An international market entry mode is an institutional arrangement that makes possible the entry of a company’s products, technology, human skills, management, or other resources into a foreign country. For a domestic company already located in the country that contains its market, the question of entry mode as distinguished from market entry (the marketing plan) simply does not arise. In contrast, the international company initially stands outside both the foreign country and the market it contains, and it must find a way to enter the country as well as a way to enter the market. Hence the international company must decide on both an entry mode and a marketing plan for each foreign target country.

From an economist’s perspective, a company can arrange entry into a foreign country in only two ways. First, it can export its products to the target country from a production base outside that country. Second, it can transfer its resources in technology, capital, human skills, and enterprise to the foreign country, where they may be sold directly to users or combined with local resources (especially labor) to manufacture products for sale in local markets. Companies whose end products are services cannot produce them at home for sale abroad and must, therefore, use this second way to enter a foreign country.

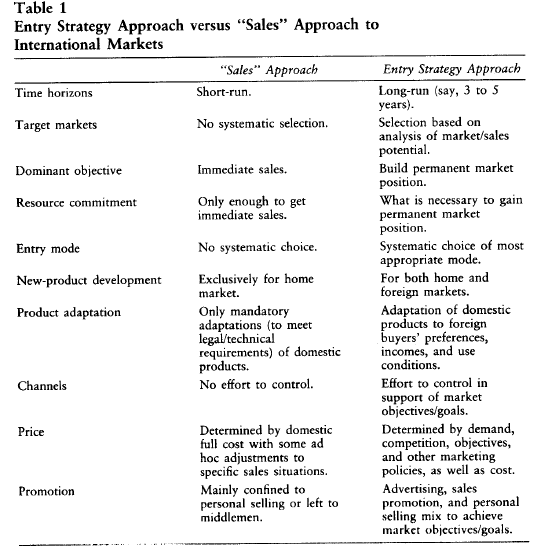

From a management/operations perspective, these two forms of entry break down into several distinctive entry modes, which offer different benefits and costs to the international company. The classification of entry modes used in this text is as follows:

Export Entry Modes

Indirect

Direct agent/distributor

Direct branch/subsidiary

Other

Contractual Entry Modes

Licensing

Franchising

Technical agreements

Service contracts

Management contracts

Construction/turnkey contracts

Contract manufacture

Co-production agreements

Other

Investment Entry Modes

Sole venture: new establishment

Sole venture: acquisition

Joint venture: new establishment/acquisition

Other

Since these modes are described and evaluated in later chapters, we cite here only their distinguishing features.

Export entry modes differ from the other two primary entry modes (contractual and investment) in that a company’s final or intermediate product is manufactured outside the target country and subsequently transferred to it. Thus exporting is confined to physical products. Indirect exporting uses middlemen who are located in the company’s own country and who actually do the exporting. In contrast, direct exporting does not use home country middlemen, although it may use target country middlemen. The latter leads to a distinction between direct agent!distributor exporting, which depends on target country middlemen to market the exporter’s product, and direct branch!subsidiary exporting, which depends on the company’s own operating units in the target country. The latter form of exporting therefore requires equity investment in marketing institutions located in the target country.

Contractual entry modes are long-term nonequity associations between an international company and an entity in a foreign target country that involve the transfer of technology or human skills from the former to the latter. Contractual entry modes are distinguished from export modes because they are primarily vehicles for the transfer of knowledge and skills, although they may also create export opportunities. They are distinguished from investment entry modes because there is no equity investment by the international company. In a licensing arrangement, a company transfers to a foreign entity (usually another company) for a defined period of time the right to use its industrial property (patents, know-how, or trademarks) in return for a royalty or other compensation. Although similar, franchising differs from licensing in motivation, services, and duration. In addition to granting the right to use the company name, trademarks, and technology, the franchisor also assists the franchisee in organization, marketing, and general management under an arrangement intended to be permanent. Other contractual entry modes involve the transfer of services directly to foreign entities in return for monetary compensation (technical agreements, service contracts, management contracts, and construction/turnkey contracts) or in return for products manufactured with those services (contract manufacture and co-production agreements). International companies frequently combine contractual entry modes with export or investment modes.

Investment entry modes involve ownership by an international company of manufacturing plants or other production units in the target country. In terms of the production stage, these subsidiaries may range all the way from simple assembly plants that depend entirely on imports of intermediate products from the parent company (and may be regarded as an extension of the export entry mode) to plants that undertake the full manufacture of a product. In terms of ownership and management control (which is the distinctive feature of this entry mode), foreign production affiliates may be classified as sole ventures with full ownership and control by the parent company or as joint ventures with ownership and control shared between the parent company and one or more local partners, who usually represent a local company. An international company may start a sole venture from scratch (new establishment) or by acquiring a local company (acquisition).

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

Generally I do not learn article on blogs, however I would like to say that this write-up very pressured me to try and do it! Your writing taste has been amazed me. Thank you, quite great post.

Excellent website. Plenty of useful information here. I’m sending it to some pals ans additionally sharing in delicious. And naturally, thank you to your sweat!