1. PROFIT SHARING AND CONTRACTUAL INCOMPLETENESS

As has been emphasised on frequent occasions, information costs and bounded rationality mean that real world contracts are not fully specified. This contractual incompleteness leaves people vulnerable to opportunism and makes the assignment of residual control rights a matter of great importance. The governance structure of the worker-owned firm and the cooperative influences its ability to cope with these problems.

1.1. Debt Finance

A firm that is closed to outside equity holders and raises finance in the form of debt has a highly ‘geared’ or ‘levered’ capital structure. Other things constant, higher leverage would imply that bankruptcy is more likely; that is, there are more states of nature in which the firm will be unable to meet its contractual obligations than there would be if more equity finance were employed. It should be remembered, however, that, in the pure worker- owned firm and in the cooperative, labour receives no wage. Because payment of a wage to labour is not an inescapable obligation, as it is in the investor-owned firm, we should not assume that the cooperative enterprise is more vulnerable to bankruptcy. Workers are residual claimants and this will reassure providers of fixed-interest capital in that interest payments are senior to payments to labour.

There is an important caveat to the above argument, however. Workers are free agents and cannot plausibly bind themselves not to leave a cooperative. Thus, if their share in the cooperative falls substantially below the level achievable in other enterprises they will leave. As labour flees from poor results, the provider of fixed-interest capital will once more face the prospect of default. The cooperative, in other words, may be resilient in the context of adverse circumstances when workers are confident that these are merely temporary. Suspicion that problems are longer term, however, may lead to rapid desertion and uncontrolled decline.

Agency problems of outside debt are therefore as troublesome to a cooperative as they are to a joint-stock enterprise. There is still the moral hazard danger that the equity holders (in this case, the workers) will act in many ways contrary to the interests of bond holders. The danger is at its greatest if the workers are not transaction dependent; that is, if their human capital is very general in nature and their dependency on the firm is very low. Workers of this type would have very little to lose by taking large risk with the bond holders’ resources in the hope of a large payoff. Bond holders, on the other hand, would not be unduly perturbed by this possibilty if the physical capital they were financing were similarly non-specific. In the event of the firm being wound up, the bond holders could always take control of these easily marketable non-firm-specific capital assets.

Mobile, non-dependent workers, therefore, will be able to form a worker- owned firm or a cooperative only where the capital requirements are small and can be raised internally, or where physical capital consists in non-firm- specific assets. Hansmann (1990) refers to the takeover of United Airlines by the pilots. Pilots are easily transferable between airlines and are unlikely to stay with an airline which yields them a low return just because it is worker owned. However, although aeroplanes are expensive, they are not firm specific, and represent satisfactory security for lenders.

Highly dependent labour embodying firm-specific skills and human capital, on the other hand, will be in a better position to persuade bond holders to finance some specific capital. To take an extreme hypothetical example, if the workers in a cooperative were so specific that their value elsewhere were zero, bond holders need not anticipate their desertion in the event of poor trading results. The probability of default is thereby lowered. We might surmise that the experimental and entrepreneurial role of cooperatives is related to this point. Groups of handicapped people, for example, whose productivity is systematically underestimated by outside employers, might find it possible and profitable to finance a cooperative. Over time, as other employers become more aware of the value of the services of handicapped people, greater mobility is possible, and the problems of running a cooperative are paradoxically increased.

The agency problems of debt thus lead us to two conclusions. Firstly, cooperative and worker-owned enterprise is assisted if human capital is firm specific while physical capital is non-specific. Secondly, cooperatives requiring highly specific capital assets are likely to be labour intensive with equity capital supplied internally by their members. Cooperatives requiring non-specific capital may be quite capital intensive operations.

1.2. Hold-up

One of the major theoretical advantages of worker ownership is that it mitigates the problem of opportunism where workers are dependent on the firm. If the equity is held by the workers and they all receive a share in the distributable surplus, it is clear that other parties cannot steal the quasirents on firm-specific human skills by downward revision of the wage. In practice, of course, things are unlikely to be so simple. Where there are several groups of workers with differing degrees of dependency and differing contracts, conflicts of interest might arise in the firm. Non-dependent workers with general skills would be expected to be paid a wage. Partners or worker-owners would be those people who were most firm dependent. This is consistent with assistants and secretaries in law firms receiving salaries while the more firm-specific partners receive a profit share.

Concentrating residual claims on the workers also overcomes some of the problems discussed at length in Chapter 9 related to the takeover. A worker-owned firm can only be taken over if the workers agree and sell their claims to a bidder. They presumably would not do this if the terms implied the expropriation of their firm-specific capital. Further, because all the holders of equity are ‘insiders’, there is no incentive to waste resources on signalling to the stock market, and this mitigates the short-termism problem. As will be seen in section 4, however, worker cooperatives face severe problems of short-termism of their own.

1.3. Bargaining Within the Firm

It is sometimes argued that the governance structure of a worker-owned enterprise lowers the costs of coming to agreements within the firm. Two reasons can be adduced in support of this proposition. Firstly, conflicts of interest between investors and workers are avoided (as noted in section 2). Secondly, information is likely to be more symmetrically distributed across the workforce and this would be expected to reduce adverse selection problems within the firm.

Although these points are plausible, they are by no means conclusive. Indeed, Hansmann (1990) points to the costs of collective decision-making within the worker-owned firm as a primary consideration explaining important aspects of its structure and governance. In the joint-stock company, equity holders may be expected to want to maximise the value of their stock. Although differing risk preferences, dealing costs, tax regimes and so forth can result in conflicts of interest even among shareholders, these are likely to be much less severe than the differences that can arise between groups of workers. If some workers receive a wage element in their remuneration and do very different types of job from others, tensions between groups will be likely. Hansmann notes that business decisions may involve closing some plants and opening others, investing in technology requiring new skills, deciding on the level of safety equipment, and adjusting any wage element of worker compensation to new circumstances. All these decisions are likely to prove contentious.

As numbers rise, the cost of direct democracy as a means of collective decision-making becomes onerous. Time and information costs increase while decisions may turn out to be very inefficient. The theory of voting indicates how, if voters are not sufficiently similar in their preferences, collective choices may result in paradoxes and collectively irrational decisions.8 Representative democracy reduces some of the decision-making costs, but it neither removes the conflicts of interest nor ensures rational collective choices, while it recreates some of the conditions said to result in feelings of alienation on the part of labour in the joint-stock firm. Homogeneous interests are therefore important to a worker-owned firm if decision-making costs are to be kept under control. ‘Worker ownership is extremely rare in firms in which there is any substantial degree of heterogeneity in the work force.’9

2. THE PROBLEM OF INVESTMENT DECISIONS

Short-termism is particularly associated with labour-managed and cooperative enterprises, though not for the same reasons adduced in the case of joint-stock firms. The problem ultimately derives from the lack of exchangeability of claims to the residual. We are therefore discussing, in this subsection, those profit-sharing enterprises in which residual claims cannot be traded. The analysis would not apply to labour-capital partnerships or (without some modification) to worker ownership, as these forms have been defined in section 1.

An elementary theorem in the theory of finance is that, with perfectly efficient capital markets, investment decisions will not be affected by the pure time preference of the particular people making the decisions. One person may be highly ‘impatient’ and disinclined to postpone consumption from one period to the next. His or her rate of ‘pure time preference’ may be high. Another person may have a very low rate of pure time preference and be disinclined to discount future utility just because it is in the future. Given the rate of interest prevailing in the market, these different individuals would be expected to come to quite different decisions about how to organise their time streams of consumption. The ‘impatient’ person will consume more ‘now’ and less ‘later’ compared with a ‘patient’ person with the same level of wealth. Both, however, will wish to maximise their wealth and will adopt all those investment opportunities that add to net present value. They will achieve their own preferred distribution of consumption over time through their borrowing or lending activities on the capital market.10

Conditions in the capital market do not, of course, accord with those required for this theorem to hold in its purest form. Rates of interest are not the same for borrowers and lenders and invariant to the size of the loan advanced. Future flows of income from investment projects are not known with certainty by all transactors in the market (the source of the signalling problem in Chapter 9). A particular problem with cooperatives, however, is that title to the intertemporal income flows is not clearly assigned. In the simple model outlined above, a person investing resources ‘now’ has an undisputed right to the returns that accrue ‘later’. People are so confident of these rights that they can trade them on the capital market. They can, if they wish, borrow in the certain knowledge that their investment returns will enable them to repay their debts, or lend secure in the knowledge that a return will be paid. In a cooperative, a person who invests does not have an individually assigned right to a share of the full flow of returns. The returns are received in the form of a share in the distributable surplus for as long as a person remains with the cooperative. Thus, an investment which yields returns over a ten-year time horizon to the cooperative as a whole may yield returns for only two years to a worker who is due to retire two years hence.

Older workers in a cooperative may be expected, therefore, to oppose long-term investments financed from internal resources, and achieving agreement on an investment strategy within the firm will be difficult because different people face different rates of return from the same projects. It is very important to note, however, that by adjusting the structure of property rights, the interests of older and younger workers can change. Hansmann (1990), for example, mentions the case in which investment from internal resources is paid into a pension fund. Through the fund, a right to investment returns is conferred on retired workers. In the extreme case in which all internal investment was held by the pension fund, retired workers would implicitly be the holders of the rights to a return on internally financed investment. Young workers would then have little to gain from agreeing to finance the firm’s investment, whereas those near retirement would favour larger payments to the capital fund at the expense of distributions to the workers.

In principle, making membership of a cooperative a tradable right would circumvent some of these problems. Cooperatives with a successful record of profitable investments would find that membership rights would trade at a premium compared with less successful cooperatives. Those leaving a cooperative could gain access to the present value of the returns from the investment they had financed. However, controlling the membership of the team may be important if the correct mix of skills and other attributes is to be achieved. The personal characteristics of shareholders are of no concern to a joint-stock enterprise and the rights can be freely traded. Where the success of the team is highly dependent on particular skills it would be difficult to introduce tradable rights in what would be a very ‘thin’ market.

Capital raised internally from the surpluses that would otherwise be distributed to the workforce has further risk-sharing disadvantages. Instead of using the capital market to spread their risks widely, workers in a cooperative who invest in the firm using part of their distributable surplus become dependent on a single firm for a return on their savings as well as on their labour and human capital. Rather than tolerate this dependency, we would expect a marked preference for the use of outside debt finance in cooperative and labour-managed firms. Individual members of the cooperative would save privately out of their share of the surplus and use outside financial intermediaries to spread their financial risks as widely as possible.

The agency problems associated with outside debt in the context of cooperative enterprise were discussed in subsection 3.1 above. Here, contractual incompleteness and agency problems are related to the determination of the firm’s investment choices. In particular, the use of outside debt rather than inside funds does not solve the problem of diverging interests between members of the firm. The duration of bank loans, for example, will determine the payments that existing team members will have to make over whatever time horizon is appropriate to their individual circumstances. Rapid repayment of a loan, for example, will obviously be detrimental to the interests of a worker who is near retirement. Workers in general will prefer only to pay interest on borrowed funds and to leave repayment of the capital sum to a future generation, but this could result in the build-up of debt obligations and the bequeathing of a considerable burden on members of the cooperative in future years. It is for this reason that Pejovich (1992) argues that an efficient investment programme will be chosen by a labour-managed firm only if ‘the labour-managed economy pushed the length of bank credits toward an equality with the expected life of capital goods to be purchased with those credits’ (p. 37).11 In a fully- fledged labour managed economy, Pejovich regards this result as a remote possibility since there appears to be little in the incentive structure to lead in that direction. Firms will want to extend the life of credit, while banks will face high information costs if they have to form judgements about the economic life of assets in every case.

3. THE SIZE OF THE TEAM

One of the most debated issues in the academic literature on profit sharing concerns its likely effect on the level of employment in a firm when compared with the norm of investor ownership. The answer depends crucially on what type of profit sharing is being analysed. There are two traditions which superficially appear to be mutually contradictory. The theory first advanced by Ward (1958), Vanek (1970), Meade (1972) and others with respect to the labour-managed firm suggests a generally restrictive impact on the size of the firm in the short run. Indeed their most famous result is that labour-managed enterprises may be expected to respond in a ‘perverse’ manner to changes in the price of their product under competitive conditions. Rising product prices will lead the team members to try to cut back on their numbers, and vice versa. In contrast, advocates of profit sharing have suggested that, in a share economy, employment would tend to expand. Weitzman (1984) is particularly associated with the view that pure investor ownership leads to insufficient wage flexibility and a high level of unemployment compared with profitsharing alternatives. The essential difference which produces these contrasting predictions is that in the cooperative or labour-managed firm it is the workforce which controls its own size, whereas in Weitzman’s share economy it is still the outside investors who determine employment levels in the firm.

3.1. Employment in the Labour-managed Firm

Assume that the surplus of a labour-managed firm, after capital charges and payments for intermediate inputs, is distributed equally among the workers in the team. Each person will therefore receive remuneration equal to the ‘surplus per worker’. In the elementary theory of the labour- managed firm, workers are assumed to determine the size of the team so as to maximise the value of this ‘surplus per worker’.12 Thus, given the price for their product under competitive conditions, they will continue to welcome new members, providing that the value of the additional output produced by the extra labour (and hence revenue generated) exceeds the ‘surplus per worker’. If the extra revenue generated by a new worker is greater than the payment he or she will receive (that is, the average surplus), the latter will rise as new workers are attracted and hence new workers will confer benefits on the existing ones. On the other hand, if the market value of extra output is less than the surplus per worker, there will be incentives to cut back on the size of the workforce.

It is this possibility which leads to the ‘perverse’ supply response of the labour-managed firm. If the size of the team is perfectly adjusted and the surplus per worker is equal to the value of the marginal product of labour, a rise in the price of the firm’s product will disturb this relationship. This may be seen by considering the expression below where

![]()

P is product price, Q is output, K is the charge on capital, MPL is the marginal product of labour, and L is the labour force. The term on the left-hand side is the surplus per worker. On the right is the value of the marginal product of labour. An increase of ten per cent in product price will increase the value of the marginal product of labour by ten per cent in competitive conditions. It will also increase total revenue per worker (PQ/L) by ten per cent. Capital charges per worker (K/L) will remain unchanged, however, which implies that the distributable surplus per worker will rise by more than ten per cent. With the value of the marginal product of labour now below the surplus per worker, there will be an incentive to reduce the size of the team in the face of an increase in demand for its product.

There are, of course, many reasons why the force of this theoretical result may be weakened in practice. If workers have the right to claim the residual they are unlikely to leave the team just when prices are rising and this residual is getting larger. It would still remain true, however, that there would be no real enthusiasm for recruiting new workers. Conversely, attracting new workers when prices have fallen might not be possible if earnings in the team have fallen below those available elsewhere. In the long run, any required expansion of output following an increase in demand has to come from the formation of new firms rather than increasing the size of existing ones. In this respect, however, the labour-managed economy would behave much like the textbook version of the competitive investor-owned economy. Where reputation and team-specific skills are important, reliance on new firm formation has distinct disadvantages, since these new firms will face the set-up costs associated with accumulating knowledge within the team and winning consumer confidence.

More recent theoretical work has suggested that labour-managed enterprises will produce the standard ‘non-perverse’ responses to price changes under certain conditions. Kahana and Nitzan (1993), for example, show that where the surplus per worker cannot fall below a level determined by alternative outside opportunities, lower product prices may cause workers to leave until the return in the labour-managed firm is equal to that available elsewhere. This flight of labour implies that the output of the firm varies directly with product price. The model is not entirely symmetrical in that the initial size of the workforce is assumed to be settled before the price of the product is revealed by the market. Workers may then leave. There is, however, no incentive for the cooperating group of workers to add recruits to their number after the price of the product is revealed, no matter how high the price of the product turns out to be, so that the restrictive nature of cooperative enterprise is still implicit.

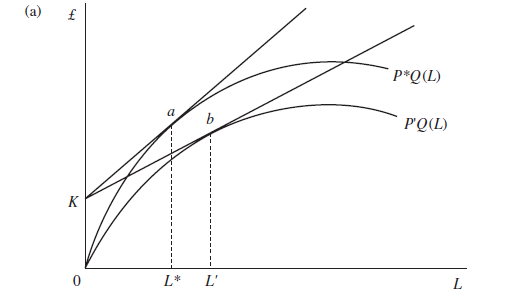

Figure 10.4 may help to clarify the differences between the conventional analysis of Meade (1972) and that of Kahana and Nitzan (1993). Meade’s analysis is presented in part (a) of Figure 10.4. The two curves P*Q(L) and P Q(L) show total revenue as the size of the team varies for two different price levels (P* >P’). K represents fixed capital charges. The slopes of the straight lines out of point K through points a and b represent the distributable surplus per worker at those points. For price level P’, this surplus per worker is maximised at b and the size of team is L’. For price level P*, surplus per worker is maximised at a, where the size of team is L*. The higher price level leads to a smaller firm.

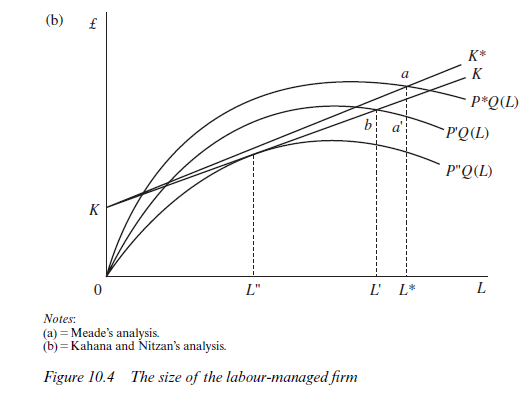

The structure of part (b) of Figure 10.4 is precisely the same. In this case, however, it is assumed that the initial size of the cooperating group is fixed in advance before the price of the product can be known. It is also assumed that opportunities exist outside the firm and that these are given by the slope of the straight line KK. Suppose that the initial size of the group of cooperators is L*. If the price of the product turns out to be P*, returns to team members will be given by the slope of KK* through point a. There is no incentive for any of them to leave, since their returns exceed those available elsewhere. A smaller team would increase the surplus per worker, but it could only be achieved at the expense of coercing members to leave, which is not compatible with the assumed voluntary nature of the cooperative association. Now assume that the price of the product turns out to be P’. A team of L* workers would produce a return per worker lower than is available outside (point a’). Workers will leave until point b is reached and the size of the team has shrunk to L’. A still lower price of P” would cause the team to shrink further to L”. No production would take place if returns within the firm fell short of outside opportunities at every firm size.

Clearly, Kahana and Nitzan’s approach yields a non-perverse supply response to price changes on the part of labour-managed firms, but their generally restrictive employment consequences are still apparent. A cooperative group, once established, only sheds labour or maintains its size; it never grows.13 Further, the determination of the initial size of the group is important. Kahana and Nitzan show that the higher the expected price of the product the smaller will be the initial size of the group. This would seem in accordance with the conventional analysis. Higher actual prices will lead people to wish they were in a smaller group, and higher expected prices might therefore lead them to opt to form a smaller group in the first place since forcing people out ex post is not possible. The negative association between group size and product prices is still there, but now dubbed a ‘long- run’ rather than ‘short-run’ phenomenon.

3.2. Employment and Profit Sharing

In contrast to the labour-managed firm, profit sharing is expected to have expansionary effects on employment where workers have no control over recruitment. Consider an extreme case in which the workers receive no wage but agree to share the distributable surplus with capital. For the sake of argument, suppose that fifty per cent goes to labour and fifty per cent to capital. With this arrangement, it will be in the interests of shareholders to recruit any worker who is capable of raising the distributable surplus by any discernible amount whatsoever. Fifty per cent of a small quantity is better (abstracting from recruitment costs) than nothing at all. From the workers’ point of view, however, the recruitment of further members of the team will only benefit them if newcomers are capable of adding to the total distributable surplus an amount that is at least as great as the existing total distributable surplus per worker. Beyond a certain point, therefore, workers and shareholders will come into conflict over recruitment, because newcomers will dilute each person’s share of the surplus.

Employment is encouraged by squeezing the earnings of labour. It does not follow, of course, that workers as a whole will necessarily be worse off in such a system. Although shareholders will be anxious to employ any remotely productive person, the return to labour cannot be reduced in any firm below what is available elsewhere or labour will desert the firm. Weitzman argues that the system is attractive because it gives such a strong encouragement to capital to employ labour. The share system, as was seen in section 2.1, implies that the payment to labour is more risky than it would be in the fully investor-owned firm where, traditionally, workers have received a fixed wage. However, although remuneration is more variable in the share system, employment is more reliable. A lower risk of unemployment is the prize for accepting greater income risk. It also permits longer- term and less-interrupted relationships between team members to develop – an important condition for the development of firm-specific skills.

With these apparently desirable properties it is a matter of some interest to know why the sharing form of enterprise is not more common, especially in the United States and the United Kingdom. Japanese enterprise, as noted in Chapter 6, does reveal sharing characteristics. Weitzman’s answer to this quandary is that economic systems may become trapped in positions from which individuals or small groups cannot easily escape. Once a system of investor-owned firms paying wages has become established it may not be in the interests of wage earners to agree to a change in their contract independently of wage earners in other firms. Vulnerability to unemployment is not necessarily evenly spread across all wage earners. Many ‘insiders’ may feel relatively secure. These secure workers will associate profit sharing with the prospect of ‘outsiders’ being recruited to the firm, both lowering pay and making it less predictable. The possible overall benefits of the system, were it to be adopted widely, would not weigh very heavily with these ‘inside’ workers. In Chapter 12, we will take up in more detail the question of how far the structure of institutions might be influenced and constrained by evolutionary forces.

‘Insiders’ may, however, be prepared to choose a profit-sharing contract in some circumstances, in spite of their fears about new recruitment and falling remuneration. As Brunello (1992) points out, what is required is that ‘insiders’ should have something to gain from employment growth. The advantage that Brunello suggests is that, in a hierarchical enterprise, employment growth will lead to more senior posts and a higher probability of promotion. ‘With internal promotion the bargained profit sharing parameter can be positive even if insiders face no unemployment risk’ (p. 571). Clearly, this effect will only be felt if insiders are promoted to senior positions, as analysed in Chapter 6, and do not compete with outsiders.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Some times its a pain in the ass to read what website owners wrote but this website is real user pleasant! .