1. Historical Foundations

The location discussion in connection with international trade theories has a long history. The mercantile doctrine, the major economic theory from the 16th to the 18th century, claims that the prosperity of a country (accumulated in gold or other precious metals) should be increased by high number of exports and a low number of imports. The more one country wins from bilateral trade through the trade surplus accumulated in the national treasury, the more the other country loses (Robock & Simmonds 1989). The mercantile doctrine was replaced by Adam Smith’s ‘theory of absolute advantage’ published in The Wealth of Nations in 1776. Smith, who was ahead of his time when he supported liberalized trade systems, argued that countries differ in their manufacturing performance (absolute cost advantage). If one country specializing in a particular product exports the product to a country from which it imports another product the trade partner specializes in, all participating countries will benefit from international trade. Import restrictions such as customs duties reduce the gains from specialization and cause a nation to lose wealth (Hill, 2005; Parkin, Powell, & Matthews 2000).

David Ricardo further developed Smith’s idea regarding comparative cost advantage as discussed in On the Principles of Economy and Taxation, published in 1817. He claimed that countries should focus on items they can manufacture most efficiently in comparison to other nations. Consequently, countries should export those goods where they have a comparative advantage and import other products where the trade partner country has an advantage. Thus, differences in productivity among countries initiate trade ambitions and result in a higher standard of living for the participating countries (Hill 2005; Mankiw 2007).

Johann Heinrich von Thunen serves as the first ‘location theory’ scholar. In his publication, Der isolierte Staat (1826), he introduced a model of agricultural land use. The reason why von Thunen serves as a location theory pioneer is because he was the first to emphasize transportation costs against the background of agricultural land and forests locations. Farmers located close to areas where demand for forest and agricultural products is high make use of lower transportation costs, which encourage others to locate their activities in similar areas (which results in increasing prices for land as well) (Viitala 2016). In other words, von Thunen provided the basis for the distance factor theory (and industry network cluster research) which claims that close areas with similar institutional endowments provide better pre-requisites for mutual prosperous economic development than geographically and institutional diversified areas (Hertenstein, Sutherland & Anderson 2015).

During the post-World War II period, location concepts with regards to firms’ internationalization strategies attracted attention. Issues such as where it is most profitable to locate a firm’s production with regards to local market imperfections (compare transaction cost theory), transportation, plant size, advantages of monopolistic competition, and incorporation of technology became the center of interest (Churchill 1967). Swedish economists Heckscher and Ohlin claimed that countries differ in their factor endowments, such as ground, labor, and financial capital. These differences cause divergent competitive advantages among nations. In addition, countries have comparative advantages in those goods for which the necessary factors of manufacture are comparatively abundant locally, which causes the price of goods to be lower because their corresponding input costs are lower. Thus, a country should manufacture and export those products that use factors that are abundant at home. At the same time, nations that have a comparative disadvantage tend to import those goods whose production requires the factors that are relatively scarce in their country (Brakman, Garretsen, Van Marrewijk, & Van Witteloostuijn 2006; Robock & Simmonds 1989).

Location Models

Location concepts focus on the access and optimal allocation of the input variables needed for efficient and innovative manufacturing and service output (Rasmussen, Jensen, & Servais 2008). In general, it is claimed that country and industry-specific factor endowments influence a firm’s innovation, business orientation, and performance: for example, whether firms rather focus on home markets or international markets. For foreign firms, as a consequence, the strategic decision for market entry primarily depends on the location factors of the target country (Pan & Tse 2000; Tesch 1980).

Two central categories of location factors can be distinguished: the category of the macro-environment and, taking a more narrow perspective, the category of the firm’s industry environment. These categories will be introduced and discussed in the following sections.

2. Location Factors

2.1. The Macro Environment

The discussion about a firm’s resources, structures, and strategies, as well as its interface with its market environment is also found in the literature within the category of ‘institutional theories of organizations.’ The institutional theory serves as a framework for identifying and analyzing the factors that support the viability and legitimacy of organizations. In general, these factors include societal, economic, and political/legal regulations, as well as an organization’s tradition and history (Bruton, Ahlstrom, & Li 2010; Glover et al. 2014).

These factors have a direct impact on the strategies and organizational decisions of firms (North 1990). With the aim of improving their position and legitimacy, firms should adhere to rules such as regulatory structures and practices (Glover et al. 2014).

Contextual risks are a result of the external uncertainties embodied in the macro-environment of the firm’s international target market. For example, political/legal uncertainties arise from instability in the political system or from policies of the local government, such as those concerning private ownership (e.g., expropriation and intervention), operational risk (e.g., price control and local content requirements), and transfer risk (currency inconvertibility and remittance) (Pan & Tse 2000).

Aspects of the institutional environment can have a direct effect on a firm’s market entry strategy in a foreign target market. For example, legal restrictions on foreign ownership of domestic enterprises, as seen in India, establish definite limits on foreign equity holdings. Country uncertainties regarding the protection of intellectual property rights further contribute to environmental risks and can result in a firm’s reduced investment activity (Delios & Beamish 1999). Demographic characteristics can result not only in lower demand for a technology but also in modification and adaptation of existing technologies (Davidson & McFer- tidge 1985).

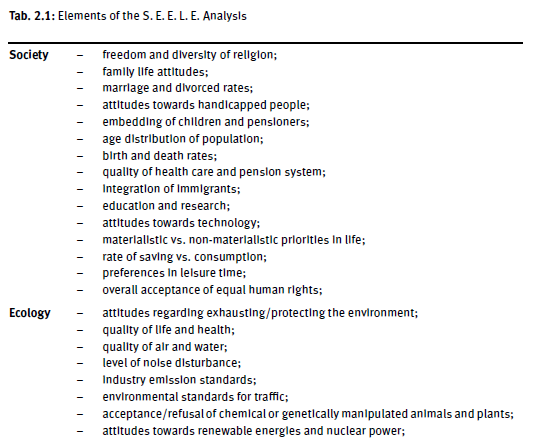

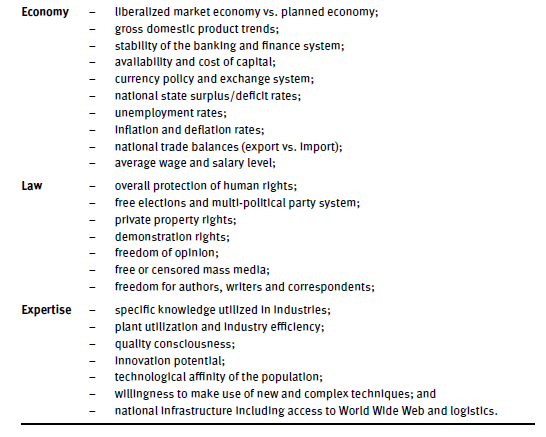

A well-known tool for scanning macro-environmental factors for a firm is PEST (political, economic, social, technology) analysis. In some sources, PEST is supplemented by ecological and legal factors, thus the acronym becomes PESTEL or PESTLE (Koumparoulis 2013). Drawbacks of PEST analysis are that originally less attention was paid to ecological issues. However, ecology has become an increasing challenge related to the global pollution of water and air, as well as exploitation of natural resources. Current global business behavior should be viewed in light of, hopefully, an increasing public awareness regarding ecological challenges. S. E. E. L. E. (society, ecology, economy, law, expertise) emphasizes societal (not narrowly ‘social’ according to PESTEL) and ecological issues and better considers modern service-industry driven societies. Important elements of the macro-environmental scan when applying S. E. E. L. E. are the following:

The study of market entry abroad necessarily assumes the recognition and understanding of the respective environmental macro structures. A firm that plans business activities in a foreign country needs to collect and evaluate necessary information based on the S. E. E. L. E. elements and their interconnections. In general, the educational system (as a fragment of ‘society’) established by the national government should attempt to provide qualified and ethically responsible people for the firms and organizations. At the same time, firms should be aware of their social responsibility. A ‘hire and fire’ policy that aims to exploit the employees for short-term objectives or, alternatively, internally developing and improving the qualifications of the firm’s personnel, reveal different behavioral and ethical aspects of a firm’s culture. These examples of diverse firm policies necessarily suggest positive or negative consequences for its national environments.

When local governments in a foreign market set new legal standards in order to reduce environmental damage (e.g., product labels that show the electricity consumption of an apparatus), the new standards hopefully cause a change in customer needs and preferences (e.g., product purchases with reduced power utilization). Consequently, such standards influence the destiny of a manufacturing firm and the sales potential of the products. If the firm has reliable, sophisticated market research and forecasting, it is better able to forecast new political and technological trends and appropriately focus the corresponding R&D activities. Suppose an enterprise performs well; its business will result in a higher number of employees. If not, employees need to be released; and the firm may face bankruptcy, which contributes to an economy’s higher unemployment rate (negative impact on its macro-environment).

A firm that targets foreign direct investment and compares different potential target markets may raise, among others, questions such as the following: How will costs and earnings develop in the respective regions in the future? Are the factor costs in countries with relatively low wage levels associated with lower educational levels that result in lower productivity and employees that are less conscious of quality? How much training is necessary for the work force? Do the work ethics and the loyalty of the staff differ culturally from the atmosphere at home? (Meyer 2006). Because factors of the macro-environment vary from country to country, they provide the basis of diversified opportunities and threats for the international business activity of the firm. An opportunity is a condition in the macro-environment that, if properly utilized, helps a firm achieve a competitive advantage, while a threat may hinder a company’s efforts to attain strategic competitiveness in global business (Hitt, Ireland, & Hoskisson 2015).

As is clear from the arguments and examples mentioned above, there are various linkages between the macro and the industry environments. These elements continuously evolve. Changes lead to modifications in the cost and revenue structure, which may be favorable or unfavorable to the firm (Rasmussen et al. 2008).

Thus, a continuous and permanent scan of the firm’s macro-environment, usually carried out by the firm’s market research department, is of vital importance to the company.

2.2. The Industry Environment

Industry groups consist of firms with similar missions, organizational structures, value-added activities, and strategies related to their products and services (Wheelen & Hunger 2010). The industry or task environment is a set of industry-specific location factors that directly influence a firm in its competitive position relative to local rivals and, logically speaking, its market entry and penetration strategy abroad. The best-known representative of industry analysis (‘five forces model’), which is thematically similar to the market-based view, is M. E. Porter (Porter 1980, 2003; Porter & Fuller 1986; Porter & van der Linde 1995). In contrast to the resource-based view (competitive advantages depend on the firm’s resources), the market-based view claims that sustainable competitive advantage and superior returns depend on the management’s recognition and utilization of the market and the influencing industry forces (Peters et al. 2011). In other words, the market based-view first takes an outside (market) – followed by an inside (firm) – perspective.

According to Porter (1990), two central concerns underlie the choice of a competitive strategy. The first is the industry structure in which the firm competes. Industries differ widely in the nature of competition, and not all industries offer equal opportunities for sustained profitability. The average profitability in pharmaceuticals is high, for example, while this is not the case in consumer electronics. The second central concern in a competitive strategy is positioning within an industry.

In each industry, the nature of competition depends on five competitive forces:

- the threat of new market entrants,

- the threat of substitute products or services,

- the bargaining power of suppliers,

- the bargaining power of buyers, and

- the rivalry among the existing competitors.

In modern marketing management, against the background of globalized and digitalized information technologies, we necessarily need to consider the role and the increasing influential power of stakeholders (which include the shareholders). Compared to the past, product and technology life-cycles have become significantly shorter, and thus should gain particular attention within an analysis of the firm’s target markets.

A firm’s performance is limited by these specific industry properties. The appearance and the strength of the forces vary from industry to industry and determine long-term industry profitability. These factors influence the attractiveness of the industry and the corresponding profits of the engaged firms (Porter 1990). According to the market-based view, the sources of value for the firm are embedded in the competitive situation characterizing its external product markets. Interaction among competitive industry forces, such as the bargaining power of suppliers and buyers, influences a firm’s profitability in the foreign target market (Hitt et al. 2015; Muller-Stewens & Lechner 2011; Wheelen & Hunger 2010). For example, a higher bargaining power for a firm in comparison to the bargaining power of the suppliers suggests that a firm might achieve higher performance because the existing suppliers have fewer alternatives within the industry.

Competitive dynamics are also influenced by barriers to entry resulting from the structure of the market (Grant 1991b; Makhija 2003). An industry environment that has high entry barriers is attractive to enter and provides, at least temporarily, higher returns for the existing companies, which take advantage of limited (foreign) competition (Peters, Siller, & Matzler 2011). Transactional risks related to market entry in foreign target markets arise as a result of the behavior of local firms, which may take action to maintain or increase entry barriers through offensive price strategies or lobbying their local governments (Pan & Tse 2000).

In the course of the development of industry analysis, the importance of the regional industry cluster (e.g., supplier-customer inter-firm relations; supporting service providers such as logistics, information technology, etc.) gained increased attention in location theories (McCann & Sheppard 2003). For example, for a firm considering a market entry through foreign direct investment, it tends to be more efficient to locate its production site close to existing local industry networks with access to an existing supplier instead of operating from a distance in remote areas.

Firms considering international market entry activities can evaluate and compare different industry clusters according to the following questions, among others: Are there any component supplier clusters available or under development in this region? Is the location an attractive one for competitors to initiate foreign direct investment activities? What infrastructure is available? How far away from the industry cluster are the major markets? How will the freight rates develop, which depends on the number of logistics firms that offer services in that region? (Meyer 2006). The rationale of the ‘incubator’ hypothesis is that a newly established industrialized area (industry cluster) offers firms attractive conditions for investment. In addition, enterprises usually benefit, at least temporarily, from tax incentives and reasonable prices for real estate. Through concentration in a cluster, firms create economies of scope by sharing storage facilities as well as transportation, which facilitates exports and imports. Especially with regard to technology-oriented complexes, for example science parks or economic development zones, the ‘incubator hypothesis’ has been useful (Rasmussen et al. 2008).

3. The Diamond Model

About a decade after categorizing the factors that affect competitive industry forces, Porter expanded the ‘competitiveness discussion’ from industry to country levels in what is known as the ‘diamond model.’ At the national level, location effects are what Porter describes as the competitive advantage of nations. Porter (1990) claims that the institutional framework at the firm’s home country fundamentally influences the firm’s motivation for internationalization (Porter 1990; Rasmussen et al. 2008). According to Porter, competition in many industries has internationalized -not only in manufacturing, but increasingly in services. Larger and internalized firms compete with truly global strategies involving selling and sourcing components and materials worldwide, and locate their activities in selected countries to take advantage of national divergent resource endowments. Porter’s diamond approach of internationalization is based on his empirical observation, which concludes that enterprises that are successful worldwide (‘global champions’) frequently originate in one country. His observation leads to the thesis that those enterprises, due to their industry environment, enjoy particularly favorable conditions, which make it possible for them to become internationally active and to attain a competitive advantage in other countries relative to the resident enterprises. Porter distinguishes four central factors and two supplementary factors that influence gaining a competitive advantage in foreign markets (Porter 1990).

Central Factor 1: Production Factor Conditions

Human resources refer to the quantity, skill, and cost of personnel and management, taking into account standard working hours and the work ethic. In connection with this, progressive factors attain special importance. Progressive factors are, for instance, the education and qualifications of the population, the potential for generating high innovation, efficient use and combination of human resources, and continuous adaptation to the requirements of (foreign) markets.

Physical resources refer to the availability and cost of a nation’s land, natural resources, infrastructure, country location and geographic size.

Knowledge resources refer to the nation’s stock of scientific, technical, and market knowledge concerning goods and services. Knowledge resources reside in universities, government research institutes, private research facilities, government statistical agencies, business and scientific literature, market research and databases, trade associations and other sources.

Capital resources are the amount and cost of capital available to finance industry. Capital is not homogeneous, but comes in various forms, such as secured and unsecured debt. The total stock of capital resources in a country and the forms in which it is deployed are influenced by the national rate of savings and by the structure of national capital markets, both of which vary widely among nations.

Infrastructure is the type, quality, and user cost of infrastructure available that affects competition, including road systems, logistics, telecommunication, access to the internet systems, banking and payment systems. Infrastructure also includes health care, housing stock, and cultural institutions, which affect the quality of life and the attractiveness of a nation as a place to live and work.

The quality of the production factors is more important to Porter than the quantity. Unlike the classical trade theories of Ricardo or Heckscher-Ohlin, Porter claims that it is advantageous for a country if physical resources (e.g., natural raw materials) are rare since the waste of resources is avoided through alternative innovative technologies that finally help to spare the environment (Porter 1990). The cases of Russia or Saudi Arabia, both countries rich in natural resources but comparatively weak in modern and technologically driven industries such as electronics, automotive, chemical, and others, supports Porter’s thesis. Finally, physical resources lose importance over time and become increasingly substitutable since an artificial way of producing them can be found or alternative production methods can be developed (e.g., in the energy sector, wind turbine and solar photovoltaic systems have replace coal and oil) (Welge & Holtbrugge 2015).

Central Factor 2: Home Demand Conditions

All factors that have an influence on the level of purchase demand are part of the category ‘home demand conditions.’ Nations gain a competitive advantage in industries where the home demand gives local firms a clearer or earlier picture of buyer needs than foreign competitors can have (Porter 1990). The size of the home market can be a criterion for competitive advantage (economies of scale). This efficiency could also lead to a domination of the industry in other countries (Hitt et al. 2015).

Quality and customer-tailored products and services become more important than just quantity recorded sales volumes. Particular characteristics of domestic demand, such as design, technology, and product functions, require specific attention by the industry (Welge & Holtbrugge 2015). As a result, firms are forced to be innovative, which positively influences the development of the whole industry. The expectations and wishes of customers at home can often result in innovative technological trends for worldwide sales in the future (Kutschker & Schmid 2011). The rate of growth of home demand can be as important to competitive advantage as its absolute market size. Rapid domestic growth forces a nation’s firm to adopt new technologies faster and, consequently, allows first mover advantages and valuable experience curve effects (Porter 1990). Today, for example, Chinese firms such as Alibaba and Huawei make use of their home market, which is among the largest in the world.

Central Factor 3: Supporting Industries

Porter describes the supplying and supporting industries in a country as, for instance, logistics, the educational system, and research and development capacities. Sophisticated, developed supply networks form the basis for stable production of technologically innovative standards with reasonable sourcing prices because supplying enterprises are confronted with high competitive pressure. Qualified suppliers are able to provide considerable input for further technological development (Welge & Holtbrugge 2015). A competitive advantage emerges from close working relationships between vendors and the industry. Suppliers help firms perceive new methods and opportunities for applying new technology. Firms gain quick access to information and innovation potentials. The exchange of R&D know-how and the joint problem solving of technical, engineering or software issues lead to faster and more efficient solutions. Through this process, the pace of innovation within the entire national industry is accelerated and finally leads to global competitive advantages (Porter 1990).

Central Factor 4: Firm Strategy, Structure, and Rivalry

Porter claims that the goals, strategies, and ways of organizing firms in industries vary among nations (Porter 1990:108). National advantage results from a good match among these choices. The pattern of rivalry at home also has a profound role to play in the process of innovation and in the ultimate prospects for international business. The higher the competitive pressure at home, the more enterprises are forced to internationalize. Nations will tend to succeed in industries where the management practices and modes of organization favored by the national environment are well suited to the industries’ sources of competitive advantage. Important national differences in management approaches occur in such areas as the way of motivating employees, the hierarchical structure of the enterprise, the strength of individual initiative, the ability to coordinate across functions, and management’s influence on customer relations (Hitt et al. 2015; Porter 1990; Welge & Holtbrugge 2015: 68).

Two Additional Factors: Government and the Role of Chance

The government positively or negatively influences the four central determinants mentioned above. Therefore, the role government and the role of chance should not be seen as separate independent factors. Factor conditions are affected by policies toward capital markets, legal property rights, a nation’s infrastructure, and the educational system. Governmental institutions establish technical standards for products (e.g., specification of safety and hygiene standards and emission standards), which influence the behavior of the market actors. Furthermore, the government also includes local public authorities, who are also buyers (e.g., office equipment) or lead infrastructure projects (Porter 1990).

Chance events are often beyond the influence of firms such as emerging new technologies (e.g., electric cars, 3-D printers). Such events often change the structure of the entire industry and provide opportunities for innovative firms. Advanced knowledge-driven industries, such as differentiated, innovative products, services, and technologies, are the most significant industries for a nation’s welfare. They are necessary in order to achieve a competitive advantage and, therefore, should be fostered by the national government. Advanced technologies are more scarce because their development demands large and often sustained investment in both human and physical capital (Porter 1990).

4. Review of the Location Concepts

The external environment of firms involved in international trade provides many opportunities but, simultaneously, is becoming increasingly complex and competitive. The liberalized global trade and capital flow framework and advanced logistics and communication systems provide many attractive chances and allow easier entry of firms into the international markets than was possible decades ago. In parallel, environmental uncertainty increases as a result of the amount of complexity plus the degree of change existing in a firm’s external environment. Considering these developments, Dai et al. (2013) emphasize that ‘location’ is decomposed into two separate factors: ‘place’ and ‘space.’ Place refers to the conventional location-specific attributes, while space emphasizes geographic distance and industry network characteristics. Thus, traditional locational ‘place’ concepts should be amplified by the issue of space’ in order to better understand multinational enterprise activities in global markets. Similarly, Beugelsdijk et al. (2013) argue that the term space should refer to characteristics among places combining within-country variations (e.g., investment behavior of firms with regards to a regional industry cluster in one country) and integrate these with between- country variations (e.g., comparison of the firms’ investment behavior concerning industry clusters between countries).

According to the location theory, before firms decide their market entry strategy, they have to scan the external macro-environment (e.g., S. E. E. L. E. or PESTEL) and industry environment (Porters five forces) in order to identify possible opportunities and threats in light of internal resources that reflect the strengths and weaknesses of the company. The more the firm is involved in global business and the higher the number of potential competitors, the greater the market research complexity. Internationalization in today’s context and complexity is less about just entering foreign markets than it is about increasing the firm’s exposure and response to permanently changing international business dynamics (Jones 2001).

The location theory assumes that the decision to make a direct investment in a particular country is certainly determined by its location factors. However, empirical studies of the relative influence of these individual factors, because of their enormous complexity, are rather difficult (Welge & Holtbrugge 2015: 69). For example, entrepreneurs may have preferences regarding selected target markets because of their personal relationship network and, therefore, do not consider location-specific factors alone. Multinational firms make use of diversified globally distributed operational networks, which even broadens the complexity of the location approaches in terms of global value chain analysis between cross-country industry clusters (e.g., a European cross-border automotive cluster between the southern part of Germany, the Czech Republic, Slovakia, and Hungary).

Porter claims in his diamond model that the competitiveness of enterprises is influenced by country-specific conditions. Some enterprises, therefore, have better prerequisites for successful international business activities because of favorable home market surroundings than others. Criticism arises because it is empirically hard to measure the ‘meaning of a competitive advantage,’ and some assumptions are rather speculative. The influence of each of the location factors, as well as their relations, is empirically difficult to verify. The model lacks the ability to consider behavioral patterns of entrepreneurs and/or the management. Precise recommendations for how to achieve a competitive advantage for the firm remains challenging, which, however, could be of interest to national governments that seek to foster their economies (Grant 1991a: 542).

The diamond model does not answer the question that asks under which circumstances it is desirable to enter the market through export or alternatively through foreign direct investment (Kutschker & Schmid 2011). Furthermore, the approach focuses on the home market conditions, which ignores the fact that multinational enterprises make use of cross-border value-added activities, depending on the costs at home and abroad. The model neglects, in light of modern globalized competitive forces, other countries and their impact on the competitiveness of firms in the home country and vice versa. This has led other authors to introduce the ‘double diamond.’ While the ‘single diamond’ model by Porter focuses on the ‘home country’ conditions, the ‘double diamond’ simultaneously takes into consideration the elements of the ‘home country’ and the ‘elements of the foreign markets’ with regards to their mutual influence on the performance of the competing firms originating in the home and foreign markets (Rugman & D’Cruz 1993; Rugman & Verbeke 1993).

Esterhuizen (2006) stresses the importance of human resources for the firm and, consequently, a nation’s competitiveness and amplifies the diamond to the ‘nine factor model’ by adding human resources, divided into categories such as ‘workers, politicians and bureaucrats, entrepreneurs, managers, and engineers,’ which are crucial to gaining a nation’s competitive advantage.

Despite all its weaknesses, location concepts and the diamond model have become widely known. The diamond model’s strength is its simplicity and pragmatic approach.

The diamond model expands traditional internationalization trade theories, connecting relevant strategic management questions with macro and industry-specific elements of nations and their industries (Grant 1991a).

Source: Glowik Mario (2020), Market entry strategies: Internationalization theories, concepts and cases, De Gruyter Oldenbourg; 3rd edition.

21 Jul 2021

21 Jul 2021

21 Jul 2021

21 Jul 2021

21 Jul 2021

21 Jul 2021