1. MONITORING AND ADVERSE SELECTION

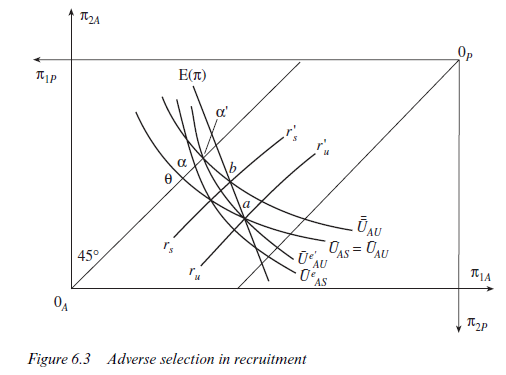

Monitoring may also be required to cope with a quite separate problem; that of ‘adverse selection’. A simple model of adverse selection has already been considered in section 2.2. Here the analysis is extended to incorporate risk aversion, while the contractors are assumed to vary in the cost of exerting effort. Suppose that there are two groups of employees with two different skill levels and that the principal cannot by simple observation determine which person belongs to which group. The problem may be illustrated in Figure 6.3. The indifference curve UAS = UAUindicates the locus of prospects yielding the same utility index to the skilled person S and the unskilled person U when neither is exerting effort. Thus, we are assuming that both skilled and unskilled persons have the same risk preferences. When the skilled person exerts effort e, his or her indifference curve becomes UeAS through point a. As usual, a0 represents the cost of effort to the skilled person. For the unskilled person, however, greater effort may be required to change the probability of outcome 1 from p1 to pe1 and his/her indifference curve is therefore labelled Ue‘AU. Distance a’θ is the cost of effort to the unskilled person. The upshot is that efficient contracts involving skilled people will lie along rsrs‘ while contracts involving unskilled people will lie along rurf. Indifference curve E(π) represents the constant expected profits line for the risk-neutral principal assuming that the required effort is being exerted. The firm or principal can therefore offer a contract at a to the unskilled, or, compatible with maintaining the same expected profit, a contract at b to the skilled. If we assume for the moment that E(π) represents some competitive level of profits, we would expect firms to sort themselves into groups: one group specialising in employing the skilled, the other group specialising in the unskilled.

This process of sorting employees into groups, however, requires that ability is observable, and we have assumed that ability cannot be observed. Of course unobservability would not matter if people could be trusted to declare accurately their level of skill assuming that they, at least, know what it is. But Figure 6.3 illustrates that the unskilled will have an incentive to lie about their ability. An unskilled person will have a higher utility index if he or she can obtain a contract at b (UAU) than he would have at a (UAU). Thus, like the craftspeople in their dealings with person A in Chapter 2, unskilled people may misrepresent their skill level and attempt to ‘contaminate’ high- skill-level firms. By undermining the firms with contracts at b, the forces of adverse selection thus lead to generally higher levels of incentive pay in the surviving firms with contracts at a.

Will it be worth monitoring workers in order to discover their true quality? If output is observable at negligible cost, as assumed above, and there are no sources of risk (or contractors are all risk neutral) monitoring is not necessary. High- and low-quality workers face the same payment schedule. Quality-1 workers receive d and quality-2 workers receive d’ in Figure 6.2. If, however, we return to the case where the less skilled could undermine risk sharing benefits otherwise available to the skilled, or if we assume that individual output is not costlessly observable but is linked to ability, the monitor can potentially achieve benefits. Using a monitor to ascertain a worker’s true quality could be used to reassign workers to tasks appropriate to their skills and thus to raise total output. The more heterogeneous are workers the larger are the potential benefits from correct assignment.11 Monitoring might also be used to prevent the adverse- selection effects analysed in Figure 6.3. Workers are all appointed to a contract at a and then, after a period of monitoring, a suitable sub-group are moved to a contract at b. On the other hand, monitoring is itself costly. If monitoring costs exceed the gains to sorting derived from a more efficient assignment of workers to jobs or a more efficient sharing of risk between contractors, it will be better to avoid monitoring. On the other hand, again, this does not imply that all workers should be offered the same contract. As was the case with moral hazard, monitoring and purely contractual responses to adverse selection are substitutes. In section 4, the role of contractual devices to cope with adverse selection is discussed.

2. MORAL HAZARD, PENALTIES AND WAGE PAYMENTS

The transactions-based view of the firm provides a rationalisation of simple hierarchy (interpreted loosely as the use of monitors) based upon an attempt to cope with moral hazard and adverse selection. As yet, however, we have no explanation of why the monitors in the hierarchy should be paid more than the people they are monitoring, why the people being monitored should have ‘standard’ contracts with the terms specified collectively rather than subject to individual bargaining, why recruitment into the hierarchy will occur at the lower levels, and so forth. These matters will be considered in later sections. For the moment, it is possible to lead into these areas by investigating another fundamental problem. Monitoring employees will be useless unless the monitor can apply some sanctions in the event of shirking being detected. The ‘monitoring gambles’ of Chapter 5 had to involve the employee in the risk of loss if observed effort were below standard. The precise mechanism involved in these monitoring gambles was not discussed in detail, however.

Suppose that a ‘team’ enterprise requires a monitor to ensure effort e is forthcoming from all its members. If effort is satisfactory, a certain payment (or wage) will be paid. Where shirking is observed, a penalty is exacted. The nature of this penalty is important. A reduction in the wage paid for bad service would create moral hazard problems of its own. The employee would have to trust that the firm would not deliberately ‘observe’ a low effort and penalise him or her dishonestly. Later, we will discuss mechanisms which may help to mitigate this problem. For the present, let us assume that the objection to relying on the ‘observations’ of only one of the contracting parties is overwhelming and consider the consequences. How is a firm to penalise an employee observed shirking? The obvious answer, and one which we encountered in Chapter 4, is that the firm can simply fire the shirker and not use his or her services henceforth. This was the rationale behind the necessity of making Alchian and Demsetz’s monitor a central contractual agent with the power to hire and fire. But, as Shapiro and Stiglitz (1984) recognise, the theoretical objection to this mechanism as it stands is that the ‘penalty’ depends upon general labour market conditions outside the firm. To take an extreme case, suppose that full employment prevailed and that any fired worker could immediately be re-employed elsewhere at the going competitive wage. The so-called penalty for being observed shirking is in fact completely absent and with it the incentive effects of monitoring.

It is tempting to object that people fired for shirking will not find reemployment easy, but this is to confuse the two separate problems of moral hazard and adverse selection. Employers may use indicators such as employment history to counter adverse selection, but Shapiro and Stiglitz explicitly assume that all workers are identical in order to abstract from this problem. Thus, firms in this situation know that there is no reason to prefer one person over another on grounds of differential skill or propensity to shirk. If a fired person comes to them for a job they will conclude either that the person was wrongly fired, as is always a possibility with monitoring gambles (as we saw in Chapter 5), or that the previous employer was not clever enough in setting the appropriate incentive structure and that anyone would have shirked in the same circumstances. How, then, is the firm to devise a credible threat?

2.1. The Efficiency Wage

In the conditions specified, being fired will be a penalty to an employee if the firm pays a wage higher than that paid by other firms. Being a ‘good employer’ and paying higher wages can therefore be seen as part of the process of constructing monitoring gambles which will induce effort. Employees wish to avoid being fired because this will involve taking a lower wage elsewhere. Unfortunately, all firms can play the same game, and if each acts independently their common policy of raising wages above the ‘norm’ will sabotage any incentive effects from differential wages. All will end up paying higher wages and each will find the incentive effects much smaller than expected. If the differential wage mechanism fails to produce incentives, however, the overall result of a general increase in the wage level is to produce monitoring incentives from a different source. As the wage level rises with each firm’s efforts to attach a penalty to being fired, the higher price of labour reduces the quantity demanded and increases the quantity supplied. An unemployment pool is the result. It is this unemployment pool, in Shapiro and Stiglitz’s framework, which provides the ‘penalty’ required if monitoring is to be viable within the firm. With a pool of unemployment a fired worker will not be able to find new employment immediately. The expected length of time unemployed will be directly related to the size of the pool. Thus, if x workers are fired per period of time and x workers are hired and if the pool of unemployed is 10x, there will be ten potential applicants for each available job per period, and hence a one in ten chance of gaining employment. The expected duration of unemployment will be ten periods.14

Shapiro and Stiglitz thus provide us with a model which predicts unemployment not as a short-term aberration, nor as a result of ‘voluntary’job search along the lines of Stigler’s approach to information acquisition discussed in Chapter 3, but as the outcome of attempts by firms to provide effort incentives through monitoring.15 The resulting unemployment is clearly ‘involuntary’ in the sense that all the unemployed are prepared to accept jobs at the proffered wage level, but wage reductions will not occur because of each firm’s desire to maintain an appropriate ‘penalty’ associated with terminating the contract of employment. As we saw in Chapter 5, not all monitoring gambles will be the same, and firms facing differing monitoring costs or differing consequences of shirking may construct different gambles. If monitoring costs are high, and the adverse consequences of shirking on the team are severe, a firm may wish to have a particularly substantial penalty associated with being fired. This will result in some firms paying higher wages for the same labour than other firms, and continuing to do so as a deliberate policy over time. Clearly this approach to unemployment is of considerable interest to macroeconomists, and the formal model can be manipulated to show how the size of the unemployment pool is expected to depend on factors such as unemployment pay.16 Our purpose in discussing it here, however, is to show how it relates to the moral hazard problem and the internal monitoring environment of the firm.

The class of models discussed in this section relies on what is termed the ‘efficiency wage’ hypothesis. This idea originated in the development- economics literature, where it was observed that higher wages by improving nutrition and health might increase the productivity of the worker. Thus, physical productivity and wages are not independent and the ‘efficiency wage’ might fall after an increase in the real wage rate. In the context of developed economies, the argument is still that effort (and hence productivity) is not independent of the wage.17

For monitoring to be effective, the worker must be dependent on the firm. Dependency implies that he or she has something to lose by being dismissed from the firm. Employment in the firm must be more highly valued than outside available opportunities. Some of the worker’s remuneration, in other words, must be a form of rent.18 In this particular setting, the rent has been artificially contrived in order to raise the productivity of monitoring. Bowles and Gintis (1993) refer to rents of this nature as enforcement rents. In the absence of trust, unemployment can result, as we have seen, and this leads Bowles and Gintis to characterise contested exchange as a system which ‘allocates power to agents on the short sides of non-clearing markets’ (p.90).

The payment of wages above the market norm can also be seen as a response to the adverse selection problem in certain circumstances. If firms cannot tell skilled from unskilled workers and simply pick at random from a group of applicants, they will wish to increase the proportion of skilled applicants to total applicants. Where the ‘reservation wage’ of people (that is, the wage below which they simply will not apply for the job) is positively related to their level of skill, the firms can persuade more skilled people to offer themselves for employment by setting a higher wage (Malcolmson, 1981). The use of this kind of mechanism implies, however, that internal monitoring of effort or skill is ineffective either for technical reasons or for the moral hazard reasons mentioned earlier. It also assumes that ‘screening’ devices are not available.

2.2. Deferred Compensation and ‘Bond-posting’

Our discussion of incentives thus far has proceeded on the assumption that moral hazard prevents agreements which use the observations of the monitor to determine rewards. The result has been a system which uses the threat of terminating the agreement to induce effort; a threat which requires unemployment if it is to be effective. Implicitly, therefore, the ‘hierarchy’ under consideration is a very simple one in which monitors observe employees and fire those observed shirking. This incentive mechanism would not involve the necessity of a pool of unemployment if the employee could be brought to trust the integrity of the firm. As in the example of police incentives in Chapter 5, each employee could then ‘post a bond’ which he or she would forfeit if discovered shirking.

‘Posting a bond’ does not have to be interpreted literally in this context. An equivalent incentive is provided if the employee agrees to receive his or her remuneration not in a constant stream over time but in a stream which starts lower and rises through time. The employer gains at first by paying a relatively low wage but will have to repay the employee later when the wage is relatively high. Clearly the employee will have an incentive to avoid being fired, and monitoring will therefore involve a credible threat (Lazear, 1979, 1981). Working for a relatively low wage early on implies that the employee provides a ‘hostage to fortune’, and demonstrates in so doing a serious commitment to the firm. The firm offers a ‘career path’ by which the worker’s employment income will include ‘seniority payments’. Remuneration rises with years of service even when productivity has not changed. The wage is below the worker’s productivity at first and rises above this level later.19

This brings us at last to the important question of what induces the firm to demonstrate a serious commitment to the employee? What induces the firm to monitor honestly and to refrain from firing the employee as soon as his or her wage reaches a level which implies repayment of his/her bond? As with the second-hand car salesman of Chapter 2 the answer to this question revolves around the value to the firm of a ‘reputation’ for honesty.

Although there are obvious short-term gains to cheating the employee, firing people dishonestly is not costless for the firm. If people begin to doubt the firm’s integrity, they will no longer be willing to enter a long-term relationship involving bond-posting, and hence the incentive effects of this system will no longer be available to the firm. The firm will have to pay higher wages to new entrants, the value of the bond will be lower or zero, and monitoring will be more costly and less effective. Thus, an agreement between firm and employee is not something which can be considered as a single isolated event. If each bargain represented the outcome of a game between the two parties and was never to be repeated, the firm would have a clear incentive to cheat the employee if the latter agreed to the bondposting scheme, but, of course, in such circumstances no employee would do so. It is the fact that the game is repeated continuously, and that cheating by the firm will have serious consequences for future agreements, which induces the firm to comply, and gives the employee the confidence to enter this kind of implicit contract (Radner,1981). We cannot, however, conclude that the firm will never cheat. Clearly, there would be circumstances in which the gains from reneging on the implicit contract are so great that they outweigh the future costs. Thus, as Lazear (1979) puts it ‘minimising cheating costs . . . will therefore trade off reduced worker cheating against increased firm cheating as (the time profile of wages) becomes more end weighted’ (p. 1271).

‘Reputation’ and ‘goodwill’ are clearly central to the problem of establishing the viability of implicit contracts. These concepts can appear somewhat abstract at first, and they are certainly difficult to observe and measure objectively. This does not mean, however, that we have to accept them as exogenous and mysterious forces out of the reach of economic analysis.

Building a reputation amounts to thinking of ways of making implicit agreements enforceable. An important factor will therefore involve demonstrating to potential employees that the firm is fulfilling its implicit obligations. In the case of the rising time profile of wages discussed by Lazear, how are the employees to know whether any workers fired were honestly considered by the firm to be shirking? What is required, it might be argued, is some observable signal which induces this type of confidence in employees.

Malcolmson (1984) suggests that the mechanism of promotion through a hierarchy is capable of generating just this kind of confidence. Instead of promising to pay everyone a higher wage later, conditional upon their avoiding being fired by exerting ‘sufficient’ effort, the firm offers to pay a specified proportion of the workforce a higher wage later. The firm gives assurances that it will promote to higher-paid positions a certain fraction of its employees and that those people promoted will be the ones observed to be exerting the greatest effort. Such a scheme offers a number of advantages. First, it does not require any attempt to define what is a ‘sufficient’ level of effort to achieve promotion, although such an effort level may be implicit in the scheme. Second, implementation of the policy gives rise to an observable signal (the number of people actually promoted), which acts as an assurance that the firm is indeed sticking to its side of the bargain. Of course, it could be questioned whether those promoted really were those who were observed to have the highest productivity. The firm might economise on monitoring costs by promoting the required proportion at random. Once again, if it did so, all the incentive properties of the scheme would disappear and it will therefore be important to the firm to convince the workforce of its monitoring integrity.20 Effort devoted to monitoring by the firm is observable by the employees, however, and this observability of monitoring effort combined with the promotions commitment provides an assurance of the firm’s honesty, unless there is some perverse reason for the firm to promote those who appear the least productive.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Thanks for the marvelous posting! I definitely enjoyed reading it, you happen to be a great author.I will always bookmark your blog and may come back in the future. I want to encourage continue your great work, have a nice morning!

Some really interesting points you have written.Aided me a lot, just what I was searching for : D.

You completed some fine points there. I did a search on the subject and found most persons will have the same opinion with your blog.