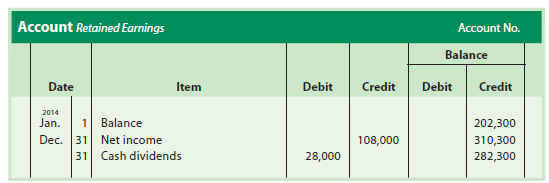

The indirect method of reporting cash flows from operating activities uses the logic that a change in any balance sheet account (including cash) can be analyzed in terms of changes in the other balance sheet accounts. Thus, by analyzing changes in noncash balance sheet accounts, any change in the cash account can be indirectly determined.

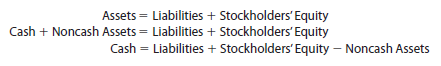

To illustrate, the accounting equation can be solved for cash as shown below.

Therefore, any change in the cash account can be determined by analyzing changes in the liability, stockholders’ equity, and noncash asset accounts as shown below.

![]()

Under the indirect method, there is no order in which the balance sheet accounts must be analyzed. However, net income (or net loss) is the first amount reported on the statement of cash flows. Since net income (or net loss) is a component of any change in Retained Earnings, the first account normally analyzed is Retained Earnings.

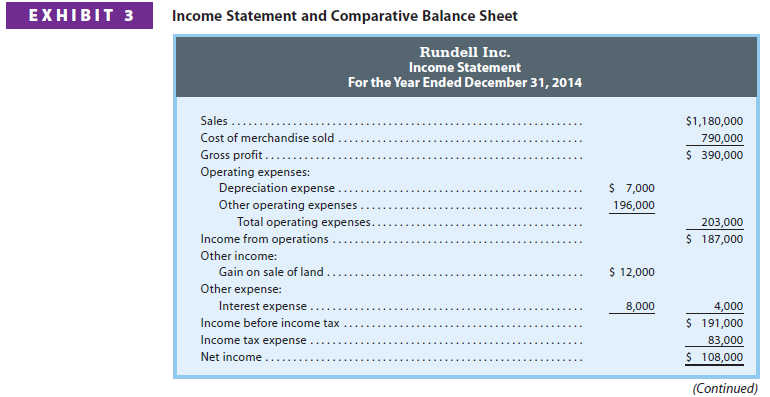

To illustrate the indirect method, the income statement and comparative balance sheets for Rundell Inc., shown in Exhibit 3, are used. Ledger accounts and other data supporting the income statement and balance sheet are presented as needed.2

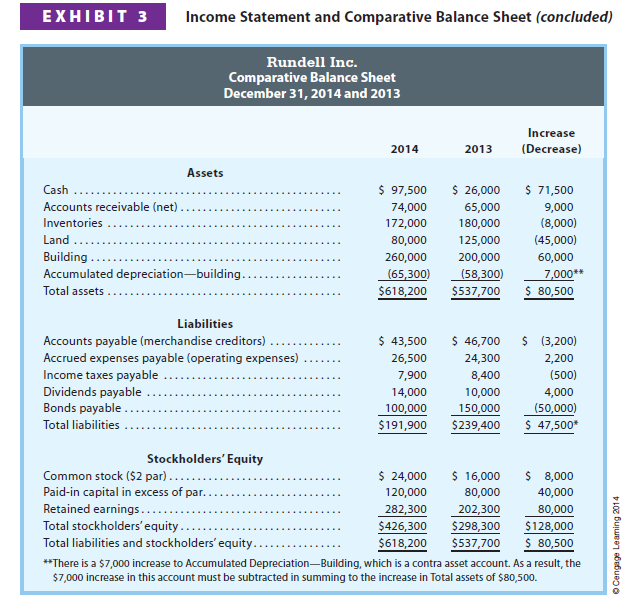

1. Retained Earnings

The comparative balance sheet for Rundell Inc. shows that retained earnings increased $80,000 during the year. The retained earnings account shown below indicates how this change occurred.

The retained earnings account indicates that the $80,000 ($108,000 – $28,000) change resulted from net income of $108,000 and cash dividends of $28,000. The net income of $108,000 is the first amount reported in the Cash Flows from Operating Activities section.

2. Adjustments to Net Income

The net income of $108,000 reported by Rundell Inc. does not equal the cash flows from operating activities for the period. This is because net income is determined using the accrual method of accounting.

Under the accrual method of accounting, revenues and expenses are recorded at different times from when cash is received or paid. For example, merchandise may be sold on account and the cash received at a later date. Likewise, insurance premiums may be paid in the current period, but expensed in a following period.

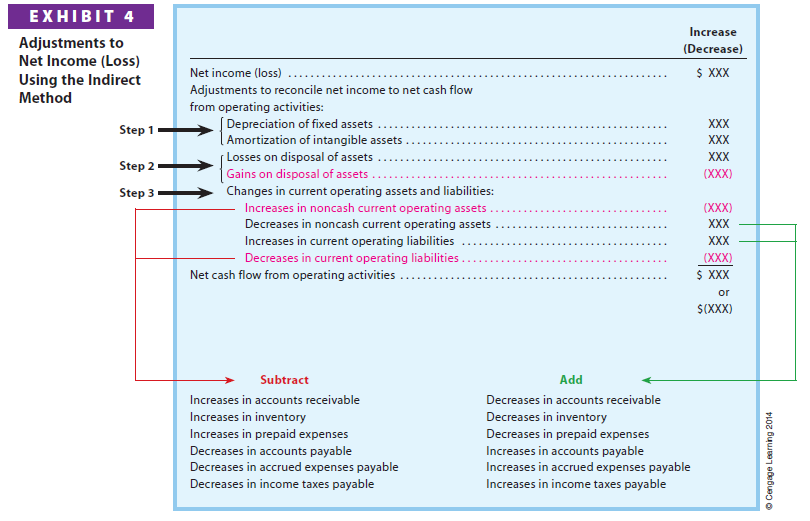

Thus, under the indirect method, adjustments to net income must be made to determine cash flows from operating activities. The typical adjustments to net income are shown in Exhibit 4.[1]

Net income is normally adjusted to cash flows from operating activities, using the following steps:

Step 1. Expenses that do not affect cash are added. Such expenses decrease net income but do not involve cash payments and, thus, are added to net income. Examples: Depreciation of fixed assets and amortization of intangible assets are added to net income.

Step 2. Losses on the disposal of assets are added and gains on the disposal of assets are deducted. The disposal (sale) of assets is an investing activity rather than an operating activity. However, such losses and gains are reported as part of net income. As a result, any losses on disposal of assets are added back to net income. Likewise, any gains on disposal of assets are deducted from net income.

Example: Land costing $100,000 is sold for $90,000. The loss of $10,000 is added back to net income.

Step 3. Changes in current operating assets and liabilities are added or deducted as follows:

Increases in noncash current operating assets are deducted.

Decreases in noncash current operating assets are added.

Increases in current operating liabilities are added.

Decreases in current operating liabilities are deducted.

Example: A sale of $10,000 on account increases sales, accounts receivable, and net income by $10,000. However, cash is not affected. Thus, the $10,000 increase in accounts receivable is deducted. Similar adjustments are required for the changes in the other current asset and liability accounts, such as inventory, prepaid expenses, accounts payable, accrued expenses payable, and income taxes payable, as shown in Exhibit 4.

The Cash Flows from Operating Activities section of Rundell’s statement of cash flows is shown in Exhibit 5. Rundell’s net income of $108,000 is converted to cash flows from operating activities of $100,500 as follows:

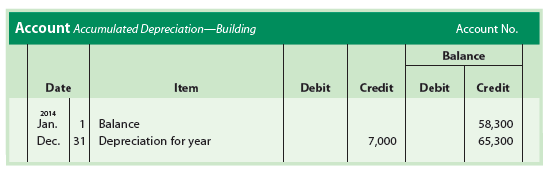

Step 1. Add depreciation of $7,000.

Analysis: The comparative balance sheet in Exhibit 3 indicates that Accumulated Depreciation—Building increased by $7,000. The account, shown on the following page, indicates that depreciation for the year was $7,000 for the building.

Step 2. Deduct the gain on the sale of land of $12,000.

Analysis: The income statement in Exhibit 3 reports a gain of $12,000 from the sale of land. The proceeds, which include the gain, are reported in the Investing section of the statement of cash flows.4 Thus, the gain of $12,000 is deducted from net income in determining cash flows from operating activities.

Step 3. Add and deduct changes in current operating assets and liabilities.

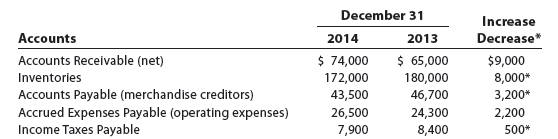

Analysis: The increases and decreases in the current operating asset and current liability accounts are shown below.

Accounts receivable (net): The $9,000 increase is deducted from net income. This is because the $9,000 increase in accounts receivable indicates that sales on account were $9,000 more than the cash received from customers. Thus, sales (and net income) includes $9,000 that was not received in cash during the year.

Inventories: The $8,000 decrease is added to net income. This is because the $8,000 decrease in inventories indicates that the cost of merchandise sold exceeds the cost of the merchandise purchased during the year by $8,000. In other words, the cost of merchandise sold includes $8,000 of goods from inventory that were not purchased (used cash) during the year.

Accounts payable (merchandise creditors): The $3,200 decrease is deducted from net income. This is because a decrease in accounts payable indicates that the cash payments to merchandise creditors exceed the merchandise purchased on account by $3,200. Therefore, the cost of merchandise sold is $3,200 less than the cash paid to merchandise creditors during the year.

Accrued expenses payable (operating expenses): The $2,200 increase is added to net income. This is because an increase in accrued expenses payable indicates that operating expenses exceed the cash payments for operating expenses by $2,200. In other words, operating expenses reported on the income statement include $2,200 that did not require a cash outflow during the year.

Income taxes payable: The $500 decrease is deducted from net income. This is because a decrease in income taxes payable indicates that taxes paid exceed the amount of taxes incurred during the year by $500. In other words, the amount reported on the income statement for income tax expense is less than the amount paid by $500.

Using the preceding analyses, Rundell’s net income of $108,000 is converted to cash flows from operating activities of $100,500 as shown in Exhibit 5, on page 649.

3. Dividends

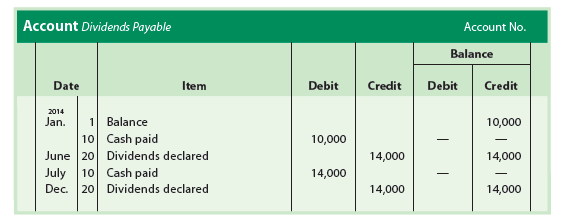

The retained earnings account of Rundell Inc., shown on page 647, indicates cash dividends of $28,000 were declared during the year. However, the dividends payable account, shown below, indicates that only $24,000 of dividends were paid during the year.

Since dividend payments are a financing activity, the dividend payment of $24,000 is reported in the Financing Activities section of the statement of cash flows, as shown below.

Cash flows from financing activities:

Cash paid for dividends………………………………………………………………………… $24,000

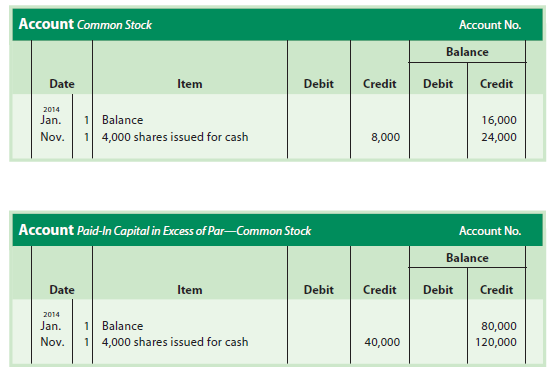

4. Common Stock

The common stock account increased by $8,000, and the paid-in capital in excess of par—common stock account increased by $40,000, as shown below. These increases were from issuing 4,000 shares of common stock for $12 per share.

This cash inflow is reported in the Financing Activities section as follows:

Cash flows from financing activities:

Cash received from sale of common stock………………………………….. $48,000

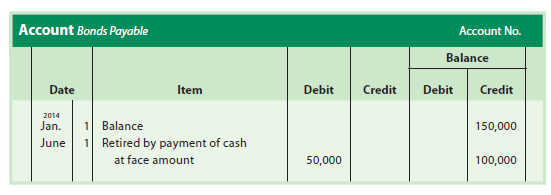

5. Bonds Payable

The bonds payable account decreased by $50,000, as shown below. This decrease is from retiring the bonds by a cash payment for their face amount.

This cash outflow is reported in the Financing Activities section as follows:

Cash flows from financing activities:

Cash paid to retire bonds payable…………………………………………………… $50,000

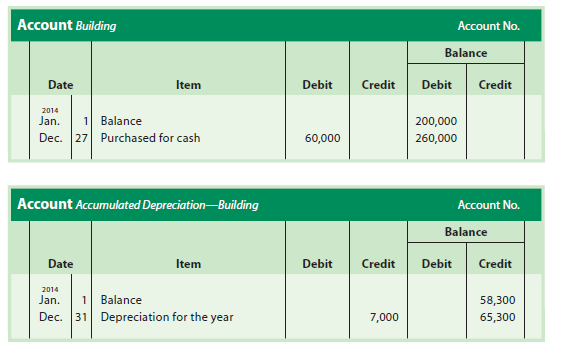

6. Building

The building account increased by $60,000, and the accumulated depreciation—building account increased by $7,000, as shown below.

The purchase of a building for cash of $60,000 is reported as an outflow of cash in the Investing Activities section as follows:

Cash flows from investing activities:

Cash paid for purchase of building………………………………………………….. $60,000

The credit in the accumulated depreciation—building account represents depreciation expense for the year. This depreciation expense of $7,000 on the building was added to net income in determining cash flows from operating activities, as reported in Exhibit 5, on page 649.

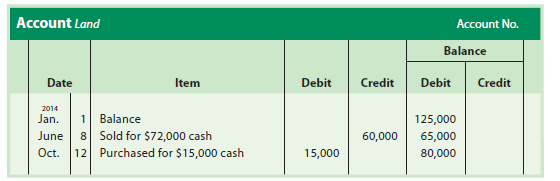

7. Land

The $45,000 decline in the land account was from two transactions, as shown below.

The June 8 transaction is the sale of land with a cost of $60,000 for $72,000 in cash. The $72,000 proceeds from the sale are reported in the Investing Activities section, as follows:

Cash flows from investing activities:

Cash received from sale of land ……………………………………………………….. $72,000

The proceeds of $72,000 include the $12,000 gain on the sale of land and the $60,000 cost (book value) of the land. As shown in Exhibit 5, on page 649, the $12,000 gain is deducted from net income in the Cash Flows from Operating Activities section. This is so that the $12,000 cash inflow related to the gain is not included twice as a cash inflow.

The October 12 transaction is the purchase of land for cash of $15,000. This transaction is reported as an outflow of cash in the Investing Activities section, as follows:

Cash flows from investing activities:

Cash paid for purchase of land………………………………………………………….. $15,000

8. Preparing the Statement of Cash Flows

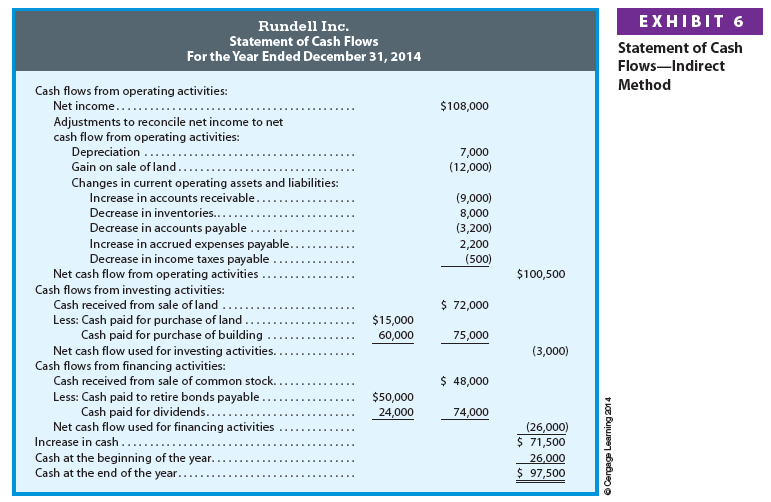

The statement of cash flows for Rundell Inc., using the indirect method, is shown in Exhibit 6. The statement of cash flows indicates that cash increased by $71,500 during the year. The most significant increase in net cash flows ($100,500) was from operating activities. The most significant use of cash ($26,000) was for financing activities. The ending balance of cash on December 31, 2014, is $97,500. This ending cash balance is also reported on the December 31, 2014, balance sheet shown in Exhibit 3 on pages 646-647.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Thankfulness to my father who told me on the topic of this blog, this blog is genuinely awesome.