1. Rounding Out the team: the role of professional advisers

Along with the new-venture team members we’ve already identified, founders often rely on professionals with whom they interact for important counsel and advice. In many cases, these professionals become an important part of the new-venture team and fill what some entrepreneurs call “talent holes.”

Next, we discuss the roles that boards of advisers, lenders, investors, and other professionals play in rounding out new-venture teams.

1.1. Board of advisors

Some start-up firms are forming advisory boards to provide them direction and advice.31An advisory board is a panel of experts who are asked by a firm’s man- agers to provide counsel and advice on an ongoing basis. Unlike a board of direc- tors, an advisory board possesses no legal responsibility for the firm and gives nonbinding advice.32 As a result, more people are willing to serve on a company’s board of advisors than on its board of directors because it requires less time and no legal liability is involved. A board of advisors can be established for gen- eral purposes or can be set up to address a specific issue or need. For example, some start-ups set up customer advisory boards shortly after they are founded to help them fine-tune their initial offerings. Similar to a board of directors, the main purpose of a board of advisors is to provide guidance and lend legitimacy to a firm. The most important thing that advisory board members can do is make high-level introductions to early customers, suppliers, and business partners.33

Most boards of advisers have between 5 and 15 members. Entrepreneurial firms typically pay the members of their board of advisors a small honorarium for their service either annually or on a per-meeting basis. Boards of advisors interact with each other and with a firm’s managers in several ways. Some ad- visory boards meet three or four times a year at the company’s headquarters or in another location. Other advisory boards meet in an online environment. In some cases, a firm’s board of advisors will be scattered across the country, making it more cost-effective for a firm’s managers to interact with the mem- bers of the board on the telephone, via e-mail, or through a Skype conference call, rather than to bring them physically together. In these situations, board members don’t interact with each other at all on a face-to-face basis, yet still provide high levels of counsel and advice.

The fact that a start-up has a board of directors does not preclude it from having one or more boards of advisors. For example, Coolibar, a maker of sun protective clothing, has a board of directors and a medical advisory board. According to Coolibar, its medical advisory board “provides advice to the com- pany regarding UV radiation, sunburn, and the science of detecting, prevent- ing, and treating skin cancer and other UV-related medical disorders, such as lupus.”34 The board currently consists of nine medical doctors, all with impres- sive credentials. Similarly, Intouch Health, a medical robotics and instruments company, has a board of directors along with a Business & Strategy advisory board, an Applications & Clinical advisory board, and a Scientific & Technical advisory board. Intouch Health says that its “diversified Advisory Board draws on the talents of seasoned executives, clinical and scientific authorities, and pioneers from a variety of technical areas. Their expertise encompasses inter- national business management, robotics, telemedicine, and computer software, hardware and networking.”35

Several guidelines are followed when organizing a board of advisors. First, a board of advisors should not be organized just so a company can boast of it. Advisers will become quickly disillusioned if they don’t play a meaningful role in the firm’s development and growth. Second, a firm should look for board mem- bers who are compatible and complement one another in terms of experience and expertise. Unless the board is being established for a specific purpose, a board that includes members with varying backgrounds is preferable to a board of people with similar backgrounds. Third, when inviting a person to serve on its board of advisors, a company should carefully spell out to the individual the rules in terms of access to confidential information.36 Some firms ask the members of their advisory board to sign nondisclosure agreements, which we described in Chapter 7. Finally, firms should caution their advisers to disclose that they have a relationship with the venture before posting positive comments about it or its products on blogs or on social networking sites. A potential con- flict of interest surfaces when a person says positive things about a company without disclosing an affiliation with the firm, particularly if there is a financial stake in the company.

Although having a board of advisors is widely recommended in start-up circles, most start-ups do not have one. As a result, one way a start-up can make itself stand out is to have one or more boards of advisors.

1.2. Lenders and investors

As emphasized throughout this book, lenders and investors have a vested interest in the companies they finance, often causing these individuals to be- come very involved in helping the firms they fund. It is rare that a lender or investor will put money into a new venture and then simply step back and wait to see what happens. In fact, the institutional rules governing banks and in- vestment firms typically require that they monitor new ventures fairly closely, at least during the initial years of a loan or an investment.37

The amount of time and energy a lender or investor dedicates to a new firm depends on the amount of money involved and how much help the new firm needs. For example, a lender with a well-secured loan may spend very little time with a client, whereas a venture capitalist may spend an enormous amount of time helping a new venture refine its business model, recruit man- agement personnel, and meet with current and prospective customers and suppliers. In fact, evidence suggests that an average venture capitalist is likely to visit each company in a portfolio multiple times a year.38 This number of visits denotes a high level of involvement and support.

As with the other nonemployee members of a firm’s new-venture team, lenders and investors help new firms by providing guidance and lending le- gitimacy and assume the natural role of providing financial oversight. In some instances, lenders and investors also work hard to help new firms fill out their management teams. Sometimes this issue is so important that a new venture will try to obtain investment capital not only to get access to money, but also to obtain help hiring key employees.

For example, during its beginning stages, eBay’s founders, Pierre Omidyar and Jeff Skoll, decided to recruit a CEO. They wanted someone who was not only experienced, but who also had the types of credentials that are valued by Wall Street investors. They soon discovered that every experienced manager they tried to recruit asked if they had venture capital backing—which at that time they did not. For a new firm trying to recruit a seasoned executive, venture capital backing is a sort of seal of legitimacy. To get this valuable seal, Omidyar and Skoll obtained funding from Benchmark Venture Capital, even though eBay didn’t really need the money. Writer Randall Stross recalls this event as follows:

eBay was an anomaly: a profitable company that was able to self-fund its growth and that turned to venture capital solely for contacts and counsel. No larger lesson can be drawn. When Benchmark wired the first millions to eBay’s bank account, the figurative check was tossed into the vault—and there it would sit, unneeded and undisturbed.39

This strategy worked for eBay. Soon after affiliating with Benchmark, Bob Kagle, one of Benchmark’s general partners, led eBay to Meg Whitman, an executive who had experience working for several top firms, including Procter & Gamble, Disney, and Hasbro. In March 2008, Whitman stepped down as eBay’s presi- dent and CEO. Her tenure at eBay was considered to be very successful during a critical period in eBay’s early development and growth.

Bankers also play a role in establishing the legitimacy of new ventures and their initial management teams. Research evidence rather consistently suggests that the presence of bank loans is a favorable signal to other capital provid- ers.40 Investors often take a seat on the boards of directors of the firms they

fund to provide oversight and advice. It is less common for a banker to take a seat on the board of directors of an entrepreneurial venture, primarily because bankers provide operating capital rather than large amounts of investment capital to new firms.

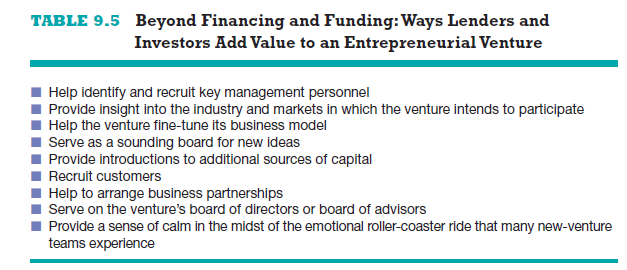

There are additional ways that lenders and investors add value to a new firm beyond financing and funding. These roles are highlighted in Table 9.5.

2. Other professionals

At times, other professionals assume important roles in a new venture’s suc- cess. Attorneys, accountants, and business consultants are often good sources of counsel and advice. The role of lawyers in helping firms get off to a good start is discussed in Chapter 7, and the role of accountants is discussed in Chapter 8. Here, we examine the role a consultant may play.

3. Consultants

A consultant is an individual who gives professional or expert advice. New ven- tures vary in terms of how much they rely on business consultants for direction. In some ways, the role of the general business consultant has diminished in im- portance as businesses seek specialists to obtain advice on complex issues such as patents, tax planning, and security laws. In other ways, the role of general business consultant is as important as ever; it is the general business consultant who can conduct in-depth analyses on behalf of a firm, such as preparing a fea- sibility study or an industry analysis. Because of the time it would take, it would be inappropriate to ask a member of a board of directors or board of advisors to take on one of these tasks on behalf of a firm. These more time-intensive tasks must be performed by the firm itself or by a paid consultant.

Those leading an entrepreneurial venture often turn to consultants for help and advice because while large firms can afford to employ experts in many areas, new firms typically can’t. If a new firm needs help in a specialized area, such as building a product prototype, it may need to hire an engineering con- sulting firm to do the work. Consultants’ fees are typically negotiable. If a new venture has good potential and offers a consulting firm the possibility of repeat business, the firm will often be willing to reduce its fee or work out favorable payment arrangements.

Consultants fall into two categories: paid consultants and consultants who are made available for free or at a reduced rate through a nonprofit or govern- ment agency. The first category includes large international consulting firms, such as BearingPoint, Accenture, IBM Business Global Services, and Bain & Company. These firms provide a wide array of services but are beyond the reach of most start-ups because of budget limitations. But there are many smaller, lo- calized firms. The best way to find them is to ask around for a referral.

Consultants are also available through nonprofit or government agencies. SCORE, for example, is a nonprofit organization that provides free consulting services to small businesses. SCORE currently has over 11,000 volunteers, 320 local chapters, and provides assistance across 62 industries via one-on- one meetings, workshops, and online webinars. An increasing number of score volunteers, called mentors, assist clients via e-mail rather than face-to-face. Commonly, SCORE mentors are retired business owners who counsel in areas as diverse as cash flow management, operations, and sales.41 The Small Business

Administration, a government agency, provides a variety of consulting services to small businesses and entrepreneurs, primarily through its network of Small Business Development Centers (SBDC), which are spread throughout the United States. There is evidence that these centers are effective in providing advice and helping entrepreneurial ventures get off to a good start. For example, one study found that the rates of survival, growth, and innovation of SBDC-counseled firms are higher than those for the population of start-ups in general.42

In summary, putting together a new-venture team is one of the most critical activities that a founder or founders of a firm undertake. Many entrepreneurs suffer by not thinking broadly enough or carefully enough about this process. Ultimately, people must make any new venture work. New ventures benefit by surrounding themselves with high-quality employees and advisers to tackle the challenges involved with launching and growing an entrepreneurial firm.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

You can definitely see your enthusiasm in the paintings you write. The world hopes for more passionate writers like you who are not afraid to say how they believe. At all times go after your heart.

I really appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again