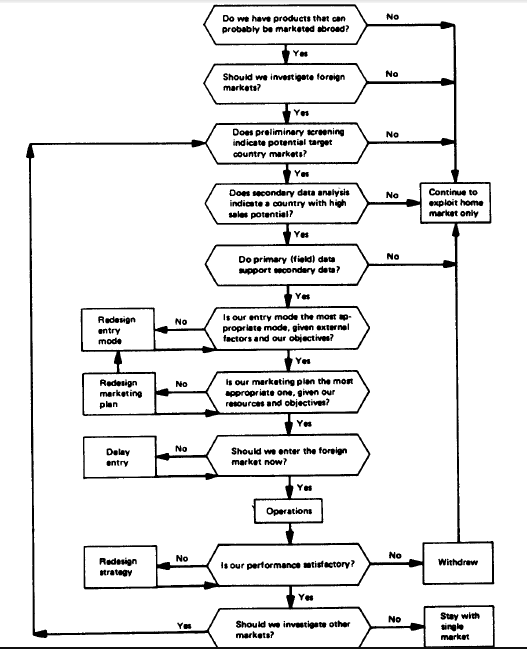

After choosing the candidate product, company managers can turn to the identification of the country market with the highest sales potential. We discuss the process of deciding on the foreign target market according to the model presented in Figure 7. In this section we consider the first phase of the model: preliminary screening.

The purpose of preliminary screening is to identify country markets whose size warrants further investigation. Preliminary screening tries to minimize two errors: (1) ignoring countries that offer good prospects for a company’s generic product, and (2) spending too much time investigating countries that are poor prospects. To minimize the first error, which is by far the more common, preliminary screening should be applied to all countries. Too often, managers start with assumptions or prejudices that rule out certain countries (or even regions) as possible target markets. Sel – imposed constraints, such as “We will consider only markets in Europe, can lead to the choice of an inferior target market. To minimize the second error, preliminary screening should be quick and economical, using quantitative data that are readily available from public sources. At the same time, the data used as screening variables should discriminate among countries with respect to market size.3

In screening foreign markets for first-time entry, managers are most probably looking for an export target market. For the most part, countries are screened for investment entry only after a company has exported to them. Investment screening, which requires the assessment of many non- market factors, is treated in Chapter 5. Nonetheless, it is a mistake to make a first-time screening solely for export markets. To do so could mean the rejection of a country that offers a good market for nonexport entry. Instead, preliminary screening should identify prospective target countries without regard to entry mode. Prospects can later be screened for export entry.

1. Consumer I User Profile

Before undertaking preliminary screening, managers should first construct the consumerluser profile of the generic candidate product—the attributes of the individuals and/or organizations that are actual or potential customers. The profile embodies answers to the first group of questions listed on page 29—answers which managers have presumably already arrived at in choosing the candidate product. In drawing up the consumer/user profile, managers in companies just entering international business must rely mainly on their experience in the home market. For consumer products, the profile describes the typical consumer in one or more market segments in terms of characteristics such as income, social class, life style, age, sex, and so on; for industrial products, it describes the size, input-output relationships, organization, and other features of typical customers in industries or government agencies that use or can use the candidate product.

The consumer/user profile guides managers in the selection of multicountry statistics that are most useful as indicators of market size.

2. Direct Estimates of Market Size

Preliminary screening requires a “quick fix” on the market potential facing the candidate product in scores of countries. Estimates of market potential need to be only good enough to identify prospective target countries. Consider the following market-potential equation: S, = f {Xu X2, . . ., Xn), where S, is the potential sales of generic product i in a given country over the planning period and Xi through X„ are economic and social factors that collectively determine Si. S, may be estimated directly by projecting actual sales data (time series analysis) or by projecting the apparent consumption or imports of the product. Or S, may be estimated indirectly by using projections of one or more of the X factors.

For most generic products, multicountry sales statistics are simply not available from published sources. Nor are managers likely to have access to the statistics needed to calculate the apparent consumption of the candidate generic product in the many countries undergoing preliminary screening, namely, local production plus imports minus exports. Even in the comparatively few instances when they are available, sales and apparent consumption figures may not be good indicators of market potential, because they are historical in nature. As we have observed, a product is usually in different phases of its life cycle in different countries, and it may not even be present in some countries. When using sales or apparent consumption data, therefore, managers also need to estimate their likely values in the future. To do so, they can project sales or apparent consumption trends (based, say, on figures for the last three years) and check on their agreement with economic and social indicators.

Import/export data may also be used for direct estimates of market size. Ideally, managers would have easy access to statistics on imports of the candidate generic product for all countries, as well as on their country origins. They could then construct a global export/import matrix that would identify key import markets and key competitors. However, international managers are seldom blessed with such data. International trade statistics, such as those appearing in Commodity Trade Statistics published by the United Nations, use broad product categories that conceal many candidate products. Given a lack of multicountry data, managers can fall back on U.S. government statistics that show the country destinations of U.S exports by 3,500 product categories.4 These statistics can identify the leading country markets for U.S. exports of the candidate product, but they overlook any major importing countries that obtain the product mainly from exporters other than the United States.

To conclude, international trade statistics are at best only a partial measure of market potential; their usefulness is limited by a historical bias, distortions created by trade barriers, and broad product categories. Low imports do not necessarily imply a small market potential: import restrictions or local production may be the explanation. In preliminary screening, trade statistics are most useful when combined with economic and social indicators.

3. Indirect Estimates of Market Size

Because of the general paucity of multicountry data on product sales, and because of their historical bias, managers must rely on quantitative economic/social statistics as indicators of market potential. For preliminary screening, these market indicators should be readily available for all countries and be comparable across countries. Many such multicountry indicators appear in publications of the United Nations, the International Monetary Fund, the World Bank, and other international agencies. A partial list of economic and social statistics available from only a few United Nations sources follows.5 The most commonly used general indicators of market size are GNP, GNP per capita, average growth rates of GDP, and imports.

3.1. National Account Statistics

- National income, gross domestic product, and net material product.

- Expenditure on gross domestic product, and net material product by use.

- National income and national disposable income.

- Gross domestic product and net material product by kind of economic activity.

- Gross domestic product and net material product at constant prices.

3.2. Population and Manpower

- Population by sex, rate of increase, surface area, and density.

- Employment/hours of work in manufacturing.

- Unemployment

- Scientific and technical manpower and expenditure for research and development.

3.3. Production

- Agriculture/forestry/fishing/mining.

- Index numbers of industrial production.

- Manufacturing production (food, textiles, paper, rubber products, chemicals, building materials, metals, transportation equipment).

- Construction (output and employment, activity).

- Energy (output and employment in electricity, gas, and water supply)-

3.4. International Trade

- Imports by end use.

- Exports by industrial origin.

- Source/destination of imports and exports.

- Imports/exports by commodity.

3.5. Other Economic Statistics

- Transportation (railways, international seaborne shipping, civil aviation traffic, motor vehicles in use, international tourist travel).

- Wages and prices (earnings in manufacturing, index numbers of wholesale prices, consumer price index numbers).

- Consumption (total and per-capita consumption of steel, fertilizers, newsprint, and other commodities).

- Finance (balance of payments, exchange rates, money supply, international reserves).

3.6. Social Statistics

- Health (hospital establishments and health personnel).

- Education (number of teachers and school enrollment, public expenditures on education).

- Culture (number of books produced by subject and language, number of radio and television receivers, total and per capita).

Managers should choose as indicators those economic/social statistics that most closely match the consumer/user profile of the candidate product. If, for example, the product is a household appliance, then private consumption expenditure on durable goods is a better indicator than gross domestic product. If the product is a machine, then industrial production in the appropriate sector is superior to manufacturing as a percent of gross domestic product. Ordinarily, several indicators do a better screening job than a single one. To illustrate, Business International estimates the overall market size of countries by calculating an index that uses statistics on population, urban population, private consumption expenditure, energy and steel consumption, cement production, and telephones, cars, and televisions in use.”

4. Accept/Reject Decisions

The fundamental accept/reject decision rule used in preliminary screening may be expressed as follows: If StJ & a (where StJ is the market size for product i in country j and a is a threshold value in dollars, units, rank order, or an index), then accept the country as a prospective target country for further investigation. But since S,-, is estimated by using several indicators, managers can interpret this rule in more than one way.

One interpretation is to establish minimum values for all the selected market indicators, rejecting those countries whose indicators fall below them. This interpretation assumes that a country’s market size is critically dependent on each indicator and that a high value for one indicator cannot offset a low value for another one. If this assumption is false, then faulty screening is a likely consequence.

A second interpretation is to consider one or a few indicators as decisive and reject all countries whose decisive indicators fall below minimum values, regardless of the values of their other indicators. If, indeed, the indicator or indicators are truly decisive measures of market size, then this approach is defensible. But then, there is no need for managers to collect information on any other indicators in screening for market size.

In most instances, the most satisfactory interpretation of the accept/ reject rule is a weighted average of the selected indicators. The weights assigned to the individual indicators reflect the judgment of managers as to the relative influence of those indicators on market size. To calculate a weighted average, managers need to express the values of the indicators in a common unit (say, as percentages). One approach is the construction of a multiple-factor index. Accept/reject decisions are then made in terms of a minimum index value or in terms of a country’s rank order.

In applying their accept/reject rule, managers identify a group of prospective target countries that represent only a small fraction of the 150 or so countries in the world. They may then decide to narrow down the list of accepted countries by applying criteria other than market size. This practice is not recommended for preliminary screening, but it is more defensible when employed after countries have been screened for market size, for then managers can better appraise the opportunity cost of rejecting a country. Political instability is probably the most common reason to reject a country that offers good market potential for a candidate product.

Source: Root Franklin R. (1998), Entry Strategies for International Markets, Jossey-Bass; 2nd edition.

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.