When a business is launched, a form of legal entity must be chosen. Sole proprietorships, partnerships, corporations, and limited liability companies are the most common legal entities from which entrepreneurs make a choice.

Choosing a legal entity is not a one-time event. As a business grows and ma- tures, it is necessary to periodically review whether the current form of busi- ness organization remains appropriate.

There is no single form of business organization that works best in all situations. It’s up to the owners of a firm and their attorney to select the legal entity that best meets their needs. The decision typically hinges on several fac- tors, which are shown in Figure 7.3. It is important to be careful in selecting a legal entity for a new firm because each form of business organization involves trade-offs among these factors and because an entrepreneur wants to be sure to achieve the founders’ specific objectives.

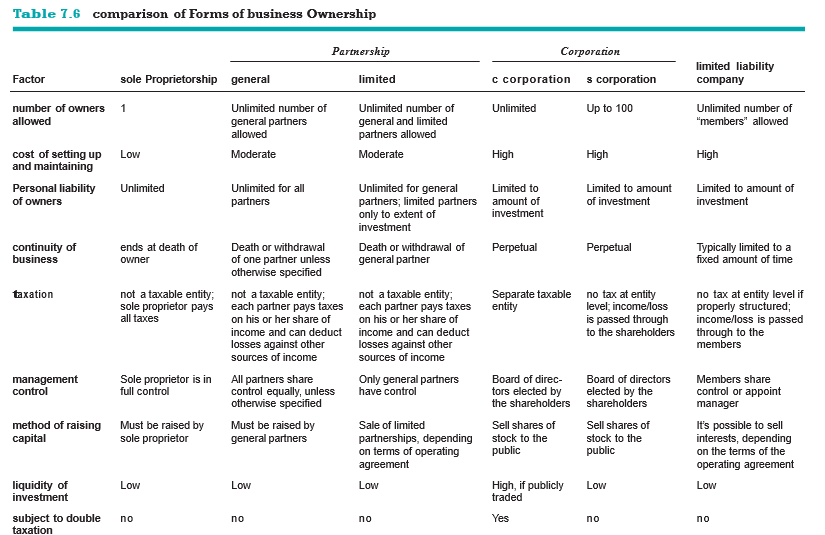

This section describes the four forms of business organization and dis- cusses the advantages and disadvantages of each. A comparison of the four legal entities, based on the factors that are typically the most important in making a selection, is provided in Table 7.6.

1. Sole Proprietorship

The simplest form of business entity is the sole proprietorship. A sole pro- prietorship is a form of business organization involving one person, and the person and the business are essentially the same. Sole proprietorships are the most prevalent form of business organization. The two most important advan- tages of a sole proprietorship are that the owner maintains complete control over the business and that business losses can be deducted against the own- er’s personal tax return.18

Setting up a sole proprietorship is cheap and relatively easy compared to the other forms of business ownership. The only legal requirement, in most states, is to obtain the appropriate license and permits to do business, as de- scribed in the previous section of the chapter.

If the business will be operated under a trade name (e.g., West Coast Graphic Design) instead of the name of the owner (e.g., Sam Ryan), the owner will have to file an assumed or fictitious name certificate with the appropriate local government agency, as mentioned earlier. This step is required to ensure that there is only one business in an area using the same name and provides a public record of the owner’s name and contact information.

A sole proprietorship is not a separate legal entity. For tax purposes, the profit or loss of the business flows through to the owner’s personal tax return document and the business ends at the owner’s death or loss of in- terest in the business. The sole proprietor is responsible for all the liabilities of the business, and this is a significant drawback. If a sole proprietor’s business is sued, the owner could theoretically lose all the business’s assets along with personal assets. The liquidity of an owner’s investment in a sole proprietorship is typically low. Liquidity is the ability to sell a business or other asset quickly at a price that is close to its market value.19 It is usu-ally difficult for a sole proprietorship to raise investment capital because the ownership of the business cannot be shared. Unlimited liability and difficulty raising investment capital are the primary reasons entrepreneurs typically form corporations or limited liability companies as opposed to sole proprietorships. Most sole proprietorships are salary-substitute or lifestyle firms (as described in Chapter 1) and are typically a poor choice for an ag- gressive entrepreneurial firm.

To summarize, the primary advantages and disadvantages of a sole propri- etorship are as follows:

Advantages of a Sole Proprietorship

■ Creating one is easy and inexpensive.

■ The owner maintains complete control of the business and retains all the profits.

■ Business losses can be deducted against the sole proprietor’s other sources of income.

■ It is not subject to double taxation (explained later).

■ The business is easy to dissolve.

Disadvantages of a Sole Proprietorship

■ Liability on the owner’s part is unlimited.

■ The business relies on the skills and abilities of a single owner to be successful. Of course, the owner can hire employees who have additional skills and abilities.

■ Raising capital can be difficult.

■ The business ends at the owner’s death or loss of interest in the business.

■ The liquidity of the owner’s investment is low.

2. Partnerships

If two or more people start a business, they must organize as a partnership, corporation, or limited liability company. Partnerships are organized as either general or limited partnerships.

General Partnerships A general partnership is a form of business organi- zation where two or more people pool their skills, abilities, and resources to run a business. The primary advantage of a general partnership over a sole propri- etorship is that the business isn’t dependent on a single person for its survival and success. In fact, in most cases, the partners have equal say in how the busi- ness is run. Most partnerships have a partnership agreement, which is a legal document that is similar to a founders’ agreement. A partnership agreement details the responsibilities and the ownership shares of the partners involved with an organization. The business created by a partnership ends at the death or withdrawal of a partner, unless otherwise stated in the partnership agreement. General partnerships are typically found in service industries. In many states, a general partnership must file a certificate of partnership or similar document as evidence of its existence. Similar to a sole proprietorship, the profit or loss of a general partnership flows through to the partner’s personal tax returns. If a busi- ness has four general partners and they all have equal ownership in the busi- ness, then one-fourth of the profits or losses would flow through to each partner’s individual tax return.20 The partnership files an informational tax return only.

The primary disadvantage of a general partnership is that the individual part- ners are liable for all the partnership’s debts and obligations. If one partner is negligent while conducting business on behalf of the partnership, all the partners may be liable for damages. Although the non-negligent partners may later try to recover their losses from the negligent one, the joint liability of all partners to the injured party remains. It is typically easier for a general partnership to raise money than a sole proprietorship simply because more than one person is willing to assume liability for a loan. One way a general partnership can raise investment capital is by adding more partners. Investors are typically reluctant to sign on as general partners, however, because of the unlimited liability that follows each one.

In summary, the primary advantages and disadvantages of a general part- nership are as follows:

Advantages of a general Partnership

■ Creating one is relatively easy and inexpensive compared to a corporation or limited liability company.

■ The skills and abilities of more than one individual are available to the firm.

■ Having more than one owner may make it easier to raise funds.

■ Business losses can be deducted against the partners’ other sources of income.

■ It is not subject to double taxation (explained later).

Disadvantages of a general Partnership

■ Liability on the part of each general partner is unlimited.

■ The business relies on the skills and abilities of a fixed number of partners.

Of course, similar to a sole proprietorship, the partners can hire employees who have additional skills and abilities.

■ Raising capital can be difficult.

■ Because decision making among the partners is shared, disagreements can occur.

■ The business ends at the death or withdrawal of one partner unless otherwise stated in the partnership agreement.

■ The liquidity of each partner’s investment is low.

Limited Partnerships A limited partnership is a modified form of a general partnership. The major difference between the two is that a limited partnership includes two classes of owners: general partners and limited partners. There are no limits on the number of general or limited partners permitted in a limited partnership. Similar to a general partnership, the gen- eral partners are liable for the debts and obligations of the partnership, but the limited partners are liable only up to the amount of their investment. The limited partners may not exercise any significant control over the organization without jeopardizing their limited liability status.21 Similar to general part- nerships, most limited partnerships have partnership agreements. A limited partnership agreement sets forth the rights and duties of the general and limited partners, along with the details of how the partnership will be man- aged and eventually dissolved.

A limited partnership is usually formed to raise money or to spread out the risk of a venture without forming a corporation. Limited partnerships are com- mon in real estate development, oil and gas exploration, and motion picture ventures.22

3. Corporations

A corporation is a separate legal entity organized under the authority of a state. Corporations are organized as either C corporations or subchapter S corporations. The following description pertains to C corporations, which are what most people think of when they hear the word corporation. Subchapter S corporations are explained later.

C Corporations A C corporation is a separate legal entity that, in the eyes of the law, is separate from its owners. In most cases, the corporation shields its owners, who are called shareholders, from personal liability for the debts and obligations of the corporation. A corporation is governed by a board of di- rectors, which is elected by the shareholders (more about this in Chapter 9). In most instances, the board hires officers to oversee the day-to-day management of the organization. It is usually easier for a corporation to raise investment capital than a sole proprietorship or a partnership because the sharehold- ers are not liable beyond their investment in the firm. It is also easier to al- locate partial ownership interests in a corporation through the distribution of stock. Most C corporations have two classes of stock: common and preferred. Preferred stock is typically issued to conservative investors who have pref- erential rights over common stockholders in regard to dividends and to the assets of the corporation in the event of liquidation. Common stock is issued more broadly than preferred stock. The common stockholders have voting rights and elect the board of directors of the firm. The common stockholders are typically the last to get paid in the event of the liquidation of the corpora- tion; that is, after the creditors and the preferred stockholders.23

Establishing a corporation is more complicated than a sole proprietorship or a partnership. A corporation is formed by filing articles of incorporation with the secretary of state’s office in the state of incorporation. The articles of incorporation typically include the corporation’s name, purpose, authorized number of stock shares, classes of stock, and other conditions of operation.24

In most states, corporations must file papers annually, and state agencies im- pose annual fees. It is important that a corporation’s owners fully comply with these regulations. If the owners of a corporation don’t file their annual paper- work, neglect to pay their annual fees, or commit fraud, a court could ignore the fact that a corporation has been established and the owners could be held personally liable for actions of the corporation. This chain of effects is referred to as “piercing the corporate veil.”25

A corporation is taxed as a separate legal entity. In fact, the “C” in the title “C corporation” comes from the fact that regular corporations are taxed under subchapter C of the Internal Revenue Code. A disadvantage of corporations is that they are subject to double taxation, which means that a corporation is taxed on its net income and, when the same income is distributed to share- holders in the form of dividends, is taxed again on shareholders’ personal in- come tax returns. This complication is one of the reasons that entrepreneurial firms often retain their earnings rather than paying dividends to their share- holders. The firm can use the earnings to fuel future growth and at the same time avoid double taxation. The hope is that the shareholders will ultimately be rewarded by an appreciation in the value of the company’s stock.

The ease of transferring stock is another advantage of corporations. It is often difficult for a sole proprietor to sell a business and even more awkward for a partner to sell a partial interest in a general partnership. If a corporation is listed on a major stock exchange, such as the New York Stock Exchange or the NASDAQ, an owner can sell shares at almost a moment’s notice. This advantage of incorporating, however, does not extend to corporations that are not listed on a major stock exchange. There are approximately 2,800 compa- nies listed on the New York Stock Exchange (with a market capitalization of approximately $18 trillion dollars) and 3,100 on the NASDAQ. These firms are public corporations. The stockholders of these 5,900 companies enjoy a liquid market for their stock, meaning that the stock can be bought and sold fairly easily through an organized marketplace. It is much more difficult to sell stock in closely held or private corporations. In a closely held corporation, the voting stock is held by a small number of individuals and is very thinly or infrequently traded.26 A private corporation is one in which all the shares are held by a few shareholders, such as management or family members, and are not publicly traded.27 The vast majority of the corporations in the United States are private corporations. The stock in both closely held and private cor- porations is fairly illiquid, meaning that it typically isn’t easy to find a buyer for the stock.

A final advantage of organizing as a C corporation is the ability to share stock with employees as part of an employee incentive plan. Because it’s easy to distribute stock in small amounts, many corporations, both public and private, distribute stock as part of their employee bonus or profit-sharing plans. Such in- centive plans are intended to help firms attract, motivate, and retain high-quality employees.28 Stock options are a special form of incentive compensation. These plans provide employees the option or right to buy a certain number of shares of their company’s stock at a stated price over a certain period of time. The most compelling advantage of stock options is the potential rewards to participants when (and if) the stock price increases.29 Many employees receive stock options at the time they are hired and then periodically receive additional options. As employees accumulate stock options, the link between their potential reward and their company’s stock price becomes increasingly clear. This link provides a powerful inducement for employees to exert extra effort on behalf of their firm in hopes of positively affecting the stock price.30

To summarize, the advantages and disadvantages of a C corporation are as follows:

Advantages of a C Corporation

■ Owners are liable only for the debts and obligations of the corporation up to the amount of their investment.

■ The mechanics of raising capital is easier.

■ No restrictions exist on the number of shareholders, which differs from subchapter S corporations.

■ Stock is liquid if traded on a major stock exchange.

■ The ability to share stock with employees through stock option or other incentive plans can be a powerful form of employee motivation.

Disadvantages of a C Corporation

■ Setting up and maintaining one is more difficult than for a sole proprietor- ship or a partnership.

■ Business losses cannot be deducted against the shareholders’ other sources of income.

■ Income is subject to double taxation, meaning that it is taxed at the corporate and the shareholder levels.

■ Small shareholders typically have little voice in the management of the firm.

Subchapter S Corporation A subchapter S corporation combines the advantages of a partnership and a C corporation. It is similar to a partner – ship in that the profits and losses of the business are not subject to double taxation. The subchapter S corporation does not pay taxes; instead, the prof- its or losses of the business are passed through to the individual tax returns of the owners. The S corporation must file an information tax return. An S corporation is similar to a C corporation in that the owners are not subject to personal liability for the behavior of the business. An additional advantage of the subchapter S corporation pertains to self-employment tax. By elect- ing the subchapter S corporate status, only the earnings actually paid out as salary are subject to payroll taxes. The ordinary income that is disbursed by the business to the shareholders is not subject to payroll taxes or self- employment tax.

Because of these advantages, many entrepreneurial firms start as sub- chapter S corporations. There are strict standards that a business must meet to qualify for status as a subchapter S corporation:

■ The business cannot be a subsidiary of another corporation.

■ The shareholders must be U.S. citizens. Partnerships and C corporations may not own shares in a subchapter S corporation. Certain types of trusts and estates are eligible to own shares in a subchapter S corporation.

■ It can have only one class of stock issued and outstanding (either pre- ferred stock or common stock).

■ It can have no more than 100 members. Husbands and wives count as one member, even if they own separate shares of stock. In some instances, family members count as one member.

■ All shareholders must agree to have the corporation formed as a subchap- ter S corporation.

The primary disadvantages of a subchapter S corporation are restrictions in qualifying, expenses involved with setting up and maintaining the sub- chapter S status, and the fact that a subchapter S corporation is limited to 100 shareholders.31 If a subchapter S corporation wants to include more than 100 shareholders, it must convert to a C corporation or a limited liability company.

4. Limited liability company

The limited liability company (LLC) is a form of business organization that is rapidly gaining popularity in the United States. The concept originated in Germany and was first introduced in the United States in the state of Wyoming in 1978. Along with the subchapter S corporation, it is a popular choice for start-up firms. As with partnerships and corporations, the profits of an LLC flow through to the tax returns of the owners and are not subject to double taxation. The main advantage of the LLC is that all partners enjoy limited liability. This differs from regular and limited partnerships, where at least one partner is liable for the debts of the partnership. The LLC combines the limited liability advantage of the corporation with the tax advantages of the partnership.32

Some of the terminology used for an LLC differs from the other forms of business ownership. For example, the shareholders of an LLC are called “members,” and instead of owning stock, the members have “interests.” The LLC is more flexible than a subchapter S corporation in terms of number of owners and tax-related issues. An LLC must be a private business—it cannot be publicly traded. If at some point the members want to take the business public and be listed on one of the major stock exchanges, it must be converted to a C corporation.

The LLC is rather complex to set up and maintain, and in some states the rules governing the LLC vary. Members may elect to manage the LLC themselves or may designate one or more managers (who may or may not be members) to run the business on a day-to-day basis. The profits and losses of the busi- ness may be allocated to the members anyway they choose. For example, if two people owned an LLC, they could split the yearly profits 50–50, 75–25, 90–10, or any other way they choose.33

In summary, the advantages and disadvantages of an LLC are as follows:

Advantages of a limited liability Company

■ Members are liable for the debts and obligations of the business only up to the amount of their investment.

■ The number of shareholders is unlimited.

■ An LLC can elect to be taxed as a sole proprietor, partnership, S corporation, or corporation, providing much flexibility.

■ Because profits are taxed only at the shareholder level, there is no double taxation.

Disadvantages of a limited liability Company

■ Setting up and maintaining one is more difficult and expensive.

■ Tax accounting can be complicated.

■ Some of the regulations governing LLCs vary by state.

■ Because LLCs are a relatively new type of business entity, there is not as much legal precedent available for owners to anticipate how legal disputes might affect their businesses.

■ Some states levy a franchise tax on LLCs—which is essentially a fee the LLC pays the state for the benefit of limited liability.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

I believe you have observed some very interesting points, regards for the post.