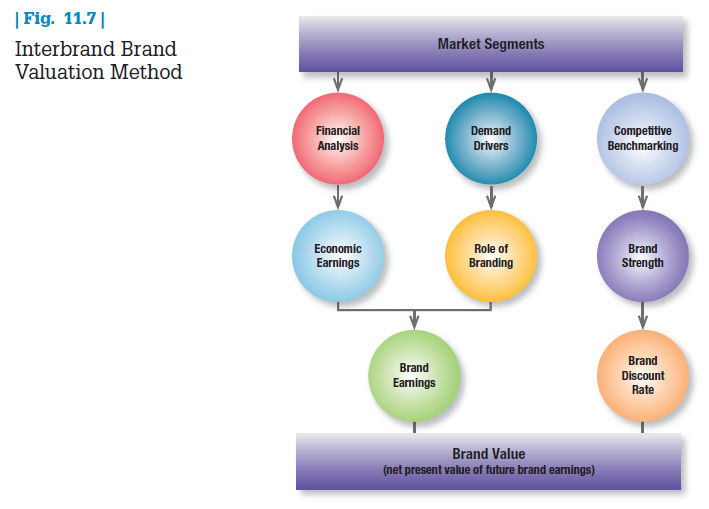

Top brand-management firm Interbrand has developed a model to formally estimate the dollar value of a brand. It defines brand value as the net present value of the future earnings that can be attributed to the brand alone. The firm believes marketing and financial analyses are equally important in determining the value of a brand. Its process follows five steps (see Figure 11.7 for a schematic overview):

- Market Segmentation—The first step is to divide the market(s) in which the brand is sold into mutually exclusive segments that help determine variations among the brand’s different customer groups.

- Financial Analysis—Interbrand assesses purchase price, volume, and frequency to help calculate accurate forecasts of future brand sales and revenues. Once it has established Brand Revenues, it deducts all associated operating costs to derive earnings before interest and tax (EBIT). It also deducts the appropriate taxes and a charge for the capital employed to operate the underlying business, leaving Economic Earnings, that is, the earnings attributed to the branded business.

- Role of Branding—Interbrand next attributes a proportion of Economic Earnings to the brand in each market segment by first identifying the various drivers of demand and then determining the degree to which the brand directly influences each. The Role of Branding assessment is based on market research, client workshops, and interviews and represents the percentage of Economic Earnings the brand generates. Multiplying the Role of Branding by Economic Earnings yields Brand Earnings.

- Brand Strength—Interbrand then assesses the brand’s strength profile to determine the likelihood that the brand will realize forecasted Brand Earnings. This step relies on competitive benchmarking and a structured evaluation of the brand’s clarity, commitment, protection, responsiveness, authenticity, relevance, differentiation, consistency, presence, and understanding. For each segment, Interbrand applies industry and brand equity metrics to determine a risk premium for the brand. The company’s analysts derive the overall Brand Discount Rate by adding a brand-risk premium to the risk-free rate, represented by the yield on government bonds. The Brand Discount Rate, applied to the forecasted Brand Earnings forecast, yields the net present value of the Brand Earnings. The stronger the brand, the lower the discount rate, and vice versa.

- Brand Value Calculation—Brand Value is the net present value (NPV) of the forecasted Brand Earnings, discounted by the Brand Discount Rate. The NPV calculation is composed of both the forecast period and the period beyond, reflecting the ability of brands to continue generating future earnings.

Increasingly, Interbrand uses brand value assessments as a dynamic, strategic tool to identify and maximize return on brand investment across a whole host of areas.

Source: Kotler Philip T., Keller Kevin Lane (2015), Marketing Management, Pearson; 15th Edition.

I have recently started a web site, the info you offer on this website has helped me greatly. Thank you for all of your time & work.