The HS code is a harmonized commodity description and coding system that is used for classifying traded products. The Harmonized System was developed under the auspices of the World Customs Organization (WCO), with the active participation of governments and private organizations. Since entering into force on January 1, 1988, the HS has been partially amended every four to six years to bring the HS nomenclature in line with the current international trade patterns, technological progress, and customs practices. It is used by more than 200 countries and customs or economic unions representing about 98 per cent of world trade.

The major benefits of adopting the harmonized system are as follows:

- The HS Code will be in line with the tariff determination procedures of most countries of the world (in the United States, it is called the Harmonized Tariff Schedule of the United States or HTSUS).

- It facilitates the shipment and documentation of merchandise and creates a uniform and familiar system for exporters shipping to other countries.

- Such uniformity in classification and coding across countries simplifies the conduct of international trade negotiations and increases the accuracy of international trade statistics.

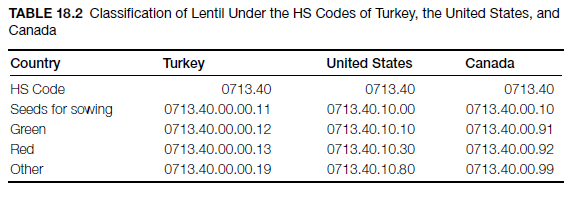

The HS Code classifies goods according to their ‘‘essential character’’ or, in the case of apparel, on the basis of the fiber of chief weight. It is a detailed classification system containing approximately 5,300 headings and subheadings organized into ninety-nine chapters and twenty-one sections (Tables 18.2 and 18.3). The six digits can be broken down into three parts. The first two digits (HS-2) identify the chapter the goods are classified in (e.g. 09 = Coffee, Tea, Mate, and Spices). The next two digits (HS-4) identify headings within that chapter (e.g. 09.02 = Tea, whether or not flavored). The next two digits (HS-6) are even more specific (subheadings) (e.g. 09.02.10 = green tea [not fermented]). HS Code up to the six-digit level is followed internationally and is common to all countries.

In the example in Table 18.2, lentil is coded as 071340 in Turkey, the United States, and Canada. However, some countries add more digits (the United States, South Korea, the European Union, and Canada add four additional digits (total of ten digits); Turkey adds six more digits; India adds two more digits; and Japan adds three more digits) to suit their national statistical and trading needs.

Goods imported are subject to duty or duty-free status in accordance with their classification under the U.S. code (HTSUS). Duty-free status, for example, is available under certain conditional exemptions provided in column 1 of the tariff schedule. Column 2 is intended for countries that do not qualify for the most-favored-nation (MFN) duty rate, and imports under this category are subject to the highest rate (Table 18.3). In cases in which the correct classification is not certain or the product falls under more than one classification, it is important to resort to the body of interpretative rules provided under the HTSUS or to seek a binding tariff classification ruling from customs, which can be relied on before placing or accepting orders. Although the average tariff rate in the United States is now around 5 percent, some imports are subject to high tariffs: watch parts (151.2 percent), some shoe imports (67 percent). In certain cases, it is also possible for customs to reverse its classification even after the product has been imported and used. The U.S. Customs Service reversed its decision on imports of muffin mix toppings in 1996 and required the importer to pay a $750,000 penalty for violating the U.S. sugar quota (the decision was, however, reversed for the second time). In another case, imports of large antique red telephone booths were blocked on the grounds that the product was actually a steel product restricted by import quotas (Bovard, 1998). Thus, one cannot overemphasize the importance of obtaining expert opinion, seeking an advance ruling by customs, or establishing reliable procedures on the correct description and classification of a given product before importation.

Note: CA = Canada (import from Canada), A = GSP countries, MX = Mexico, E = Caribbean Basin countries, IL = Israel, J = Andean Preference Pact.

Rates of Duty-General: GATT members and others obtaining such status by a bilateral agreement; Special: Imports from countries accorded special duty treatment (i.e., Canada, Mexico, GSP countries); 2: Countries not friendly to the United States (e.g., Libya, North Korea).

It is also important to note that the term “HTSUS” is used for imports and that the classification is managed by the Office of Tariff Affairs and Trade Agreements within the International Trade Commission (ITC). When one is exporting from the United States, the system of classification is called Schedule B and is managed by a different agency, the U.S. Census Bureau. HTSUS and Schedule B are identical up to the six-digit level but may vary at the level of the commodity code.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.