Strategists use numerous tactics to accomplish strategies, including being a “first mover,” outsourcing, and reshoring. There are advantages and disadvantages of such tactics, as discussed next.

1. First Mover Advantages

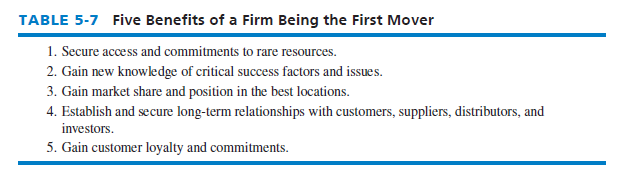

First mover advantages refer to the benefits a firm may achieve by entering a new market or developing a new product or service prior to rival firms. As indicated in Table 5-7, some advantages of being a first mover include securing access to rare resources, gaining new knowledge of key factors and issues, and carving out market share and a position that is easy to defend and costly for rival firms to overtake. First mover advantages are analogous to taking the high ground first, which puts one in an excellent strategic position to launch aggressive campaigns and to defend territory. Being the first mover can be an excellent strategy when such actions (1) build a firm’s image and reputation with buyers; (2) produce cost advantages over rivals in terms of new technologies, new components, new distribution channels, and so on; (3) create strongly loyal customers, and (4) make imitation or duplication by a rival difficult or unlikely.

To sustain the competitive advantage gained by being the first mover, a firm needs to be a fast learner. There are, however, risks associated with being the first mover, such as unexpected and unanticipated problems and costs that occur from being the first firm doing business in the new market. Therefore, being a slow mover (also called fast follower or late mover) can be effective when a firm can easily copy or imitate the lead firm’s products or services. If technology is advancing rapidly, slow movers can often leapfrog a first mover’s products with improved second-generation products. Samsung is an example in the smartphone business. Apple has always been a good example of a first mover firm.

First mover advantages tend to be greatest when competitors are roughly the same size and possess similar resources. If competitors are not similar in size, then larger competitors can wait while others make initial investments and mistakes, and then respond with greater effectiveness and resources. Lenovo has done this of late, as has Volkswagen.

2. Outsourcing and Reshoring

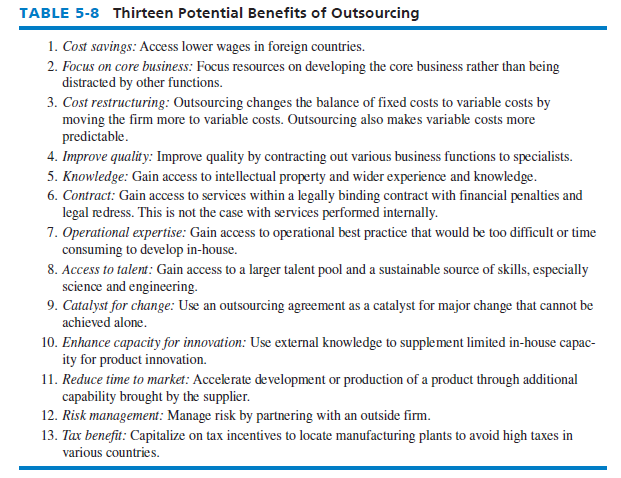

The second largest U.S. airline by traffic, United Continental Holdings, recently outsourced its check-in, baggage-handling, and customer service jobs to vendors who perform the duties at a lower cost. Outsourcing involves companies hiring other companies to take over various parts of their functional operations, such as human resources, information systems, payroll, accounting, customer service, and even marketing.

For more than a decade, U.S. and European companies have been outsourcing their manufacturing, tech support, and back-office work, but most insisted on keeping research and development activities in-house. However, an ever-growing number of firms today are outsourcing their product design to Asian developers. China and India are becoming increasingly important suppliers of intellectual property. The details of what work to outsource, to whom, where, and for how much can challenge even the biggest, most sophisticated companies. And some outsourcing deals do not work out, such as the J. P. Morgan Chase deal with IBM and Dow Chemical’s deal with Electronic Data Systems. Both outsourcing deals were abandoned after several years. India has become a booming place for outsourcing.

Table 5-8 reveals some of the potential benefits that firms strive to achieve through outsourcing. Notice that benefit #1 is that outsourcing is oftentimes used to access lower wages in foreign countries.

Reshoring is the new term that refers to U.S. companies planning to move some of their manufacturing back to the United States. Many U.S. companies plan to reshore in 2016-2017 for the following reasons: a desire to get products to market faster and respond rapidly to customer orders, savings from reduced transportation and warehousing, improved quality and protection of intellectual property, pressure to increase U.S. jobs. “Made in the USA” is making a comeback. Walmart, for example, is spending an added $250 billion in the next 10 years on USA- made goods. Consequently, numerous Walmart suppliers, such as Element Electronics based in Eden Prairie, Minnesota, are bringing manufacturing and assembly operations back to the United States. Element now assembles flat screen televisions in Winnsboro, South Carolina. Whirlpool and General Electric have also reshored some of their production operations back to the United States. However, the management consulting firm A. T. Kearney reports that reshoring has stalled, and that U.S. firms are increasingly producing goods in lower-cost countries.29 The strength of the dollar also has led U.S. firms to look outside the United States more and more to produce goods. The high value of the dollar makes U.S. goods more expensive overseas and makes imports to the United States cheaper. However, seven benefits of reshoring back into the United States are as follows:

- Stable wages

- Reduced gas and electricity costs

- Excellent security to protect designs from overseas copycats

- Enable closer tabs on quality control and supply chains

- Excellent economy with consumers purchasing more

- Less shipment costs with consumers nearby

- Excellent human rights, education, legal, and political systems that promote freedom and opportunity for citizens

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

18 May 2021

17 May 2021

18 May 2021

18 May 2021

18 May 2021

17 May 2021