1. THE NON-PROFIT ENTERPRISE

Institutions which cannot distribute residual profits and issue no exchangeable or non-exchangeable claims to profits are non-profit enterprises. Nonprofit enterprises have a board of trustees who are responsible for appointing managers to run the day-to-day administration, and for ensuring that the activities of the enterprises are compatible with the purposes for which they were established. They are frequently observed in areas such as education and health provision or where charitable (that is, redistributional) objectives are being pursued.2

A difficulty with the definition of non-profit enterprise suggested above is that it would appear to include organisations of the state which provide services free to consumers. Every state-run school, for example, might be considered a non-profit enterprise. It is therefore useful to distinguish institutions that sell their output in the market from those that are in receipt of subsidies and may provide services free of charge. Hansmann (1980, 1987) suggests the term commercial non-profit enterprise, where sales of goods or services provide the major source of revenue. Enterprises in receipt of subsidy are called donative non-profit firms. Again, it is useful to distinguish subsidies which derive from the state and those that are provided from voluntary private giving. The former defines a situation of bureaucratic supply.

Sales of services, financial assistance from the state, and donations from private sources can vary widely as a proportion of total revenue, and it will always be possible to argue about the point at which a bureau becomes a non-profit enterprise, or where a donative non-profit firm becomes commercial. Nevertheless, the terminology reflects distinctions which are of great importance for incentives and behaviour.

Another significant issue concerns the governance of the non-profit enterprise. Some non-profit institutions give their patrons collective rights to nominate trustees and thereby to determine the general policy of the firm. These enterprises are called mutual non-profit firms. In giving voice to the mutual interests of their patrons, they resemble cooperatives, but, unlike the cooperative, they are unable to distribute residual profits to their members. Other non-profit institutions have a board of trustees that is self-perpetuating – making appointments and accepting resignations. Because ‘control’ of these non-profit firms is dependent upon the character of board members, Hansmann (1980) calls them entrepreneurial non-profit organisations.3

Nationalisedfirms present a further problem for terminology. It might be argued that the absence of residual claims combined with the sale of its output means that the nationalised firm is in the commercial non-profit category. This would clearly be unsatisfactory since, amongst the objectives set for them, managers of nationalised firms may be asked by the responsible ministers of state to meet a profit target. Rather than regarding the nationalised firm as being without residual claims, therefore, it may be more suitable to see these claims as non-exchangeable and spread over the entire body of the tax-paying public. Profits and losses accrue to taxpayers. This implicit sharing of the residual amongst taxpayers puts the nationalised firm in a category of its own. Bureaucratic supply will be considered later in this chapter (in section 5) while a fuller discussion of public enterprise is delayed until Chapter 13 in Part 3.

2. GOVERNANCE PROBLEMS AND THE NONPROFIT ENTERPRISE

It will be evident from the brief description of the governance arrangements in non-profit firms in section 1 that effort incentives are likely to present a serious problem and that managerial discretion will be substantial. An analysis based upon the property rights theory of Chapter 4 would predict a low level of productive efficiency in non-profit enterprise. Trustees will have no pecuniary incentive to monitor the effectiveness of managers. Managers cannot be given incentive payments based on profit sharing, holdings of common stock, or stock options. Bonuses based upon other dimensions of performance are costly to contrive in service industries where output is difficult to measure objectively and ‘team production’ is often important. The takeover threat does not operate. At first sight, these features would appear to be a serious handicap and to suggest poor survival qualities on the part of non-profit enterprise in the competitive battle between institutional arrangements.

Managers might be expected to have considerable discretionary power under these circumstances, and theories of the activities of non-profit institutions have been developed in this ‘managerial’ tradition. Nicols (1967) argues, for example, that mutual (that is, non-profit) savings and loan associations in the USA will behave differently from stock (that is, for profit) associations. Depositors in mutuals receive ‘shares’ but ‘typically surrender their proxies to management on opening an account’ (p. 337). The result is a diffused ‘ownership’, but ‘control’ concentrated in management. Nicols describes management at one point as ‘a self-perpetuating autocracy’ (p. 337). Managers can divert the resources of mutuals for their own benefit, he argues, by inflating expenses. Where new entry is restricted, managers may operate a policy of creating artificial shortages and then ‘ration’ loans to those who purchase insurance or other services from private companies in which they have a personal interest. Nepotism is likely to be higher in mutual than in stock associations; a proposition Nicols tested by the simple expedient of checking the names of chief executive officers and other officers to see how frequently officers had the ‘same name’.

A similar type of analysis is presented by Newhouse (1970) in his model of a non-profit hospital. Trustees, administrators and medical staff will inflate the quality of medical services provided in the interests of prestige. Expensive medical equipment will be under-utilised, while Newhouse uses ‘accreditation’ as an index of quality and notes that ‘there is a lower percentage of accreditation among the proprietaries than among the voluntaries’ (p. 69). We will discuss Newhouse’s model briefly again in section 4. For now it suffices to note that the view of non-profit institutions taken by Nicols and Newhouse suggests that they can survive only in a protected environment. Both are explicit about this: ‘The mutual is an institution which can survive only at the cost of continued governmental restriction of competition’ (Nicols, 1967, p.346). Similarly, Newhouse explains the nonprofit hospital by reference to legal barriers to entry and favourable tax status. Thus, both writers take the same position with respect to non-profit enterprises as Adam Smith took with respect to the joint-stock firm. They can survive only with an ‘exclusive privilege’.

Property rights are undoubtedly attenuated within the non-profit firm, but, for a variety of reasons, it would be wrong to deduce that effort incentives are entirely absent.

- Trustees, for example, have legal obligations which the state may enforce (even if imperfectly). Because non-profit enterprises often face a lenient tax environment, the tax authorities have an interest in ensuring that the non-profit firm does not abuse this position. Some monitoring from this source can therefore be expected.

- Further, non-profit firms may employ people who gain satisfaction from the knowledge that they are engaged in some ‘higher’ purpose than the simple pursuit of monetary reward. This might logically result in the existence of a degree of peer pressure. As was seen in Chapter 10, peer pressure requires participation in a collective outcome. In the context of a profit-sharing enterprise the outcome was the firm’s residual. If a non-profit firm produces a good which confers joint benefits on its workers (such as the successful achievement of charitable or public objectives), a similar mutual interest in the collective result will exist. That incentives of this type are important is suggested by the large amount of voluntary labour that is used by non-profit firms and by the fact that non-profit firms pay lower wages to people of similar skills than do profit-making firms.4 It has been suggested that nonprofit firms ‘screen’ for a particular type of person. Someone who gains satisfaction from ‘high quality’ output will be willing to work for a lower wage in a non-profit than in a profit-making firm providing that the former produces ‘higher quality’ services than the latter (at least as perceived by the worker). The worker’s interest in quality of output per se will then provide an incentive to monitor peers. As we saw in Chapter 10, however, a fairly small scale of operation is likely to be necessary if this mechanism is to be effective.

- Competition in the product market is another force which will operate on the non-profit firm. Non-profit firms can become bankrupt. Providing that the managers and staff are to some degree dependent on the firm and cannot costlessly and immediately find equivalent employment elsewhere, bankruptcy is something they will try to avoid. Competition with other non-profit enterprises which face similar incentive and control problems is not predicted to be effective. However, as Hansmann (1980, p. 863) points out ‘commercial nonprofits almost always operate in competition with proprietary firms that provide similar services, suggesting that the competing advantages and disadvantages of the two types of firms are closely balanced’. The incentive mechanism is therefore similar to that analysed by Hart (1983) and discussed in Chapter 8, whereby proprietary firms provide incentives to ‘managerial’ or, in this case, non-profit firms. Government suppliers are also often active in the areas served by non-profit enterprises, such as hospitals, educational establishments or research organisations. There is evidence that costs are higher in government than in other forms of enterprise. In nursing homes in the United States, for example, one study indicates5 that employees were paid 6.6 per cent more than in profit-making establishments and ten per cent more than in church-related non-profit nursing homes. Steinberg (1987, p. 130) comments that ‘it seems unlikely that governmental competition provides the same spur to efficiency that for-profit competition does’.

- Another incentive mechanism discussed in Chapter 8 was the managerial labour market. The absence of tradable residual claims makes it more difficult to signal good managerial performance in the context of non-profit enterprise. Information about managerial competence is more likely to be ‘impacted’ within the firm and the overall performance of management is very difficult to measure effectively when objectives are complex. There are situations, however, in which objectives are fairly clear and success is easily signalled. Donative nonprofits require the services of fund-raisers. Success in this area can easily be signalled in terms of amounts of money raised during particular time periods. Good fund-raisers can be sought by non-profit firms and a market in their services can develop. People with fund-raising skills can form consultancy firms which operate on a profit-making basis, selling their services to non-profit firms.

Although monitoring by the tax authorities, peer pressure, competition from other firms, and competition in the labour market may all play a part in mitigating the adverse effects on work incentives of non-profit status, it is still not clear what are the advantages of the non-distribution constraint. Unless we can point to some specific comparative institutional advantage associated with non-profit status, Nicol’s (1967) assertion that profit- oriented firms will put non-profit firms out of business when the latter are not protected by the state would appear well founded. What does the nondistribution constraint enable a non-profit enterprise to achieve which could not equally be achieved by a profit-making firm, a partnership, or a cooperative?

3. THE RATIONALE OF THE NON-PROFIT ENTERPRISE

3.1. Contract Failure

Recent work in the transactions costs tradition suggests that non-profit status is partly a response to the adverse selection problem. The nondistribution constraint acts as a crude, but possibly effective, consumer protection device. Papers by Hansmann (1980), Easley and O’Hara (1983) and Holtmann (1983) explore the idea that non-profit enterprises are a response to particular kinds of information problem and thus ‘contract failure’. Consider once more the non-profit firm in the context of the principal-agent problem of Chapter 5. Easley and O’Hara (1983), following the work of Hansmann (1980), discuss the circumstances in which a non-profit organisation ‘can be at least partially described as the solution to an optimal contracting problem’ (p. 531). In their formulation, the consumer becomes the principal and the firm or manager becomes the agent. A profitmaking firm faces no constitutional constraints on the payment of executives, production techniques, or profits distributed. Providing the consumer is supplied with the benefits for which he or she has contracted, the manager of the firm is left to arrange production by any means deemed appropriate. Diagrammatically this is equivalent to the consumer (principal) receiving a definite payoff, and the manager (agent) bearing the entire risk (point ^ in Figure 5.5). In contrast, a non-profit firm is constrained to pay ‘reasonable’ compensation to its executives and cannot distribute any profits. This might be interpreted as the manager receiving a definite, constant, payoff and the consumer bearing the risk by receiving variable benefits depending upon the state of the world (point 0 in Figure 5.5). Assume that consumers can observe neither the effort of managers nor the state of the world, then if consumers are risk averse and managers are risk neutral a first-best position will be achieved with a for-profit institution (at ^ in Figure 5.6). This approach would suggest that non-profit institutions merely cope with managerial risk aversion, and, to the extent that this can be achieved by other methods, it implies a limited role for the non-profit firm.

There is, however, another possibility that consumers cannot observe the benefits which they hope they are buying. If I buy medical care, I may not be in a position to judge whether the services were really delivered or not. This is obvious if my purchase is on behalf of someone else who is not capable of reporting to me, but it might also apply to my own purchases. Whether the treatment I am being offered is really in my best interests or merely serves to increase the profits of the supplier may be very difficult to determine. A profit-maximising agency employed to transport food to the starving would have an incentive to pocket all charitable donations if the actual delivery of food could not be monitored. In circumstances such as these, the ability to control the supplier’s remuneration may be valuable. Where benefits are completely unobservable, a profit-maximising firm will produce no benefits at all. A non-profit firm will operate at minimum effort, but, providing this minimal effort results in some positive output, it may nevertheless permit activities not possible under alternative institutional arrangements.

Complete ‘unobservability’ of output is an extreme assumption designed merely to illustrate the ‘contractual’ approach to non-profit institutions. In less extreme conditions, a profit-oriented firm would have to worry about the loss of reputation if it cheated its customers, and this may be a constraint on managerial rent seeking which is as effective as restricting managerial remuneration. We do not observe non-profit garages, for example, even though customer ignorance may be substantial. The consequences of using a poor garage may be expected to be less severe than a poor hospital, and the discipline of continuous dealings is likely to be more significant. In the case of hospitals, therefore, a bias in favour of high-quality service for the managerial reasons mentioned by Newhouse (1970) might be precisely the type of bias that customers would prefer.6

Commercial non-profit enterprises will always be subject to competition from profit-making firms who can try to develop reputations for fair dealing and high-quality performance over time. Wherever donations are an important source of funds, however, non-profit status would appear to be necessary to reassure contributors that their money will not simply be used to augment profits.7 Similar comments apply to the suppliers of volunteer labour. Were these volunteers to believe that their efforts left service quantity or quality unaffected and merely raised the profits of the proprietor or the shareholders, their commitment would presumably rapidly wane. Nonprofit status is a mechanism for ensuring that all resources are used within the organisation and cannot be distributed outside. Resources may be used inefficiently relative to some ideal, but they may be more likely to be used to the donor’s satisfaction than in a for-profit enterprise.

3.2. Government Failure

Weisbrod (1975) was among the first to propose that non-profit enterprise enabled adjustments to be made to the quantity of public goods produced by governments. In Chapter 2, the role of political institutions in the provision of public goods was discussed. Markets, it was argued, would fail to produce an efficient quantity of these goods because of the free-rider problem. Here the standpoint is reversed. When collective choices are made concerning the quantity of public goods to finance using the political process, it would be unlikely that all the citizens in a jurisdiction would express themselves satisfied with the result. Some would have preferred a greater quantity of public goods to be provided (given the methods of taxation used to finance them) and others might have preferred less. Where tastes and incomes vary, dissatisfaction is the inevitable outcome of any

political decision.8 Voters wishing to receive greater quantities of public goods than provided by the state could band together to make marginal adjustments. This private provision of additional public goods could be effected through non-profit firms.

In this model, non-profit firms grow up to pursue the collective purposes left unsatisfied by the government. They take non-profit form because they rely on voluntary donations to finance their activities. In this respect, Weisbrod’s approach to non-profit firms is complementary to Hansmann’s contractual failure approach. Weisbrod is simply exploring the ultimate source of the demand for the services of non-profits. He still requires Hansmann’s analysis to explain why cooperatives, partnerships, or other types of firm could not be used for the provision of additional public services.9

Clearly, the existence of donative non-profit enterprises with charitable or other public objectives contradicts the pure free-rider model of individual decision making. Apparently people are prepared to contribute to certain public causes even when uncoerced. Some of this giving may be explained by reference to the pursuit of status, prestige or a good reputation; that is, indirectly to self-interested motives; but it is also possible to model donor behaviour on the assumption of a degree of altruism and truly philanthropic motives. People might care about the consumption levels of certain goods experienced by others.10 Even in this case, however, the free-rider problem would inhibit donations unless the very act of giving conferred a degree of satisfaction.11 Models of donor behaviour (for example, Steinberg, 1985) therefore assume that donors gain satisfaction both from provision of the public good and the personal act of giving. For our purposes here, however, the main thing to note is that the existence of commercial non-profit enterprise can be explained without reference to altruistic or other ethical responses. Donative non-profit enterprises providing non-excludable public goods, on the other hand, do seem to imply a degree of altruistic behaviour by donors, although purely self-regarding motives can be invoked even in this case.12

3.3. Tax advantages

Non-profit enterprises receive favourable treatment by the state in most countries. This may take the form of exemption from sales, property or income taxation (as in the United States at the state level) and may include other advantages, such as privileged postal rates, preferential regulatory treatment, the issue of tax-exempt bonds, the use of public contracts to favour non-profit firms and so forth. Some economists have argued that much of the recent growth in non-profit enterprise can be attributed to these advantages rather than to the inherent ability of the form to cope with contract failure.

Steinberg (1987) reports that tax advantages do result in a larger share of non-profit enterprise. Hansmann (1980, p. 881) argues, however, that ‘tax considerations are probably far less important than is commonly thought’. In support of this conclusion, Hansmann argues that non-profit firms were well established in certain fields before the era of public sector growth and high taxation. Further, tax and regulatory advantages have tended to follow the expansion of non-profit enterprise into a field rather than vice versa. A more recent contribution by West (1989) takes a far more sceptical view. Tax and other advantages, he argues, can be converted into benefits for those who work in non-profit firms. The ‘self interest theory of non-profit formation predicts a larger ratio of non-profit to for profit firms in jurisdictions where tax rates are high’ (p.170). Non-profit status can be used as a means of shielding the income from non-tax-exempt activities. Commercial research, for example, might easily be passed off as charitable activity, thus giving an advantage to non-profit- compared with profit-oriented research organisations.

West (1989) offers a public choice view of the growth of non-profit enterprise. It is the suppliers, in his view, who gain from non-profit status and therefore lobby governments to achieve this end. Consumers of the output of commercial non-profit firms are dispersed and much less influential. West argues that consumers may have a prejudice against profit making in certain areas of activity and may not be inclined to resist the spread of the non-profit firm. If this ‘prejudice’ were related to an implied appreciation of contract failure on the part of consumers, Hannsman’s view of the growth of the non-profit sector would be supported. In the area of commercial non-profit enterprise, however, West doubts that adverse selection leading to contract failure is sufficiently serious to give the non-profit firm an advantage over the profit-making firm.

4. BUREAUCRACY

A bureaucracy can be viewed as a form of non-profit enterprise with the government acting as the main or even exclusive provider of funds. Because the output of a bureau is not marketed, competition in the product market is weak. Indeed, it is usual to assume that a bureau has a monopoly of the supply of some service. The threat of bankruptcy is also removed, since the state stands ready to finance deficits and will often directly employ the staff of the bureau. Bureaucrats are less constrained, therefore, than the managers of commercial non-profit enterprises or non-profit firms that rely on donations from the private sector.

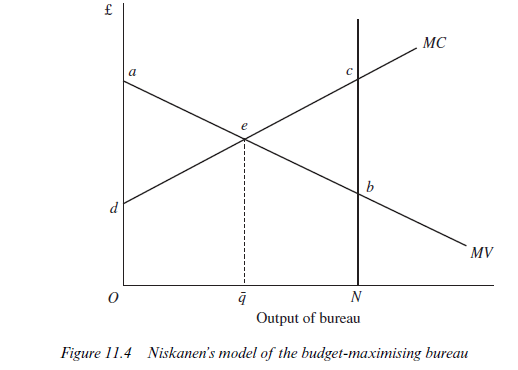

Niskanen’s (1968) model of bureaucracy is a managerial model. He assumes that bureaucrats maximise their budget in the ultimate interests of power, status or prestige and are constrained only by the demand curve for the services they provide. The situation is illustrated in Figure 11.4. Curve MV is the demand curve faced by the bureaucrat. It shows the marginal willingness to pay for output by the bureau’s consumers. The ultimate consumers may be taxpayers, but their demands are reflected through a political process so that MV really represents the valuations of politicians. Curve MC is the marginal cost curve. As drawn, bureaucratic output will be ON, at which point the total benefit derived from the output will be equal to the total costs incurred. The bureaucrat’s budget will be given by area abNO = dcNO. The total willingness to pay for service level ON is extorted from the ‘consumer’ in the manner of a perfectly discriminating monopolist. Niskanen’s approach to bureaucracy therefore gives all the bargaining power to the bureaucrat. The justification for this rather extreme assump-tion is that only the bureaucrat knows the true position of the marginal cost curve and is capable of exploiting the ignorance of politicians.

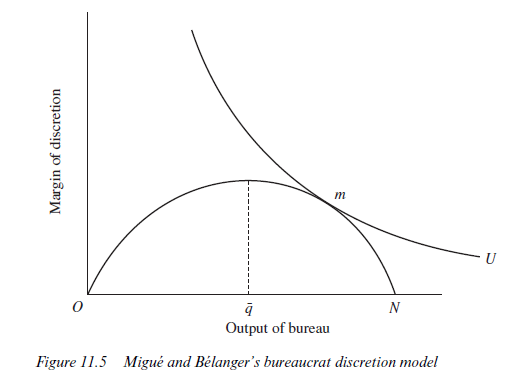

Clearly, this is a rather special set of circumstances, and Migué and Bélanger (1974) amended Niskanen’s approach and presented a more general managerial discretion model. They first calculated ‘the margin of discretion enjoyed by the manager’ (p.30) as ‘the excess of revenue over minimum cost’. This is the curve ON in Figure 11.5. They then assume that the manager ‘can choose to divide his discretionary profit between only two desired goods: output and a combination of other expenses’ (p. 31). The size of the bureau is still important but it is now combined with other possible items yielding managerial satisfaction. Niskanen’s early work implied that bureaucrats would operate in a technically efficient way. Economic inefficiency resulted entirely from the ‘over-expansion’ of services. Migué and Bélanger imply that managers will take their rewards in other ‘cost- increasing’ ways, such as unnecessarily large numbers of staff, lavish equipment or ‘on-the-job leisure’. The manager’s utility function can be represented conventionally as a set of indifference curves, and the final position is at point m in Figure 11.5.

A feature of each of these models is that the monitoring of bureaucrats by their ‘principal’ is nowhere explicitly discussed, and the precise nature of the bureaucrat’s contract, incorporating as it might various incentive devices, is ignored. This led Breton and Wintrobe (1975) to criticise Niskanen’s assumption that bureaucrats are perfectly discriminating monopolists constrained in their depredations only by the maximum total willingness to pay for each level of service. Instead, they argue that ‘politicians are able to enforce their preferences by the use of control devices’ (p. 206). These control devices are used to gain information and reduce ‘overexpansion’. They are worth instituting up to the point at which the additional costs of control equal the marginal benefits from control. Musgrave (1981) also disputes the bureaucratic over-expansion hypothesis, which he argues largely follows from the behavioural assumptions of Niskanen’s model and which disregards checks built into the budgetary process.

The explicit incorporation of monitoring into models of bureaucracy has been attempted by a number of theorists. Lindsay (1976) compares the problem of monitoring a manager of a joint-stock firm with monitoring a bureaucrat. Monitoring financial statements will not be appropriate for a government enterprise if output is not marketed or if the manager’s job is to modify market outcomes in the interests of social policy. Lindsay concludes that crude ‘performance indicators’ will be established relating ‘output’ to total costs. Output, however, is often very difficult to define and measure, and may be multidimensional, and thus ‘the output of government enterprises will, in general, contain fewer of those attributes which are “invisible” to Congress, that is, whose presence and quantity are not measured’ (p. 1066). ‘Observable’ attributes, on the other hand, will be overproduced, with the result that the average cost of these ‘observable’ attributes is predicted to appear lower in government enterprises than in proprietary enterprises. Managers in government enterprises (for example, in Veterans Administration Hospitals) have less incentive to incur staffing costs to produce non-observable benefits such as reassurance to patients, closer attention to personal comfort and so forth, compared with proprietary hospitals.

Property rights theory predicts that production within a bureau confronts greater problems of incentives and control than does production in any of the other institutional arrangements discussed so far. Empirical studies which attempt to estimate the technical and economic inefficiencies of bureaucratic supply, however, face considerable methodological problems. If a bureaucracy really does produce a non-excludable public good, state-financed zero-priced provision would seem the only institutional form capable of delivering substantial output. The crucial question is then whether all the units of the public good should be produced by a monopoly supplier staffed by employees of the state, or whether a set of suppliers competing for public contracts is a feasible option. Defence, for example, has long been considered an archetypal public good. Yet it does not follow that the inputs into ‘defence production’ must all be organised within state bureaucracies. Military aircraft, tanks and other weaponry are produced within private firms; maintenance of equipment can be undertaken by private contractors; food can be delivered by private caterers and so forth. Most of the cost comparisons that have been made have therefore concerned the relative efficiency of bureaucracies and other types of institution when contracting out is possible. A fuller discussion of the problems of contracting with the public sector appears in Chapter 15.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

he blog was how do i say it… relevant, finally something that helped me. Thanks

Enjoyed looking at this, very good stuff, thankyou.