Errors may occur in posting debits and credits from the journal to the ledger. One way to detect such errors is by preparing a trial balance. Double-entry accounting requires that debits must always equal credits. The trial balance verifies this equality. The steps in preparing a trial balance are as follows:

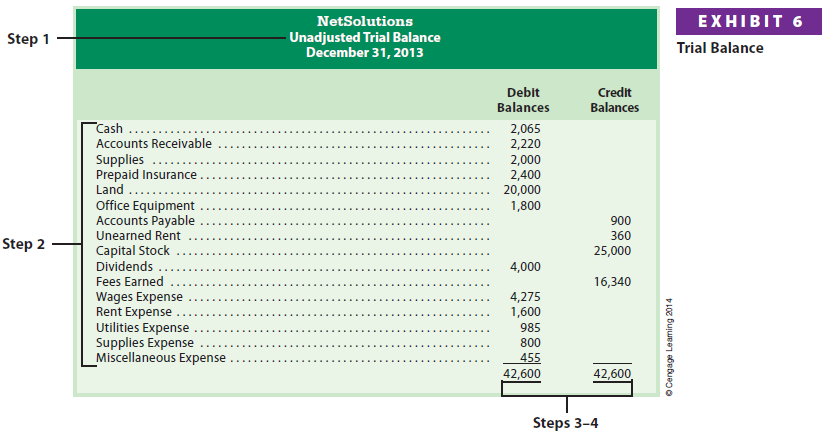

Step 1. List the name of the company, the title of the trial balance, and the date the trial balance is prepared.

Step 2. List the accounts from the ledger, and enter their debit or credit balance in the Debit or Credit column of the trial balance.

Step 3. Total the Debit and Credit columns of the trial balance.

Step 4. Verify that the total of the Debit column equals the total of the Credit column.

The trial balance for NetSolutions as of December 31, 2013, is shown in Exhibit 6. The account balances in Exhibit 6 are taken from the ledger shown in Exhibit 5. Before a trial balance is prepared, each account balance in the ledger must be determined. When the standard account form is used as in Exhibit 5, the balance of each account appears in the balance column on the same line as the last posting to the account.

The trial balance shown in Exhibit 6 is titled an unadjusted trial balance. This is to distinguish it from other trial balances that will be prepared in later chapters.

These other trial balances include an adjusted trial balance and a post-closing trial balance.

1. Errors Affecting the Trial balance

If the trial balance totals are not equal, an error has occurred. In this case, the error must be found and corrected. A method useful in discovering errors is as follows:

- If the difference between the Debit and Credit column totals is 10, 100, or 1,000, an error in addition may have occurred. In this case, re-add the trial balance column totals. If the error still exists, recompute the account balances.

- If the difference between the Debit and Credit column totals can be evenly divisible by 2, the error may be due to the entering of a debit balance as a credit balance, or vice versa. In this case, review the trial balance for account balances of one-half the difference that may have been entered in the wrong column. For example, if the Debit column total is $20,640 and the Credit column total is $20,236, the difference of $404 ($20,640 — $20,236) may be due to a credit account balance of $202 that was entered as a debit account balance.

- If the difference between the Debit and Credit column totals is evenly divisible by 9, trace the account balances back to the ledger to see if an account balance was incorrectly copied from the ledger. Two common types of copying errors are transpositions and slides. A transposition occurs when the order of the digits is copied incorrectly, such as writing $542 as $452 or $524. In a slide, the entire number is copied incorrectly one or more spaces to the right or the left, such as writing $542.00 as $54.20 or $5,420.00. In both cases, the resulting error will be evenly divisible by 9.

- If the difference between the Debit and Credit column totals is not evenly divisible by 2 or 9, review the ledger to see if an account balance in the amount of the error has been omitted from the trial balance. If the error is not discovered, review the journal postings to see if a posting of a debit or credit may have been omitted.

- If an error is not discovered by the preceding steps, the accounting process must be retraced, beginning with the last journal entry.

The trial balance does not provide complete proof of the accuracy of the ledger. It indicates only that the debits and the credits are equal. This proof is of value, however, because errors often affect the equality of debits and credits.

Example Exercise 2-6 Trial Balance Errors

For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

- Payment of dividends of $5,600 was journalized and posted as a debit of $6,500 to Salary Expense and a credit of $6,500 to Cash.

- A fee of $2,850 earned from a client was debited to Accounts Receivable for $2,580 and credited to Fees Earned for $2,850.

- A payment of $3,500 to a creditor was posted as a debit of $3,500 to Accounts Payable and a debit of $3,500 to Cash.

Follow My Example 2-6

- The totals are equal since both the debit and credit entries were journalized and posted for $6,500.

- The totals are unequal. The credit total is higher by $270 ($2,850 – $2,580).

- The totals are unequal. The debit total is higher by $7,000 ($3,500 + $3,500).

2. Errors Not Affecting the Trial balance

An error may occur that does not cause the trial balance totals to be unequal. Such an error may be discovered when preparing the trial balance or may be indicated by an unusual account balance. For example, a credit balance in the supplies account indicates an error has occurred. This is because a business cannot have “negative” supplies. When such errors are discovered, they should be corrected. If the error has already been journalized and posted to the ledger, a correcting journal entry is normally prepared.

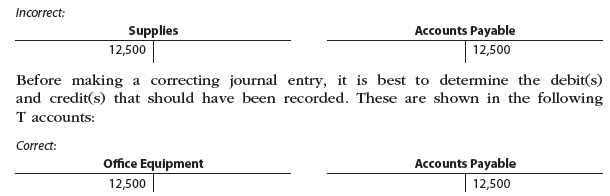

To illustrate, assume that on May 5 a $12,500 purchase of office equipment on account was incorrectly journalized and posted as a debit to Supplies and a credit to Accounts Payable for $12,500. This posting of the incorrect entry is shown in the following T accounts:

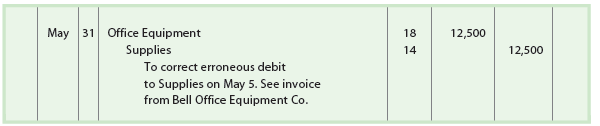

Comparing the two sets of T accounts shows that the incorrect debit to Supplies may be corrected by debiting Office Equipment for $12,500 and crediting Supplies for $12,500. The following correcting entry is then journalized and posted:

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

You can definitely see your enthusiasm in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.