Probably the three most widely read books on competitive analysis in the 1980s were Michael Porter’s Competitive Strategy (1980), Competitive Advantage (1985), and Competitive Advantage of Nations (1989). According to Porter, strategies allow organizations to gain competitive advantage from three different bases: cost leadership, differentiation, and focus. Porter calls these bases generic strategies.

Cost leadership emphasizes producing standardized products at a low per-unit cost for consumers who are price sensitive. Two alternative types of cost leadership strategies can be defined. Type 1 is a low-cost strategy that offers products or services to a wide range of customers at the lowest price available on the market. Type 2 is a best-value strategy that offers products or services to a wide range of customers at the best price-value available on the market. The best-value strategy aims to offer customers a range of products or services at the lowest price available compared to a rival’s products with similar attributes. Both Type 1 and Type 2 strategies target a large market.

Porter’s Type 3 generic strategy is differentiation, a strategy aimed at producing products and services considered unique to the industry and directed at consumers who are relatively price insensitive.

Focus means producing products and services that fulfill the needs of small groups of consumers. Two alternative types of focus strategies are Type 4 and Type 5. Type 4 is a low- cost focus strategy that offers products or services to a small range (niche group) of customers at the lowest price available on the market. Examples of firms that use the Type 4 strategy include Jiffy Lube International and Pizza Hut, as well as local used car dealers and hot dog restaurants. Type 5 is a best-value focus strategy that offers products or services to a small range of customers at the best price-value available on the market. Sometimes called “focused differentiation,” the best-value focus strategy aims to offer a niche group of customers the products or services that meet their tastes and requirements better than rivals’ products do. Both Type 4 and Type 5 focus strategies target a small market. However, the difference is that Type 4 strategies offer products or services to a niche group at the lowest price, whereas Type 5 offers products and services to a niche group at higher prices but loaded with features so the offerings are perceived as the best value. Bed-and-breakfast inns and local retail boutiques are examples of Type 5 firms.

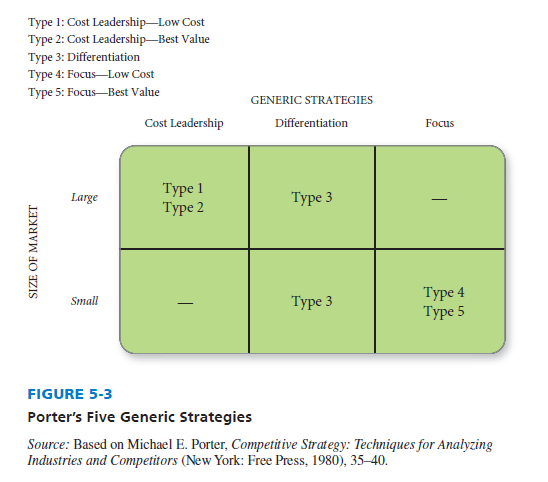

Porter’s five strategies imply different organizational arrangements, control procedures, and incentive systems. Larger firms with greater access to resources typically compete on a cost leadership or differentiation basis, whereas smaller firms often compete on a focus basis. Porter’s five generic strategies are illustrated in Figure 5-3. Note that a differentiation strategy (Type 3) can be pursued with either a small target market or a large target market. However, it is not effective to pursue a cost leadership strategy in a small market because profits margins are generally too small. Likewise, it is not effective to pursue a focus strategy in a large market because economies of scale would generally favor a low-cost or best-value cost leadership strategy to gain or sustain competitive advantage.

Porter stresses the need for strategists to perform cost-benefit analyses to evaluate “sharing opportunities” among a firm’s existing and potential business units. Sharing activities and resources enhances competitive advantage by lowering costs or increasing differentiation. In addition to prompting sharing, Porter stresses the need for firms to effectively “transfer” skills and expertise among autonomous business units to gain competitive advantage. Depending on factors such as type of industry, size of firm, and nature of competition, various strategies could yield advantages in cost leadership, differentiation, and focus.

1. Cost Leadership Strategies (Type 1 and Type 2)

A primary reason for pursuing forward, backward, and horizontal integration strategies is to gain low-cost or best-value cost leadership benefits. But cost leadership generally must be pursued in conjunction with differentiation. A number of cost elements affect the relative attractiveness of generic strategies, including economies or diseconomies of scale achieved, learning and experience curve effects, the percentage of capacity utilization achieved, and linkages with suppliers and distributors. Other cost elements to consider in choosing among alternative strategies include the potential for sharing costs and knowledge within the organization, research and development (R&D) costs associated with new product development or modification of existing products, labor costs, tax rates, energy costs, and shipping costs.

Striving to be the low-cost producer in an industry can be especially effective when the market is composed of many price-sensitive buyers, when there are few ways to achieve product differentiation, when buyers do not care much about differences from brand to brand, or when there are a large number of buyers with significant bargaining power. The basic idea is to underprice competitors and thereby gain market share and sales, entirely driving some competitors out of the market. Companies employing a low-cost (Type 1) or best-value (Type 2) cost leadership strategy must achieve their competitive advantage in ways that are difficult for competitors to copy or match. If rivals find it relatively easy or inexpensive to imitate the leader’s cost leadership methods, the leaders’ advantage will not last long enough to yield a valuable edge in the marketplace. Recall that for a resource to be valuable, it must be either rare, hard to imitate, or not easily substitutable. To employ a cost leadership strategy successfully, a firm must ensure that its total costs across its overall value chain are lower than competitors’ total costs. There are two ways to accomplish this:18

- Perform value chain activities more efficiently than rivals and control the factors that drive the costs of value chain activities. Such activities could include altering the plant layout, mastering newly introduced technologies, using common parts or components in different products, simplifying product design, finding ways to operate close to full capacity year-round, and so on.

- Revamp the firm’s overall value chain to eliminate or bypass some cost-producing activities. Such activities could include securing new suppliers or distributors, selling products online, relocating manufacturing facilities, avoiding the use of union labor, and so on.

When employing a cost leadership strategy, a firm must be careful not to use such aggressive price cuts that its own profits are low or nonexistent. Constantly be mindful of cost-saving technological breakthroughs or any other value chain advancements that could erode or destroy the firm’s competitive advantage. A Type 1 or Type 2 cost leadership strategy can be especially effective under the following conditions:19

- Price competition among rival sellers is especially vigorous.

- Products of rival sellers are essentially identical and supplies are readily available from any of several eager sellers.

- There are few ways to achieve product differentiation that have value to buyers.

- Most buyers use the product in the same ways.

- Buyers incur low costs in switching their purchases from one seller to another.

- Buyers are large and have significant power to bargain down prices.

- Industry newcomers use introductory low prices to attract buyers and build a customer base.

A successful cost leadership strategy usually permeates the entire firm, as evidenced by high efficiency, low overhead, limited perks, intolerance of waste, intensive screening of budget requests, wide spans of control, rewards linked to cost containment, and broad employee participation in cost control efforts. Some risks of pursuing cost leadership are that competitors may imitate the strategy, thus driving overall industry profits down; technological breakthroughs in the industry may make the strategy ineffective; or buyer interest may swing to other differentiating features besides price. The dollar stores are well known for their low-cost leadership strategies.

2. Differentiation Strategies (Type 3)

Different strategies offer different degrees of differentiation. Differentiation does not guarantee competitive advantage, especially if standard products sufficiently meet customer needs or if rapid imitation by competitors is possible. Durable products protected by barriers to quick copying by competitors are best. Successful differentiation can mean greater product flexibility, greater compatibility, lower costs, improved service, less maintenance, greater convenience, or more features. Product development is an example of a strategy that offers the advantages of differentiation.

A differentiation strategy should be pursued only after a careful study of buyers’ needs and preferences to determine the feasibility of incorporating one or more differentiating features into a unique product that showcases the desired attributes. A successful differentiation strategy allows a firm to charge a higher price for its product and to gain customer loyalty because consumers may become strongly attached to the differentiation factors. Special features that differentiate one’s product can include superior service, spare parts availability, engineering design, product performance, useful life, gas mileage, or ease of use.

A risk of pursuing a differentiation strategy is that the unique product may not be valued highly enough by customers to justify the higher price. When this happens, a cost-leadership strategy easily will defeat a differentiation strategy. Another risk of pursuing a differentiation strategy is that competitors may quickly develop ways to copy the differentiating features. Firms thus must find durable sources of uniqueness that cannot be imitated quickly or cheaply by rival firms.

Common organizational requirements for a successful differentiation strategy include strong coordination among the R&D and marketing functions and substantial amenities to attract scientists and creative people. Firms can pursue a differentiation (Type 3) strategy based on many different competitive aspects. Differentiation opportunities exist or can potentially be developed anywhere along the firm’s value chain, including supply chain activities, product R&D activities, production and technological activities, manufacturing activities, human resource management activities, distribution activities, or marketing activities.

The most effective differentiation bases are those that are hard or expensive for rivals to duplicate. Competitors are continually trying to imitate, duplicate, and outperform rivals along any differentiation variable that has yielded competitive advantage. For example, when U.S. Airways cut its prices, Delta quickly followed suit. When Caterpillar instituted its quick-delivery-of-spare- parts policy, John Deere soon followed suit. To the extent that differentiating attributes are tough for rivals to copy, a differentiation strategy will be especially effective, but the sources of uniqueness must be time consuming, cost prohibitive, and simply too burdensome for rivals to match. A firm, therefore, must be careful when employing a differentiation (Type 3) strategy. Buyers will not pay the higher differentiation price unless their perceived value exceeds the price they are currently paying.20 Based on such matters as attractive packaging, extensive advertising, quality of sales presentations, quality of website, list of customers, professionalism, size of the firm, or profitability of the company, perceived value may be more important to customers than actual value.

A Type 3 differentiation strategy can be especially effective under the following four conditions:21

- There are many ways to differentiate the product or service and many buyers perceive these differences as having value.

- The buyer’s needs and uses are diverse.

- Few rival firms are following a similar differentiation approach.

- Technological change is fast paced and competition revolves around rapidly evolving product features.

3. Focus Strategies (Type 4 and Type 5)

A successful focus strategy depends on an industry segment that is of sufficient size, has good growth potential, and is not crucial to the success of other major competitors. Strategies such as market penetration and market development offer substantial focusing advantages. Midsize and large firms can effectively pursue focus-based strategies only in conjunction with differentiation or cost leadership-based strategies. All firms essentially follow a differentiated strategy. Because only one firm can differentiate itself with the lowest cost, the remaining firms in the industry must find other ways to differentiate their products.

Focus strategies are most effective when consumers have distinctive preferences or requirements and when rival firms are not attempting to specialize in the same target segment. For example, Clorox Company, which obtains 80 percent of its revenue from the United States, is focusing on brands viewed as environmentally friendly. Marriott continues to focus on its hotel business by announcing plans to double its hotels in Asia to 275 by 2017, especially growing its China-based hotels to about 125 from 60 and covering nearly 75 percent of Chinese provinces. Reasoning for Marriott’s strategy is that Chinese tourists are traveling at home and abroad in dramatically increased numbers, up 21 percent on average year after year.

Risks of pursuing a focus strategy include the possibility that numerous competitors will recognize the successful focus strategy and copy it or that consumer preferences will drift toward the product attributes desired by the market as a whole. An organization using a focus strategy may concentrate on a particular group of customers, geographic markets, or particular productline segments to serve a well-defined but narrow market better than competitors who serve a broader market.

A low-cost (Type 4) or best-value (Type 5) focus strategy can be especially attractive under these conditions:22

- The target market niche is large, profitable, and growing.

- Industry leaders do not consider the niche to be crucial to their own success.

- Industry leaders consider it too costly or difficult to meet the specialized needs of the target market niche while taking care of their mainstream customers.

- The industry has many different niches and segments, thereby allowing a focuser to pick a competitively attractive niche suited to its own resources.

- Few, if any, other rivals are attempting to specialize in the same target segment.

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

Great article, thanks for sharing!

I was looking through some of your articles on this internet site and I believe this web site is rattling informative ! Continue putting up.