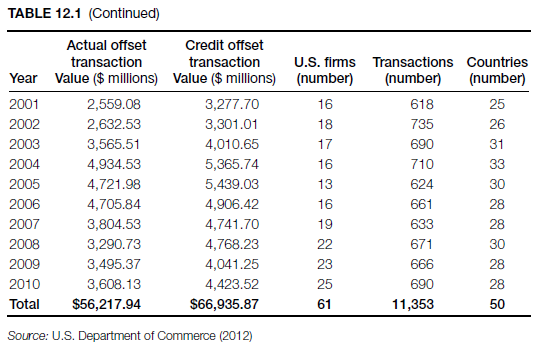

Offsets in defense trade encompass a range of industrial compensation arrangements required by foreign governments as a condition of the purchase of defense articles and services from a nondomestic source. This mandatory compensation can be directly related to the purchased defense article or service, or it can involve activities or goods unrelated to the defense sale. The U.S. government policy on offsets in defense trade states that the government considers offsets to be “economically inefficient and trade distorting,” and it prohibits any agency of the U.S. government from encouraging, entering directly into, or committing U.S. firms to any offset arrangement in connection with the sale of defense articles or services to foreign governments. U.S. defense contractors generally see offsets as a reality of the marketplace for companies competing for international defense sales (See Tables 12.1 and 12.2). Several U.S. defense contractors acknowledge that offsets are usually necessary in order to make defense sales—sales that can help support the U.S. industrial base. U.S. firms are required to report annually on contracts for the sale of defense articles or defense services to foreign governments or foreign firms that are subject to offset agreements exceeding $5 million in value and on offset transactions completed in performance of existing offset commitments for which offset credit of $250,000 or more has been claimed from the foreign representative (U.S. Department of Commerce, 2012).

During 1993-2010, fifty-two U.S. firms reported entering into 763 offset-related defense export sales contracts worth $111.59 billion with forty-seven countries. The associated offset agreements were valued at $78.08 billion. In 2010, direct offsets (transactions directly related to the defense export sale with an associated offset agreement) accounted for 33.10 percent of the actual value of reported offset transactions. Indirect offsets (transactions not directly related to the defense export sale with an associated offset agreement) accounted for 63.11 percent of the actual value of reported offset transactions. During 1993-2010, direct offsets accounted for 40.22 percent of the actual value of the reported offset transactions, with indirect offsets accounting for 59.04 percent. The top three offset transaction categories reported by industry for 2010 were purchases, subcontracting, and technology transfer (U.S. Department of Commerce, 2012). These three categories represented 81.59 percent of all offset transactions reported for 2010. U.S. prime contractors develop long-term supplier relationships with foreign subcontractors based on short-term offset requirements. These new relationships, combined with the mandatory offset requirements related to offset agreements, can limit future business opportunities for U.S. subcontractors and suppliers, with negative consequences for the domestic industrial base.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

Thank you for every other fantastic post. The place else may just anybody get that kind of information in such a perfect manner of writing? I have a presentation next week, and I am on the search for such info.