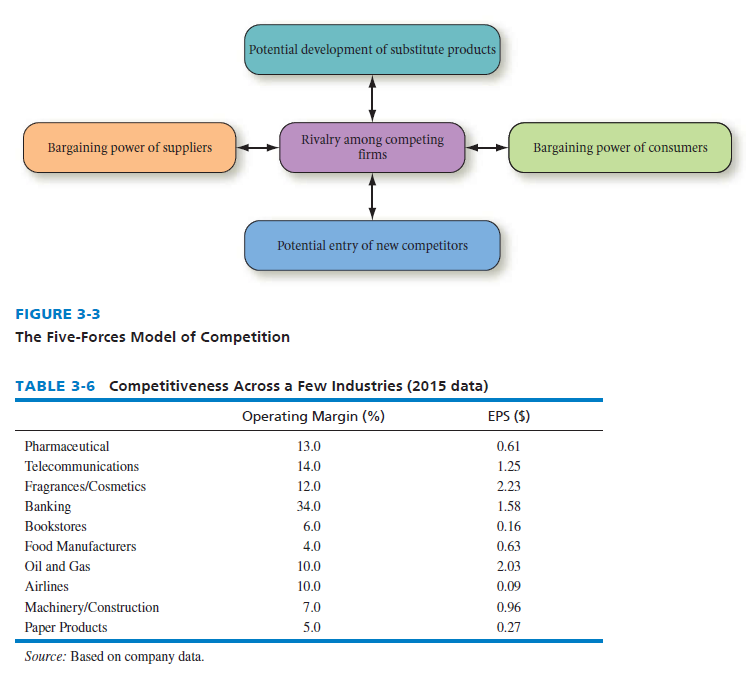

Former chair and CEO of PepsiCo Wayne Calloway said, “Nothing focuses the mind better than the constant sight of a competitor that wants to wipe you off the map.” As illustrated in Figure 3-3, Porter’s Five-Forces Model of competitive analysis is a widely used approach for developing strategies in many industries. The intensity of competition among firms varies widely across industries. Table 3-6 reveals the average gross profit margin and earnings per share (EPS) for firms in different industries. Note the substantial variation among industries. For example, note that industry operating margins range from 4 to 34 percent, whereas industry EPS values range from -16 to 2.23. Note that food manufacturers have the lowest average profit margin (2.3), which implies fierce competition in that industry. Intensity of competition is highest in lower-return industries. The collective impact of competitive forces is so brutal in some industries that the market is clearly “unattractive” from a profit-making standpoint. Rivalry among existing firms is severe, new rivals can enter the industry with relative ease, and both suppliers and customers can exercise considerable bargaining leverage. According to Porter, a Harvard Business School professor, the nature of competitiveness in a given industry can be viewed as a composite of five forces:

- Rivalry among competing firms

- Potential entry of new competitors

- Potential development of substitute products

- Bargaining power of suppliers

- Bargaining power of consumers

1. Rivalry Among Competing Firms

Rivalry among competing firms is usually the most powerful of the five competitive forces. The strategies pursued by one firm can be successful only to the extent that they provide competitive advantage over the strategies pursued by rival firms. Changes in strategy by one firm may be met with retaliatory countermoves, such as lowering prices, enhancing quality, adding features, providing services, extending warranties, and increasing advertising. For example, Verizon recently acquired AOL for $4.4 billion and soon thereafter launched its own video streaming to mobile devices, in a direct attack on rivals Facebook, Google, Sony, Dish Network, and even Apple. With AOL onboard, Verizon also now derives millions of dollars of mobile advertising revenue.

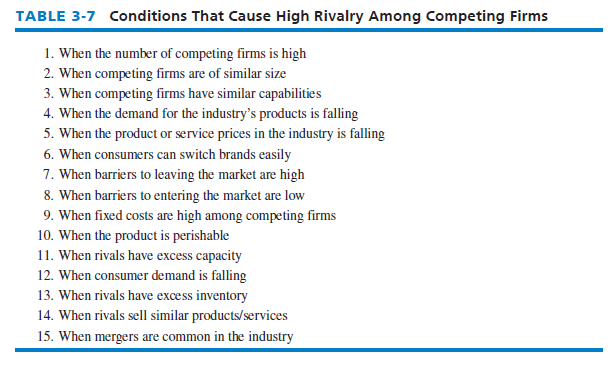

The intensity of rivalry among competing firms tends to increase as the number of competitors increases, as competitors become more equal in size and capability, as demand for the industry’s products declines, and as price cutting becomes common. Rivalry also increases when consumers can switch brands easily; when barriers to leaving the market are high; when fixed costs are high; when the product is perishable; when consumer demand is growing slowly or declines such that rivals have excess capacity or inventory; when the products being sold are commodities (not easily differentiated, such as gasoline); when rival firms are diverse in strategies, origins, and culture; and when mergers and acquisitions are common in the industry. As rivalry among competing firms intensifies, industry profits decline, in some cases to the point where an industry becomes inherently unattractive. When rival firms sense weakness, typically they will intensify both marketing and production efforts to capitalize on the “opportunity.” Table 3-7 summarizes conditions that cause high rivalry among competing firms.

2. Potential Entry of New Competitors

Whenever new firms can easily enter a particular industry, the intensity of competitiveness among firms increases. Barriers to entry, however, can include the need to gain economies of scale quickly, the need to gain technology and specialized know-how, the lack of experience, strong customer loyalty, strong brand preferences, large capital requirements, lack of adequate distribution channels, government regulatory policies, tariffs, lack of access to raw materials, possession of patents, undesirable locations, counterattack by entrenched firms, and potential saturation of the market.

Despite numerous barriers to entry, new firms sometimes enter industries with higher-quality products, lower prices, and substantial marketing resources. The strategist’s job, therefore, is to identify potential new firms entering the market, to monitor the new rival firms’ strategies, to counterattack as needed, and to capitalize on existing strengths and opportunities. When the threat of new firms entering the market is strong, incumbent firms generally fortify their positions and take actions to deter new entrants, such as lowering prices, extending warranties, adding features, or offering financing specials.

The Walt Disney Company is nearing completion of its Shanghai Disneyland, a $4.4 billion complex set to open in China in 2016, complete with hotels, restaurants, retail shops, and other amenities. However, a rival firm, DreamWorks Animation SKG, is nearing completion of a $3.1 billion entertainment district named Dream Center in Shanghai right beside Disneyland and says its facility will also open in 2016. Although expensive to build, theme parks are becoming more popular globally. Time Warner’s Warner Brothers is building Harry Potter attractions around the world, including a converted movie studio outside London.

3. Potential Development of Substitute Products

In many industries, firms are in close competition with producers of substitute products in other industries. Examples are plastic container producers competing with glass, paperboard, and aluminum can producers, and acetaminophen manufacturers competing with other manufacturers of pain and headache remedies. The presence of substitute products puts a ceiling on the price that can be charged before consumers will switch to the substitute product. Price ceilings equate to profit ceilings and more intense competition among rivals. Producers of eyeglasses and contact lenses, for example, face increasing competitive pressures from laser eye surgery. Producers of sugar face similar pressures from artificial sweeteners. Newspapers and magazines face substitute-product competitive pressures from the Internet and 24-hour cable television. The magnitude of competitive pressure derived from the development of substitute products is generally evidenced by rivals’ plans for expanding production capacity, as well as by their sales and profit growth numbers.

Competitive pressures arising from substitute products increase as the relative price of substitute products declines and as consumers’ costs of switching decrease. The competitive strength of substitute products is best measured by the inroads into the market share those products obtain, as well as those firms’ plans for increased capacity and market penetration.

4. Bargaining Power of Suppliers

The bargaining power of suppliers affects the intensity of competition in an industry, especially when there are few suppliers, when there are few good substitute raw materials, or when the cost of switching raw materials is especially high. It is often in the best interest of both suppliers and producers to assist each other with reasonable prices, improved quality, development of new services, just-in-time deliveries, and reduced inventory costs, thus enhancing long-term profitability for all concerned.

Firms may pursue a backward integration strategy to gain control or ownership of suppliers. This strategy is especially effective when suppliers are unreliable, too costly, or not capable of meeting a firm’s needs on a consistent basis. Firms generally can negotiate more favorable terms with suppliers when backward integration is a commonly used strategy among rival firms in an industry.

However, in many industries it is more economical to use outside suppliers of component parts than to self-manufacture the items. This is true, for example, in the outdoor power equipment industry, where producers (such as Murray) of lawn mowers, rotary tillers, leaf blowers, and edgers generally obtain their small engines from outside manufacturers (such as Briggs & Stratton) that specialize in such engines and have huge economies of scale.

In more and more industries, sellers are forging strategic partnerships with select suppliers in an effort to (1) reduce inventory and logistics costs (e.g., through just-in-time deliveries), (2) accelerate the availability of next-generation components, (3) enhance the quality of the parts and components being supplied and reduce defect rates, and (4) squeeze out important cost savings for both themselves and their suppliers.11

5. Bargaining Power of Consumers

When customers are concentrated or large in number or buy in volume, their bargaining power represents a major force affecting the intensity of competition in an industry. Rival firms may offer extended warranties or special services to gain customer loyalty whenever the bargaining power of consumers is substantial. Bargaining power of consumers also is higher when the products being purchased are standard or undifferentiated. When this is the case, consumers often can negotiate selling price, warranty coverage, and accessory packages to a greater extent.

The bargaining power of consumers can be the most important force affecting competitive advantage. Consumers gain increasing bargaining power under the following circumstances:

- If they can inexpensively switch to competing brands or substitutes

- If they are particularly important to the seller

- If sellers are struggling in the face of falling consumer demand

- If they are informed about sellers’ products, prices, and costs

- If they have discretion in whether and when they purchase the product12

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

Some genuinely interesting points you have written.Aided me a lot, just what I was searching for : D.