The most critical element in planning international market entry strategies is the choice of the product. A company with a single product needs only to decide whether that product is a suitable candidate for international market entry, that is, a product with good enough prospects to warrant an investigation of foreign markets. But the majority of companies with two or more products must decide which of these products is the best candidate for expansion abroad.

1. Product Screening

Product screening is intended to save time and money by indicating which of a company’s products, if any, justifies a systematic appraisal of interna-tional markets. The profile of an ideal product candidate drawn up by a company’s managers would probably include the following features: ready market acceptance, high profit potential, availability from existing production facilities, and suitability for marketing abroad in much the same way as at home. Only some companies will have a product that rates highly on all these features, but a candidate product must possess certain advantages that will allow it to obtain a competitive niche in foreign markets. These advantages may be low price or distinctive features (quality, design, technical superiority, and the like) that differentiate the candidate product from rival products.

For the most part, U.S. manufacturers must rely on product differentiation rather than price to achieve a competitive position in foreign markets, although price can seldom be ignored as an influence on buying decisions. Hence a good candidate product is almost always found among a company’s most competitive products in the home market. Conversely, a product not competitive at home is a poor candidate for foreign markets. However, a good candidate product may face a mature or declining market at home if its life cycle is more advanced at home than abroad.

Company managers need to appraise each product by getting answers to the following questions:

- Is this product competitive at home? What are its competitive strengths and weaknesses?

- What need (or needs) does this product serve in the domestic market? Do these same needs exist in foreign markets? If they do, which products currently meet those needs in foreign markets? If they do not, can this product serve other needs that do exist in foreign markets?

- How new is this product to foreign markets? How much competition is it likely to encounter? What competitive advantages and disadvantages does this product have in foreign markets?

- Does this product have the same use conditions in foreign markets as in the home market?

- Does this product require after-sales services or complementary products for its use? Are they available in foreign markets?

- Does this product have to be adapted to foreign markets in one or more of its physical, package, and service attributes?

- Can this product be marketed abroad the same way as at home?

Answers to these questions relating to foreign markets are seldom specific at this early planning stage prior to a systematic investigation of international markets. But even answers based on general knowledge should help managers choose a candidate product.

2. The Global Product Life Cycle

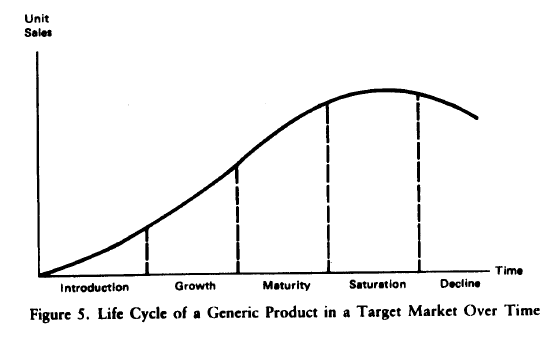

The concept of a product life cycle can also assist managers in choosing a candidate product for foreign markets. All generic products experience a life cycle, whose shape and duration vary from one product to another, and from one country market to another for the same generic product. The conventional product life cycle is depicted in Figure 5.

In the introduction phase, the product is new to the market and the innovating company strives to develop an awareness of the product’s benefits and to obtain a trial use by early adopters. In the growth phase, sales of the product move up rapidly due to the cumulative effects of promotion and distribution efforts by the innovating company and by rival companies that now enter the market with their own versions of the product. In the maturity phase, sales growth continues but at a diminishing rate while competition intensifies as rival sellers try to maintain market shares. In the saturation phase, sales reach a plateau determined by the level of replacement demand, and rival sellers defend their brands against other brands and against other (newer) substitute products. As individual company products lose their differentiation and price competition becomes more intense, sellers direct their efforts at cutting production and marketing costs. Competition becomes relatively stable unless a seller makes substantial improvements in the generic product. In the decline phase, sales start to drop as the product is progressively replaced by a new generic product. Several competitors abandon the product while others try to “milk” the product of all possible profits.

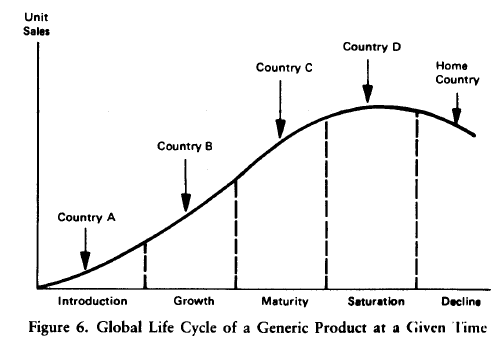

The life cycle concept is ordinarily used by managers to analyze the dynamics of a given target country market over time, but it can also be used to identify the relative positions of a generic product in several country markets at the same time. This global product life cycle is shown in Figure 6.

Firms in the United States and a small number of other advanced countries introduce most of the new consumer and industrial products. Generally, new products are first commercialized in the home market and then spread to other country markets at varying speeds. At any one time, therefore, a product occupies different phases of the global life cycle in different countries. It is at the most advanced phase in the home country and the next most advanced phase in other industrial countries, while it is at earlier phases in developing countries. Indeed, it may not have been introduced at all in the least developed countries. At some time in the future, the global life cycle will run its course as the generic product in question experiences saturation and decline in all country markets.

The global product life cycle has important implications for companies contemplating international market entry. A company that faces a saturated or declining home market for its product may be able to exploit growth opportunities in foreign markets in earlier phases of the product cycle. Putting the matter another way, managers should look for a candidate product that occupies early phases of the life cycle abroad. Also, since different national markets have different imitation lags with respect to the home (innovating) country, the global product life cycle can help managers in the selection of foreign target markets.

As communication among national markets improves and as more countries come closer to matching the affluence and sophistication of the United States and other advanced countries, product imitation lags become ever shorter. This speed-up in global product life cycles means that companies must respond more quickly than in the past to foreign market opportunities. If a company delays foreign market entry, it is likely to find that its product type has already reached advanced phases of the life cycle in other industrial countries. Multinational firms are now introducing new products simultaneously in several national markets, and by so doing they are not only responding to the speed-up of the global product life cycle but also adding to it.1

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.