1. RESIDUAL CLAIMS AND ENTERPRISE GOVERNANCE

The joint-stock corporation is an immensely important institutional form, but it is not ubiquitous, and, as Chapters 8 and 9 have shown, it faces significant contractual problems. Given these problems, we might not expect the joint-stock enterprise to be better adapted than any alternative possible assignment of property rights to all conceivable situations. In this chapter, a variety of enterprises is discussed, enterprises which have the common characteristic that residual claims are held by people other than outside shareholders. Sections 1 through to 7 are concerned with enterprises in which residual claims are held by the workforce or, in section 6, shared between the workforce and providers of capital. Sections 8 through to 10 discuss enterprises in which consumers are residual claimants, while section 11 briefly reviews recent debates about ‘stakeholding’. We delay until chapter 11 an analysis of the operation of non-profit enterprises – institutions without residual claims. Public enterprise is not considered until Part 3.

Because the number of possible bundles of property rights assignments is so great, and one type of enterprise shades into another, the nomenclature can become confusing. It will therefore be useful at the start to clarify the terminology that will be used and to define the distinguishing characteristics of the various enterprises that will be discussed.

- Profit-sharing enterprises Any enterprise that distributes to its workforce, or to some group other than the providers of capital, a share of the residual is engaging in profit sharing. Thus, a joint-stock corporation can be a profit-sharing enterprise. All the types of enterprise discussed in this chapter are profit sharing, according to this definition, including the retail cooperative.

- The management-owned firm Where all residual claims are held by several monitors of a team we term the enterprise a management- owned firm. Some of the features of this variety of enterprise were discussed in Chapter 4, although there the context was the traditional unlimited partnership. From a purely legal point of view, a company in which the management team holds all the equity capital is likely to be a private limited company. Management buy-outs, for example, frequently result in this form of organisation. The main points here are that the equity is held by a subset of people who work in the firm (the managers), the residual rights are not necessarily distributed equally among the holders, and the rights can be traded (though only with the agreement of other shareholders).

- The professional partnership Residual claims in this case are again held by a subset of those who work in the firm. Lawyers, management consultants, accountants and doctors are often organised in professional partnerships. In this case, the partners are not primarily engaged in a managerial role (though some management may inevitably be necessary) but as practitioners. Junior associates, secretaries and other assistants receive a wage or salary and are not residual claimants. One partner will not have hierarchical authority over another. The earnings of the partnership are distributed equally between the partners, with some allowance for age and experience. All partners do essentially the same job. Residual rights are not privately or collectively exchangeable.

- Worker ownership Where all workers share the residual, and either elect managers from their number or appoint managers on separate contracts from outside, we will refer to worker ownership. Under worker ownership, residual rights are collectively exchangeable. The workers collectively could decide, for example, to sell their firm to a single proprietor if the price were sufficiently attractive. The residual may be distributed on a basis of equality, but where individual output is easy to measure, remuneration may instead be determined by reference to such output. Taxi firms, for example, are often worker owned but the revenue is easily attributable to individual drivers. The drivers benefit from the provision of central services such as marketing, reputation, and radio communications for which they pay a proportion of their takings. In contrast, the plywood industry in the United States, in which worker ownership has a strong tradition, operates on the basis of equal distribution of the earnings of the team.2 Like taxi drivers, the workers do jobs that are similar to one another, but their individual productivity is not so easily gauged. Managerial skills for the firm are purchased from salaried ‘outsiders’.

- The worker cooperative The main difference between a worker-owned firm and a worker cooperative is that, in the latter, residual claims are non-tradable. A pure form of worker cooperative would distribute the net revenue of the team (that is, revenue after paying for intermediate inputs, interest on borrowed capital and allowing for maintenance and depreciation) equally between the members. There would, in other words, be no ‘wage’ element in the worker’s compensation package. Rights to this stream of payments would be non-exchangeable and would depend upon continued membership of the team. Managers would be team members on the same terms as other workers.

In practice, of course, institutions called ‘worker cooperatives’ may have characteristics which depart from those of the pure case. Equal distribution of the net revenue, for example, will be unworkable where individuals with differing skills have opportunities outside the firm. Payment of a market-related ‘wage’ element might then be necessary, with the team’s ‘residual’ defined in the same way as that in a private company. Where the legal ‘ownership’ of the enterprise is vested in the state (as was the case in the pre-civil war Yugoslavian system), George (1982) suggests the use of the term ‘labour-managed firm’. The labour- managed firm was studied extensively in the 1970s.3 Our interest, however, will primarily be in cooperative enterprise where the state plays no role in protecting or encouraging it.

- Labour-capital partnerships In a labour-capital partnership, the residual is shared among workers and outside providers of equity capital. The situation differs from simple profit sharing (subsection 1) in that the division of the residual between labour and capital is not constant but will vary as employment rises or falls. When new capital is raised, new capital shares will be issued. Similarly, when labour is recruited, new labour shares will be issued. The ‘dividend’ on both types of share is the same. Capital shares are freely tradable on stock markets; labour shares are non-tradable. Thus, risk-bearing capital does not hire labour as in the traditional capitalist firm, nor does riskbearing labour hire capital as in the worker-owned or cooperative firm. Labour and capital share the risk between them.

This type of enterprise is, at the moment, more of theoretical than practical interest. James Meade (1985, 1989) is particularly associated with analysing the properties of labour-capital partnerships. Section 6 will be devoted to a brief summary of Meade’s analysis because it helps clarify the theoretical issues surrounding the problems faced by other forms of profit sharing.

- Retail and wholesale cooperatives Although we are principally concerned in the main part of this chapter with profit sharing among workers, the possibility that buyers of goods may set up organisations and share residual profits in proportion to their purchases is discussed in section 8. Suppliers’ cooperatives are covered in section 9.

- The mutual enterprise An important form of enterprise in many areas but especially in financial intermediation is the mutual. Ownership is shared between the users of the financial services who club together for the purposes of mutual provision and protection. Insurance companies and Savings and Loan Associations (Building Societies) have often been established as mutuals in the past and this form of enterprise is considered in section 10.

Our immediate objective is to look more closely at profit sharing from a transactional point of view. Even if full worker ownership is rare there are features of most firms which imply an element of cooperation, mechanisms for encouraging trust, for rewarding investment in firm-specific skills and so forth. The passage from Marshall’s Principles of Economics which opens this chapter indicates that this has been recognised for many years, but how plausible is Marshall’s Victorian view of the economic value of explicit profit sharing?

2. PRINCIPAL-AGENT THEORY AND PROFIT SHARING

2.1. Type of Firm Classified by Distribution of Residual Claims

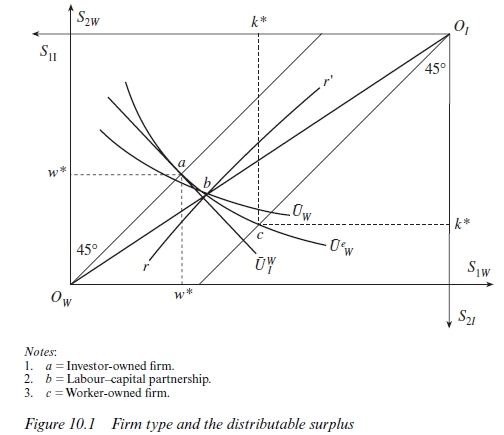

Some of the issues can be disentangled by considering once more the diagrammatic exposition of principal and agent introduced in Chapter 5. Consider Figure 10.1. Two parties are negotiating a contract. One is the ‘outside’ investor (I). The other is the ‘inside’ worker (W). The two outcomes represent the revenue of the firm after payment of intermediate inputs and raw materials and after providing for maintenance and depreciation on capital. In other words, the sides of the Edgeworth Box give the available distributable surplus to labour and capital depending upon which of two states of the world happens. As in other chapters, the probability of the occurrence of these states is influenced by the worker’s effort. The problem is to share the surplus between the parties.

A contract at point a in Figure 10.1 represents the traditional capitalist investor-owned firm (IOF). The figure is drawn on the assumption that the worker is risk averse while the investor is risk neutral. At point a, therefore, risk is shared efficiently. The worker receives a fixed wage w* and the investor receives whatever remains. Thus, the investor can be seen as holding one hundred per cent of the equity of the firm. Because investors are able to spread their risks widely over many enterprises while workers are normally more restricted in the number of enterprises to which they can supply their labour, the above assumptions about risk preferences would seem plausible. As Meade (1972) argues ‘this presumably is a main reason why we (traditionally) find risk-bearing capital hiring labour rather than risk-bearing labour hiring capital’ (p. 426).

As we saw in Chapter 5, however, this solution is viable only if the worker can be monitored at low cost. Without information about the

worker’s level of effort, and in the absence of monitoring, the worker will shirk. Further, our justification for assuming investors are risk neutral implies that they are only minimally committed to any one enterprise and that they will not have an incentive to monitor effectively. Giving investors an incentive to monitor by concentrating their investments is likely to result in a degree of risk aversion on their part. Both risk aversion on the part of the investor and the provision of effort incentives unrelated to investor monitoring would require the worker to move away from the certainty line in the efficient contract. The firm, in other words, begins to take on profitsharing characteristics.

Let us assume that monitoring is extremely costly and ineffective. Effort incentives for the worker require a contract along rr’ in Figure 10.1. Let the diagonal through each origin in the diagram cut rr’ at b. In this set of circumstances, the optimal contract yields a labour-capital partnership. The worker does not receive a wage but a share in the distributable surplus. The worker’s share is Owb/OwOI.

If effort costs are very great or worker risk aversion less pronounced, the locus rr’ will move even further to the right. In the extreme case, we might envisage a contract at point c on the investors certainty line. This is the worker-ownedfirm. The outside investor receives a fixed payment for the use of his or her capital. Interest payments are given by distance OIk*. The worker receives no wage but the entire distributable surplus after interest payments. One hundred per cent of the equity is held by the worker. It will be recalled, however, that one of the results obtained in Chapter 5, section 4, was that an efficient contract could not occur along the principal’s certainty line if the agent were risk averse. In the present context this implies that, if the worker is risk averse, a fully worker-owned firm cannot be an efficient response to this contractual problem.

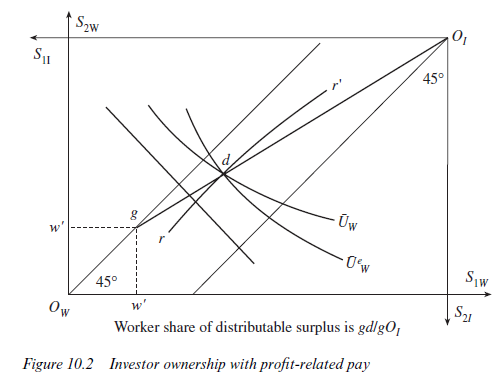

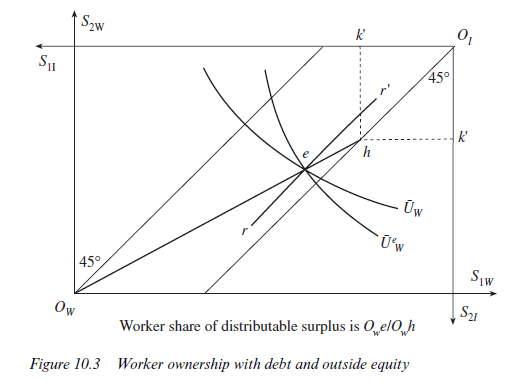

Figures 10.2 and 10.3 illustrate other sharing arrangements short of complete worker ownership. Figure 10.2 shows an investor-owned firm but with profit sharing. The contract is at point d. It implies a fixed wage of w’ and a share of the distributable surplus (now after the payment of wages) of gdIgOj. There is no debt finance. By contrast, in Figure 10.3 the contract point is at e. It shows a mainly worker-owned firm with some outside debt and equity. The wage is zero. The worker has a share in the distributable surplus (now after interest payments) of Owe/Owh. The outside investor receives the remaining share of the surplus and an interest payment ofOIk’.

Already this simple analysis gives some clues about the conditions under which profit sharing will occur. In particular, it is consistent with the ‘stylised facts’ of market economies in suggesting that profit sharing is a rational response to particular circumstances but that full worker ownership is much less likely.4

- If a large commitment to monitoring on the part of the investor yields only very noisy information about the worker’s level of effort, monitoring gambles of the type discussed in Chapter 5, section 7, will not be acceptable and other types of worker incentive, including profit sharing, will be required.

- If investors are risk averse because capital markets are undeveloped and do not permit risk spreading, profit sharing will be encouraged.

- The less risk averse are workers, the more attractive will be profit sharing arrangements.

- The greater the efficiency of effort (that is, the lower the effort cost of achieving the higher probability of the good state) the closer will be rr’ to the worker’s certainty line and the more likely it will be that a mutually acceptable profit-sharing contract exists.

The question of the efficiency of worker effort raises another fundamental problem with profit sharing. We have so far concentrated on the role of sharing the surplus between worker and outside capitalist, but where there are many workers employed in an enterprise the surplus will be shared between them, and the original Alchian and Demsetz analysis of the freerider problem reasserts itself. If a large number of investors leads to a low incentive to monitor, large numbers of profit-sharing workers lead to a small incentive to work. As was pointed out in Chapter 5, in team environments the relationship between any individual worker’s effort and the probability of good profit outcomes may be slight, even if collectively the relationship is strong. Moving away from the worker’s certainty line will then not be an effective means, in itself, of inducing effort.

2.2. Monitoring Effort and the Profit-sharing Firm

This brings us to the role of monitoring in a profit-sharing or worker- ownership environment. Profit sharing, according to this line of reasoning, is not primarily about inducing effort directly from workers because it is in their individual interests. Profit sharing is about reducing the costs and increasing the effectiveness of monitoring both worker and management effort.5 There are several ways in which this may be brought about.

- Workers may monitor one another. This possibility will be explored in more detail in section 7.

- Workers may feel a loyalty to their fellow profit sharers or cooperators that is absent in their dealings with outside investors. A satisfying ‘contractual atmosphere’, as Williamson terms it6, may be important and may reduce the need for monitoring. The principal advantage of the cooperative enterprise has long been considered the more positive motivation of the workforce and the absence of ‘alienation’ that is said to afflict workers in joint-stock enterprises.

- Monitoring of managers by workers might be more effective than the monitoring of managers by outside investors. Workers might be more informed about company operations, face lower costs of taking part in collective decision-making processes, and have a greater individual stake in the enterprise than dispersed outside shareholders. These factors would tend to reduce the agency costs of the relationship between residual claimants and managers that we investigated at great length in the context of the joint-stock enterprise in Chapter 8. A worker-owned firm would represent the arrangement described by McManus (1975) and referred to in the organisational literature as ‘the fable of the barge’. On protesting at the brutality of an overseer as he whipped a team of men pulling barges on the Yangtze River, an observer was informed ‘those men own the right to draw boats over this stretch of water and they have hired the overseer and given him his duties’.7

As the fable suggests, however, the managers need a penalty to impose or a prize to offer if their monitoring is to be effective. Hierarchical incentive devices discussed in Chapter 6 do not sit easily with the egalitarian residual-sharing basis of cooperation, although the incorporation of such mechanisms into worker ownership or labour-capital partnerships is theoretically feasible, as will be seen in section 6. Managers might also be given the right to impose fines or to terminate a person’s membership of a team. Given that managers are hired by the team and could themselves be fired for abusing their position, workers might be prepared to tolerate a significant degree of managerial discretion in the determination of rewards and penalties.

If the managers are salaried employees and do not share in the residual, an active managerial labour market and the protection of reputation would seem to be an important component of the incentive structure. Managers taken from outside the team might appear more ‘neutral’ and able to resist the subtle personal pressures and accusations of favouritism that otherwise might reduce the productive efficiency of their decisions. Where no tradable outside residual claims exist, however, the manager’s ability to inform the managerial labour market of his or her ability is restricted. The prices of shares act as a means of conveying news of success or failure to others. Except where competing teams are operating in similar conditions and in close proximity so that reliable knowledge of managerial performance circulates easily, the absence of exchangeable residual claims may make it more costly to build managerial reputations in labour-owned or cooperative enterprises than in investor-owned enterprises. A prediction suggested by this reasoning is that salaried outside managers are more likely to be used in worker-owned enterprises (which can be transformed at low cost into investor-owned firms) than in pure cooperatives.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Your place is valueble for me. Thanks!…

This is very interesting, You’re a very skilled blogger. I’ve joined your rss feed and look forward to seeking more of your fantastic post. Also, I’ve shared your web site in my social networks!