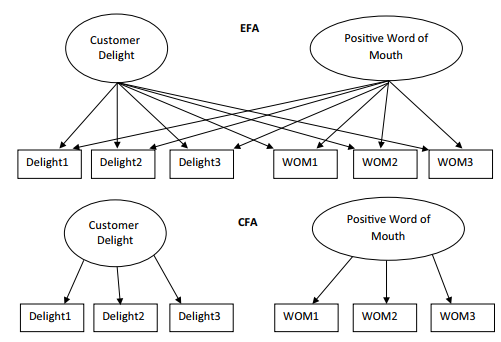

An exploratory factor analysis (EFA) is useful in data reduction of a large number of indicators and can be quite helpful in seeing if indicators are measuring more than one construct. EFAs are typically the first step in determining if an indicator is measuring a construct. In an EFA, the researcher is not denoting which indicators are measuring a construct.The analysis simply tries to let every indicator load on every construct. This is where “cross loading” can occur, where an indicator is actually loading strongly on more than one construct.This is a concern that your indicator is not a strong measure of the specified construct. In contrast, a CFA does not allow an indicator to load on more than one construct. The researcher prior to the analysis will specify what the indicators are for each construct, and those indicators can load only on that specific construct. Other ways that an EFA and CFA are different is an EFA is typically conducted with correlation matrices, which can be problematic in comparing parameters across samples. CFA uses a covariance matrix and is more adept at handling comparisons across samples.An EFA will also consider data rotation that is often done to achieve a better loading of indicators on a con- struct or sometimes a reduction of cross loading with other constructs. A CFA does not worry about rotation because you are denoting the specific items that are loading on a construct. For a graphic representation of EFA versus CFA, see Figure 4.2.

Figure 4.2 Difference between EFA and CFA

Source: Thakkar, J.J. (2020). “Procedural Steps in Structural Equation Modelling”. In: Structural Equation Modelling. Studies in Systems, Decision and Control, vol 285. Springer, Singapore.

28 Mar 2023

31 Mar 2023

29 Mar 2023

30 Mar 2023

22 Sep 2022

21 Sep 2022