1. Your Current Position

Most of you reading this book will have some employment situation you are trying to remedy. There are many, and we will go through what each means and how it may impact your life as an entrepreneur. The key thing is to analyze and acknowledge what your own personal situation is, and what you’re trying to get out of becoming your own boss.

1.1. Unemployed

The unemployment rate in the United States in 2008 was rising, hovering at a bit over 6 percent. This means that about 6 percent of you are not working, and many of you want to be. There is a phenomenon in economics called the “natural rate of unemployment,” which means that a segment of the population doesn’t want to work and therefore isn’t unemployed by definition. However, economists have argued for years over what the “natural rate” really is, and some even argue that there is no such thing, given ample opportunity and pay.

If you are unemployed, there is probably no better time for you to pursue your own business—unless you are actively looking for a job and have a mortgage payment due next week. If that is the case, you may have to find a corporate job with some flexibility so you can still start your own business on the side, and eventually make “it.”

1.2. Underemployed

What does it mean to be underemployed? It means you want more work than you have now, and this may very well apply to you. Numbers on underemployment aren’t widely collected or considered very accurate because if you have a job you are not unemployed, which is the number economists focus on.

If you are underemployed, you might be working part time but really need to be working full time. You might be a part time administrative assistant wanting full time work, or you might be in a part time job working for an employment agency and looking for a full time position. You may have dreams of owning your own business, but with family obligations and your part time job you’re struggling to find the time.

This actually may be the most ideal situation to be in; you are in fact earning something—hopefully enough to pay the bills—and you can use the time you would be spending looking for a job becoming the next great small business owner. All it takes is an idea, a plan, and some courage.

Additionally, lots of workers may have full time jobs, but feel underemployed because the cost of goods and services they purchase, like fuel and clothing, have gone up, so their current job no longer makes ends meet. Having a full time job and not being able to pay the bills is extraordinarily frustrating. The “out” for you may well be becoming your own boss, even starting while you still hold down your day job.

Certainly the costs of getting to work and preparing for that day job are rising. You may be seriously concerned about the rising costs of living or commuting to work—or you may just flat out be tired of wasting one to two hours per day stuck in traffic. Being your own boss means working from wherever you think best—whether that’s from your home office in your PJs or from your own corporate skyscraper.

It is very important to note where the survey respondents said they were when they made the switch to self employment:

- 63 percent were employed when they took the leap to their own business

- 26 percent were underemployed and wanting full time work

- 10 percent were unemployed

1.3. Worried About Losing a Job and Conflicting Obligations

Still yet, you might be fully employed but seeing your company, well, struggling to maintain its employment level. You may be working for a large financial institution and have a nagging feeling that you’ll be losing your job very shortly, or you may just feel insecure with a frustrating boss, cost-cutting, and a business looking to make the company more “efficient”—often by cutting positions.

Often those most at risk are middle management, who are said to add less value than senior leaders or worker bees. You may have time during your day to begin your own business without quitting your job. Try to think of what you do during the day and see if you can carve an hour or two out of it to begin your new business. The goal? Not to rely on “the man” (or “the woman”) anymore—but on yourself instead!

You may also be torn between conflicting obligations—family and work—and have a corporate job that is getting more demanding with 24/7 response times, all made possible due to our lovely society driven by BlackBerry devices and cell phones. Perhaps you are just tired of this, and you want to set the rules. Who can blame you? I did the same thing.

2. Doing the Math

Any new business owner is going to run into financial barriers, questions, concerns, and the like. You will need to do some detailed math to really determine how profitable your business can be, but the following four issues are those you need to consider immediately because they can be incredibly costly and unpredictable. In this chapter, we will walk through many of the things that frighten people—in particular, taxes—in detail.

2.1. Insurance Basics

You will need to insure your business. This may be as simple as filing for corporate or limited liability corporate (LLC) status so that your own personal liability is limited. Still, you may need actual insurance for your business. You should talk with an insurance advisor as well as an attorney to know what your potential risks are. They vary greatly based on what type of product or service you are selling, and even based on your location (some states may protect you more than others and some areas may require certain coverage when others may not). For my own business, I have one umbrella policy that lists each of my corporations and my sole proprietorship tacked on to my general homeowner’s insurance. It has cost me about $800 per year but it covers all of my assets, including my rental policies. This is often a good and inexpensive route to go, but be sure you are fully protected. Some companies will require more insurance than others and some are higher risk than others.

2.2. Tax Basics

Your taxes and the way you file will change when you become an entrepreneur. You will be filing a Schedule C for your business (or another schedule if you run a real estate business with rental property or a farm). You will likely want to talk with a tax planner who can help you understand the ramifications of tax changes. You no longer have a company withholding money from your paycheck, so you have to do this yourself. Your tax rate will vary based on your income, so talking with a planner is your best bet here. You do get some benefits, particularly if you work out of your home, such as in home office deductions including utilities and maintenance, prorated based on the square footage your home office takes as a percentage of total square footage. Again, a tax planner can help and is unconditionally advised.

Let’s start with the average corporate worker in California. The numbers may change slightly depending on your state—some states have state income tax and others don’t, some offset income tax with higher sales tax while others have no or low sales tax, and still others have higher property tax while some have little or none at all—so your own situation may be different. This is a good example to go from, though.

I’ll compare two situations that are nicely laid out on answers.google.com in two scenarios.

Let’s look at an employee making $120,000 in an annual salary, with a $20,000 bonus, for a total of $140,000, and a contractor making $140,000 in 1099 income. Sounds great right? The Google Answers column clearly spells out the answer here for the employee:

The employee will pay about $29,000 to the IRS, $10,000 to the State of California, $8,400 for the employee’s share in FICA/MED, and $600 to State Disability Insurance, or SDI. (The employer is paying medical and dental insurance.) This means the total tax is about $48,500, which is about 34 percent tax in total.

Now let’s look at a contractor contracting him or herself out in the city of Los Angeles—someone who is self employed but earning his or her living off contracts from other companies.

The contractor will pay about $33,280 to the IRS, $12,800 to the State of California, $16,570 in FICA/MEDI, $1700 in SDI, and $700 to the City of Los Angeles. This is a total of $70,450.

In this scenario the contractor is paying about 42 percent tax where the employee pays 34 percent.

But—and it is a big but—every single thing that person did as a contractor— advertising, driving, meals, travel, toll roads, paying for his or her own health insurance, and so on—comes off the taxable income, thereby reducing the amount he or she is taxed on by a substantial amount.

This is the real benefit of being self employed. By filing your taxes on a Schedule C of your standard 1040 tax return, you are transferring your business income to yourself and paying income tax on it. But you are first deducting expenses, so you are only paying on the net gain.

Some states have insanely high tax rates; California, for instance, is almost 10 percent for some tax brackets. One option to discuss with your accountant is how to officially do business in another state or incorporate your business so you can pay corporate tax, which might be lower. In some cases, becoming an S corporation could lower your tax, but an accountant needs to go through the details with you. For a great article from the IRS on whether you are officially a contractor or employee, visit www.rs.govarticle0,,d=99921,00.html.

If we take this a step further, as a self-employed business you have an even better situation!

Many things are deductible to a small business owner that are not available to an employee. Here are a few:

- Home office expense

- Car and mileage expenses

- Advertising

- Utilities, on a prorated basis for the area you work out of (if it’s your home)

- Contract laborers

- Business parking charges, tolls, etc.

- Home office equipment

- Business travel

- Business meals

- SEPs and IRAs

Many of you won’t have businesses where you are a contractor, but instead you will be selling something. You will still set up your business the same way and any large customers (those who spend over $600 with you) may send you a 1099 at the end of the year, which is the same thing contractors get.

So imagine this:

You earn $170,000 in net income. Your cost of goods sold is $25,000. Your contract labor and equipment rental is $20,000. Your professional and legal fees are $5,000. Your home business write off, including utilities, is $3,000. Your meals and transportation costs are $9,000. You bought a Treo, some computers, a new laptop, and gifts for your clients, for a total of $10,000. Your taxable income drops to $98,000, so you’re only being taxed on that amount. This means your effective tax rate will drop to below what an employee who makes $140,000 per year is paying! Depending on your state, you will get tax breaks for various small business incentives; but assuming you don’t and you pay the same percentage as the contractor, you will still pay $41,000 in taxes. This is less than any other scenario and doesn’t include even a fraction of the items you get to write off.

2.3. Healthcare Costs

When you leave your Corporate America job, you will probably be given an option to pay for COBRA (an extension of your health insurance) for a few months. Unfortunately, a few months is inadequate, so you should proceed as though you don’t have it and work through your solution.

You will be able to find self-employed insurance policies, and if you belong to a group, you might find even better deals through that group. For instance, the National Association of Realtors offers realtor’s insurance through their group plan, even if you don’t work for a realtor company. Look into these options, but look first into worst case scenarios for insuring you, and your family, if this applies to you.

If you are already unemployed, lack of insurance is something you have to handle anyway, so it isn’t a new risk or a new issue. Just be sure you have some estimates ready to go so you don’t get sticker shock. Amazingly, there are some inexpensive plans out there.

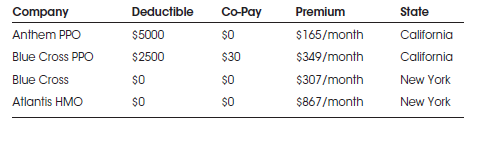

Here is a table to show you some costs in California and New York, with one child and one nonsmoking healthy spouse (note that I often choose the two most expensive states so you can see how “not so expensive” it really is):

HMOs offer drawbacks compared to PPOs—for instance, an HMO usually requires a doctor’s referral to see a specialist, whereas a PPO plan usually allows you to go to one directly. However, PPOs are usually more expensive because they often have a very high deductible as you can see in the table. You need to decide what you and your family ultimately need, and weigh prescription costs, too, which can quickly add up and eat up many unexpected dollars in co-pays.

See also if the company you ultimately go with allows for a self-employed flexible plan, which can allow you to take some of your expenses pretax.

Many people are surprised to learn how inexpensive healthcare can be. Preexisting conditions, obesity, and being a smoker are all things that will impact your quote, so living a healthy lifestyle certainly helps. Check with healthcare providers before leaving your insurance carrier to be sure any preexisting conditions won’t disqualify you from coverage.

2.4. Your Personal Break-Even Point

Whether you are unemployed, underemployed, or looking to leave Corporate America behind by quitting the full time job that you joyfully go to each day, you need to find your own personal break-even point. While you may want more freedom, you have to decide what you’re willing to pay for it, both in time and money, while you get your business up and running.

It can be hard to quantify feelings; researchers have been trying to do it for years. Writing down the pros and cons, weighting them based on how important they are to you, and then determining how well your new business ranks will help you come up with a proportion of satisfaction. I will supply you later with an example of how to do this, walking you through the quantification process step by step. It isn’t as hard as it sounds and it can actually help alleviate worries to get your concerns into numbers and see how the math adds up.

3. Final Thoughts

You are probably contemplating starting your own business because you are either unemployed, underemployed, or underutilized (your skills and talents just aren’t being used to their maximum). Maybe you’ve always wanted to start your own business but felt there were too many complications. Starting the business is easy—maintaining it is a bit more of a challenge; you’ll be able to accomplish both—keep faith, keep focused, and enjoy the ride!

Source: Babb Danielle (2009), The Accidental Startup: How to Realize Your True Potential by Becoming Your Own Boss. Alpha.

Thanks for this post, I am a big big fan of this web site would like to go along updated.

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care