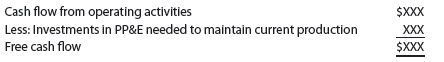

A valuable tool for evaluating the cash flows of a business is free cash flow. Free cash flow measures the operating cash flow available to a company to use after purchasing the property, plant, and equipment (PP&E) necessary to maintain current productive capacity.[1] It is computed as follows:

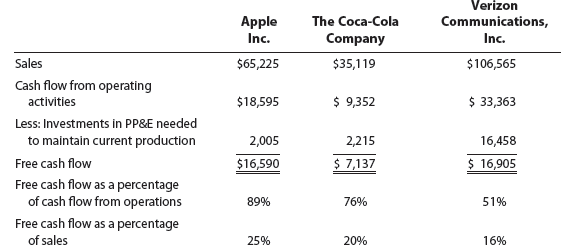

Analysts often use free cash flow, rather than cash flows from operating activities, to measure the financial strength of a business. Industries such as airlines, railroads, and telecommunications companies must invest heavily in new equipment to remain competitive. Such investments can significantly reduce free cash flow. For example, Verizon Communications Inc.’s free cash flow is approximately 51% of the cash flow from operating activities. In contrast, Apple Inc.’s free cash flow is approximately 89% of the cash flow from operating activities.

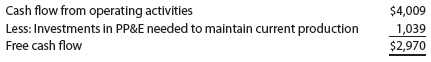

To illustrate, the cash flow from operating activities for Research in Motion, Inc., maker of BlackBerry® smartphones, was $4,009 million in a recent fiscal year. The statement of cash flows indicated that the cash invested in property, plant, and equipment was $1,039 million. Assuming that the amount invested in property, plant, and equipment is necessary to maintain productive capacity, free cash flow would be computed as follows (in millions):

Research in Motion’s free cash flow was 74% of cash flow from operations and over 15% of sales. Compare this to the calculation of free cash flows for Apple Inc. (a computer company), The Coca-Cola Company (a beverage company), and Verizon Communications, Inc. (a telecommunications company), shown below (in millions):

Positive free cash flow is considered favorable. A company that has free cash flow is able to fund internal growth, retire debt, pay dividends, and benefit from financial flexibility. A company with no free cash flow is unable to maintain current productive capacity. Lack of free cash flow can be an early indicator of liquidity problems. As one analyst notes, “Free cash flow gives the company firepower to reduce debt and ultimately generate consistent, actual income.”

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Nice post. I learn something totally new and challenging on websites I stumbleupon every day.

It’s always helpful to read through content from

other writers and use something from their websites.

Hello, i think that i saw you visited my website thus i came to “return the favor”.I am attempting to find things to enhance my website!I suppose its ok to use a few of your ideas!!