A retailer may be categorized by its strategy mix, the firm’s particular combination of store location, operating procedures, goods/services offered, pricing tactics, store atmosphere and customer services, and promotional methods.

Store location refers to the use of a store or nonstore format, placement in a geographic area, and the kind of site (such as a shopping center). Operating procedures include the personnel employed, management style, store hours, and other factors. The goods/services offered may encompass many product categories or just one; quality may be low, medium, or high. Pricing refers to the use of prestige pricing (creating a quality image), competitive pricing (setting prices at the level of rivals), or penetration pricing (underpricing other retailers). Store atmosphere and customer services are reflected by the physical facilities and personal attention, return policies, delivery, and more. Promotion involves activities in such areas as advertising, displays, personal selling, and sales promotion. By combining the elements, a retailer can devise a unique strategy.

To flourish today, a retailer should strive to be dominant in some way. The firm may then reach destination retailer status, whereby consumers view the company as distinctive enough to be loyal to it and go out of their way to shop there. We tend to link “dominant” with “large geographic footprint.” Yet, both small and large retailers can be influential in different ways, by dominating their consumer’s choices based on time, money spent, or status upheld. As shown here, there are many ways to be a destination retailer, and combining two or more approaches can yield even greater appeal for a given retailer:

- Be price-oriented and cost-efficient to attract price-sensitive shoppers.

- Be upscale to attract full-service, status-conscious consumers.

- Be convenient to attract those consumers who want shopping ease, nearby locations, or extended hours.

- Offer a dominant assortment in the product lines carried to appeal to customers interested in variety and in-store shopping comparisons.

- Offer superior customer service to attract those frustrated by the decline in retail service.

- Be innovative or exclusive and provide a unique way of operating (such as kiosks at airports) or carry products/brands not stocked by others to reach people who are innovators or bored.

Before looking at specific strategy mixes, let’s consider three concepts that help explain the use of these mixes: the wheel of retailing, scrambled merchandising, and the retail life cycle—as well as the ways in which retail strategies are evolving.

1. The Wheel of Retailing

According to the wheel of retailing theory, retail innovators often first appear as low-price operators with low costs and low profit margin requirements. Over time, the innovators upgrade the products they carry and improve their facilities and customer service (by adding better-quality items, locating in higher-rent sites, providing credit and delivery, and so on), and prices rise. As innovators mature, they become vulnerable to new discounters with lower costs—hence, the wheel of retailing.1 See Figure 5-1.

The wheel is based on four principles: (1) Many price-sensitive shoppers will trade customer services, wide selections, and convenient locations for lower prices. (2) Price-sensitive shoppers are often not loyal and will switch to retailers with lower prices. In contrast, prestige-oriented customers enjoy shopping at retailers with high-end strategies. (3) New institutions are frequently able to have lower operating costs than existing formats. (4) As retailers move up the wheel, they typically do so to increase sales, broaden the target market, and improve their image.

For example, when traditional department store prices became too high for many consumers, the growth of the full-line discount store (led by Walmart) was the result. The full-line discount store stressed low prices because of such cost-cutting techniques as having a small sales force, situating in lower-rent store locations, using inexpensive fixtures, emphasizing high stock turnover, and accepting only cash or check payments for goods. Then, as full-line discount stores prospered, they typically sought to move up a little along the wheel. This meant enlarging the sales force, improving locations, upgrading fixtures, carrying a greater selection of merchandise, and accepting credit. These improvements led to higher costs, which led to somewhat higher prices. The wheel of retailing again came into play as newer discounters, such as off-price chains, factory outlets, and permanent flea markets, expanded to satisfy the needs of the most price-conscious consumer. More recently, we have witnessed the birth of discount Web retailers, some of which have very low costs because they do not have “brick- and-mortar” facilities.

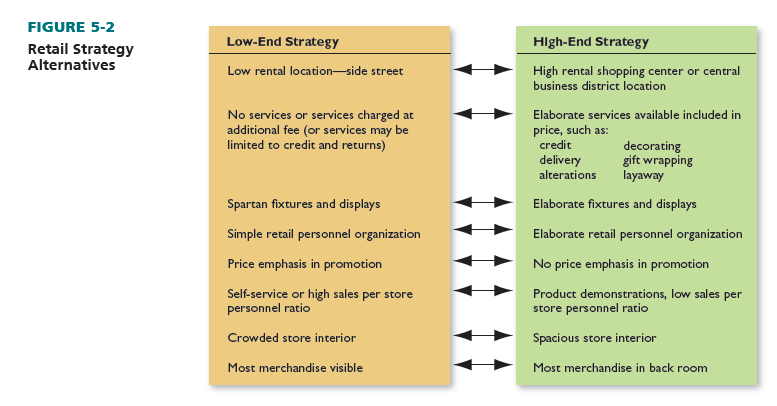

As indicated in Figure 5-1, the wheel of retailing reveals three basic strategic positions: low end, medium, and high end. The medium strategy may have some problems if retailers in this position are not perceived as distinctive. In a mature format such as department stores, competitors at the higher-end and lower-end can steal market share from a middle-of-the-road retailer such as Sears. Its merchandising strategy of selling a vast array of mid-priced goods and services, and a failure to anticipate and react as department stores have diverged into two separate approaches (one at the low end and one at the high end), is threatening its survival as a retailer.2 Figure 5-2 shows the opposing alternatives in considering a strategy mix.

The wheel of retailing suggests that established firms should be wary of adding services or converting a strategy from low end to high end. Because price-conscious shoppers are not usually loyal, they are apt to switch to lower-priced firms. Furthermore, retailers may then eliminate the competitive advantages that initially led to profitability. This occurred with the retail catalog showroom, a now defunct retail format.

2. Scrambled Merchandising

Whereas the wheel of retailing focuses on product quality, prices, and customer service, scrambled merchandising involves a retailer increasing its width of assortment (the number of different product lines carried). Scrambled merchandising occurs when a retailer adds goods and services that may be unrelated to each other and to the firm’s original business. See Figure 5-3.

Scrambled merchandising is popular for many reasons: Retailers want to increase overall revenues; fast-selling, highly profitable goods and services are usually the ones added; consumers make more impulse purchases; people like one-stop shopping; different target markets may be reached; and the impact of seasonality and competition is reduced. In addition, the popularity of a retailer’s original product line(s) may decline, causing it to scramble to maintain and grow the customer base. For example, although Starbucks’ in-store coffee sales are still strong, it now faces more competition in the coffee market from Dunkin’ Donuts (www .dunkindonuts.com), McDonald’s (www.mcdonalds.com), and other chains that have upgraded their offerings. Today, Starbucks (www.starbucks.com) carries many items outside its original coffee business, including pastries, hot breakfasts, salads, sandwiches, smoothies, and even wine at some locations.

Scrambled merchandising is contagious. Drugstores, bookstores, florists, kitchenware stores and gift shops are all affected by supermarkets’ scrambled merchandising. A significant amount of U.S. supermarket sales are from general merchandise, health and beauty aids, and other nongrocery items, such as pharmacy items, magazines, flowers, and kitchen items. In response, drugstores and others are pushed into scrambled merchandising to fill the sales void caused by supermarkets. Drugstores have added toys and gift items, greeting cards, batteries, and cameras. This then creates a void for additional retailers, which are also forced to scramble.

The prevalence of scrambled merchandising means greater competition among different types of retailers, and distribution costs are affected as sales are dispersed over more retailers. There are other limitations to scrambled merchandising, including the potential lack of retailer expertise in buying, selling, and servicing unfamiliar items; the costs associated with a broader assortment (including lower inventory turnover); and the possible harm to a retailer’s image if scrambled merchandising is ineffective.

3. The Retail Life Cycle

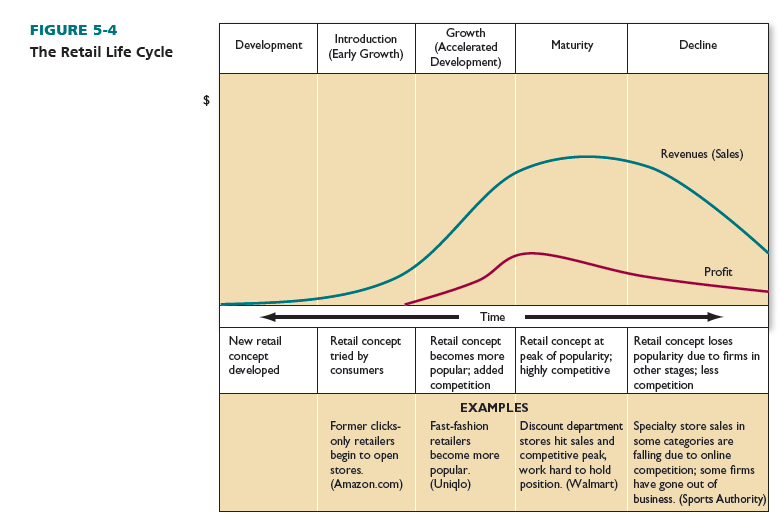

The retail life cycle concept states that retail institutions—like the goods and services they sell— pass through identifiable life stages: introduction (early growth), growth (accelerated development), maturity, and decline. The direction and speed of institutional changes can be interpreted from this concept.3 Take a look at Figure 5-4. The figure shows the five stages of the retail life cycle, with a brief description of each. Examples of each stage are shown at the bottom of the figure.

Let’s examine the retail life cycle as it applies to individual institutional formats and highlight specific examples. During the first stage of the cycle, introduction, there is a strong departure from the strategy mixes of existing retail institutions. A firm in this stage significantly alters at least one element of the strategy mix from that of traditional competitors. Sales and then profits often rise sharply for the first firms in the new category. At this stage, long-run success is not assured. There are risks that new institutions will not be accepted by shoppers, and there may be large initial losses due to heavy investments.

One retail format in the innovation stage is the online flash-sale retail Web site. Many flash- sale Web sites specialize in selling few items in limited sizes and colors of high-end brand apparel at significantly lower-prices for a short time—often a few hours—to bargain-seeking customers who subscribe to their service.

The early category leader was Gilt Groupe (www.gilt.com), which was launched in the United States in 2007 and is owned by Hudson’s Bay. Others include Rue La La (www.rulelala.com), Ideel (www.ideel.com), Haute Look (www.hautelook.com), The RealReal (www.therealreal.com), and Zulily (www.zulily.com), which caters to mothers and young children and is the only publicly traded company in this category.4 During the economic downturn starting in 2008, store sales of high-end brands dropped dramatically, which resulted in manufacturers and retailers needing to find buyers quickly to unload excess inventory of high-end products. This provided the perfect opportunity for flash sales to emerge and succeed in the market.

The economy and consumers’ financial situations have since improved and demand for high- end items has increased. Some high-end brands scaled back production during the recession and are now more conservative about increasing production despite higher demand. Given the lower volume of liquidated high-end goods, and the purchasing power of off-price retailers such as T. J. Maxx, which can make early buys, some flash-sale sites are struggling to get inventory. Sparser selections and higher shipping rates compared to larger apparel retailers have led to a slowdown in growth.5 Flash sites are adapting by merging with larger players, diversifying into multiple product categories such as art, household goods (Beyond the Rack), and consignments (The RealReal) or to a hybrid retail model—offering curated collections (Trunk Club) or personal closet service (Gilt Groupe).6

In the growth stage, both sales and profits exhibit rapid growth. Existing firms expand geographically, and newer companies of the same type enter. Toward the end of accelerated development, cost pressures (to cover a larger staff, a more complex inventory system, and extensive controls) may begin to affect profits.

The interactive electronic video kiosk is an institution in the growth stage. Today, kiosks sell everything from clothing to magazines to insurance to personal computers (PCs). Kiosks come in many forms: self-checkout machines; ticketing kiosks (at amusement parks, parking facilities, movie theaters, etc.); check-in kiosks (at hotels); food-ordering kiosks; postal kiosks (to mail packages and letters); and miscellaneous kiosks (such as DVD rental). According to one research report, U.S. retail revenues generated by kiosks exceeded $1 trillion as of 2015.7 This format is examined further in Chapter 6.

The third stage of the retail life cycle, maturity, is characterized by slow sales growth for the institutional type. Although overall sales may continue to go up, that rise is at a much lower rate than during prior stages. Profit margins may have to be reduced to stimulate purchases. Maturity is brought on by market saturation caused by the high number of firms in an institutional format, competition from newer institutions, changing societal interests, and inadequate management skills to lead mature or larger firms. Once maturity is reached, the goal is to sustain it as long as possible and not to fall into decline.

The beer, wine, and liquor store—a specialty store—is in the maturity stage; sales are rising, but slowly compared to earlier times. This is due to competition from membership clubs, mailorder wine retailers, and supermarkets (in states allowing wine or liquor sales); changing lifestyles and attitudes regarding alcoholic beverages; a national 21-year-old drinking age requirement; and limits on nonalcoholic items that these stores are permitted to sell in some locales.

The final stage in the retail life cycle is decline, whereby industrywide sales and profits for a format fall off, many firms abandon the format, and newer formats attract consumers previously committed to that retailer type. In some cases, a decline may be hard or almost impossible to reverse. In others, it may be avoided or postponed by repositioning the institution.

After peaking in the 1980s, the retail catalog showroom declined thereafter; it vanished in the United States in 1998 as the leading firms went out of business. With this format, consumers chose items from a catalog, shopped in a warehouse setting, and wrote up orders. Why did it fade away? Many other retailers cut costs and prices, so showrooms were no longer low-price leaders. Catalogs had to be printed far in advance. Many items were slow-sellers or had low margins. Some people found showrooms crowded and disliked writing orders, a lack of displays reduced browsing, and the paucity of apparel goods held down revenues. Note: Great Britain’s Argos chain (www.argos.co.uk), part of Home Retail Group, operates 845 catalog showrooms, making it the largest general goods retailer in Great Britain.8

On the other hand, conventional supermarkets have slowed their decline by placing new units in suburban shopping centers, redesigning interiors, lengthening store hours, offering lower prices, expanding the use of scrambled merchandising, closing unprofitable smaller units, and converting to larger outlets.

The life-cycle concept highlights the proper retailer response as formats evolve. Expansion should be the focus initially, administrative skills and operations become critical in maturity, and adaptation is essential at the end of the cycle.

Source: Barry Berman, Joel R Evans, Patrali Chatterjee (2017), Retail Management: A Strategic Approach, Pearson; 13th edition.

I would like to thnkx for the efforts you have put in writing this site. I’m hoping the same high-grade web site post from you in the upcoming as well. In fact your creative writing skills has inspired me to get my own web site now. Really the blogging is spreading its wings fast. Your write up is a great example of it.