1. Claims

Shippers can claim from carriers or insurers with respect to loss or damage to their cargo. Shippers often attempt to recover from carriers when they have a reasonable basis to believe that the loss or damage was caused by the negligent act or omission of the carriers that was easily preventable through exercise of due diligence in the transportation and handling of the cargo. Another motivating factor for the insured to obtain a satisfactory settlement with carriers could be to maintain a healthy loss to premium and keep premiums low. It could also be that the loss or damage is not covered by the insurance policy. However, in most cases, shippers claim from their insurers partly because carriers reject claims received from the insured or because the shippers find that the adjustment for loss or damage is inadequate due to liability limitations. It may also be that some shippers find it more convenient and efficient to handle claims with insurance companies.

Settling losses under insurance contracts is the function of claims management. Claims management is often accomplished through employed (in-house) or independent adjusters who negotiate settlement with the insured. The claims department is responsible for ascertaining the validity of the loss, investigating, estimating the extent and amount of the loss, and finally approving payment of the claim. It is important to note the following in relation to insurance claims:

- To be recoverable, the loss or damage incurred by the insured must be covered by the insurance policy. The insurer will avoid liability if the particular risk is specifically excluded or is not reasonably attributable to the risk insured against.

- The burden of proof falls on the insured to show that the loss or damage to the cargo is covered by the policy.

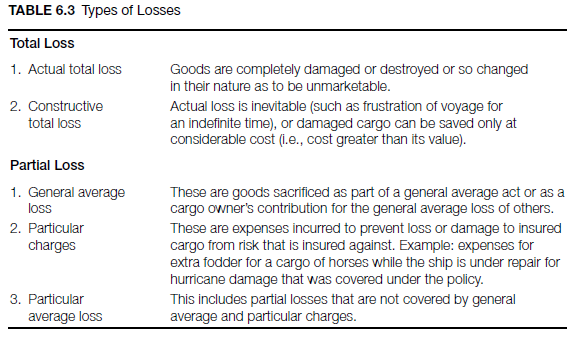

- The insured must take prudent measures to protect the merchandise from further loss or damage. Under the sue and labor clause that is incorporated in most cargo insurance contracts (see International Perspective 6.3 for other typical clauses), the insured is required to take all necessary steps to safeguard the cargo and save it from further damage, without in any way prejudicing its rights under the policy. The underwriter agrees to pay any resulting expense (Tables 6.2 and 6.3 and International Perspective 6.4).

- Once the insurance company settles the insured’s claim, it could exercise its subrogation right to claim from parties responsible for the loss or damage. Under the principle of subrogation, the right to recover from carriers and other parties who are responsible for the loss or damage passes from the insured to the insurer on payment of the insurance money. Since the insurer stands in the shoes of the insured in claiming from third parties, the insurer does not have a better right than the insured possessed. Any payments obtained by the insured shipper from the carrier or other parties must be transferred to the insurer (after settlement with insurer) because, under the principle of subrogation, the insured is not allowed to recover more than once for the same loss.

Claims are generally valid for two years from the date of arrival for air shipments and one year in the case of ocean shipments. Claims are invalid if not initiated within this period unless legal action is pursued.

2. Typical Steps in Claim Procedures

Step 1

Preliminary notice of claim. The export-import firm (insured) must file a preliminary claim by notifying the carrier of a potential claim as soon as the loss is known or expected. A formal claim may follow when the nature and value of the loss or damage is ascertained.

Step 2

Formal notice of claim. The consignee must file a formal claim with the carrier and the insurance company once the damage or loss is ascertained. The claim should include costs such as the value of the cargo, inland freight, ocean/airfreight, documentation, and other items. If the insurance policy is 110 percent of the cost in freight (CIF) value, the insured could add 10 percent of the value of the goods to the claim. Assuming that the insured intends to claim from the insurer (not the carrier), the insured should arrange for a survey with the claims agent of the insurance company. The formal claim form should be submitted with certain documents: a copy of the commercial invoice; a signed copy of bill of lading/air waybill; the original certificate of insurance; a copy of the claim against the carrier, or reply thereto; the survey report, if done by the surveyor; the packing list; and a copy of the receipt given to the carrier on delivery of the merchandise. It could also include photographs, repair invoice, and an affidavit from the carrier, if possible.

Step 3

Settlement of claim. If the claim is covered by the policy and claims procedures are appropriately followed, the insurance company will pay the insured. If the insurance company declines to approve payment, the insured could pursue arbitration or other dispute settlement procedures as provided in the insurance contract.

The claim is filed by the party that assumes the risk of loss on transit. For example, in CIF contracts, the exporter takes out an insurance policy for the benefit of the buyer and the risk of loss is transferred to the buyer once goods are put on board the vessel at the port of shipment. The exporter will send the necessary documents and detailed instructions to the overseas customer (consignee) to follow in the event of loss or damage. The consignee should be instructed to examine the goods upon delivery to determine any apparent or concealed loss or damage to cargo. Any loss or damage discovered upon such inspection should be noted on the carrier’s delivery receipt or air waybill. Once the carrier obtains a clean receipt from the consignee, it becomes difficult for the latter to successfully make a claim.

The best way to deal with claims is to prevent the occurrence of loss or damage to cargo as much as is practically feasible. It is estimated that proper packing, handling, and stowage can prevent about 70 percent of cargo loss or damage. The frequent occurrence of damage or loss to cargo not only becomes a source of friction or suspicion on the part of insurance companies but also discourages the growth and expansion of trade. It could also have the effect of reducing sales abroad if overseas customers are discouraged by the frequency of such occurrences, since it could consume the parties’ time and effort. If payment has already been made to the exporter, the buyer’s capital is tied up with merchandise that cannot be sold.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

14 Jul 2021

13 Jul 2021

13 Jul 2021

13 Jul 2021

14 Jul 2021

15 Jul 2021