Now let’s look at franchising from the franchisee’s perspective. Purchasing a franchise is an important business decision involving a substantial financial commitment. Potential franchise owners should strive to be as well informed as possible before purchasing a franchise and should be well aware that it is often legally and financially difficult to exit a franchise relationship. Indeed, an individual franchise opportunity should be meticulously scrutinized. Close scrutiny of a potential franchise opportunity includes activities such as meeting with the franchisor and carefully reading the Franchise Disclosure Document, soliciting legal and financial advice, and talking to former franchi- sees that have dropped out of the system one is considering. In particularly heavily franchised industries, such as fast food and automobile repair, a pro- spective franchisee may have 20 or more franchisors from which to make a se- lection. It is well worth franchisees’ time to carefully select the franchisor that best meets their individual needs.17

Some franchise organizations are designed to provide their franchisees a part-time rather than a full-time income, which is attractive to some people. An example is Fit4Mom, a company that gathers new mothers together to do 45-minute power walks with their babies in strollers. The initial franchise fee ranges between $5,000 and $50,000, depending on several factors, includ- ing how densely populated the area is in which the franchise will be located. Owning a Fit4Mom franchise is ideal for a woman who wants to work two to three hours a day rather than eight, and who is passionate about fitness.ranchising may be a particularly good choice for someone who wants to start a business but has no prior business experience. Along with offering a refined business system, well-run franchise organizations provide their fran- chisees training, technical expertise, and other forms of ongoing support.

1. Is Franchising right for you?

Entrepreneurs should weigh the possibility of purchasing a franchise against the alternatives of buying an existing business or launching their own venture from scratch. Answering the following questions will help determine whether franchising is a good fit for people thinking about starting their own entrepre- neurial venture:

■ Are you willing to take orders? Franchisors are typically very particular about how their outlets operate. For example, McDonald’s and other suc- cessful fast-food chains are very strict in terms of their restaurants’ ap- pearance and how each unit’s food is prepared. Franchising is typically not a good fit for people who like to experiment with their own ideas or are independent minded.

■ Are you willing to be part of a franchise “system” rather than an inde- pendent businessperson? For example, as a franchisee you may be re- quired to pay into an advertising fund that covers the costs of advertising aimed at regional or national markets rather than the market for your individual outlet. Will it bother you to have someone use your money to develop ads that benefit the “system” rather than only your outlet or store? Are you willing to lose creative control over how your business is promoted?

■ How will you react if you make a suggestion to your franchisor and your suggestion is rejected? How will you feel if you are told that your sugges- tion might work for you but can be put in place only if it works in all parts of the system?

■ What are you looking for in a business? How hard do you want to work?

■ How willing are you to put your money at risk? How will you feel if your business is operating at a net loss but you still have to pay royalties on your gross income?

None of these questions is meant to suggest that franchising is not an attractive method of business ownership for entrepreneurs. It is important, however, that a potential franchisee be fully aware of the subtleties involved with franchising before purchasing a franchise outlet.

2. The Cost of a Franchise

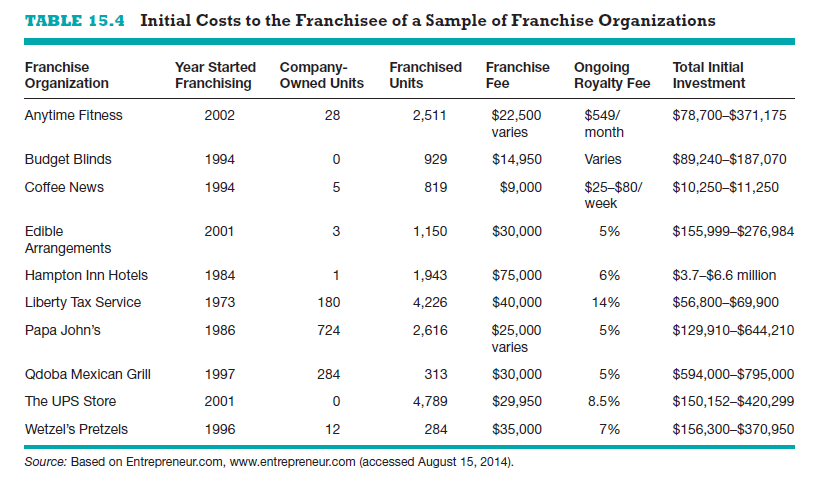

The initial cost of a business format franchise varies, depending on the fran- chise fee, the capital needed to start the business, and the strength of the fran- chisor. For example, some franchisors, such as McDonald’s, own the land and buildings that their franchisees use, and lease the property to the franchisees. In contrast, other organizations require their franchisees to purchase the land, buildings, and equipment needed to run their franchise outlets. Table 15.4 shows the total costs of buying into several franchise organizations. As you can see, the total initial cost varies from a low of $10,250 for a Coffee News franchise up to $6.6 million for a Hampton Inn Hotel franchise.

Also shown in Table 15.4 is a breakdown of the number of company-owned units and the number of franchise units maintained by different organizations. Company-owned units are managed and operated by company personnel, and there is no franchisee involved. Franchise organizations vary in their philoso- phies regarding company-owned versus franchised units. As we noted earlier in this chapter, some companies (e.g., Budget Blinds) are strictly franchisors and have no company-owned units. Other companies, such as Qdoba Mexican Grill, have roughly the same number of franchises and company owned stores. In addition, some U.S.-based franchise systems have more foreign franchises than domestic franchises. For example, of the 18,875 franchises in KFC’s system, 4,491 are in the United States and 14,384 are in foreign countries. In fact, there are more KFC franchises in China (4,563) than there are in the United States.

When evaluating the cost of a franchise, prospective franchisees should consider all the costs involved. Franchisors are required by law to disclose all their costs in a document called the Franchise Disclosure Document and send it to the franchisee. (We’ll talk about this document in more detail later in this chapter.) To avoid making a hasty judgment, a franchisee may not purchase a franchise for 14 days from the time the circular is received. The following costs are typically associated with buying a business format franchise:18

■ Initial franchise fee: The initial franchise fee varies, depending on the franchisor, as shown in Table 15.4. High-overhead brick-and-mortar fran- chises charge less (4 to 5 percent of gross sales), while low-overhead home- based and service business charge more (8 to 10 percent of gross sales).

■ Capital requirements: These costs vary, depending on the franchisor, but may include the cost of buying real estate, the cost of constructing a building, the purchase of initial inventory, and the cost of obtaining a business license. Some franchisors also require a new franchisee to pay a “grand opening” fee for its assistance in opening the business.

■ Continuing royalty payment: In the majority of cases, a franchisee pays a royalty based on a percentage of weekly or monthly gross income. Note that because the fee is typically assessed on gross income rather than net income, a franchisee may have to pay a monthly royalty even if the busi- ness is losing money. Royalty fees are usually around 5 percent of gross income.19

■ Advertising fees: Franchisees are often required to pay into a national or regional advertising fund, even if the advertisements are directed at goals other than promoting the franchisor’s product or service. (For example, advertising could focus on the franchisor’s attempt at attracting new fran- chisees.) Advertising fees are typically less than 3 percent of gross income.

■ Other fees: Other fees may be charged for various activities, including training additional staff, providing management expertise when needed, providing computer assistance, or providing a host of other items or sup- port services.

Although not technically a fee, many franchise organizations sell their fran- chisee products that they use in their businesses, such as restaurant supplies for a restaurant franchise. The products are often sold at a markup and may be more expensive than those the franchisee could obtain on the open market.

The most important question a prospective franchisee should consider is whether the fees and royalties charged by a franchisor are consistent with the franchise’s value or worth. If they are, then the pricing structure may be fair and equitable. If they are not, then the terms should be renegotiated or the prospective franchisee should look elsewhere.

An increasingly common way that franchise organizations decrease costs and increase sales is by partnering with one another through co-branding relation- ships. This practice is discussed in this chapter’s “Partnering for Success” feature.

3. Finding a Franchise

There are thousands of franchise opportunities available to prospective fran- chisees. The most critical step in the early stages of investigating franchise opportunities is for the entrepreneur to determine the type of franchise that is the best fit. For example, it is typically unrealistic for someone who is not a mechanic to consider buying a muffler repair franchise. A franchisor teaches a franchisee how to use the contents of a business model, not a trade. Before buying a franchise, a potential franchisee should imagine operating the pro- spective franchise or, better yet, should spend a period of time working in one of the franchisor’s outlets. After working in a print shop for a week, for exam- ple, someone who thought she might enjoy running a print shop might find out that she hates it. This type of experience could help avoid making a mistake that is costly both to the franchisee and to the franchisor.

There are many periodicals, websites, and associations that provide in- formation about franchise opportunities. Every Thursday and Saturday, for example, ads for franchise opportunities appear in special sections of the Wall Street Journal. Similar ads appear every Wednesday in USA Today. Periodicals featuring franchise opportunities include Inc. and Entrepreneur, and franchise- specific magazines to review include The Franchise Handbook and Franchise Times. Prospective franchisees should also consider attending franchise oppor- tunity shows that are held periodically in major U.S. cities and the International Franchise Expo, which is held annually in different cities across the United States. The U.S. Small Business Administration is another good source of fran- chise information. There are also several excellent franchise-focused individuals and organizations that post frequently on Twitter. Examples include Franchise Expert (@FranchiseBiz), Franchising.com (@Franchising_com), and Franchise Direct USA (@topfranchises). Because of the risks involved in franchising, the se- lection of a franchisor should be a careful, deliberate process. One of the smart- est moves a potential franchise owner can make is to talk to current franchisees and inquire if they are making money and if they are satisfied with their franchi- sor. Reflecting on how this approach helped ease her inhibitions about buying a franchise, Carleen Peaper, the owner of a Cruise Planner franchise, said:

I was really apprehensive about making an investment of my time and money into a franchise, so I e-mailed 50 Cruise Planner agents with a set of questions, asking for honest feedback. Everyone responded. That was a big thing and helped me de- termine that I wanted to join them.20

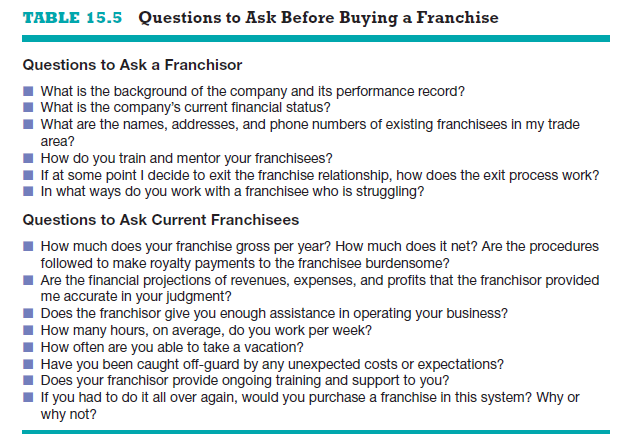

Table 15.5 contains a list of sample questions to ask a franchisor and some of its current franchisees before investing. Potential entrepreneurs can expect to learn a great deal by studying the answers they receive in response to these questions.

4. Advantages and Disadvantages of Buying a Franchise

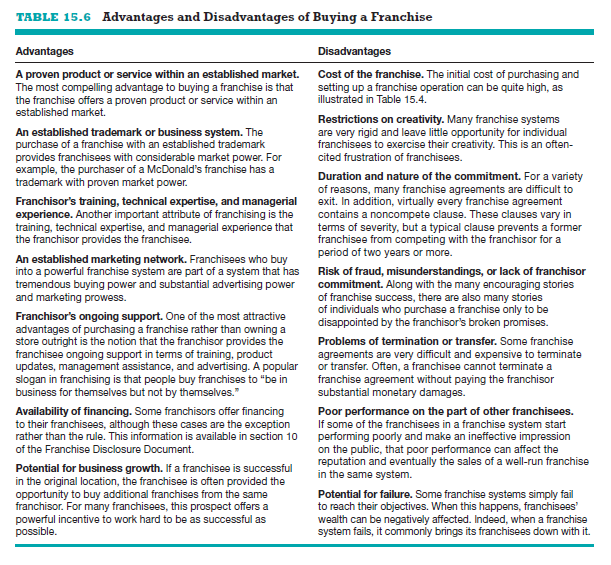

There are two primary advantages to buying a franchise over other forms of business ownership. First, franchising provides an entrepreneur the oppor- tunity to own a business using a tested and refined business model. This at- tribute lessens the probability of business failure. In addition, the trademark that comes with the franchise often provides instant legitimacy for a busi- ness.21 For example, an entrepreneur opening a new Gold’s Gym would likely attract more customers than an entrepreneur opening a new, independently owned fitness center because many people who are a part of the target market of Gold’s Gym have already heard of the firm and have a positive impression of it. Second, when an individual purchases a franchise, the franchisor typically provides training, technical expertise, and other forms of support. For exam- ple, many franchise organizations provide their franchisees periodic training both at their headquarters location and in their individual franchise outlets.

The cost involved is the main disadvantage of buying and operating a fran- chise. As mentioned earlier, the franchisee must pay an initial franchise fee. The franchisee must also pay the franchisor an ongoing royalty as well as pay into a variety of funds, depending on the franchise organization. Thus, fran- chisees have both immediate (i.e., the initial franchise fee) and long-term (i.e., continuing royalty payments) costs. By opening an independent business, an entrepreneur can keep 100 percent of the profits if it is successful.

Table 15.6 contains a list of the advantages and disadvantages of buying a franchise.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

Good web site! I really love how it is easy on my eyes and the data are well written. I’m wondering how I might be notified whenever a new post has been made. I have subscribed to your feed which must do the trick! Have a nice day!