Generally accepted accounting principles require that unusual items be reported separately on the income statement. This is because such items do not occur frequently and are typically unrelated to current operations. Without separate reporting of these items, users of the financial statements might be misled about current and future operations. Unusual items on the income statement are classified as one of the following:

- Affecting the current period income statement

- Affecting a prior period income statement

1. Unusual Items Affecting the Current Period’s Income Statement

Unusual items affecting the current period’s income statement include the following:

- Discontinued operations

- Extraordinary items

These items are reported separately on the income statement for any period in which they occur.

Discontinued Operations A company may discontinue a segment of its operations by selling or abandoning the segment’s operations. For example, a retailer might decide to sell its product only online and, thus, discontinue selling its merchandise at its retail outlets (stores).

Any gain or loss on discontinued operations is reported on the income statement as a Gain (or loss) from discontinued operations. It is reported immediately following Income from continuing operations.

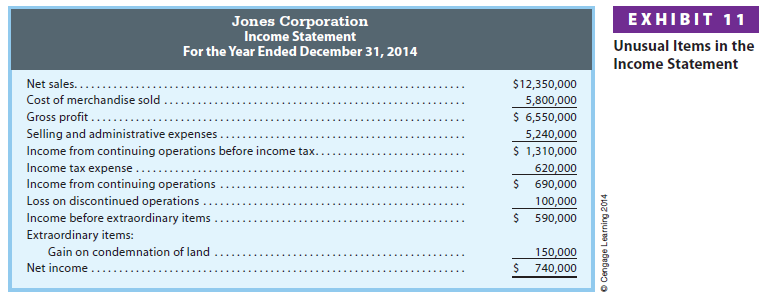

To illustrate, assume that Jones Corporation produces and sells electrical products, hardware supplies, and lawn equipment. Because of a lack of profits, Jones discontinues its electrical products operation and sells the remaining inventory and other assets at a loss of $100,000. Exhibit 11 illustrates the reporting of the loss on discontinued operations.[1]

In addition, a note accompanying the income statement should describe the operations sold, including such details as the date operations were discontinued, the assets sold, and the effect (if any) on current and future operations.

Extraordinary Items An extraordinary item is defined as an event or a transaction that has both of the following characteristics:

- Unusual in nature

- Infrequent in occurrence

Gains and losses from natural disasters such as floods, earthquakes, and fires are normally reported as extraordinary items, provided that they occur infrequently. Gains or losses from land or buildings taken (condemned) for public use are also reported as extraordinary items.

Any gain or loss from extraordinary items is reported on the income statement as Gain (or loss) from extraordinary item. It is reported immediately following Income from continuing operations and any Gain (or loss) on discontinued operations.

To illustrate, assume that land owned by Jones Corporation was taken for public use (condemned) by the local government. The condemnation of the land resulted in a gain of $150,000. Exhibit 11 illustrates the reporting of the extraordinary gain.[2]

Reporting Earnings per Share Earnings per common share should be reported separately for discontinued operations and extraordinary items. To illustrate, a partial income statement for Jones Corporation is shown in Exhibit 12. The company has 200,000 shares of common stock outstanding.

Exhibit 12 reports earnings per common share for income from continuing operations, discontinued operations, and extraordinary items. However, only earnings per share for income from continuing operations and net income are required by generally accepted accounting principles. The other per-share amounts may be presented in the notes to the financial statements.

2. Unusual Items Affecting the Prior Period’s Income Statement

An unusual item may occur that affects a prior period’s income statement. Two such items are as follows:

- Errors in applying generally accepted accounting principles

- Changes from one generally accepted accounting principle to another

If an error is discovered in a prior period’s financial statement, the prior-period statement and all following statements are restated and thus corrected.

A company may change from one generally accepted accounting principle to another. In this case, the prior-period financial statements are restated as if the new accounting principle had always been used.5

For both of the preceding items, the current-period earnings are not affected. That is, only the earnings reported in prior periods are restated. However, because the prior earnings are restated, the beginning balance of Retained Earnings may also have to be restated. This, in turn, may cause the restatement of other balance sheet accounts. Illustrations of these types of adjustments and restatements are provided in advanced accounting courses.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Hello! Do you use Twitter? I’d like to follow you if that would be okay.

I’m definitely enjoying your blog and look forward to new posts.

This is very interesting, You’re a very skilled blogger.

I have joined your rss feed and look forward to seeking more of your excellent post.

Also, I’ve shared your site in my social networks!

It’s wonderful that you are getting thoughts from this article as well as

from our argument made at this time.

I think this is a real great article post.Really looking forward to read more. Fantastic.