A note has some advantages over an account receivable. By signing a note, the notes receivable. debtor recognizes the debt and agrees to pay it according to its terms. Thus, a note is a stronger legal claim.

1. Characteristics of Notes Receivable

A promissory note is a written promise to pay the face amount, usually with interest, on demand or at a date in the future.2 Characteristics of a promissory note are as follows:

- The makeris the party making the promise to pay.

- The payeeis the party to whom the note is payable.

- The face amountis the amount for which the note is written on its face.

- The issuance dateis the date a note is issued.

- The due dateor maturity dateis the date the note is to be paid.

- The termof a note is the amount of time between the issuance and due dates.

- The interest rateis that rate of interest that must be paid on the face amount for the term of the note.

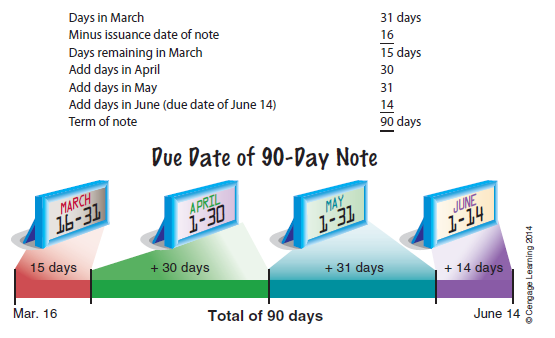

Exhibit 4 illustrates a promissory note. The maker of the note is Selig Company, and the payee is Pearland Company. The face value of the note is $2,000, the interest rate is 10%, and the issuance date is March 16, 2013. The term of the note is 90 days, which results in a due date of June 14, 2013, as shown below.

The interest on a note is computed as follows:

Interest = Face Amount x Interest Rate x (Term/360 days)

The interest rate is stated on an annual (yearly) basis, while the term is expressed as days. Thus, the interest on the note in Exhibit 4 is computed as follows:

Interest = $2,000 x 10% x (90/360) = $50

To simplify, 360 days per year will be used. In practice, companies such as banks and mortgage companies use the exact number of days in a year, 365.

The maturity value is the amount that must be paid at the due date of the note, which is the sum of the face amount and the interest. The maturity value of the note in Exhibit 4 is $2,050 ($2,000 + $50).

2. Accounting for Notes Receivable

A promissory note may be received by a company from a customer to replace an account receivable. In such cases, the promissory note is recorded as a note receivable.[1]

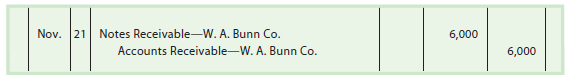

To illustrate, assume that a company accepts a 30-day, 12% note dated November 21, 2014, in settlement of the account of W. A. Bunn Co., which is past due and has a balance of $6,000. The company records the receipt of the note as follows:

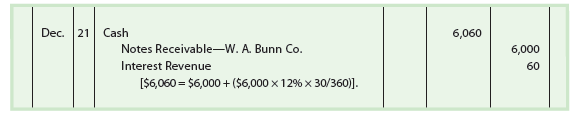

At the due date, the company records the receipt of $6,060 ($6,000 face amount plus $60 interest) as follows:

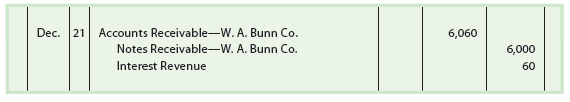

If the maker of a note fails to pay the note on the due date, the note is a dishonored note receivable. A company that holds a dishonored note transfers the face amount of the note plus any interest due back to an accounts receivable account. For example, assume that the $6,000, 30-day, 12% note received from W. A. Bunn Co. and recorded on November 21 is dishonored. The company holding the note transfers the note and interest back to the customer’s account as follows:

The company has earned the interest of $60, even though the note is dishonored. If the account receivable is uncollectible, the company will write off $6,060 against Allowance for Doubtful Accounts.

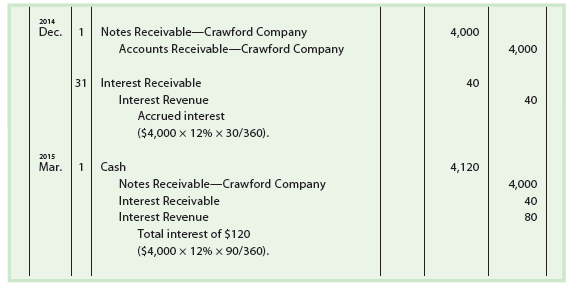

A company receiving a note should record an adjusting entry for any accrued interest at the end of the period. For example, assume that Crawford Company issues a $4,000, 90-day, 12% note dated December 1, 2014, to settle its account receivable. If the accounting period ends on December 31, the company receiving the note would record the following entries:

The interest revenue account is closed at the end of each accounting period. The amount of interest revenue is normally reported in the Other Income section of the income statement.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

Attractive component to content. I simply stumbled upon your blog and in accession capital to say that I acquire in fact enjoyed account your blog posts. Any way I’ll be subscribing in your feeds or even I success you get right of entry to constantly quickly.