When a board of directors declares a cash dividend, it authorizes the distribution of cash to stockholders. When a board of directors declares a stock dividend, it authorizes the distribution of its stock. In both cases, declaring a dividend reduces the retained earnings of the corporation.

1. Cash Dividends

A cash distribution of earnings by a corporation to its shareholders is a cash dividend. Although dividends may be paid in other assets, cash dividends are the most common. Three conditions for a cash dividend are as follows:

- Sufficient retained earnings

- Sufficient cash

- Formal action by the board of directors

There must be a sufficient (large enough) balance in Retained Earnings to declare a cash dividend. That is, the balance of Retained Earnings must be large enough so that the dividend does not create a debit balance in the retained earnings account. However, a large Retained Earnings balance does not mean that there is cash available to pay dividends. This is because the balances of Cash and Retained Earnings are often unrelated.

Even if there are sufficient retained earnings and cash, a corporation’s board of directors is not required to pay dividends. Nevertheless, many corporations pay quarterly cash dividends to make their stock more attractive to investors. Special or extra dividends may also be paid when a corporation experiences higher than normal profits.

Three dates included in a dividend announcement are as follows:

- Date of declaration

- Date of record

- Date of payment

The date of declaration is the date the board of directors formally authorizes the payment of the dividend. On this date, the corporation incurs the liability to pay the amount of the dividend.

The date of record is the date the corporation uses to determine which stockholders will receive the dividend. During the period of time between the date of declaration and the date of record, the stock price is quoted as selling with-dividends. This means that any investors purchasing the stock before the date of record will receive the dividend.

The date of payment is the date the corporation will pay the dividend to the stockholders who owned the stock on the date of record. During the period of time between the record date and the payment date, the stock price is quoted as selling ex-dividends. This means that since the date of record has passed, any new investors will not receive the dividend.

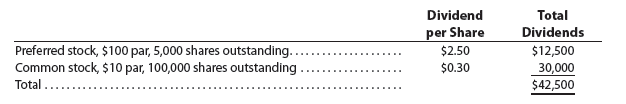

To illustrate, assume that on October 1 Hiber Corporation declares the cash dividends shown below with a date of record of November 10 and a date of payment of December 2.

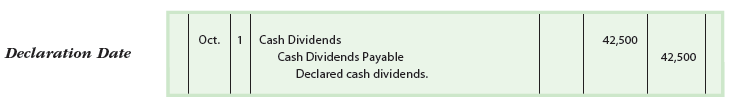

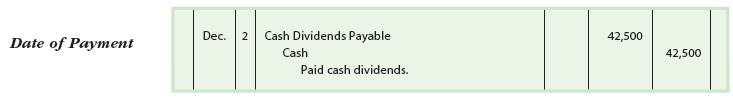

On October 1, the declaration date, Hiber Corporation records the following entry:

Date of Record

On November 10, the date of record, no entry is necessary. This date merely determines which stockholders will receive the dividends.

On December 2, the date of payment, Hiber Corporation records the payment of the dividends as follows:

At the end of the accounting period, the balance in Cash Dividends will be transferred to Retained Earnings as part of the closing process. This closing entry debits Retained Earnings and credits Cash Dividends for the balance of the cash dividends account. If the cash dividends have not been paid by the end of the period, Cash Dividends Payable will be reported on the balance sheet as a current liability.

2. Stock Dividends

A stock dividend is a distribution of shares of stock to stockholders. Stock dividends are normally declared only on common stock and issued to common stockholders.

A stock dividend affects only stockholders’ equity. Specifically, the amount of the stock dividend is transferred from Retained Earnings to Paid-In Capital. The amount transferred is normally the fair value (market price) of the shares issued in the stock dividend.[2]

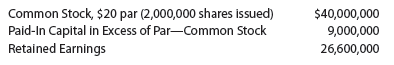

To illustrate, assume that the stockholders’ equity accounts of Hendrix Corporation as of December 15 are as follows:

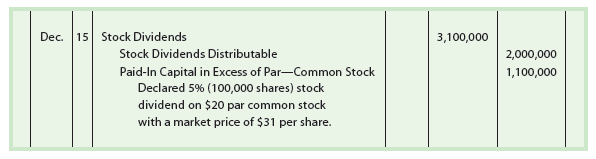

On December 15, Hendrix Corporation declares a stock dividend of 5% or 100,000 shares (2,000,000 shares x 5%) to be issued on January 10 to stockholders of record on December 31. The market price of the stock on December 15 (the date of declaration) is $31 per share.

The entry to record the stock dividend is as follows:

After the preceding entry is recorded, Stock Dividends will have a debit balance of $3,100,000. Like cash dividends, the stock dividends account is closed to Retained Earnings at the end of the accounting period. This closing entry debits Retained Earnings and credits Stock Dividends.

At the end of the period, the stock dividends distributable and paid-in capital in excess of par—common stock accounts are reported in the Paid-In Capital section of the balance sheet. Thus, the effect of the preceding stock dividend is to transfer $3,100,000 of retained earnings to paid-in capital.

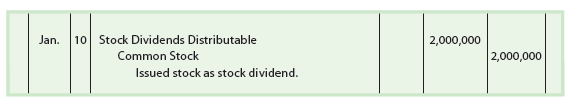

On January 10, the stock dividend is distributed to stockholders by issuing 100,000 shares of common stock. The issuance of the stock is recorded by the following entry:

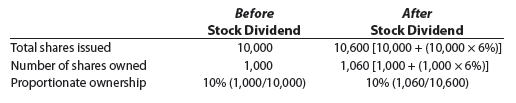

A stock dividend does not change the assets, liabilities, or total stockholders’ equity of a corporation. Likewise, a stock dividend does not change an individual stockholder’s proportionate interest (equity) in the corporation.

To illustrate, assume a stockholder owns 1,000 of a corporation’s 10,000 shares outstanding. If the corporation declares a 6% stock dividend, the stockholder’s proportionate interest will not change, as shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I likewise think hence, perfectly indited post! .

I love it when people come together and share opinions, great blog, keep it up.