1. Do Shareholders Monitor Managers?

The analysis of section 4 applied to the standard case in which the effort of the agent was ‘unobservable’. Could it be, however, that some monitoring of managers by shareholders is feasible? Let us envisage that managerial services are purchased from specialist suppliers. The nature of the service is highly complex and costly to monitor, but let us further suppose that shareholders through specialist advisers, journalists, independent auditors and other personal contacts are able to form some assessment of the competence and dedication of the management. They have, in the jargon of Chapter 5, some ‘informative signal’ at their disposal. Incentives could then be given to the top management, not only through the direct ownership of shares, or the offer of options and bonuses, but through a type of ‘monitoring gamble’. This system has traditionally been regarded as inapplicable to the joint-stock form of enterprise, and it is interesting to consider whether the traditional approach is justified.

Shareholder intervention is usually expected to founder on the prisoner’s dilemma. In a dispersed corporation, there is no single shareholder in a position to monitor the management and enforce the terms of any monitoring gamble. A penalty for ‘shirking’ could be imposed only through the mechanism of the shareholders’ meeting, and we have already drawn attention to the lack of any incentive for the small individual shareholder to attend, or even to become acquainted with whatever ‘informative signal’ might be relevant. Further, in the unlikely event of a substantial shareholder revolt, it has usually been assumed that the incumbent management has an advantage because of the system of ‘proxy’ votes.26 Uninformed shareholders may simply permit the managers to vote on their behalf. Persuading them to act for themselves by informing them of the evidence of managerial shirking may be a very costly undertaking, and if any single shareholder or group of shareholders attempted it they would effectively be supplying a public good (information) free of charge to the rest of the shareholding body. Thus, except in the special circumstances of low costs of acquiring a sufficiently informative signal and low participation costs at shareholders’ meetings, shareholder monitoring might appear to be of little practical importance.

This view, however, has to be qualified in important respects. Whether shareholders monitor managers will depend upon the balance of private cost and benefit. We may agree that monitoring will be lower in a dispersed corporation than in one with concentrated shareholdings, for the reasons discussed in the previous paragraph, but the extreme conclusion that no monitoring will take place relies on the assumption that all shareholders are alike in holding a negligible fraction of the outstanding equity and thus will receive a negligible benefit. In practice, however, non-negligible blocks of shareholdings exist. This can affect incentives substantially, both by encouraging monitoring and playing a role in the takeover mechanism (see Chapter 9).

2. The Costs of Monitoring

The cost of monitoring will be influenced by three major factors:

- Economic environments that are unpredictable and ‘noisy’ in a statistical sense may reduce the information content of a signal so much that its value falls short of the costs of observation and enforcement. In our discussion of the franchise chain, in Chapter 7, it was observed that outlets in urban centres (where trade was more predictable and comparisons could be made between similarly placed establishments) could be managed while rural outlets were franchised. Similarly, in stable businesses and those which give scope for performance comparisons between firms, monitoring costs will be lower than in highly unstable areas.

- Monitoring costs will be lower the fewer the decision options between which managers can choose. Some assets give managers enormous scope for exercising discretion, others give only limited possibilities for management choice. Alchian and Woodward (1987) argue that where the assets of the firm allow for only a limited range of possible uses, the monitoring problem will not be severe. They call such assets implastic Conversely, ‘We call resources or investments “plastic” to indicate there is a wide range of legitimate decisions within which the user may choose, or that an observer can less reliably monitor the choice’ (p. 117). The oil well, for example, is considered an implastic asset. In spite of the risks associated with fluctuating oil prices, oil recovery is easy to monitor and permits, they argue, a high level of debt finance in that particular business.

- Receiving useful information is one thing; enforcing a change in policy or management is another. The costs of enforcing the shareholders ‘control rights’ will depend upon the minimum size of the coalition required to unseat the incumbent management. It was the assumed enormous size of this coalition which lay behind the argument that shareholder monitoring would not take place. In the following subsection, the question of whether shareholders can enforce their control rights is considered in more detail.

3. The Degree of Shareholder Control

3.1. Measuring the degree of ‘control’

As was seen in section 2.2, Berle and Means assigned companies to ‘control types’ on the basis of criteria which were ultimately somewhat arbitrary. If a stock interest in excess of twenty per cent of the voting shares existed in a company with otherwise dispersed shareholdings, that company was classified as ‘minority controlled’. ‘Management-controlled’ companies were those with no single important stock interest and so forth. This type of study continued to be important for many years but the problem of establishing agreed criteria is reflected in Larner’s (1966) paper which, while following Berle and Means in most particulars, argued that ‘minority control’ might be achieved with as little as ten per cent of the shares.

An alternative tradition has therefore developed for studying ‘ownership structure’ which relies on measures of concentration. The idea is that the degree of ‘control’ exercised by shareholders will depend not merely on the size of the largest holding but on the concentration of voting power more generally. It might be, for example, that two large shareholders, each with 18 per cent of the shares will be more influential than a single shareholder with 21 per cent. Yet, by the Berle-Means criteria, the former situation would be defined as a case of ‘management control’ and the latter as ‘minority control’. Students of corporate governance have therefore investigated the ratio of the outstanding shares held by the largest two, three, four shareholders and so on. These ‘concentration ratios’ then provide numerical measures of ‘ownership structure’ without requiring that each firm is definitively described as under the full ‘control’ of any given interest.

Concentration ratios on their own, however, are still not fully adequate as measures of shareholder influence, for the influence of any given coalition of shareholders, it could be argued, will depend upon the degree of dispersion of the remaining shares; that is, those held outside the coalition. Two shareholders, each with 18 per cent of the stock, will between them exert more authority if no other shareholder exists with more than a minute fraction of the company’s shares than if many other shareholders have significant holdings. For this reason, Cubbin and Leech (1983) developed a measure of ‘degree of shareholder control’ which, for a coalition of the largest k shareholders, depends (positively) on the proportion of shares held by the group and positively also on the degree of dispersion of the remaining shares.27 By this measure, possession of a fairly small proportion of the issued shares can give a high degree of control if the remaining shares are sufficiently dispersed.

It might be objected, of course, that although it is possible for a small coalition to exercise a high degree of control and that the costs of coalition formation may therefore not be great, the benefits to the participants will also diminish as the proportion of shares held declines. If five per cent of the shares can, in certain circumstances, confer considerable power over a corporation, it still remains true that 95 per cent of any benefits accruing to the exercise of such power will be received by passive shareholders who play no part in the monitoring process. How do we know that, even with a substantial degree of control by the Cubbin-Leech measure, minority shareholders will have an incentive to exercise their power?

This problem is precisely the same as that explored in section 4 in the context of managerial incentive contracts. There, we distinguished between the percentage of the shares held by an individual (which might be small) and the impact on the individual’s wellbeing of the value of those shares (which might be very great). It was the latter, we argued, that would determine the influence of shareholding on a person’s effort. Although effort would always be less than would occur in an ideal world of perfect observability and zero transactions costs, and certainly less than would occur if a single person held the entire equity, the latter would stimulate too great a level of effort while the former is not relevant to institutional choice which must be concerned with potentially realisable alternative arrangements rather than imaginary ideal states.

Behind arguments that corporate control can be exercised with small fractions of the stock, therefore, are assumptions that the quantitative stake is large enough to induce substantial monitoring effort. In large corporations we would then expect a highly diversified ‘ownership structure’ to be compatible with a high degree of control by the Cubbin-Leech measure. In small corporations, on the other hand, the ‘ownership structure’ would be expected to be less diversified, as monitoring incentives require shareholders to hold a higher fraction of the total stock. These hypotheses are supported by Leech and Leahy (1991) who, in a sample of 470 UK listed companies, find that measures of ‘ownership concentration’ (that is, concentration ratios) depend (inversely) on firm size but that measures of ‘control classification’ based on the Cubbin-Leech approach are not related to firm size. ‘Control is exogenous while ownership concentration is endogenous, variations in the latter not necessarily having any implications for the former’ (p. 1435).

In general, recent scholarship has tended to cast doubt on the Berle-Means thesis about the power of management vis-à-vis the shareholder. Leech and Leahy (1991), for example, calculate for their sample of large UK companies the size of coalition that would be necessary to give shareholders a degree of control of 99 per cent by the Cubbin-Leech measure. They concluded that a potential controlling coalition of three shareholders or fewer existed in 252 firms, or 54 per cent of their sample. Controlling coalitions of ten shareholders or fewer existed in all but one case. Looked at from this particular point of view, therefore, ownership ‘control’ could be argued to be almost universal.

Similar conclusions were drawn by Cosh and Hughes (1987). They used a variety of different approaches to assessing the control classification of a company. In particular, they distinguished between shareholdings of Board members and ‘Off Board’ holdings. Information flows to Board members might be expected to be better than to non-Board shareholders, thereby providing a bigger incentive to act in defence of shareholders’ interests.28 The existence of family connections between shareholders may increase the coherence and influence of shareholders as a group; a point emphasised in Nyman’s and Silberston’s (1978) study of the UK. Cosh and Hughes also draw attention to the importance of financial institutions in the UK and the USA in the case of non-Board holdings; a topic to which we will return in Chapter 9. Shared directorships with financial institutions are also important. ‘This recurring intimacy between relatively small numbers of giant financial and industrial concerns is clearly a significant feature of the contemporary anatomy of corporate control’ (p. 302). Taken all round, Cosh and Hughes conclude that their results, ‘especially for the US, are not very comforting for the managerialist position’ (p. 311).

Much modern research seems to suggest, therefore, that perceptions of the powerlessness of shareholders in the Berle-Means tradition may have been overdone. The costs of forming a coalition of some influence with access to information (either through Board members, or family or other business connections) and with an incentive to monitor performance are not necessarily prohibitive in spite of a generally dispersed structure of shareholding. It is worth noticing that the incentive to monitor does depend, however, on establishing an implicit differential in the value of control rights for different shareholders. In some countries, this phenomenon is so pronounced that family control of corporations is widespread even though these families hold only a small fraction of the shares. Claessens, Djankar and Pohl (2000), for example, report that ‘when control is defined as a twenty per cent ownership threshold, sixty to seventy per cent of companies are family controlled in Indonesia, Malaysia, Hong Kong and Thailand’.29 This far-reaching influence of families is not necessarily advantageous and has given rise to the term ‘crony capitalism’. In Chapter 4 we noted that the influence of family control in the UK in the first part of the twentieth century hindered the development of the professional management required for the modern corporate economy. There, however, it was the private company which was the vehicle for family control and over the course of the century family influence declined, companies adopted the public form, and were floated. Under ‘crony capitalism’ families extend their control over the public corporate economy through pyramid structures (one firm owning another) or through shares carrying multiple voting rights.

3.2. Control rights and profit rights

Shareholders with minute proportions of a company’s shares will have little incentive to become informed or to take part in elections. Their control rights are worthless. Rational abstention on the part of these shareholders means that the influence of minority shareholders is potentially greater than the bald proportion of shares held might suggest. There is a tendency, in other words, for the value of control rights to be more concentrated than the actual distribution of shares. Were control rights to be separately tradable, we might expect to see small shareholders maintaining their residual rights but selling their control (that is, voting) rights to a significant (though minority) shareholder.30 More realistically, it would be possible for a substantial minority shareholder to be given authority by other shareholders to exercise their votes by proxy. The transactions costs of such an arrangement are likely, however, to be substantial.

As will be seen in section 9, there are systems in which these transactions costs have been reduced and where the overt concentration of control rights separate from residual rights is more common. In Germany, for example, the voting rights associated with shares deposited at banks can be exercised by the banks on behalf of the shareholders. In effect, the voting rights are clearly separate from residual rights and can be exercised by the bearer. This gives the banks an influence greater than would be expected on the basis of their shareholdings alone, and combined with their representation on company boards suggests that banks may perform important monitoring services in that system. The absence in the USA and the UK, either for legislative or historical reasons, of substantial holdings of shares in commercial companies by the banks, has meant that a similar system has not developed. In these countries, as mentioned above, it is the financial institutions (pension funds and insurance companies) that are the main shareholders and the extent to which they fulfil a monitoring role in the corporate economy is a controversial question.

The incentive effects produced by shareholder monitoring of managers will depend upon the structure of the monitoring gambles involved. In Chapter 5, it was seen how risk bearing costs, effort costs, and the reliability of information combined to influence the structure of monitoring gambles. Thus far in this section, we have concentrated mainly on discussing the costs to the monitor of collecting information and exercising a collective voting or ‘control’ right. Any benefit from incentive effects, however, will derive from the penalty associated with poor managerial performance, and the nature of this penalty has yet to be spelled out.

3.3. Measures of management performance

One possibility is that managerial remuneration can be linked to qualitative measures of performance based on the achievements of other executives in the same industry. Alternatively, various accounting measures of performance might be used to determine the level of bonus received by the senior managers. Empirical studies have failed to establish the importance of such bonus payments, however. Jensen and Murphy (1990b), for example, find that ‘it does not appear that relative performance is an important source of management incentives’ (p.247). The median CEO bonus was fifty per cent of base salary in their sample but they argue that the year- to-year stability of this payment tells against linking it with substantial performance incentives. There are also dangers of distorting effort into manipulating the accounting system or producing deceptively good values for whatever signal is used to calculate the bonus. This, however, is a general problem with the use of any ‘informative signal’.31

It is not immediately obvious why Jensen and Murphy should infer the absence of incentive effects from the stability of a bonus. If the probability of misperceiving the effort level of an industrious executive is small, while the chance of misperceiving the effort level of an idle executive is substantial, then, if the cost of effort is significant, we would expect a large bonus to be paid for effort. It can be large because the industrious executive does not fear being mistakenly deprived of it, and the potentially idle executive requires a sufficiently unfavourable gamble to induce effort. In other words the bonus will be large and stable. This in no way implies that the incentive effects are small.

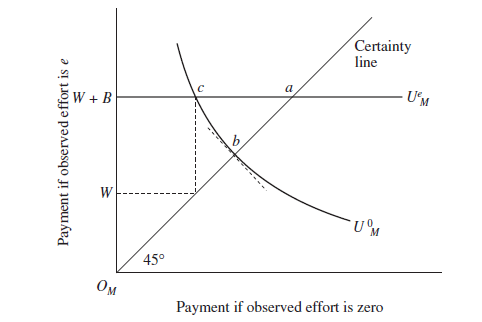

Consider Figure 8.3, which is based on the same structure as Figure 5.8. It illustrates the extreme case in which a manager exerting effort level e will always be correctly observed and will receive a bonus. The indifference curves of the industrious manager will be horizontal straight lines. A typical indifference curve for expected utility level UM is shown in the figure cutting the certainty line at a. In contrast, information if the manager is idle is very ‘noisy’. Indeed, the probability of being observed idle is the same as that of being observed to exert effort e (both equal to 0.5). The slope of the manager’s indifference curve if he or she chooses not to exert effort will therefore be -1 where it cuts the certainty line. Now, suppose the cost of effort is given by distance ab. A contract at c (where the manager’s ‘noeffort’ indifference curve intersects his or her ‘with-effort’ curve with the same expected utility index) will be required to induce effort. This contract involves a fixed payment of W and a bonus of B when effort is observed.

The bonus will always induce effort and will always be paid, but if the bonus were incorporated into basic pay, the manager would shirk. Thus, instability of a bonus is not a necessary condition for that bonus to have large incentive effects.32

Another type of incentive discussed in Chapter 6 was the ranking hierarchy and the use of promotion as a type of monitoring gamble. The problem in the present context is that for managers at the very top of the hierarchy there appears to be no further prospect of promotion. Any appeal to this mechanism requires, therefore, a redefinition of the hierarchy. Aoki (1989) confronts this very problem when discussing top management incentives in Japan. The possibility of appointments to positions of social distinction within the industry after retirement are significant, he argues, and exert an important influence. This, however, is to see the industry rather than the individual firm as the relevant hierarchy. Within Aoki’s framework for analysing the Japanese situation, this may not be inappropriate. As we saw in Chapters 6 and 7, much emphasis is placed by the Japanese system on cooperative relationships within the firm and with outside suppliers. Managers are rewarded for seeking and achieving consensus. Top managers are regarded by Aoki (1984) as mediators between potentially conflicting interests within the firm and are not simply agents of ‘sovereign’ shareholders. Managers at the top of a firm in such a system will be interested in their reputation in the industry as a whole. The incentives produced by this mechanism, however, are clearly not aimed at increasing the shareholders’ influence on management.

Within the agency costs tradition which we are primarily expounding here, top management incentives derive not merely from internal ‘monitoring gambles’ but also from the operation of the outside ‘managerial labour market’. It is the operation of this mechanism which is investigated in the next section.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Hi there! This is kind of off topic but I need some advice from an established blog. Is it very hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about setting up my own but I’m not sure where to start. Do you have any points or suggestions? Thank you

Some really excellent information, Glad I found this.

It’s difficult to acquire knowledgeable people during this topic, however, you seem like do you know what you’re talking about! Thanks